Top 100 U.S. Pre-Roll Brands of 2025

Posted by Custom Cones USA on Jun 11th 2025

The Top 100 U.S. Pre-Roll Brands of 2025

Researched, written and produced by Brian Beckley and James Valentine of Custom Cones USA in collaboration with Cain Newman and Marshall Engelthaler, cannabis business students and LSSU Cannabis Club members at Lake Superior State University.

$3.1 billion. 316.8 million units sold. Nearly 3,000 brands vying for dominance.

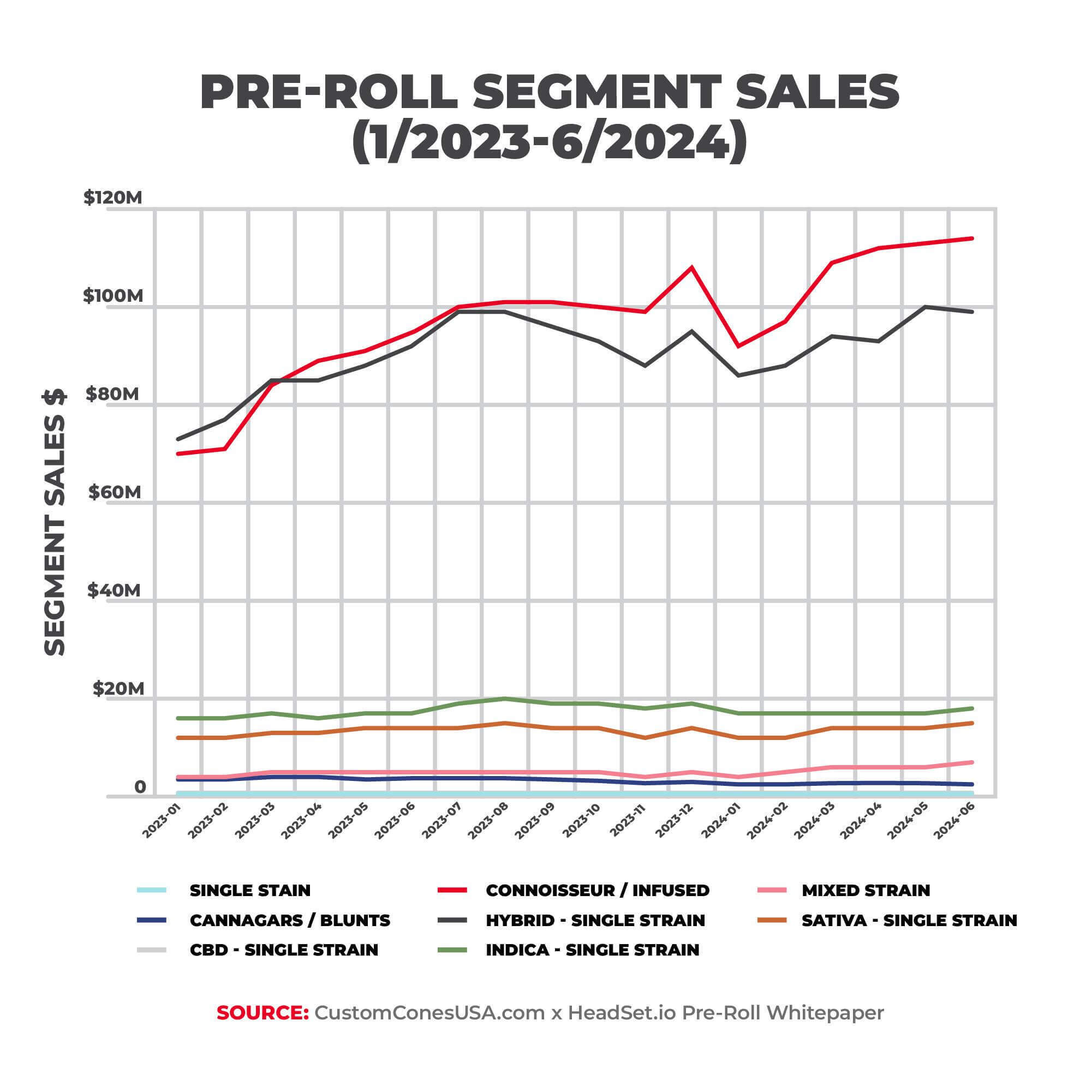

Welcome to America's pre-roll market, where 82% of cannabis smokers fuel a category growing 12% year-over-year and commanding 15.4% of the entire cannabis landscape. This isn't just big business; it's a revolution led by brands that cracked the code on what consumers actually want, with 94% preferring joints as their consumption method of choice.

