The State of the Pre Roll Market 2024

Posted by Custom Cones USA on Sep 3rd 2024

The pre roll industry is undergoing exciting developments, marked by the emergence of new product categories and expanding markets. In 2023, infused pre rolls became the top-selling category, reflecting a shift in consumer preferences. And in the past few years, new markets like Arizona, Illinois, Maryland, Missouri, and New York have joined the legal cannabis landscape, contributing to the industry's rapid growth.

To gain comprehensive insights into the current state of the pre roll market, we partnered with cannabis industry analytics firm Headset, combining their retail point-of-sale data from 12 tracked U.S. states from January 2023 to June 2024 with our B2B sales data.

Our study also includes feedback from more than 300 companies representing every corner of the pre roll industry, including recreational and medical cannabis producers, hemp producers, plant processors, vertically integrated brands, cannabis brand agencies, dispensaries, and multi-state operators.

We found pre rolls remain a potent and profitable aspect of the cannabis industry, giving producer/processors an opportunity to focus on innovation because of the inexpensive nature and the full range of customization a manufacturer can pack into a pre rolled cone. Infused pre rolls have become the dominant segment and go-to choice for consumers, the multi-pack is an unstoppable consumer force, and with new markets opening to recreational cannabis every year, the pre roll market shows no signs of slowing down soon.

This white paper delves into these themes, as well as market trends, segment growth, production challenges, consumer preferences, and future projections. Last year at this time, for example, we used the data available to correctly predict the continued expansion of the infused category, the increasing pace of multi-pack sales and that the pre-roll would overtake flower as the No. 1 sales category in Canada, all of which proved true.

By exploring these areas, we aim to provide a comprehensive overview of the pre roll industry's current landscape and future potential.

- The Cannabis Market at a Glance

- Pre Roll Companies

-

Pre Roll Production

- How Many Pre Rolls Can You Make?

- What Kind of Pre Roll Machines Do You Use?

- What’s the Most Frustrating Part of Pre Roll Production?

- What’s Your Best Tip or Trick About Pre Roll Production?

- What Challenges Do You Face When Purchasing Pre Roll Supplies?

- Do Your Pre Roll Employees Wear Safety Equipment?

- What Packaging Options Do You Use?

- What Do You Think About Eco-Friendly Packaging?

- Types of Pre Rolls

- What Cannabis Material is in Your Pre Rolls?

- What Do Consumers Care About When Selecting Pre Rolls?

- What Do You Care About When Selecting Pre Roll Materials?

- What Are The Popular Pre Roll Sizes and Shapes?

- What Are The Popular Pre Roll Paper Types?

- Do You Sell THCa and Delta-8 Products?

- Do You Sell Infused Pre Rolls?

- What’s Next For Pre rolls

The Cannabis Market at a Glance

When looking at cannabis category data, it’s clear that the pre roll category is thriving in cannabis markets across the U.S. It’s the third biggest cannabis category in the country, behind only flower and vapor pens.

From June 2023 to June 2024, pre rolls saw the biggest increase in sales revenue among all categories with an 11.89% jump year over year. While the beverage category also experienced an impressive 10.97% increase, monthly pre roll sales revenue was almost 12 times higher than beverage sales revenue in June 2024.

The only other categories to see an increase in sales revenue during that span were vapor pens and flower, both of which saw modest gains of less than 3.5%. Niche categories like topicals and capsules saw big drops in overall revenue. Surprisingly, the concentrates category also declined by over 11%, which points to consumers preferences of convenience and shifts toward vape pens.

It is now two years in a row that pre rolls have been the fastest growing category in the cannabis industry, outpacing other growth categories and helping to offset the large declines of more niche categories.

Though sometimes viewed as an afterthought or an add on item, pre-rolls have quickly become a go-to option for consumers thanks to their affordability and convenience.

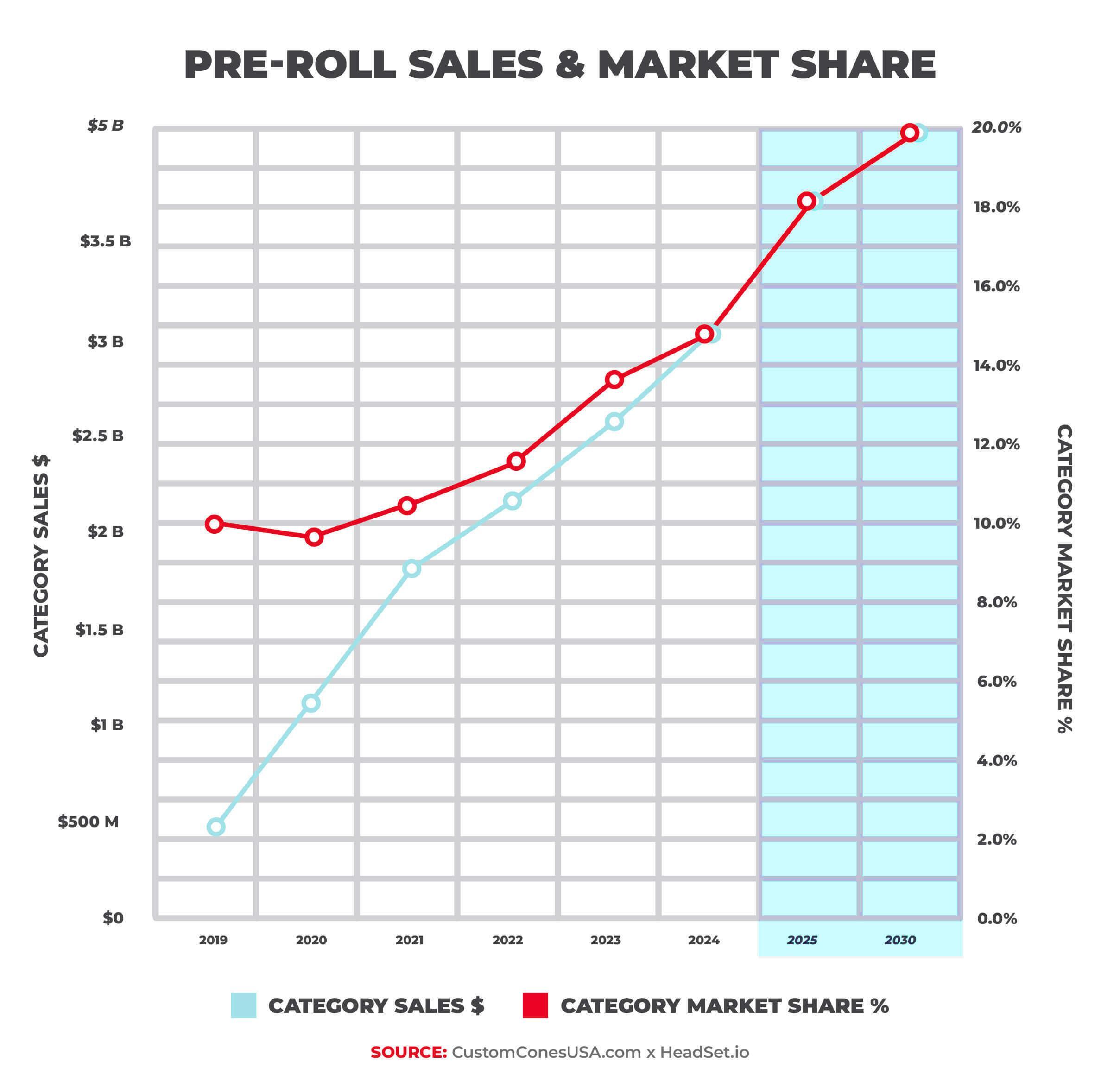

Pre Roll Sales & Market Share

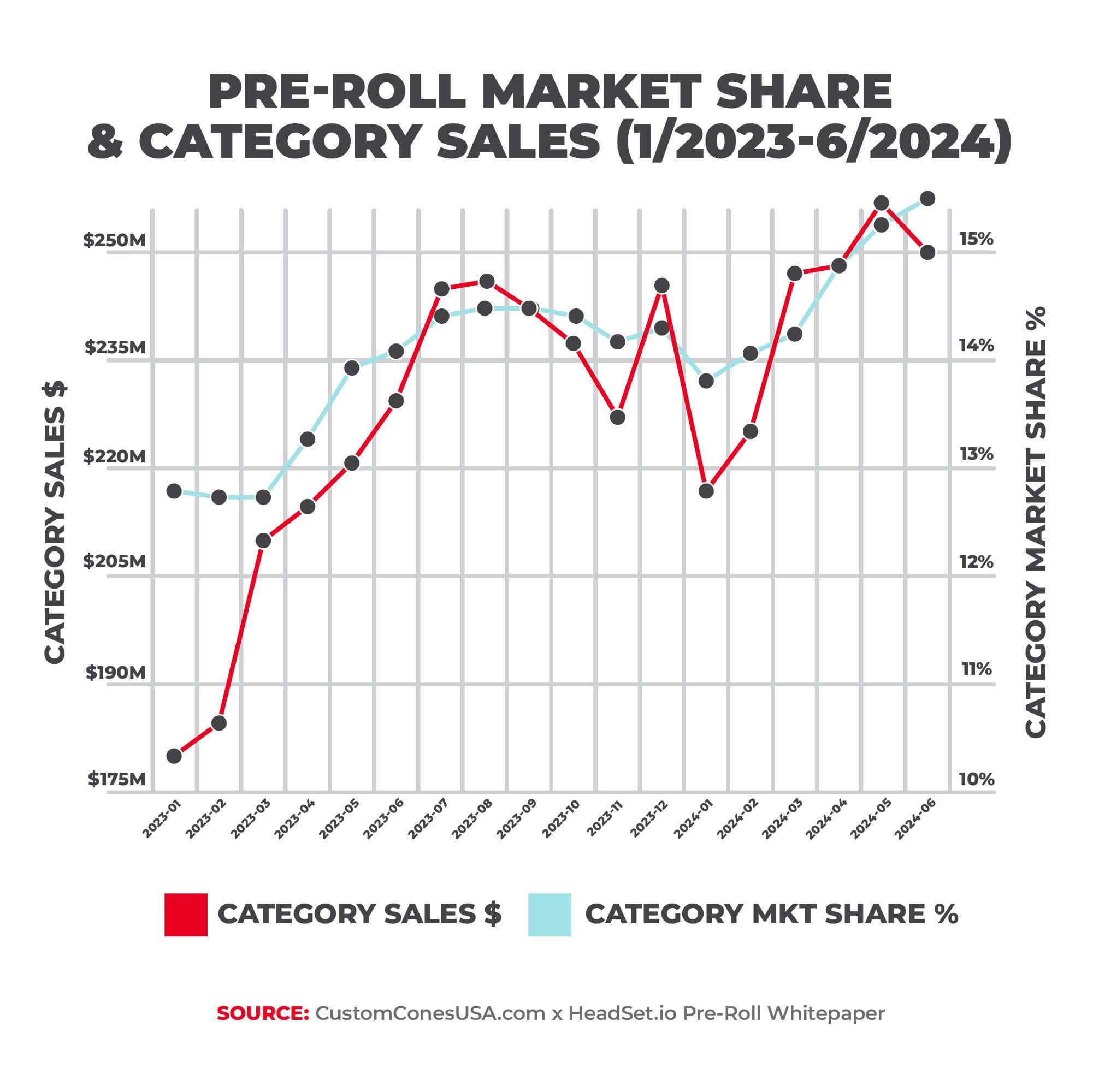

Taking a deeper look at the data shows the extent of the rise of the pre roll. Data from 12 tracked states from 2023 and the first half of 2024 shows that pre rolls have experienced a marked increase in both market share and sales revenue in that time.

Pre rolls amassed more than $4.1 billion in sales revenue and sold more than 394 million units in that span. They also saw a meteoric increase in market share, going from a 13.2% market share in January 2023 to a record-high 15.9% market share in June 2024.

The sales revenue tells a similar story. Monthly pre roll sales revenue has steadily risen from $181.2 million in January 2023 to $257 million in June 2024.

The rise of the pre roll market is even more impressive when looking back even further. Pre roll market share has increased every year since 2020 – when it stood at just 9.8%. The increase in sales revenue in the last five years is nothing short of remarkable: annual pre roll sales revenue went from $469 million in 2019 to $2.7 billion in 2023. That’s nearly a sixfold increase in annual revenue.

Not only are pre-roll sales revenue increasing, but the declining cost of pre-rolls has helped propel the number of pre-roll units sold to unforeseen levels. Annual pre-roll unit sales have increased from 41.9 million units in 2019 to 246.7 million units in 2023. Keep in mind these figures include multi-packs, so the number of individual pre-rolls is much higher.

As cannabis expands into new markets and the market share continues to rise, we can expect pre rolls to continue their upward sales trajectory.

The growth potential is also aided by the introduction of pre-rolls in states like Ohio and Hawaii, which just recently began allowing the sale of pre-rolls. Many states that only allow medical cannabis, like Hawaii, initially forbid the sale of pre-rolls but eventually allow it as restrictions ease and the medical market matures.

The introduction of pre-rolls to new markets will create more opportunities for businesses looking to expand their pre roll product lines and cash in on the growing consumer interest in pre rolls.