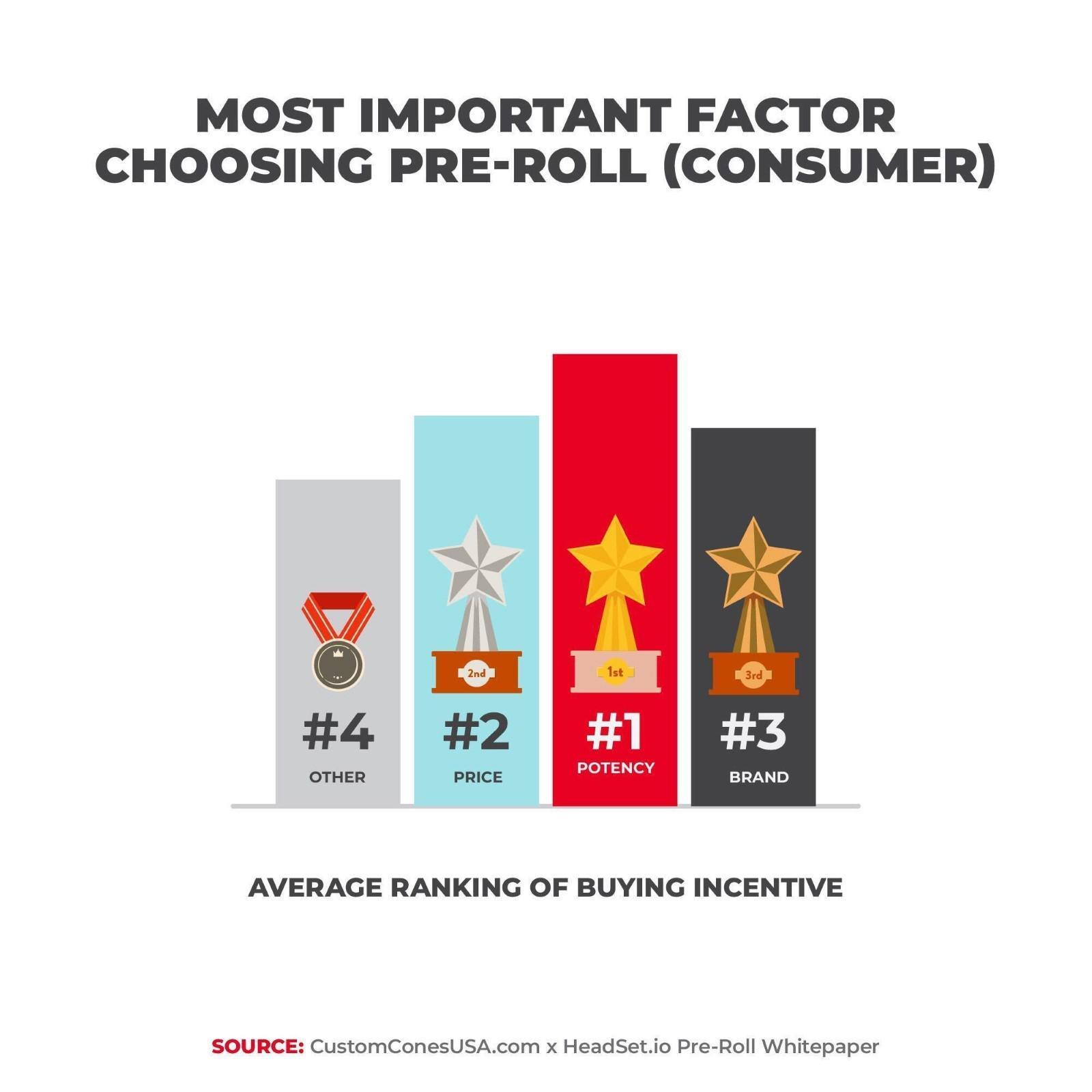

Top brands understand that the pre-roll game has changed. Infused pre-rolls dominate with a 44.4% market share, while multi-packs capture nearly 50% of all sales. With 80% of cannabis users consuming multiple times daily and ranking potency, price, and brand as their top three factors when purchasing pre-rolls, loyalty becomes everything.