Pre Roll Segments

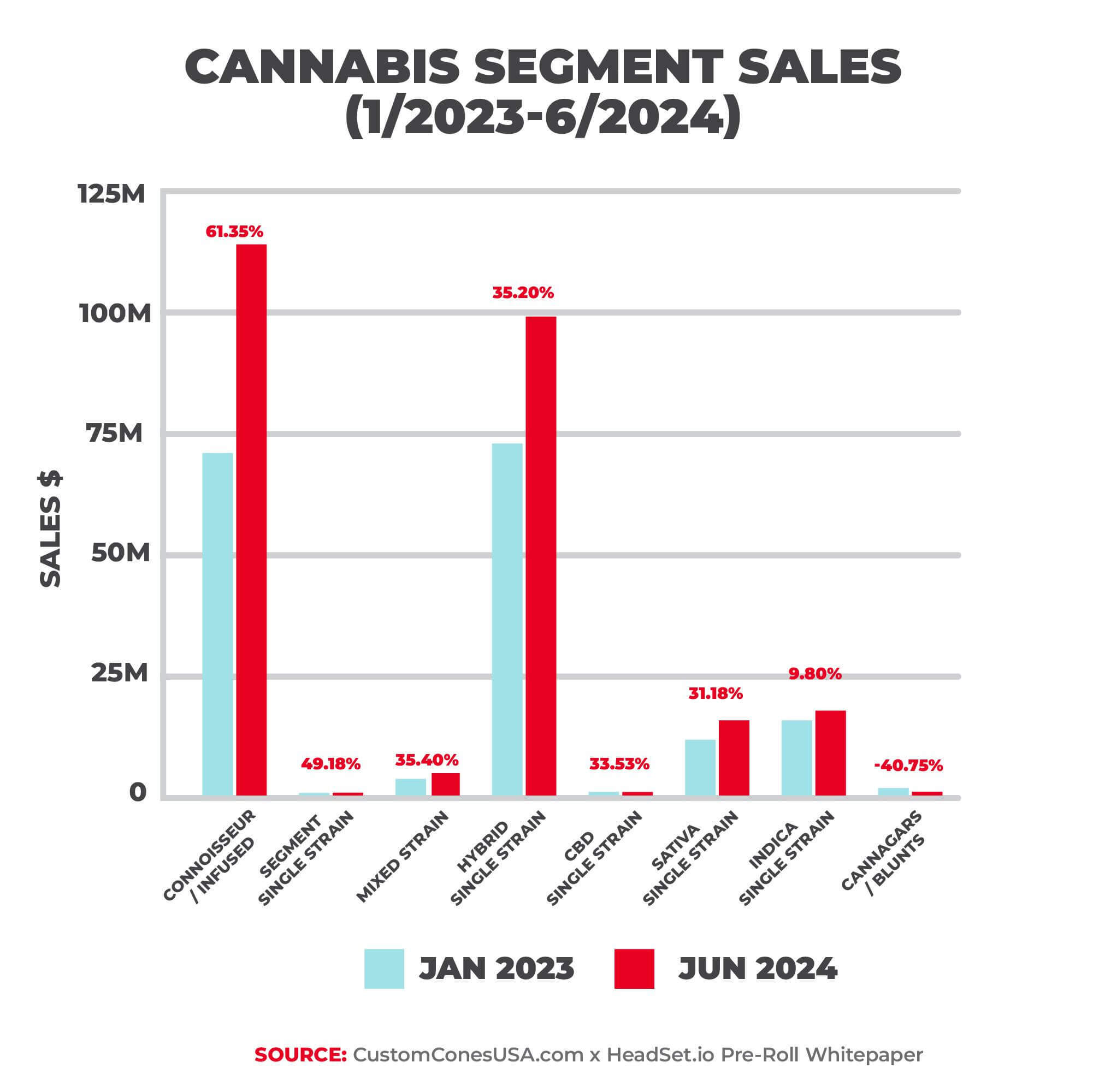

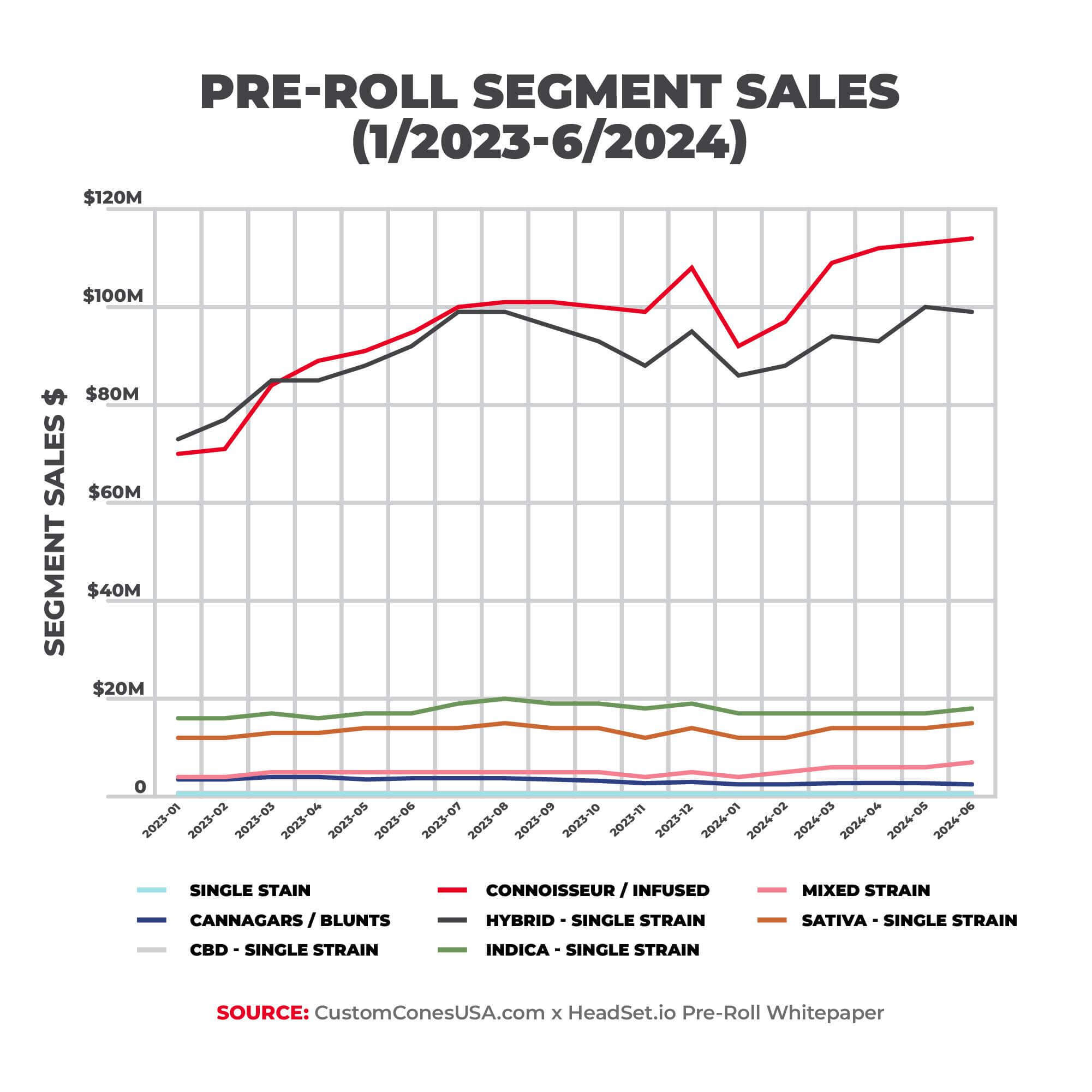

While there’s no denying that the pre-roll market is thriving, taking a deeper look at pre roll segment data can help us understand the current landscape in the pre roll market. So, we dove into the sales data from January 2023 and June 2024 to see the growth patterns and trends within the pre roll industry.

The Connoisseur/Infused segment, which combines a concentrate with the flower used in the pre roll, experienced the biggest growth, a 61% increase in just 18 months. The growing consumer preference for infused products has helped the Connoisseur/Infused segment outshine all other pre roll segments (more on that later). Hybrid – Single Strain also maintained steady sales and growth, accruing between $73-$100 million per month during that span.

Interestingly, there's a clear hierarchy among strain-specific products. Indica-dominant strains consistently outsell Sativa strains, with Indica sales ranging from $16-20 million per month compared to Sativa's $12-16 million. This could indicate a consumer preference for the relaxing effects typically associated with Indica strains.

The Mixed Strain segment also showed strong growth with a 35% increase in monthly sales revenue, suggesting an increased interest in products offering varied experiences, though it still only accounts for about $5.7 million per month.

One potential reason for the increase in Mixed Strains is that pre-roll businesses often do not grow their own flower, meaning it’s easier to create blends than to keep a single strain in stock. Blends also help keep the particle size and moisture content of flower more uniform, which is crucial for businesses that use automated machines to create their pre-rolls.

While the pre roll market as a whole is growing by leaps and bounds, the Cannagars/Blunts segment showed a downward trend. Since peaking at more than $3 million in sales in March 2023, the Cannagars/Blunts segment sales have been steadily declining, reaching only $1.68 million in June 2024 (a 45% decrease in just 15 months).

Still, 1 in 4 pre roll businesses polled in our 2024 industry survey said they sell a cannagar product and another 13% stated they intend to add one to their product line – suggesting that this pre roll category has a small but loyal following and room to grow.

A New Top Pre Roll Segment

Perhaps the most noteworthy change visible in the data is the rise of the Connoisseur/Infused segment. Infused pre roll sales, with their heightened potency, have been steadily rising in the last few years. But they officially became the king of pre roll segments when they overtook Hybrid - Single Strain as the highest selling pre-roll segment in 2023.

The Connoisseur/Infused segment dominated the charts in 2023 and the first half of 2024, accounting for more than $1.75 billion in sales – edging out Hybrid - Single Strain and its $1.64 billion sales for that time, due in part to the higher price point created by added concentrate.

The market share of Connoisseur/Infused pre rolls has shown impressive growth. Since 2019, the segment has maintained an average 34.4% share of the pre roll category across tracked markets. This share has recently experienced a rapid acceleration, reaching 41.5% in 2023 and climbing further to 44.4% in the first half of 2024. This trend suggests a growing consumer preference for these premium products (that also command premium prices).

Aside from being highly potent, infused pre rolls benefit from recent advancements in pre roll machinery. Market demand in both the U.S. and Canada have driven innovation in infused machinery, with pre roll machines helping to automate the infusion process and mix oil into flower efficiently to produce infused pre rolls at scale.

These machines keep infused production costs low and profits for these premium products high – a win-win for cannabis businesses looking to cash in on the popularity of this segment.

It’s clear that the cannabis industry is experiencing a premiumization trend, particularly evident in the rise of Connoisseur/Infused pre rolls. These products cater to consumers seeking sophisticated and enhanced consumption experiences. Pre rolled cones serve as an ideal canvas for innovation, allowing for experimentation with unique flavors, increased potency, and premium cannabis strains because of the myriad paper types, sizes, filter tips and customization options available to pre roll manufacturers.

How Much Do Pre Rolls Cost?

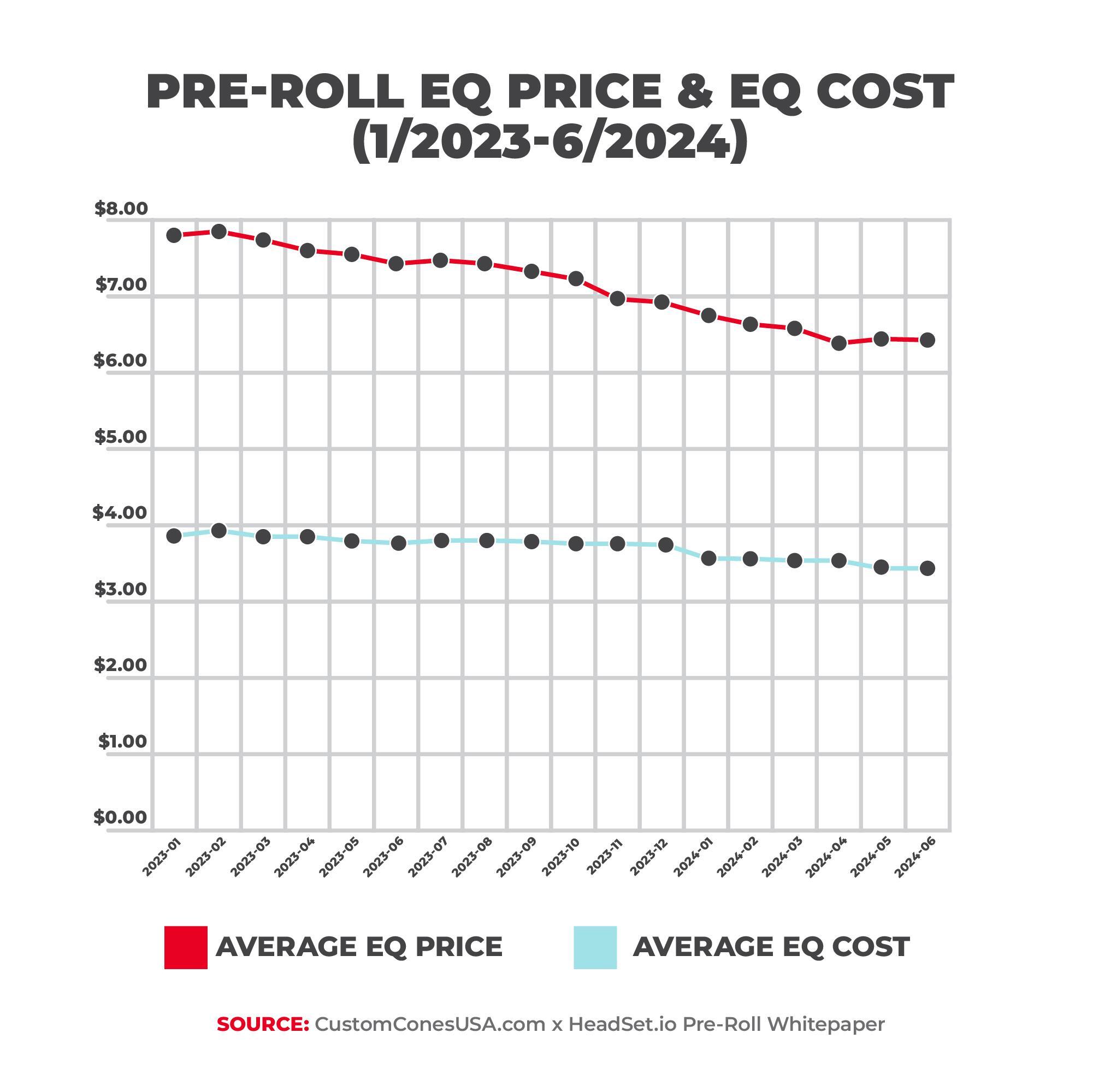

The pre roll cannabis market is experiencing a fascinating dichotomy. On one hand, there's a surge in ultra-premium, high potency infused offerings that command luxury prices. On the other, we're witnessing a trend of overall price stabilization and even slight declines across the broader pre roll category.