These Top 100 Brands haven’t just adapted, they have led an industry transformation. From Jeeter's $243 million diamond-infused empire to Dragonfly Cannabis moving 12.3 million units through strategic pricing, each brand has discovered their unique paths to pre-roll dominance. Some are single-state powerhouses like Goodlyfe Farms. Others are multi-state operators like STIIIZY. Nearly all have invested in automated production, sophisticated infusion technologies, and premium pre-roll materials that separate them from the pack.

These are the pioneers who didn't just ride the pre-roll wave, but helped create it. These brands set tomorrow's standards today, and their success stories reveal the blueprint for pre-roll excellence in one of America's most competitive and innovative cannabis categories.

Methodology

In partnership with Seattle-based cannabis analytics firm Headset, whose data is sourced from actual consumer transactions across over 3,500 retailers in 12 U.S. state markets and 4 Canadian provinces, Custom Cones USA has identified the Top 100 Pre-Roll Brands in the American market using total pre-roll sales data to highlight the top-selling brands in the U.S. cannabis Pre-Roll segment.

Headset data from the following 12 states was analyzed: Arizona, California, Colorado, Illinois, Maryland, Massachusetts, Michigan, Missouri, Nevada, New York, Oregon, and Washington.

Custom Cones USA created a 10-point Social Score, by calculating the percentile rank of each brand’s Instagram, LinkedIn, and website metrics to reduce the impact of outliers. These percentile-based values were then weighted by relevance to generate a balanced score that reflects how engaged and visible a brand is online.

Instagram contributes 40% to the overall score and is based on several factors: 35% of the score comes from the number of followers, 20% from the number of posts, 30% from the average number of likes calculated as an average of the 10 most recent posts, and 15% from the average number of comments, also calculated from the 10 most recent posts.

It should be noted, Instagram’s rules are especially tough on cannabis brands, getting shadowbanned or having their accounts deleted just for showing someone smoking or using words like "cannabis" in their captions. Some profiles may be down right now as Instagram’s moderation hits hard.

LinkedIn accounts for 25% of the overall score and is based on the number of followers.

Website metrics make up 35% of the total score, with 45% of that score coming from the domain rating and 55% from the amount of organic traffic.

America's Top Pre-Roll Brands of 2025

-

- #1

-

Jeeter

-

-

- Total Pre-ROll Sales $245,331,451

- Pre-Roll Units Sold 9,963,014

-

-

-

TOTAL PRODUCTS

(2024) 1403 -

AVG ITEM PRICE

(2024) $24.62 -

AVG UNIT COST

(2024) $16.34 -

PROFIT

MARGIN 34% -

BRAND MARKET SHARE

(2024) 8.00%

-

About the Brand

Jeeter is the undisputed heavyweight champion of the pre-roll world. The California-based company moved nearly 10 million units across four states in 2024 for a total revenue of more than $243 million, more than double its closest national competitor. Launched in California in 2018 by co-CEOs Lukasz Tracz and Sebastian Solano, along with Chief Financial Officer Scot Garrambone, Chief Sales Officer David Solano and Chief Product Officer Peter Dimirov, the company is named for the group’s pre-legality code word for a joint. Jeeter earned the top pre-roll revenue spot in California, Arizona and Michigan and landed in fifth in Massachusetts, accounting for a full 8% of pre-roll revenue nationwide. Because of the company’s focus on infused products, their pre-rolls have a higher average price point than many of its competitors, leading to higher revenues on fewer item sales. For example, while Jeeter’s 8% of revenue is easily the largest in the country, it places second in units sold at 3.1%.

Products and Packaging

The company offers three main product sizes of most strains, all of which are infused with either THC Diamonds or cannabis oil, depending on the state, and then rolled in kief: the 1-gram Jeeter pre-rolled cone, the 2-gram Jeeter XL pre-rolled tube and 0.5-gram Baby Jeeter, packaged in jars of 5 pre-rolled cones for a total of 2.5 grams. All of Jeeter’s pre-rolls are packaged in glass or clear plastic jars or tubes, with bright, foil labeling and a color-matched metallic cap. Along with the easily recognizable outside infusion, Jeeter adds an extra layer of branding with a color-coded filter wrap featuring the company’s branding, or in the case of the 2-gram XL, a customized cigar band featuring the branding that wraps around a glass-tipped pre-rolled tube.

Marketing

Jeeter is known primarily for its infused pre-rolls, celebrity pairings like its 4.2-gram Bob Marley “Unity Joint” in guitar-shaped packaging and athlete collaborations, such as a special Ricky Williams “Jeeter X Highsman” pack, a Dwayne Wade pack and even a Boston Celtics “18th Banner Tribute” pack celebrating the team’s 2024 NBA championship. Jeeter is also known for its stylish, elaborate packaging and unique strain drops. The company is famous for elaborate packaging as well, such as the “Jeeter HOF” pack celebrating Dwayne Wade’s career that features a full grain basketball-style faux leather and two exterior “lockers” filled with easter eggs celebrating Wade’s basketball and post-basketball careers.TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Baby Jeeter - Blueberry Kush Infused Pre-Roll 5-Pack (2.5g) | $6,605,399 | 230,816 | $28.62 | 3% |

| #2Baby Jeeter - Watermelon Zkittlez Diamond Infused Pre-Roll 5-Pack (2.5g) | $5,691,886 | 200,858 | $28.34 | 2% |

| #3Baby Jeeter - Blue Zkittles Quad Infused Pre-Roll 5-Pack (2.5g) | $5,650,179 | 199,050 | $28.39 | 2% |

| #4Baby Jeeter - Strawberry Sour Diesel Liquid Diamond Infused Pre-Roll 5-Pack (2.5g) | $5,642,081 | 195,859 | $28.81 | 2% |

| #5Baby Jeeter - Grandaddy Purple Quad Infused Pre-Roll 5-Pack (2.5g) | $5,454,722 | 190,547 | $28.63 | 2% |

-

- #2

-

STIIIZY

-

-

- Total Pre-ROll Sales $110,507,739

- Pre-Roll Units Sold 5,071,074

-

-

-

TOTAL PRODUCTS

(2024) 347 -

AVG ITEM PRICE

(2024) $21.79 -

AVG UNIT COST

(2024) $12.77 -

PROFIT

MARGIN 41% -

BRAND MARKET SHARE

(2024) 3.61%

-

About the Brand

The No. 2 spot nationally easily belongs to California-based STIIIZY. The company sold more than 5.1 million pre-roll units in five states in 2024 for a total annual revenue of $110.5 million. Founded in 2017 as a vape company, STIIIZY’s 40’s brand infused pre-rolls and infused blunts have become a favorite in the pre-roll category. Co-founded by CEO James Kim, an Iraq war veteran who used cannabis to treat his PTSD and help transition to civilian life, STIIIZY overflows with SoCal vibes, including the name, which is derived from the Cali term “steez,” referring to the convergence of style and ease. Like other top-selling pre-roll companies, STIIIZY’s focus on infused products gives it a high average price point, leading to higher revenues on smaller unit sales than other pre-roll manufacturers. STIIIZY accounts for 3.6% of total pre-roll revenue and 1.6% of all units sold, however, because the company sells a wide variety of items, its overall brand market share is the highest in the data. In fact, STIIIZY’s 40's - Blue Dream Infused Pre-Roll 5-Pack (2.5g) is the top-selling pre-roll product in the country.

Products and Packaging

STIIIZY pre-roll line is known as 40’s, because of their potency, and comes in both 1-gram single-packs and 2.5-gram 5-packs of classic pre-rolls. They also offer 5-packs of 0.5-gram hemp wrap blunt cones and 2-gram hemp wrap blunt tubes. All of the STIIIZY 40’s are infused with live resin and dusted in kief. All of STIIIZY’s pre-rolls are packaged in glass jars with elaborate, metallic labels that are color coded with the caps used on the jars, as well as customized branding on the filters, all of which say “STIIIZY.” The pre-rolled blunt cones use color-coded cigar bands that match the colors on the jar, while the 2-gram tubes feature a customized cigar band with the brand name.