But while premium pre roll sales soar, pre roll prices have actually dropped. The average price of a pre roll has fallen by 16.7% since January 2023, going from $7.80 a unit to $6.50 a unit in June 2024.

The market share growth for the Connoisseur/Infused segment is even more remarkable when you consider the average item price across tracked markets from January 2023-June 2024 is $10.25, well above the average item price for the entire pre roll category.

This pricing trend is consistent across the board, as even Connoisseur/Infused prices dropped every month from January 2023 to June 2024. The average Connoisseur/Infused item price decreased by over 23% in that span, going from an average of $11.51 in January 2023 to an average of $8.77 in June 2024.

One potential reason for this downward trend is the maturation of cannabis markets across the U.S. As markets mature, they face increased competition and downward pricing pressure that value-focused brands are leveraging.

States like Nevada, Massachusetts, and Arizona have reached this threshold, where an elevated level of production and competition are driving down pre-roll prices. Newly legal states like Maryland and Missouri command higher prices as the markets try to meet demand, but the sales volume isn’t high enough to outweigh the nationwide dip in pre-roll prices.

While seeing a pricing decrease may be worrying to cannabis businesses, looking at the big picture helps alleviate concerns. For one, the average EQ cost of pre rolls (per gram) for dispensaries (or the average amount that producers get per gram for their pre-rolls) has remained relatively steady, declining only 9% from $3.85 in January 2023 to $3.49 in June 2024.

And though the average item price is on the decline, total pre roll items sold are skyrocketing – going from 15.9 million items sold in January 2023 to a record 26 million units sold in June 2024. Profitability on pre-rolls remains high as well, as pre-rolls are a higher margin item. The recent rise of pre roll multi-packs has also helped reduce packaging and labor costs on a per pre-roll basis, which helps pre-roll businesses maintain profitability.

While there’s no denying that prices have stabilized in the pre roll market, the improved pre roll market share, unit sales, and total units sold presents even more opportunities for profitability in the months and years ahead.

Profit Margin Analysis – House Brand vs. Non House Brand

In the cannabis industry, "house brands" refer to products manufactured and sold by companies in their own dispensaries. This vertical integration, where allowed, provides for unique pricing and profitability strategies compared to non-house brands.

House brands price their pre-rolls lower, averaging $6.75 per item versus $9.83 for non-house brands in the 90 days prior to the data pulled for this report . Despite this, house brands achieve higher profit margins due to significantly lower unit costs ($3.39 vs. $5.31).

Profitability varies across segments:

House Brands:

- CBD and Single Strain categories lead with 64% margins

- Cannagars/Blunts follow at 60%

- Connoisseur/Infused products lag at 47%, likely due to higher production costs

Non-House Brands:

- Margins are more consistent, ranging from 45% to 51%

- Single Strain category tops at 51%

- Connoisseur/Infused products also show the lowest margin at 45%

Both categories have seen price drops over the past year (house brands by 14.5%, non-house by 13.0%), indicating increased market competition.

The data suggests house brands leverage their integrated structure for competitive pricing and higher margins. Non-house brands, while commanding higher prices, face tighter margins, possibly due to distribution costs or brand premiums.

As the market evolves, efficient cost management and strategic pricing will be crucial for profitability in all segments, with particular attention needed for high-cost, premium categories like Connoisseur/Infused products.

Pre Roll Multi-Packs

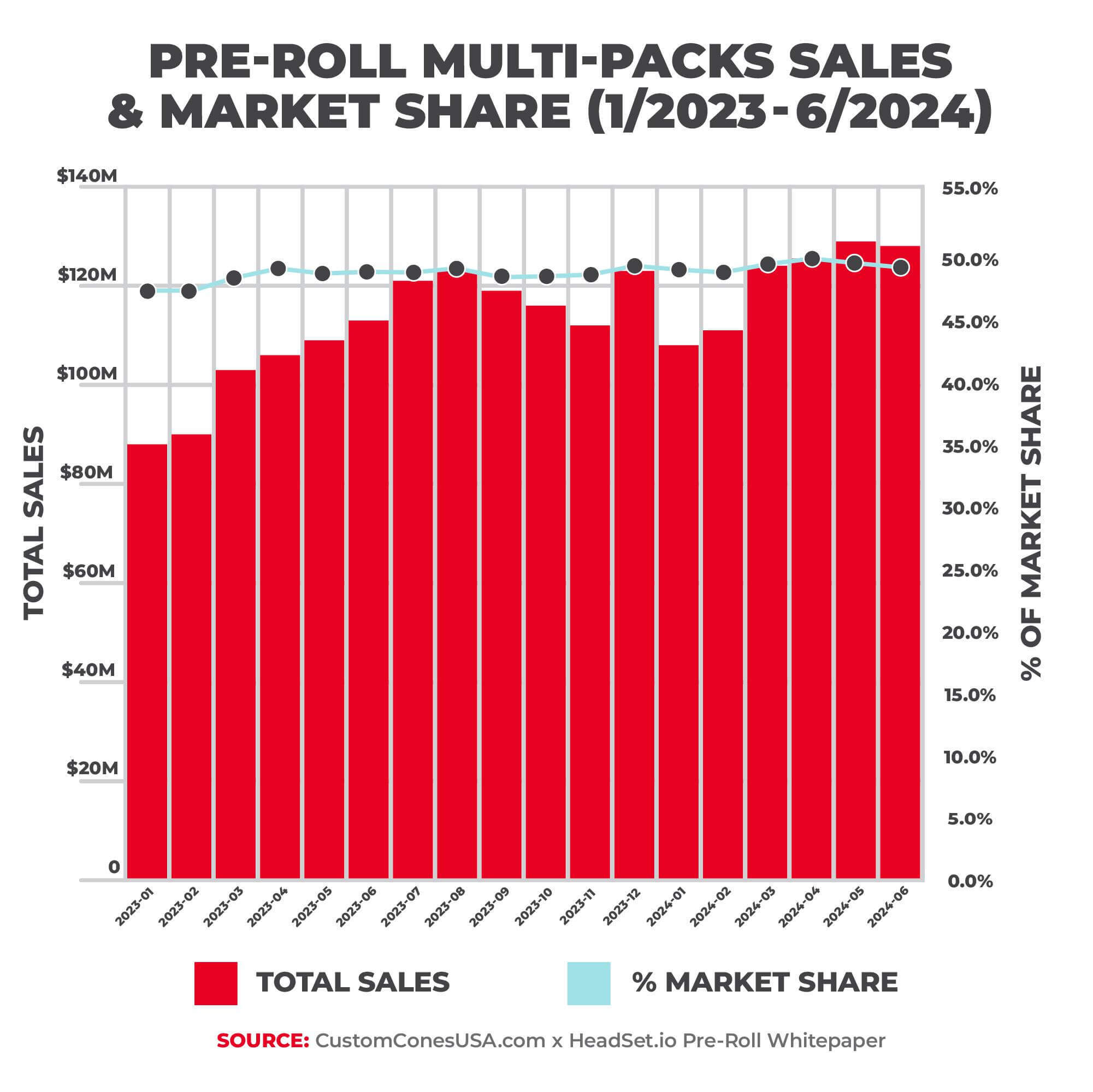

One of the hottest trends in pre roll packaging has been the pre roll multi-pack, and this year was no exception.

Multi-pack sales have been steadily climbing because they are economical and convenient for both pre roll producers and consumers. For producers, multi-packs bring savings on packaging and labor costs by including multiple pre rolls in a single pack. Consumers also save money by bundling pre rolls into a single purchase, adding the convenience of not returning to the dispensary every time they want another pre roll.

In 2018 multi-packs made up 27.7% of the market. As of June 2024, multi-packs make up 49.6% of the pre roll market. Multi-pack sales revenue has also climbed, going from $89.1 million in January 2023 to $127.4 million in June 2024 – a 43% increase in just 18 months.

Leading the most popular multi-pack by size is the 2.5 gram pack (five .5 gram pre-rolls), which represents 16.2% of total pre roll sales for January 2023 to June 2024. Of the products sold in all markets for this timeframe, 31 of the top 50 were 5-pack pre roll multi-packs.

But even as consumers flock to multi-packs for their convenience and value, single 1-gram pre rolls reign supreme as the most popular product size, accounting for 42.3% of all pre roll sales during this period.

Our 2024 survey of pre-roll businesses revealed just how strong adoption of multi-pack pre rolls has been. More than 76% of respondents confirmed they sell multi-pack pre rolls. Among those selling multi-packs, there is a noticeable preference for single strain multi-packs (sold by 78.9% of respondents) in comparison to variety multi-packs (sold by only 40% of respondents).

While the number of pre rolls in each multi-pack varies, the survey data also shows a clear preference for pre roll 5 packs (sold by 62.2% of respondents). Larger sizes like 8-10 packs were sold by 40% of respondents, while smaller 2 and 3 packs were sold by 28.9% and 17.8% of respondents, respectively. The variety in the number of pre rolls per pack indicates a flexibility in catering to different consumer needs and preferences.

New Products

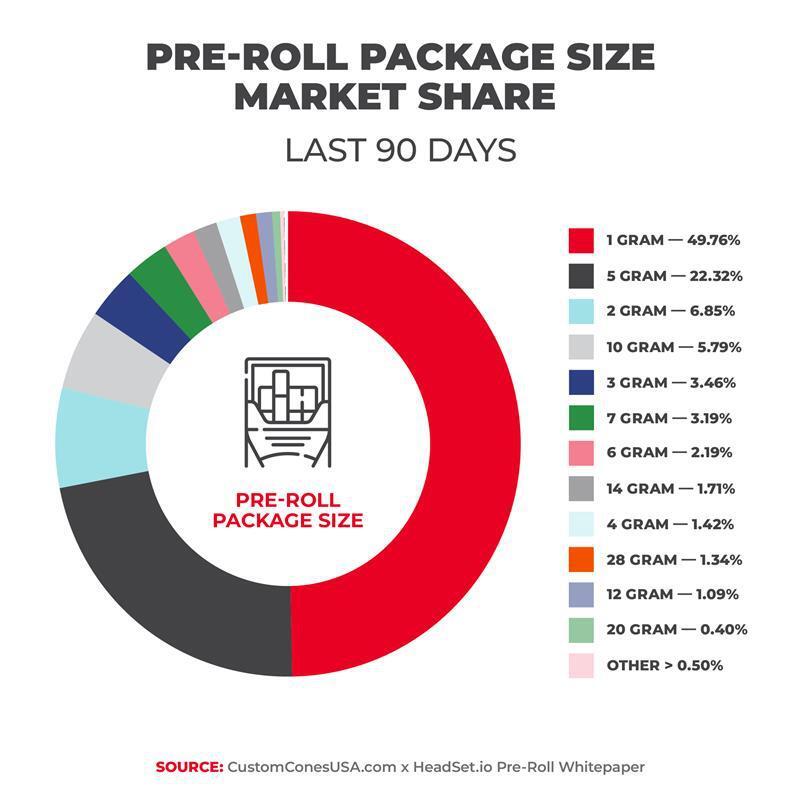

While Headset doesn’t have data on new products from previous years, they do track new products that have entered the market in the previous 90 and 180 days. This gives us a snapshot of the type and size of products coming into the pre roll space, while also giving us a peek into more recent trends.