Marketing

As a company that got its start making concentrates and vapes, STIIIZY’s pre-roll marketing is focused on the potency of the concentrate it uses to infuse its joints, going so far as to name their pre-roll line “40’s” in deference to the potency. The company also focuses on its Southern California roots, and its branding tends toward the high-end, with the use of glass tubes and jars, as well as metallic printing to match the higher price point of its infused product lines. Unlike other companies, STIIIZY does not do collaborations with artists or celebrities, though it has been active in sponsoring events, such as the Rolling Loud Hip-Hop festival, as well as partnering with Weed for Warriors on an exclusive vape battery and Zumiez apparel.TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #140's - Blue Dream Infused Pre-Roll 5-Pack (2.5g) | $8,533,977 | 356,876 | $23.91 | 8% |

| #240's - Strawberry Cough Infused Pre-Roll 5-Pack (2.5g) | $6,738,806 | 275,309 | $24.48 | 6% |

| #340's - King Louis XIII Mini Infused Blunt 5-Pack (2.5g) | $5,714,172 | 239,430 | $23.87 | 5% |

| #440's - Pink Acai Infused Pre-Roll 5-Pack (2.5g) | $5,136,397 | 213,192 | $24.09 | 5% |

| #540's - Pineapple Express Live Resin Infused Blunt 5-Pack (2.5g) | $5,022,217 | 207,733 | $24.18 | 5% |

-

- #3

-

Dogwalkers

-

-

- Total Pre-ROll Sales $76,980,340

- Pre-Roll Units Sold 3,396,704

-

-

-

TOTAL PRODUCTS

(2024) 792 -

AVG ITEM PRICE

(2024) $22.66 -

AVG UNIT COST

(2024) $12.93 -

PROFIT

MARGIN 43% -

BRAND MARKET SHARE

(2024) 2.51%

-

About the Brand

Coming in third is the Dogwalkers brand, which has been so successful at popularizing the mini cone that the brand’s name has become synonymous with the product, like Kleenex or Xerox. In 2024, Dogwalkers sold $77 million worth of pre-rolled cones, moving 3.4 million units across nine states. Dogwalkers was founded in Illinois in 2016 by Ben Kolver, who was inspired to create pre-rolls he could enjoy on walks with his dog, Bailey. They are part of Green Thumb Industries (also founded by Kolver). Dogwalkers pre-rolls are “intentionally sized” to be smaller, more personal pre-rolls that are filled with premium cannabis, perfect for, say, a walk around the block with a four-legged friend. Dogwalkers’s offerings in 2024 accounted for 2.5% of total pre-roll revenue and 1.1% of total units sold.

Products and Packaging

Dogwalkers offers only three pre-roll products and, interestingly enough, most are off-size by general industry standards. Whereas most companies produce 109mm full-gram pre-rolls and 84mm half-gram pre-rolls, Dogwalkers has built its success on in-between sizes: the 0.35-gram Mini Dogs Pre-Rolls that the company is most known for, the 0.75-gram Big Dog Pre-Roll for “longer walks,” and the new Show Dog Infused Pre-Roll, available in 0.45 grams and 1-gram size, the company’s only “normal” sized pre-roll. The company packages all of its pre-rolls in “discreet” packaging that is designed to be taken on-the-go. Its Mini Dogs are packaged in small, reusable, forest green branded embossed tins that hold either 5 or 12 pre-rolls. The Big Dog pre-rolls are packaged in reusable green, branded tubes with twist-off caps. The Show Dog infused pre-rolls are available in both a white embossed tin (the 0.45-gram pre-rolls) and a white tube (the full gram).

Marketing

Dogwalkers does not do any celebrity collaborations or any other major sponsorships, instead focusing on its niche sizes and leaning into its canine-themed motif, referencing “Chihuahuas and Dachshunds” in its Mini Dog marketing and “Great Danes and Newfoundlands” as part of its Big Dog sales pitch. The company is also committed to helping animals and partners with animal rescue organizations in states where the product is sold, with portions of every Dogwalkers product purchased going to that state’s organization. The donations are made as part of the “Bailey Legacy Fund,” celebrating the life of the dog that inspired the company’s founding and died in 2020.TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Mini Dog - Animal Face Pre-Roll 5-Pack (1.75g) | $5,635,138 | 237,569 | $23.72 | 7% |

| #2Mini Dog - Brownie Scout Pre-Roll 5-Pack (1.75g) | $3,975,422 | 168,437 | $23.60 | 5% |

| #3Mini Dog - Afternoon Delight #4 Pre-Roll 5-Pack (1.75g) | $3,485,692 | 145,119 | $24.02 | 5% |

| #4Mini Dog - Head Cracker Pre-Roll 5-Pack (1.75g) | $2,026,739 | 81,396 | $24.90 | 3% |

| #5Mini Dog - White Durban Pre-Roll 5-Pack (1.75g) | $1,799,701 | 77,181 | $23.32 | 2% |