More than 15,000 new products entered the pre roll market from February 7-August 5 2024. Nearly 8,900 of those products were 1-gram, highlighting the dominance of this package size in the pre-roll market. Many of these products are also new strains, which shows the need for innovation from businesses looking to keep up with consumer desire for variety in their pre-rolls.

Pre-Roll Package Size Market Share Last 90 Days (5/7/24-8/5/24) - source Headset.io

Aside from 1-gram products, most new products sold in that span were multi-packs. For reference, 1,456 5-gram multi-packs were introduced during this time, followed by 1,373 2.5-gram and 1,268 3.5-gram multi-packs.

Only 1,112 half-gram products and 182 0.7-gram products were introduced during this time, showing just how popular multi-packs have become in comparison to single serving packages.

The average new item price was $9.19 - which is much higher than the average of $6.50 from June 2024. However, the influx of multi-packs to the market could be contributing to the higher new item price.

Pre Roll Companies

While pre-roll data is revealing, it doesn’t tell us the whole story of what’s going on in the industry at large. So we polled more than 300 representatives from companies that sell pre-rolls to get a more complete picture of the state of the pre-roll industry.

We asked pre roll producers a wide-range of questions to understand not only their businesses, but what they’re selling, what trends they’re seeing, and what they think is coming next.

Here are some key themes we discovered about their perspective of the cannabis industry as well as the growth of the pre-roll market.

How Old Is Your Pre Roll Company?

In our 2020 survey of pre roll businesses, more than 70% of pre roll companies said they were less than 3 years old. That number dipped to 50.9% in 2022 and rose slightly to 54.3% in 2024. The influx of new cannabis markets and the maturation of older markets has kept the number of new pre roll businesses stable over the last few years.

Interestingly, the number of pre roll businesses 4–7 years old dropped – with the most significant drop being in those in the 6-7 year range, falling from 20.5% of pre roll businesses in 2022 to just 5.5% in 2024.

While pre roll businesses of medium age have declined, the number of older businesses has skyrocketed in recent years. Pre roll businesses older than 7 years has grown from 2.9% in 2020 to 26.8% in 2024, showing the staying power of the industry and the companies that are part of it.

We’ve reached a point where legacy business, multi-state operators (MSO’s) and larger pre roll businesses have secured a foothold in mature markets, while a wave of new businesses pour into greener cannabis markets.

It will be interesting to see if small and mid-size businesses keep losing ground to established companies and MSO’s. And while there is no shortage of opportunities for pre roll businesses in emerging markets, market dynamics vary wildly from state to state. Newly legal states like Maryland have seen a phenomenal rise (a 231% increase in pre roll sales year over year), while other states like New York have experienced much more modest sales due to legal challenges and red tape during the industry’s rollout.

We will be watching how pre roll businesses fare in new markets, where pre roll prices have a higher price tag. States that recently legalized recreational cannabis use like Missouri, Maryland, and New York have some of the highest pre roll prices in the country. While Missouri has thrived (selling 2.5 million pre roll units in January-April of 2024 alone), others like New York have experienced some difficulty as new businesses still face numerous challenges.

What’s the Size of Your Pre Roll Business?

Our poll shows that nearly three-quarters of the pre roll businesses surveyed (74.2%) have fewer than 25 employees. Most pre roll businesses (60%) keep only 1-2 employees on staff to produce pre rolls, with another 20% keeping 3-5 employees on staff for pre roll production.

The key takeaway is that many successful pre roll companies can operate with small and lean teams. Additionally, roughly half of respondents (48.3%) said that it takes them only a few hours to train new employees to create pre rolls, suggesting that it does not overtax resources to launch and run a pre roll brand.

Nearly three-quarters of pre roll businesses (73.3%) also said that employee turnover in their pre roll division was low. So once these businesses onboard and train employees in charge of producing pre rolls, they stick around – minimizing disruptions and helping to keep pre roll profits rolling in.

Developments in pre roll machines have also helped keep production lines running smoothly. Most cone filling machines are designed to be easy to operate and create consistent inputs and products. This makes it less likely that new hires destroy a batch of flower in a blender or produce unusable or low-quality pre rolls.

When you invest in pre roll machinery, an entry-level associate can be responsible for making pre rolls with minimal training. The only exception is automated pre roll machinery. These require trained individuals to operate, and it is not considered a job where you want high turnover.

How Much of Your Business is Pre Rolls?

In our most recent poll, 61.7% of respondents said that pre rolls made up a quarter of their business or less while 25% said pre rolls made up 26-50% of their business.

This tells us that pre rolls aren’t the main source of revenue for most companies but do provide a steady revenue stream for businesses that produce them. And with pre roll revenue and market share on the rise (experiencing a sixfold increase in sales revenue since 2019), there are more opportunities than ever to expand pre roll product lines.

It’s also worth noting that the largest pre roll companies (based on sales revenue) offer a large variety of products. With all the customizations available, catering to different consumers and their preferred pre roll paper, weight, and package size can be highly profitable.

The largest pre roll companies

| Rank | Brand Name | Total Sales | Total Units | Number of Products |

|---|---|---|---|---|

| 1 | Jeeter | $354,407,115 | 13,174,172 | 577 |

| 2 | House Brand | $229,361,169 | 31,174,578 | 6,806 |

| 3 | STIIIZY | $157,811,766 | 6,030,972 | 199 |

| 4 | Dogwalkers | $102,783,452 | 4,360,673 | 547 |

| 5 | Cali-Blaze | $65,802,573 | 8,421,518 | 1,561 |

| 6 | Presidential | $61,612,748 | 3,503,088 | 162 |

| 7 | Lowell Herb Co / Lowell Smokes | $55,435,963 | 2,024,324 | 269 |

| 8 | Verano | $49,229,579 | 2,417,865 | 559 |

| 9 | Ozone | $38,786,112 | 2,661,655 | 252 |

| 10 | Dragonfly Cannabis | $38,176,915 | 12,726,509 | 309 |

| 11 | Pacific Stone | $36,789,500 | 1,393,206 | 117 |

While Jeeter is the undisputed top pre roll company, “House Brand” pre rolls that companies sell in their own dispensaries brought in the second most revenue for 2023 and the first half of 2024. So, product diversity and vertical integration are both key to large scale profitability.

Do You Plan on Expanding?

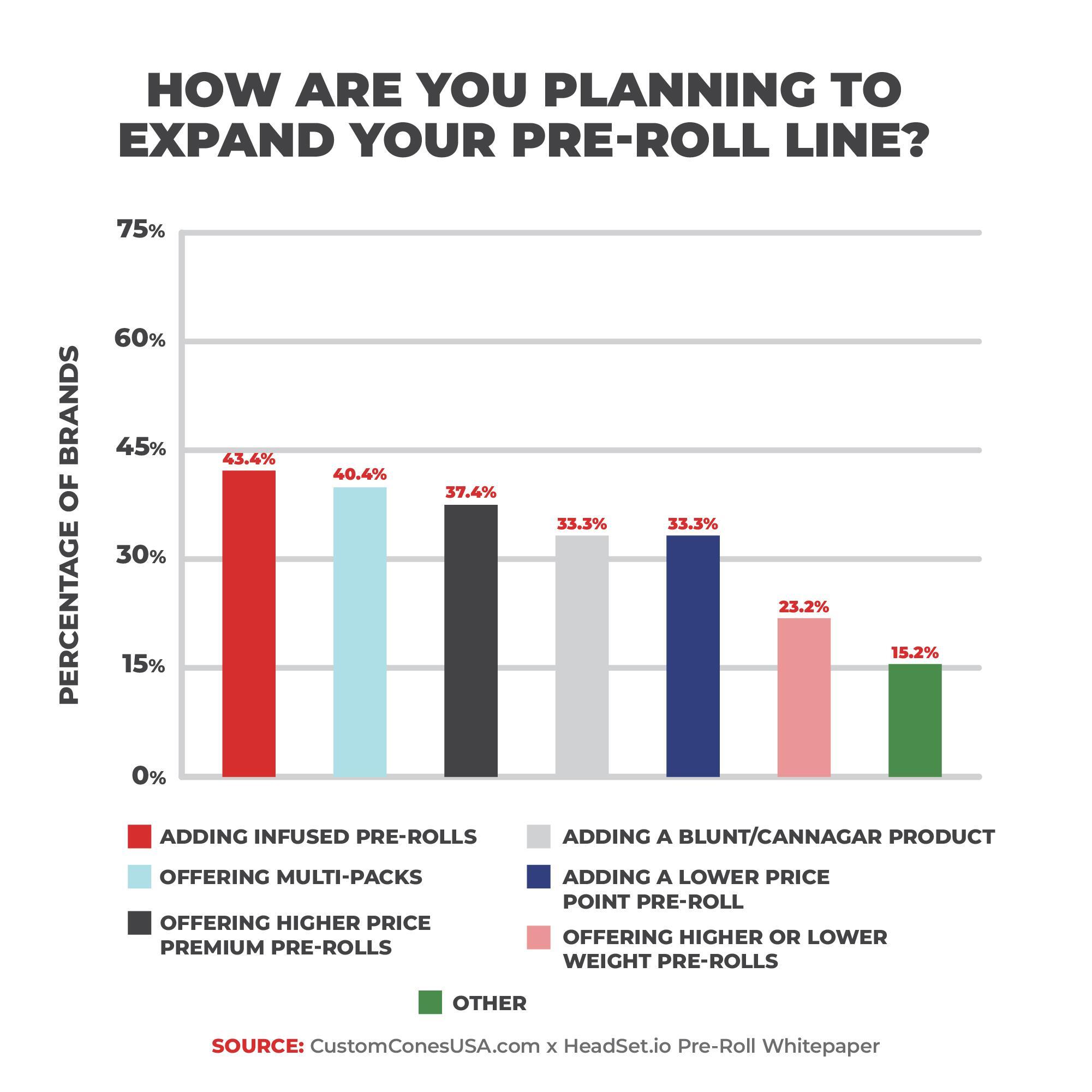

The vast majority of pre roll businesses (85.8%) have plans to expand in the near future. While it may seem obvious that businesses expect to grow, what’s interesting is how these companies are planning to expand their pre roll lines.

The biggest plans for new products involve infused pre rolls, with 43.4% of pre roll businesses planning to add them to their product lines. The rise of infused pre rolls has been nothing short of remarkable, as it overtook Hybrid-Single Strain as the top-selling pre roll segment in the U.S. in 2023.

As more consumers clamor for infused products, companies are looking to cash in on these potent and higher-priced products. More than 37.4% of respondents said they planned on offering higher price premium pre rolls, again echoing the demand for infused products.

Many pre roll businesses also plan to add multi-pack products. The rise of multi-packs is a trend we’ve been following for years now. Data from April 2022-April 2024 shows that nine of the top 10 selling products are 5-packs of half-gram pre rolls.

Additionally, 19 of the 20 top-selling products on the sales charts are multi-packs, with the majority being 5-packs and the remainder being 10-packs of mini “dogwalker” cones, with a total weight of 3.5 grams.

While infused and multi-pack pre rolls have dominated pre roll sales it’s important to note that each market is unique. Make sure you do your research on local trends and market fluctuations before launching a new product.

Pre Roll Production

There’s no denying the impact pre roll machinery has had on pre roll production. Pre roll machinery has seen significant innovation and growth since the dawn of legal cannabis sales in the U.S., when mass production of pre rolls was expensive and time consuming (to say the least).

The role of cone-filling machines in pre roll production cannot be overstated. Cone filling machines like the King Kone and Fill N’ Fold can produce hundreds of pre rolls per hour with a single operator. And thanks to tamping tools that come with some machines, companies no longer have to tediously finish pre rolls one by one.

These machines, plus the advent of automated pre roll machinery, are helping companies scale fast and efficiently, producing more high-quality pre rolls than ever before. Let’s see just how many pre rolls are being made.