-

- #4

-

Cali-Blaze

-

-

- Total Pre-ROll Sales $61,812,846

- Pre-Roll Units Sold 8,168,269

-

-

-

TOTAL PRODUCTS

(2024) 744 -

AVG ITEM PRICE

(2024) $7.57 -

AVG UNIT COST

(2024) $4.38 -

PROFIT

MARGIN 42% -

BRAND MARKET SHARE

(2024) 2.02%

-

About the Brand

Despite only operating in three states – neither of which is California, ironically – Michigan-based Cali-Blaze claims the fourth spot nationally, selling an astounding 8.3 million units and hauling in $61.8 million in revenue in 2024. Located in per-roll crazy Michigan and established in 2022, Cali-Blaze lands in the state’s second spot for revenue and second in units sold, both likely related to the company’s price points. Cali-Blaze is heavily invested in making infused pre-rolls, with all 50 of their top products falling into the connoisseur/infused segment. With a wallet-friendly average item price of $7.57, Cali-Blaze products have built a strong following in the state, though, interestingly enough, they did not have a single product that cracked the Top 50. The company also ranks second in Colorado’s pre-roll market. However, nationally, Cali-Blaze still accounted for 2% of all pre-roll units sold putting them third behind Dragonfly Cannabis and Jeeter.

Products and Packaging

Cali-Blaze's signature product is the Tarantula, a 1-gram pre-roll infused with THCa or live resin and then rolled in kief and available in more than 20 flavors in packs of 1 or 3. There is also a 1.4-gram King Tarantula variety infused with “strain-specific live resin.” The company also produces classic pre-rolls of just flower, as well as 1.2-gram classic pre-roll infused with Liquid Diamonds, as well as its Donut Blunts, a 1.2-gram pre-roll with a glass filter tip that is infused with live resin. They also have 5-packs of mini pre-rolls. All of the company’s pre-rolls have the Cali-Blaze logo printed on the filter, except for the blunts, which use a custom cigar band. Cali-Blaze packages its pre-rolls in jars, with colorful logos and metallic printing that vary depending on flavor paired with black tops.

Marketing

Cali-Blaze does not do any collaborative marketing, instead focusing on the products themselves and the company’s indoor-grown flower (which separates it from other Top 10 Michigan brands). Cali-Blaze marketing uses the phrase “find your flavor”, focusing on the more than 30 different flavor options of its pre-rolls. They are also known for the high potency percentages their infusion methods provide, with some reaching past 41% THC, while still maintaining a relatively low price point. The company also places a heavy emphasis on building relationships with budtenders, with a focus on events.TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Watermelon Diamond Infused Pre-Roll (1.2g) | $1,469,461 | 203,339 | $7.23 | 2% |

| #2Dragon Fruit Infused Pre-Roll (1.2g) | $1,463,709 | 215,402 | $6.80 | 2% |

| #3Fruit Punch Infused Pre-Roll (1.2g) | $1,402,039 | 202,564 | $6.92 | 2% |

| #4Strawberry Infused Pre-Roll (1.2g) | $1,391,675 | 198,183 | $7.02 | 2% |

| #5Blueberry Infused Donut Blunt (1.2g) | $1,353,082 | 196,328 | $6.89 | 2% |

-

- #5

-

Presidential

-

-

- Total Pre-ROll Sales $43,262,454

- Pre-Roll Units Sold 2,577,072

-

-

-

TOTAL PRODUCTS

(2024) 280 -

AVG ITEM PRICE

(2024) $16.79 -

AVG UNIT COST

(2024) $8.52 -

PROFIT

MARGIN 49% -

BRAND MARKET SHARE

(2024) 1.41%

-

About the Brand

Rounding out the Top 5 is Presidential Cannabis, which bills itself as the “World’s Strongest” pre-rolls and blunts. Presidential was one of the first companies to sell infused pre-rolls and infused blunts, which they infuse with THC distillate using a “proprietary process” and roll in kief. In 2024, that led them to $43.3 million in sales, totaling about 2.6 million units. Presidential’s 28 products accounted for 1.4% of national pre-roll sales revenue and 0.8% of all units sold, which equates to a 0.2% market share. (Note: Numbers used for this piece do not include Oklahoma sales.) Founded in 2012 by Everett Smith following a career playing professional basketball in Europe, Presidential products are available in four states and saw growth in sales, units sold and market share in 2024.