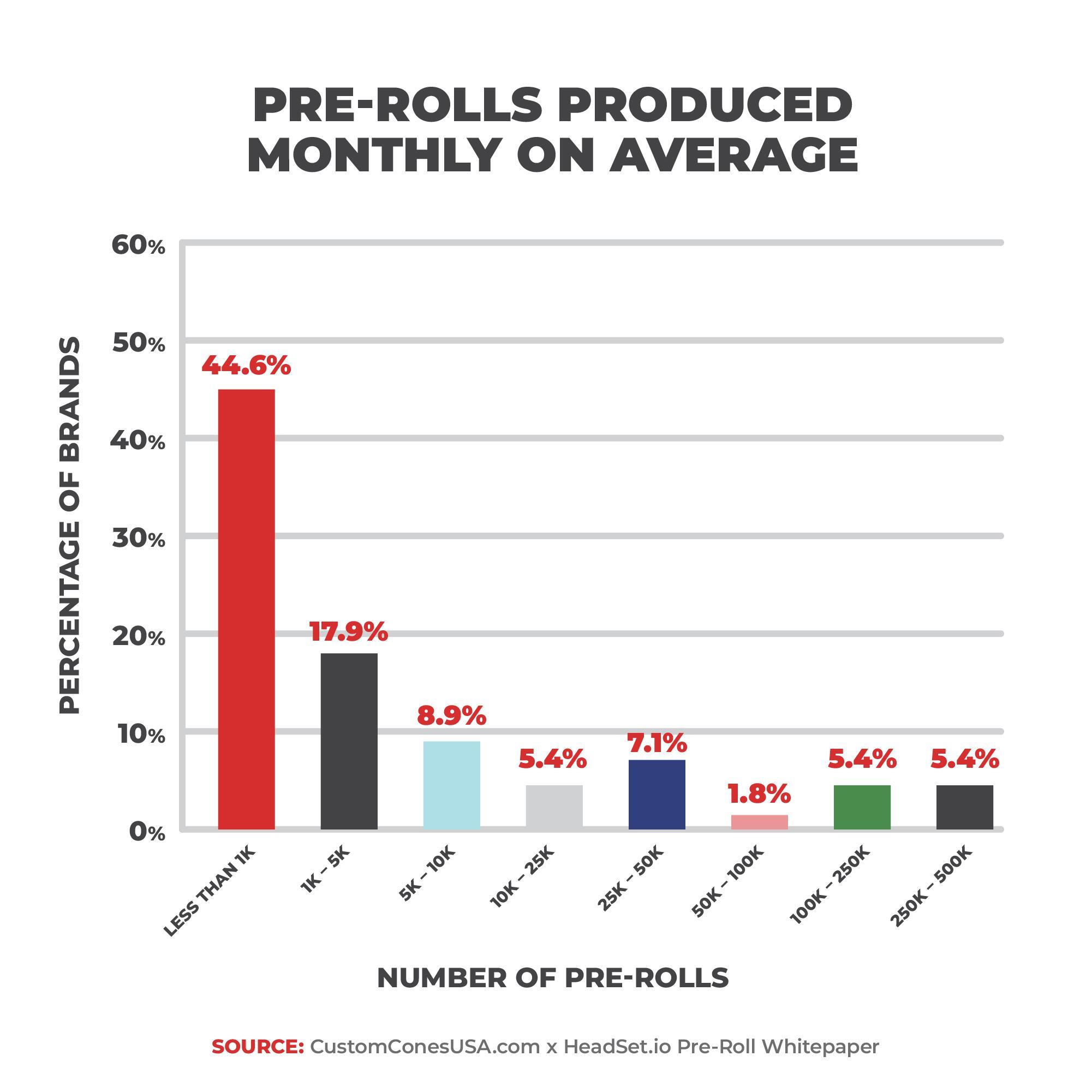

How Many Pre rolls Can You Make?

With more than half of businesses being under 3 years old, it should come as no surprise that many businesses (44.6%) are producing less than 1,000 pre rolls per month.

Nearly 18% of pre roll businesses have mid-level production of 1,000-5,000 pre rolls per month, while 12.4% of pre roll businesses have a high level of production of more than 100,000 pre rolls per month.

The data shows that while a wide variety of production numbers exist, production levels follow a predictable cycle. Newer brands likely rely on manual filling or tabletop machinery. But once pre roll businesses are more established, they’re able to take advantage of better machinery and production methods to scale their pre roll output. For businesses with mid-level production, even small changes in production and machinery could mean big boosts to their bottom line.

What Kind of Pre Roll Machines Do You Use?

While much of the pre roll production discussion is focused on cone filling machines, filling is only one part of the equation. Other pre roll machines not only serve to expedite pre roll production, but also ensure consistency and quality of your final products.

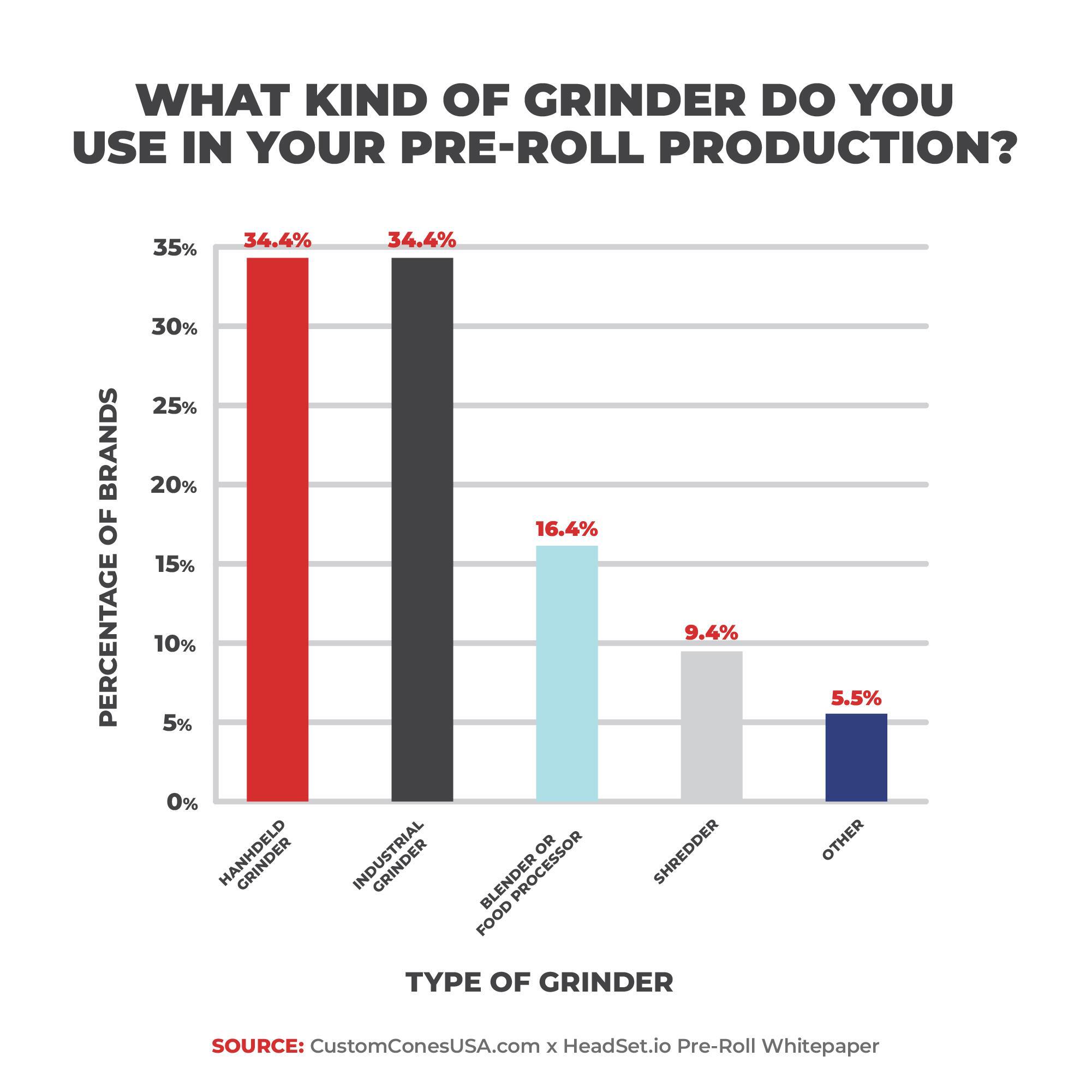

When it comes to grinding, pre roll businesses are split evenly between using handheld or industrial grinders (which are useful for scaling up production). Handheld and industrial grinders are used by a little more than one-third of pre roll businesses (34.4% each), while more than a quarter (25.8%) of pre roll businesses still use basic machinery like blenders, food processors, or shredders, despite the damage they can do to the flower.

In the world of pre roll production, it all starts with the grind. Grinding is an essential step that can make or break the quality of your pre-rolls. Industrial grinders can help ensure uniform particle size in your flower, while also helping to prevent canoeing that diminishes the smoking experience.

Grinders that use a high torque, low-RPM motor that preserves trichomes, like our flagship industrial grinder, help maintain the quality of your flower as you scale up your pre-roll production.

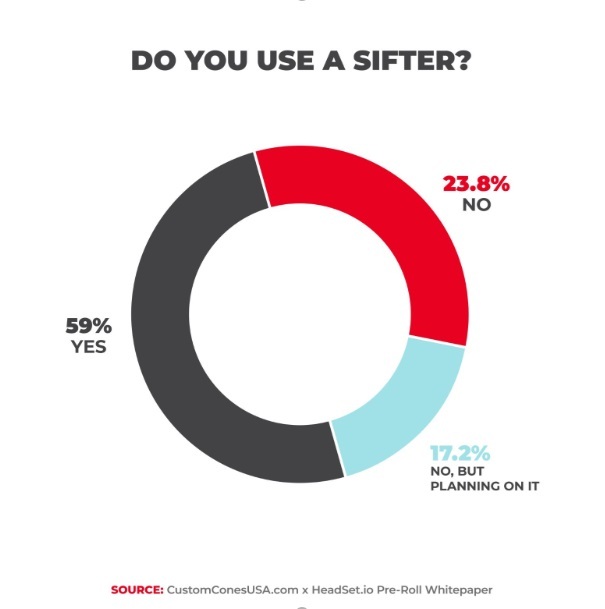

While every pre roll business uses a grinder of some kind, opinions are divided on the use of sifters. Currently, only 59% of pre roll businesses sift their flower, although an additional 17.2% plan to start using sifters in the future. Sifting is a vitally important though oft forgotten step of the pre roll production process, as it creates a consistent particle size that leads to better packed pre rolls. Our stainless steel sifters come with the screen sizes of your choice, which allows you to customize your pre-rolls while removing stems, seeds, and other foreign material.

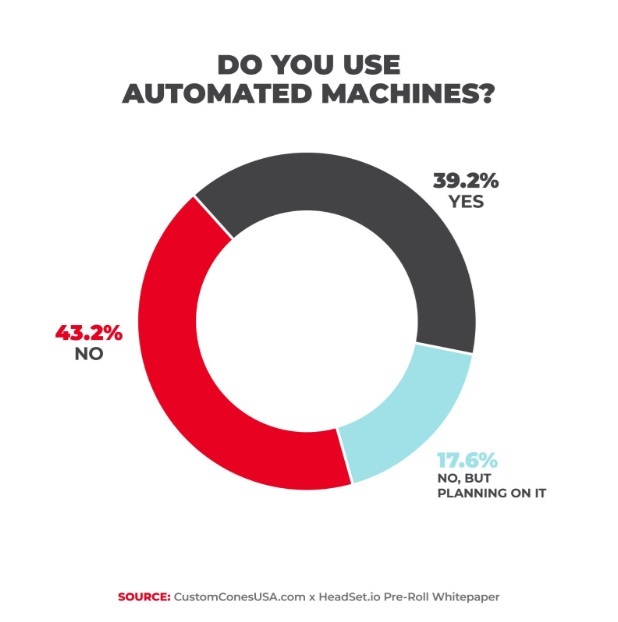

Unsurprisingly, the numbers are split regarding automated tools – which are useful for larger businesses producing over 50,000 pre rolls per month. According to our survey, 39.2% of pre roll businesses use automated pre roll machines, with an additional 17.6% stating that they intend to use these machines in their production down the road.

As we mentioned before, only a small percentage of companies are currently producing at least 50,000 pre rolls per month. So, automated tools are good if you’re looking to scale up, but are not needed if you’re just getting started.

For newer brands looking to boost their pre-roll production, tabletop cone filling machines are a great option. They can produce just as many pre-rolls per hour as automated machines, but are also much more versatile in their ability to produce multiple pre-roll sizes.

Many companies that have purchased automated machines find it more advantageous (and budget friendly) to invest in newer cone filling machines with folding attachments rather than a second automated machine.

What’s The Most Frustrating Part of Pre Roll Production?

According to survey results, labor-intensive tasks and quality control issues are persistent frustrations that lead to slow downs during production and manufacturing, highlighting the industry’s ongoing struggle with efficiency.

And when it comes to time-consuming tasks, twisting and folding was mentioned as the biggest choke point by 24.4% of pre roll businesses. Other top responses include filling (22%), packaging (20.3%), grinding (12.2%), sifting (11.4%), and weighing (8.1%).

"Large batches take lots of manpower to stuff.”

“Packaging regulations from the state that require us to submit a request every time we change strains within the same brand, size, type.”

“Finessing the grind for each strain.”

“Consistent flower supply being an independent manufacturer.”

“The manufacturing causes no stress - it's the regulatory rules around them that causes a delay in the time to shelves.”

Finishing pre rolls is a major drain on time resources, but it doesn’t have to be. Cone filling machines like the Fill N’ Fold have special tamping tools that help you quickly finish many pre rolls at once.

Conversely, when asked about the least time-consuming part of pre roll production, businesses identified grinding (34%), filling (21.1%), and packaging (15.6%) as not being labor-intensive. This clearly highlights the differences in production efficiency between companies that use pre roll machinery, such as industrial grinders and cone filling machines, and those that do not.

What’s Your Best Tip or Trick About Pre Roll Production?

While many companies are expanding into the pre roll business, perfecting pre roll production comes with a learning curve. To help, we polled businesses to gather tips and tricks they've learned on the job.

Grinding and sifting techniques were the most frequently mentioned tips, with 15% of respondents highlighting the importance of proper particle size and material preparation.

Packing and filling techniques followed closely, emphasizing the customer expectation for consistent and high-quality pre rolls. Patience and practice were also often mentioned, underscoring the experience factor in pre roll production.

For new pre roll brands entering the market, our respondents emphasized the importance of quality control, with 15% stressing the need to prioritize product quality and suggesting it is crucial for long-term success.

Uniqueness and differentiation were the second most common pieces of advice (12%), highlighting the importance of customization and standing out as the pre roll market becomes more competitive.

“Finding the right equipment for filling is critical.”

“Reliable machines and employees.”

“Slow and steady. Quality control.”

“Take time while grinding.”

“Practice, practice, practice.”

“Keep material at consistent humidity for good packing.”

“Dial in all SOPs first before going to market and work out a large rolling backstock.”

“Choose quality cones and brand them for that extra touch. Grind and sift well. Learn how to produce them at correct weight to avoid doing by hand.”

What Challenges Do You Face When Purchasing Pre Roll Supplies?

The pre roll manufacturing industry faces various challenges, with cost management being a significant concern for 18% of respondents. On average, pre roll producers estimated that starting a pre roll line cost around $40,000, although many reported lower costs.

Regulatory compliance and product quality issues are also major challenges, each accounting for 12% of responses.

Operational hurdles such as supply availability, shipping logistics, and packaging concerns also represent a significant portion of the challenges.

Some of the responses were more granular, pointing to more specific issues:

“Equipment is still evolving and competition from low quality producers.”

“Compliance testing for Chromium.”

“Changing regulations and labeling requirements.”

Do Your Pre Roll Employees Wear Safety Equipment?

Safety concerns have been front and center lately, following the death of a pre roll worker who died on the job in Massachusetts in late 2023. As a result, cannabis companies have been taking extra precautions to protect their workers – and our survey data backs that up.

A full 85.8% of pre roll businesses require their employees to wear safety equipment when making pre rolls. The most common safety equipment required includes gloves (95%), PPE masks (53.9%) and goggles or eyeglasses (47.1%).

These small measures go a long way to protect pre roll employees, and we encourage all businesses to require basic safety equipment to avoid putting workers at risk.

What Packaging Options Do You Use?

There’s no shortage of packaging options for pre roll businesses to choose from. However, we found one type, pop top pre roll tubes, is dominating the market. We also noticed that many producers were using more than one type of packaging. This means that, instead of focusing on one look, producers are releasing varied product types to expand their line and help distinguish their brands.

When asked about label application, 75.8% of pre roll businesses said that they were still labeling their pre rolls by hand. This is surprising considering the repetitive nature of the job, but it makes sense if you have labels that do not need exact placement.

In other words, if you are just trying to get a sticker on a package to be compliant, applying by hand can work. If you invested heavily in your branding and want your stickers to fit perfectly, it makes sense to get an automated machine or have them professionally applied for you. It would take too much time for an employee to perfectly apply hundreds of stickers.

What Do You Think About Eco-Friendly Packaging?

The cannabis industry uses a lot of plastic in their packaging, and a lot of it isn’t easily recyclable. We wanted to see how important it was for producers to incorporate recycled materials into their production line. On a scale of 1-10, producers were asked how important recycled materials were to their packaging. The average response was a 6.9, indicating a decent level of concern for eco-friendly packaging..

However, more than half of respondents (54.2%) said they would not be willing to pay more for compostable pop-top tubes. Only 37.3% said they’d be willing to pay up to 10% more..

So, while eco-friendly options remain more expensive, we’re not likely to see a major shift to more green packaging options in the cannabis industry anytime soon.

Types of Pre Rolls

One of the reasons pre rolls are so popular is because they are the most customizable product in cannabis. This means more options for consumers as well as producers. As we showed earlier, the brands with the highest sales numbers are also the brands that offer the most options (SKUs) to their customers.

Companies like Jeeter and STIIIZY have created hundreds of products to cater to a wide array of pre roll consumers. But let’s take a deeper look at what pre roll businesses are currently selling to get a better grasp on what exactly consumers are clamoring for.

What Cannabis Material is in Your Pre Rolls?

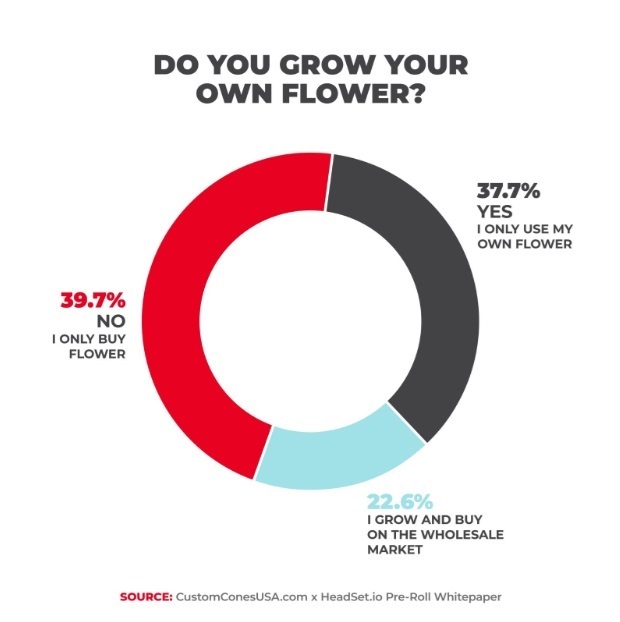

Pre roll companies are evenly split on where they get their flower; 37.7% of pre roll businesses said they use their own flower, which is up significantly from 21.6% of businesses polled in 2022. Meanwhile, 39.6% said they only buy flower.

So, while the number of pre roll businesses growing their own cannabis is on the rise, most still either buy at least some flower from other farms or on the wholesale market. This helps to explain why mixed strain pre-rolls remain popular, as pre-roll businesses who purchase their flower often find it difficult to rely on consistently receiving enough of the same single strain.

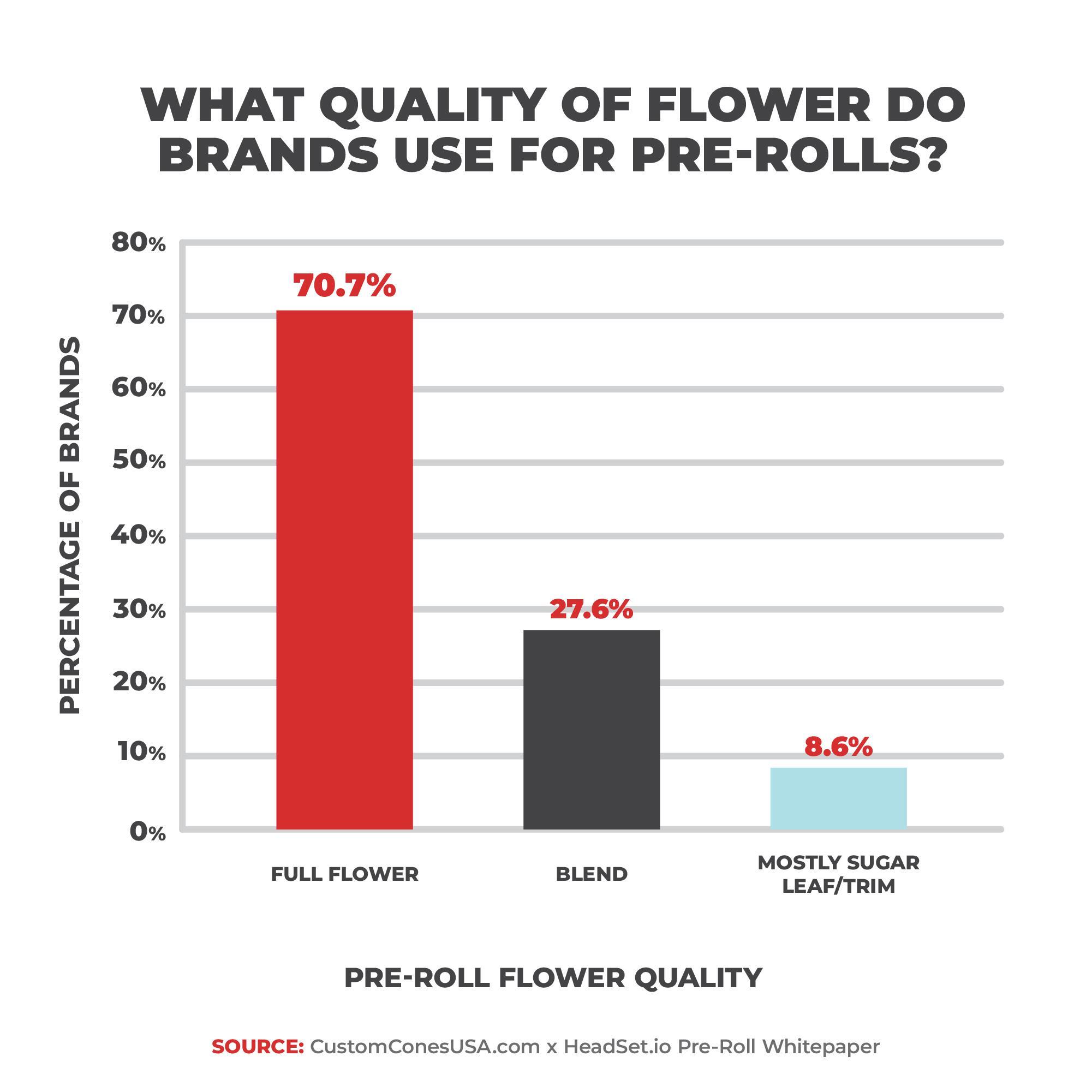

As for the quality of the flower, 70.7% of companies said they make full-flower pre rolls, 27.6% said they use a blend of flower and trim, and only 8.6% said they make pre rolls with pure sugar leaf and trim.

There is a growing premiumization trend in the pre roll sector, as consumers are drawn to higher-end and luxury pre rolls. This is reflected not just in the improved quality of flower used in pre rolls, but in the growing demand for infused and connoisseur pre rolls as well.

Our poll also showed that half of pre roll producers consider themselves either a premium or mid-shelf brand – further proof that premium pre rolls are on the rise.

This may come as a surprise to many cannabis consumers who still consider pre rolls a lower quality or cheaper product, as pre roll producers are largely using higher quality materials. However, there is still a significant market for economical pre rolls, indicating a wide range of opportunity for pre roll producers looking to establish a customer base.

What Do Consumers Care About When Selecting Pre Rolls?

But do businesses' perceptions of consumer preferences align with what consumers actually want? To find out, we asked pre roll producers what they believe consumers prioritize when selecting pre rolls and then surveyed consumers about their actual preferences. This allowed us to identify any discrepancies between the two perspectives.

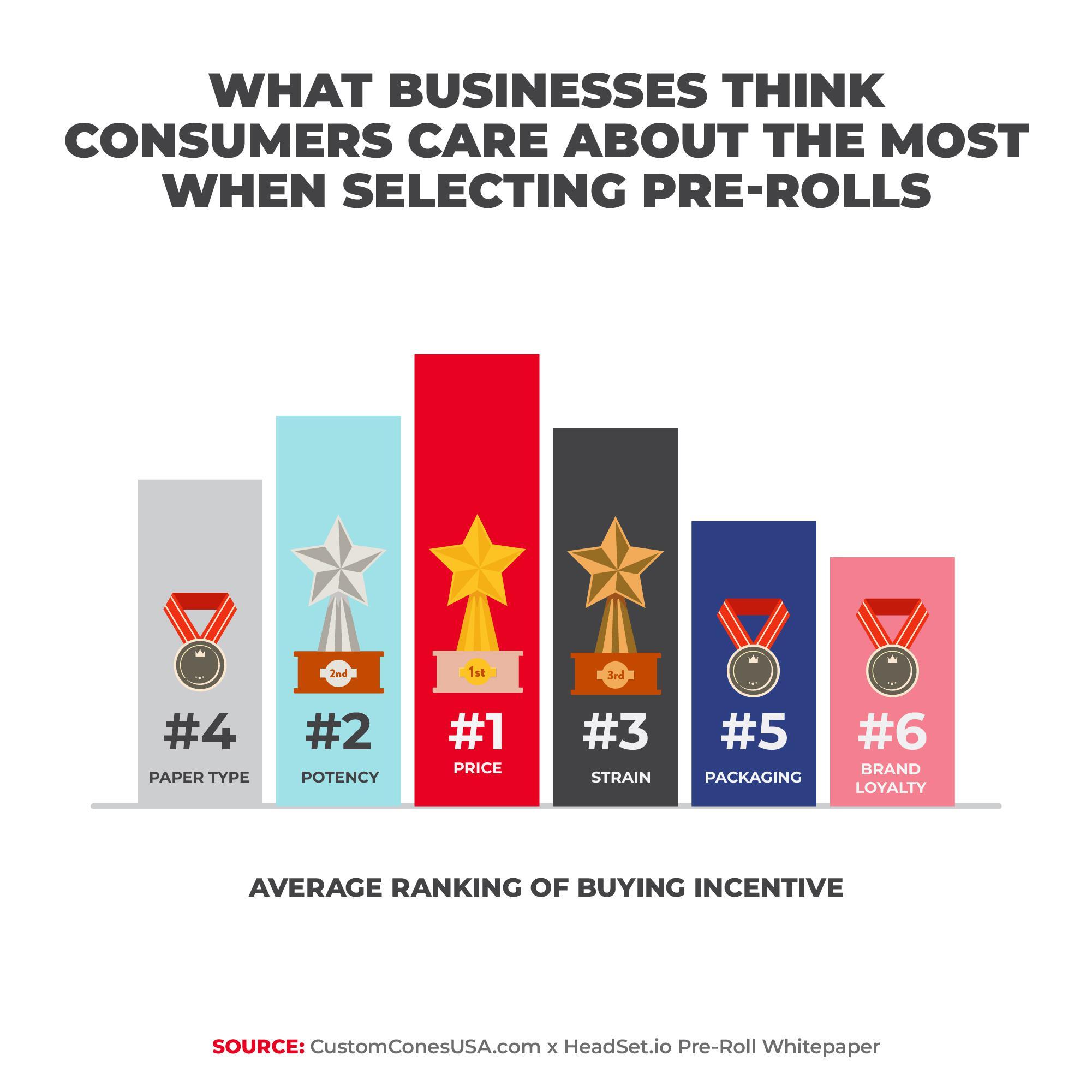

Pre roll businesses and consumers were asked to rank in order of importance the factors that weighed into consumers’ buying decisions around pre-rolls. Pre roll businesses ranked price, potency, and strain as the top 3 factors, respectively. This was followed by paper type, packaging, and brand loyalty.

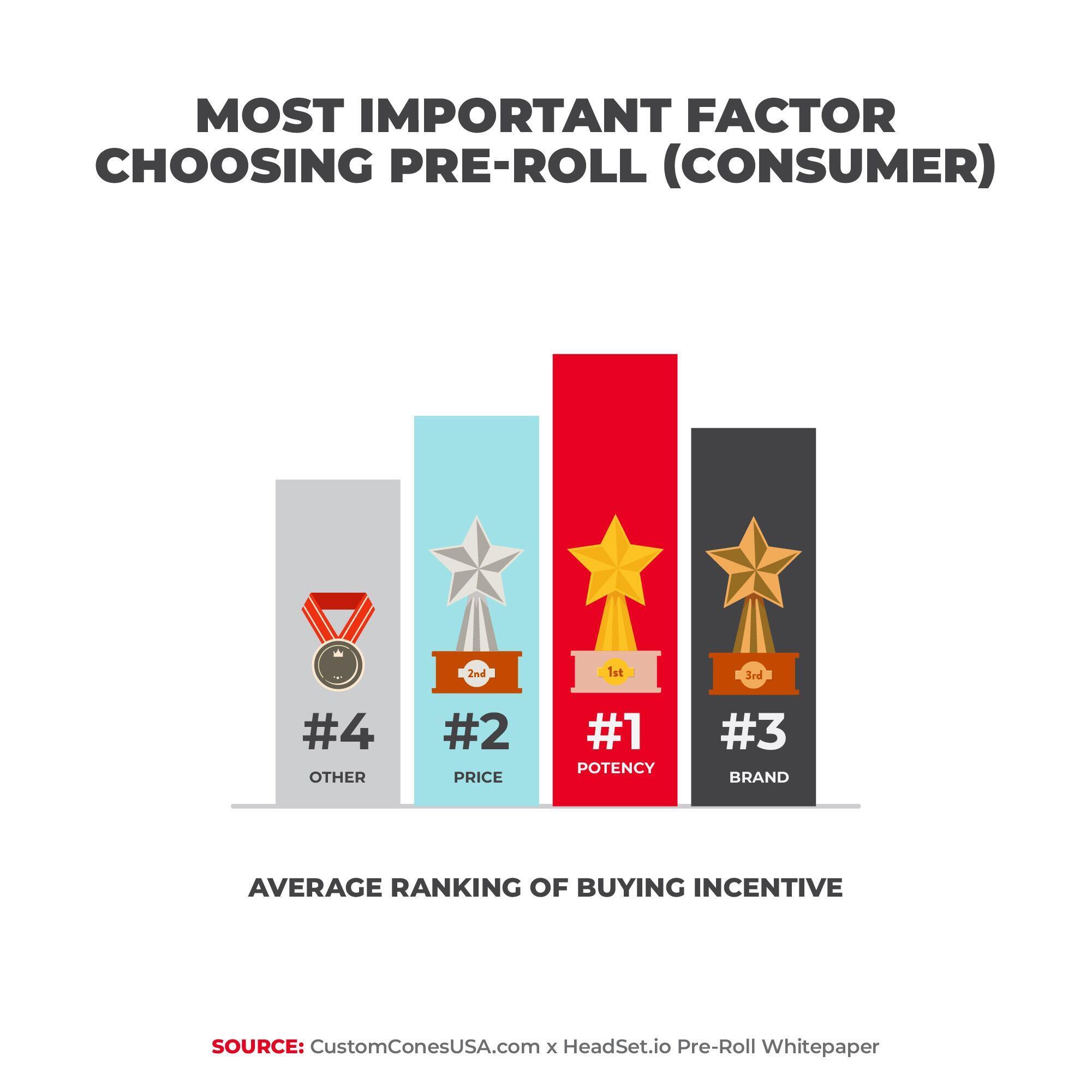

Our survey of nearly 1,000 pre roll consumers revealed that the businesses weren’t far off. Consumers listed potency as the number one factor when choosing between pre rolls, followed closely by price.

However, brand was listed as the third most important factor – placing brand loyalty much higher than what businesses perceived the value to be.

When buying bulk pre rolled cones for filling at their production facilities, businesses listed product quality, price, and reliability as the most important factors driving their decisions.

What Do You Care About When Selecting Pre Roll Materials?

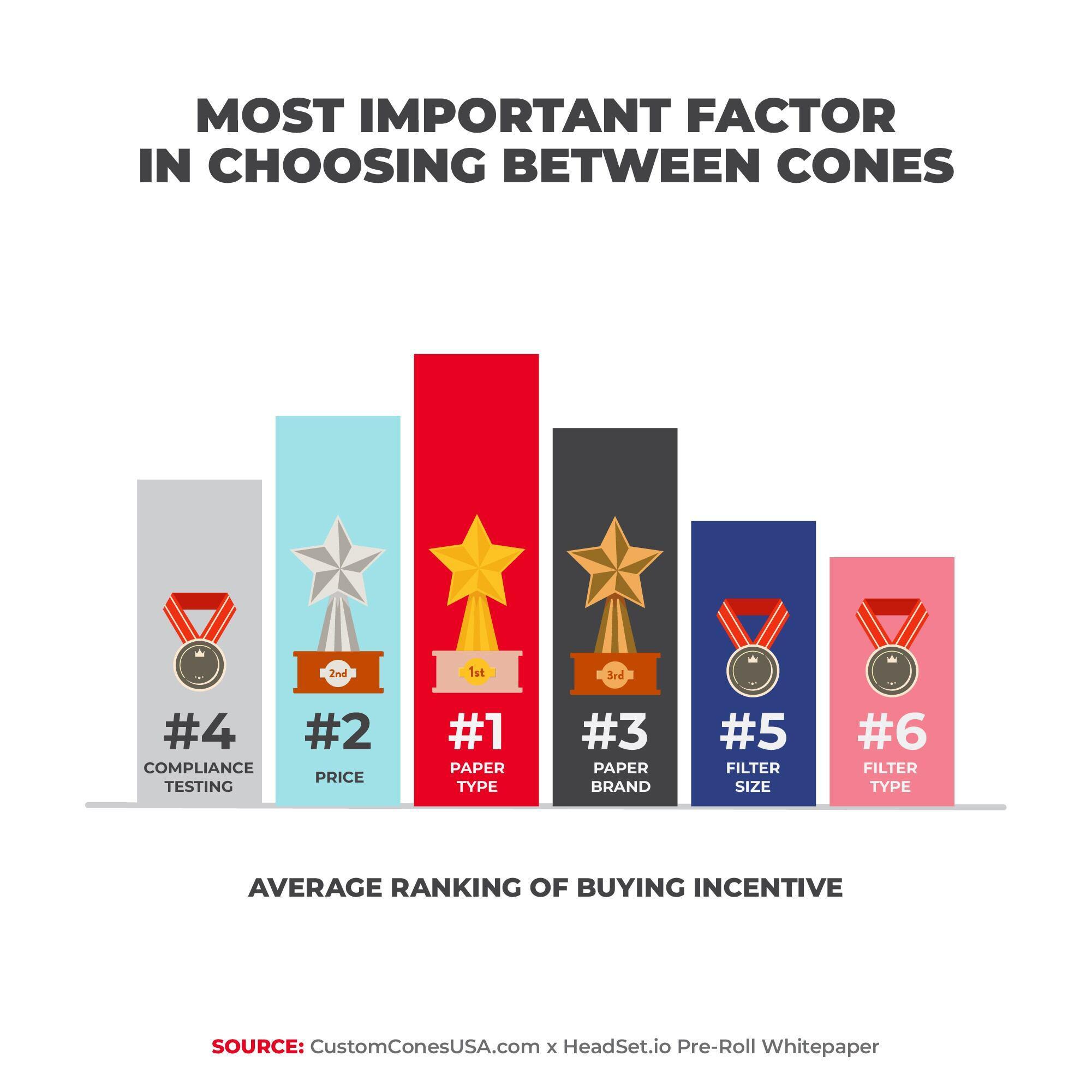

When asked about the most important factor is when it comes to deciding between cones for their pre rolls, businesses listed paper type as the top choice.

While price ranked as the No. 2 concern, things like paper brand, compliance testing, and filter size and type were all important factors. Because testing of rolling papers and cones is not required, not every pre roll supplier has their product tested for heavy metals, pesticides, and microbials, though Custom Cones USA does. You can be sure that you’ll get only high-quality pre roll products that meet compliance standards so your paper will never cause a testing failure.

What Are the Popular Pre Roll Sizes and Shapes?

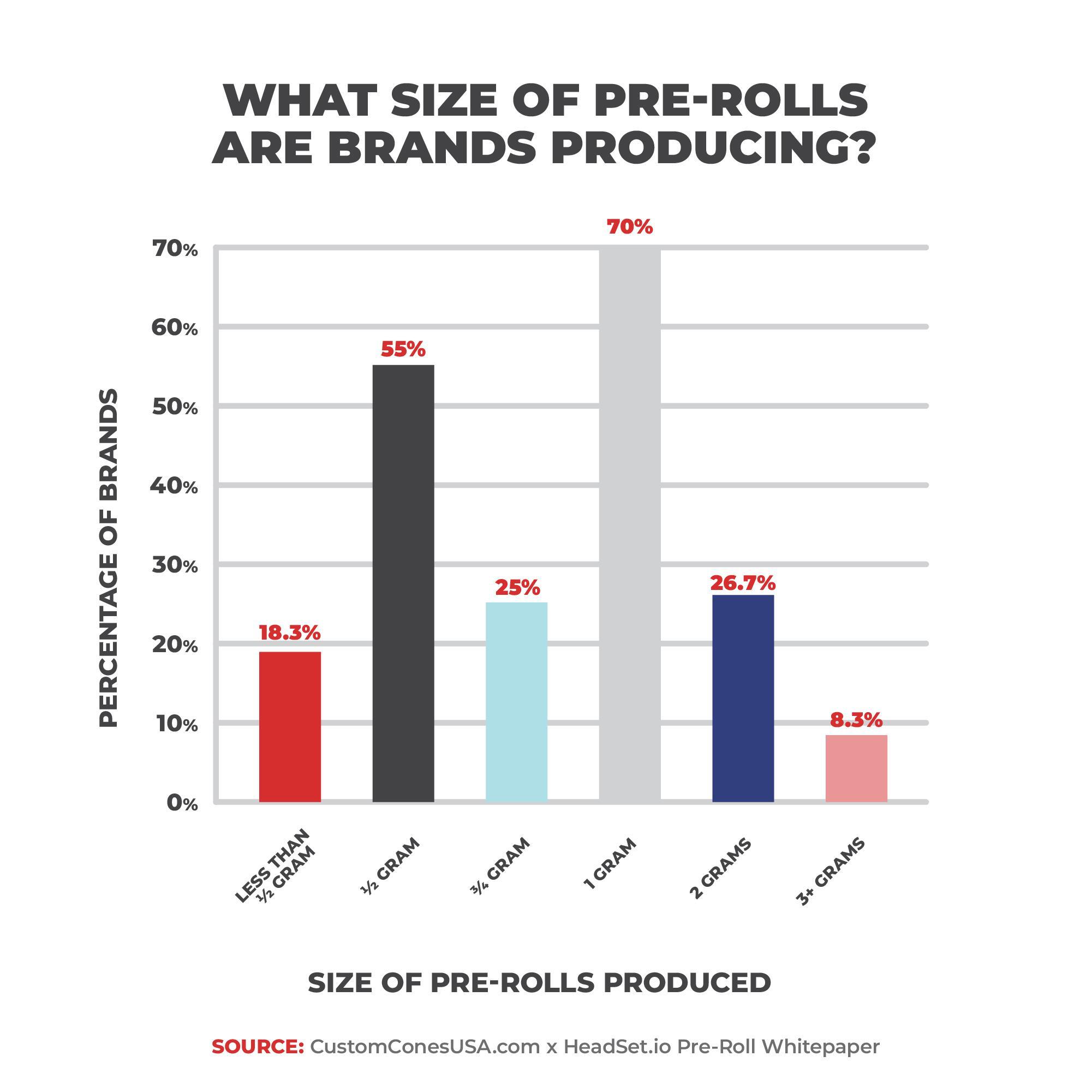

In our survey, we found that most pre roll businesses (70%) are making 1g pre rolls. This is consistent with our findings in previous years and data that shows 1 gram pre rolls remain the top-seller when it comes to individual product sizes (although multi-packs have been climbing the charts of highest-selling products).

Our poll revealed the wide diversity of pre roll sizes – many businesses are making multiple types of pre rolls and expanding their product lines. Many pre roll businesses made half gram (55%), two gram (26.7%), three quarter gram (25%) and other pre roll sizes, often producing multiple sizes at once.

Pre roll businesses are also not afraid to change their product lines – 70% of respondents indicated that they change the strains in their pre rolls monthly with another 18.3% stating they change their strains quarterly.

As for shape, pre rolled cones dominate the market, with 85.7% of pre roll producers making cone-shaped pre rolls (compared to 14.3% using only pre rolled tubes). Most of these businesses use custom branded cones, (56%) to help them differentiate themselves and stand out from the competition.

Most pre roll companies (55.7%) offer more than one brand of pre rolls – and among those the average number of pre roll brands was 4.6.

What Are The Popular Pre Roll Paper Types?

There are many paper types available in the pre roll market and our poll showed just how much variety there is in the types of papers used by pre roll producers. Refined white, natural brown, and organic hemp paper are all used by more than 44% of pre roll businesses.

Refined white remains the most popular paper type and the de facto option for pre-roll businesses. Although it’s colloquially referred to as rice paper, white rolling paper actually comes from wood pulp. White rolling paper being made out of rice paper is a common myth in the pre-roll industry and the use of this term was even the subject of a recent lawsuit, which helped to shed light that rice paper is not a real paper type.

Hemp wrap blunt cones, natural leaf, and cigarette style tubes make up a significant chunk of the market as well. It’s clear that while there are established favorites in the pre roll market, a wide array of paper choices can be found in pre roll lines.

It’s worth noting that some paper types, specifically natural leaf or those made from palm leaves, can contain harmful materials that may cause testing failures, due to the less processed nature of the product. They often contain harmful pesticides and heavy metals – which is why you’ll no longer find any Custom Cones USA products made from this material.

When asked what made them decide between paper types, pre roll businesses consider quality, price, and customer preference feedback as the most important factors.

Notably, specific product characteristics such as burn quality and taste/flavor are significant factors too, suggesting that manufacturers are keenly aware of the end-user experience when choosing a pre rolled cone supplier.

Do You Sell THCa and Delta-8 Products?

THCa has been generating buzz in the cannabis community. This compound has intoxicating effects once it’s heated through a process known as decarboxylation. While it’s been a trending cannabis product, most (61.5%) of pre roll businesses polled do not sell THCa products.

Like THCa, delta-8 THC has seen growing sales in recent years as it is not regulated to the same standards as delta-9 THC. But the future of both is uncertain, especially as states crack down on the sale of hemp-derived products.

Many respondents stated that THCa and Delta-8 have had little to no impact on their business, but some expressed frustration at the lack of information and regulations surrounding these products.

“It hurts the entire industry since they aren't held to the same standards as we are - consumers are being told false information in person, and in advertising.”

“Not sure how you compete with businesses who found the loopholes to cross borders or how you explain to people why they can buy it online but still have restrictions in in person interactions.”

“We constantly fight the misinformation being given to consumers about hemp and D8, THCa. They are told they're purchasing from a dispensary, but not that they aren't purchasing what is offered by licensed operators.”

How Many Companies Sell Infused Pre Rolls?

While infused pre rolls became the top-selling pre roll segment in tracked US markets in 2023, you might be surprised to learn that just over half (53.3%) of pre roll businesses currently produce or sell infused products.

Their dominance in the marketplace has many pre roll businesses looking for ways to get in the infused pre roll game. So how are businesses infusing their products? Most (53.8%) businesses use only internal infusion methods compared to just 15.4% using only external methods (30.8% use both).

When it comes to the type of concentrate used for infusion, kief is king with 65% of businesses use kief for their infusion. Kief is the golden collection of cannabis trichome particles knocked off during grinding and sifting that are both highly potent and easy to use, making them a win-win for pre roll producers.

Other top infusion methods are as follows:

- Live resin (50%)

- Diamonds (45%)

- Oil/distillate (45%)

- THCa powder (40%)

- Hash Rosin (30%)

- Sugar/Wax/Badder (30%)

- Bubble Hash (20%)

- High Terpene Extract (20%)

The most popular infusion method involves painting with oil and rolling in kief – 90% of businesses with infused brands use this method, while 45% mix flower and oil, and 35% either hand roll hash rosin or inject it straight into the pre roll to create the popular “hash hole” style infused pre roll.

And even though specialized machinery can help businesses scale their infused production lines fast, 60% of businesses still infuse their pre rolls by hand – leaving a lot of room for improving their efficiency and profitability.

WHAT’S NEXT FOR PRE ROLLS

What is the Next Big Trend in Cannabis?

We asked pre roll businesses what they thought would be the dominant trend over the next year in cannabis. Unsurprisingly, infused products led all results with 15% of respondents. Concentrates and extracts followed closely with 11 % of participants, indicating a growing interest in more potent and refined cannabis products.

We predict that freshness will be the next big thing for pre-rolls, as businesses can help differentiate themselves by providing consumers with fresher products.

Freshness will be impacted by the adoption of humidors, which help regulate the moisture content and temperature that pre-rolls are stored in. Businesses will benefit from using them after production and at retail.

Businesses will also produce fresher pre-rolls using better forecasting and supply chain methods. This way, businesses can sell pre-rolls closer to the time they are produced, rather than mass producing thousands of pre-rolls months in advance.

Better product packaging will also contribute to fresher pre rolls. From airtight caps to super seal tubes, there is constant packaging innovation happening that helps to keep pre-rolls fresher for longer.

“Higher quality at better price.”

“Quality affordable flower!”

“Better flavored cones.”

“New extractions & extraction methods.”

“Designer hash holes, limited release small batch.”

“Flavored products high potency.”

“Brand loyalty, consistency, quality.”

“Less plastic packaging.”

What Is Exciting About The Future of Pre Rolls?

There’s growing excitement about the future of the pre roll industry, with innovation and new products leading the way. Nearly 18% of respondents expressed excitement for upcoming innovations and novel product offerings, such as automation, eco-friendly products, and new infused products.

Market growth and expansion was the second most common source of excitement, mentioned by 11% of participants, highlighting optimism about the industry's trajectory.

Innovation in the space and buying into automation in the next few years.”

“The different types of mixed and infused material.”

“Interstate commerce.”

“An increase in market share for the category. Pre rolls are a solution for tourists and locals alike.”

“Innovative machines at better prices.”

“Customer education and quality focused rather than a race to the bottom.”

“Consistent ever-expanding quality.”

“Like everything else in this industry: The constant innovation and creativity.”

“The endless possibilities.”

How Will Cannabis Legalization Impact Pre Rolls?

The continued legalization of cannabis at the state level across the U.S. is anticipated to be the primary driver behind exponential growth of the pre roll category over the next decade. As more states legalize cannabis, consumer access increases, leading to higher overall sales in the pre roll market.

Let’s take a closer look at some of the new cannabis markets and their potential impact on the pre roll industry:

Ohio

Ohio is poised to become a significant cannabis market as recreational sales began in August 2024. As the seventh-largest state with nearly 12 million residents (about twice the population of Arizona, a red-hot cannabis market), Ohio has the potential to contribute significantly to pre roll sales.

If it follows the growth trajectory of the similarly populated Illinois, we can expect Ohio pre roll sales to be around $150 million annually within a few years.

Minnesota

Despite its slow rollout of recreational cannabis, Minnesota’s pre roll market is slated to go live sometime in 2025. Minnesota and its population of 5.7 million has the potential to be a significant market right out of the gates. Should it follow a similar trajectory to Colorado (population 5.8 million), we can expect annual sales to reach $30-$40 million in Minnesota in the next few years. Once the market matures, it could even match Colorado’s strong $100+ million annual pre roll market.

Florida

While several states are slated to enter the legal cannabis market, perhaps the most pivotal state to the growth of the pre roll market is Florida. As the third-largest state in the U.S., it has immense potential for pre roll sales if voters approve legalization in November 2024.

Despite political challenges, strong voter support could see Florida enter the pre roll arena as an immediate contender to become the second largest market (California’s $750 million annual market will be tough to beat). Even conservatively, we can expect Florida to bring an immediate $100+ million annual influx to the pre roll segment and around $400-$500 million per year once it matures.

How Will Markets Mature?

Key to the growth of the pre roll category is not just newly legalized markets, but the maturity of markets as well. From newly established markets like Michigan and Arizona to old stalwarts like Colorado and Washington, we’ve seen incredible pre roll growth in states once their cannabis industries reach full swing.

Here are a few markets set to take off:

Maryland

Maryland has experienced phenomenal growth since legalizing recreational cannabis in 2023. The state has raked in more than $135 million in pre roll revenue in 2023 and the first six months of 2024.

The numbers are even more impressive when you compare sales from 2023 to 2024. Maryland experienced a 220% increase in year-over-year June pre roll sales, going from $3.5 million in June 2023 to $11.2 million in June 2024. The sky is the limit for the Old Line State as it enters its third year of recreational cannabis.

Missouri

Missouri has been one of the hottest pre roll markets since recreational cannabis first went live in early 2023. Monthly sales have increased from $7.1 million in February 2023 to $13.5 million in June 2024, a 90% increase in a 16-month span. The Show Me State has racked up more than $200 million in pre roll sales in that time – showing potential for a strong and reliable pre roll market in the coming years.

New York

Perhaps no tracked pre roll market has been as frustrating as New York. The Empire State legalized cannabis in 2021 but the industry has yet to fully mature thanks to a litany of bureaucratic roadblocks. Pre roll sales reached $10.2 million in June 2024, which ranks 10th in the 13 tracked U.S. states in Headset (despite New York having the fourth largest population of any state in the U.S.)

Still, New York’s potential as a pre roll market cannot be overstated. With a population of nearly 20 million, New York could easily surpass the $100 million annual sales mark once the rollout of legal cannabis is complete.

Pre Roll Market Projections

So where does the pre roll market go from here?

Looking at all these factors, let's forecast what the state of the pre roll industry will look like in the future.

Sales & Market Share

Pre roll market share has steadily increased, going from 10.3% in 2019 to 15.9% in June 2024. If the pre roll market continues to increase at its current pace, we can estimate a market share of 17 to 18% by the end of 2025, which would equate to roughly $4 billion in annual sales.

By 2030, pre roll market share could reach 20% with annual sales potentially exceeding $5 billion, depending on the size of the overall cannabis market.

Infused Pre Rolls

As consumer demand grows for premium pre roll products, infused pre rolls will continue their ascent. Infused pre roll market share has risen steadily in recent years, going from a 34.4% market share in 2019 to 44.4% in the first half of 2024.

As innovation brings forth new infusion technologies, exotic strain crosses, and ultra-premium ingredients, we can expect an influx of premium and infused products entering the marketplace. Rising consumer demand and innovation could help infused pre rolls hit a 50% market share by the end of 2025 and 60% by 2030.

Consumer Preferences

The growth of the pre roll market is set to increase competition among businesses aiming to attract pre roll enthusiasts. This heightened competition will result in better options for consumers seeking innovative pre roll products.

In addition to infused pre rolls, we anticipate a surge in items like premium tips and custom-branded cones. Consumers will also demand superior products, including higher quality flower and pre rolls preserved with blunt caps or humidors to maintain freshness, especially on high end blunt products.

With so many consumers turning to premium products, brands will likely need to differentiate themselves from the competition with improved quality. We’ve already seen the pre-roll industry begin eschewing cheap and low-quality pre-rolls in favor of superior products. A natural progression of the premium trend will be the advent of fresher flower, preserved through superior packaging and storage methods.

The State of Pre Rolls in 2024 and Beyond

The pre roll industry is characterized by rapid innovation and adaptation. Our analysis reveals a sector driven by consumer demand for premium products, particularly infused pre rolls, alongside a growing emphasis on product diversity and quality – companies are even making cross joint shaped pre-rolls.

Production efficiency remains a key challenge, with businesses exploring various technologies and techniques to streamline processes while maintaining product integrity. The industry's expansion into new markets brings both opportunities and regulatory hurdles, requiring companies to remain agile and informed.

As the pre roll sector matures, success will likely hinge on balancing innovation with consistency, navigating complex regulatory environments, and responding to evolving consumer preferences for both premium and value options.

With its blend of artisanal craft and technological advancement, the pre-roll market is poised not just for growth, but for a revolution in how cannabis is consumed and experienced. Those who can ride this wave of change – melding premium offerings with operational excellence – will shape the industry's trajectory for years to come.

View Past Pre-Roll Industry White Papers:

2023 Pre-Roll Industry White Paper

2021 Pre-Roll Industry White Paper

The pre roll industry is undergoing exciting developments, marked by the emergence of new product categories and expanding markets. In 2023, infused pre rolls became the top-selling category, reflecting a shift in consumer preferences. And in the past few years, new markets like Arizona, Illinois, Maryland, Missouri, and New York have joined the legal cannabis landscape, contributing to the industry's rapid growth.