Products and Packaging

Presidential sells both infused pre-rolls and infused blunts, both of which are made with organic flower, THC distillate and rolled in kief. The company’s infused blunts are 1.5 grams, made with moonrocks that are packed into a hemp pre-rolled cone and labeled with a custom cigar band. They also offer 3-packs of 0.7-gram mini blunts, made the same way. The company also sells traditional pre-rolls, made with the same moonrocks, in 1-gram cones and as 3-packs of 0.5-gram cones, each featuring the company’s logo printed on the filter. The company packages its pre-rolls and blunts in mylar packs that look a lot like cigarillo packs that contain the cigars commonly used to make home-rolled blunts.

Marketing

Presidential’s marketing focuses on potency, with its “World’s Strongest” slogan featured on every package, as well as communicating that their hemp blunt products are 100% tobacco free. Touting their status as one of the trailblazers of infused products in the U.S. cannabis market, their commitment to excellence fuses cannabis with cutting-edge science and technology to create the safest, most reliable and innovative products on the market. They host parties and events that draw big crowds that set the vibe for the brand: cool, confident, and bold.TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Waui Moon Rock Infused Blunt (1.5g) | $2,272,666 | 130,345 | $17.44 | 5% |

| #2Presidential x THC Design - Pink Cookies Moonrock Infused Blunt (1.5g) | $1,456,311 | 88,649 | $16.43 | 3% |

| #3Grape Moonrock Triple Threat Infused Pre-Roll (1g) | $1,430,253 | 101,904 | $14.04 | 3% |

| #4Blue Raspberry Moonrock Infused Pre-Roll (1g) | $1,365,730 | 98,105 | $13.92 | 3% |

| #5Presidential x Rove - Skywalker Moonrock Infused Pre-Roll (1g) | $1,345,613 | 93,982 | $14.32 | 3% |

-

- #6

-

Simpler Daze

-

-

- Total Pre-ROll Sales $31,459,640

- Pre-Roll Units Sold 4,332,015

-

-

-

TOTAL PRODUCTS

(2024) 39 -

AVG ITEM PRICE

(2024) $7.26 -

AVG UNIT COST

(2024) $3.94 -

PROFIT

MARGIN 46% -

BRAND MARKET SHARE

(2024) 1.03%

-

About the Brand

Despite only having operations in two states, the Simpler Daze brand makes the most of the Michigan market’s love of pre-rolls, riding $23.1 million in sales in the Wolverine State to land at No. 6 on our charts. In total, Simpler Daze racked up more than $31.5 million in sales on over 4.3 million units sold, with the vast majority of those coming from Michigan, where the company has an average price point of just $7.26. That’s good enough for 1% of all pre-roll sales and 1.4% of all items sold. Founded in 2021 in Michigan, Simpler Daze is a brand owned by the Glorious Cannabis Company aimed at delivering a quality product at an affordable price point. In 2024, the top three best-selling pre-roll products in Michigan were all from Simpler Daze.

Products and Packaging

Despite its relatively low price point, Simpler Daze exclusively sells infused or connoisseur pre-rolls, mostly under the company’s “Fire Styxx” branding. The company uses simple plastic “doob tube” packaging with custom labels, part of its commitment to keeping the Simpler Daze price point low. In Michigan, the labels are full color and feature a skeleton as part of the artwork, to tie in with the reference to the River Styx in the product’s name. In Massachusetts, the labels are similar but comply with the state’s two-color limit on packaging.

Marketing

Despite selling infused products, the Simpler Daze brand is marketed as a low and slow session-style brand, aimed at those not necessarily looking for the highest potency. Both Simpler Daze and Glorious Cannabis are quiet on socials, but that hasn’t held them back from controlling a strong share of the national pre-roll market. The company sees the Simpler Daze brand as something for “OG’s” who are looking for a good high, but to not be couch-locked. It is “simple, good weed” that is high in cannabinoid and terpene content and packed into pre-rolls to keep them at an accessible price point for consumers.TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Fire Styxx - Unicorn Tears THCA Infused Pre-Roll (1g) | $6,256,845 | 901,166 | $6.94 | 20% |

| #2Fire Styxx - Grape Escape THCA Infused Pre-Roll (1g) | $5,689,516 | 819,041 | $6.95 | 18% |

| #3Fire Styxx - Razzberry Diesel Infused Pre-Roll (1g) | $4,417,186 | 606,947 | $7.28 | 14% |

| #4Fire Styxx - Midnight Berry THCA Infused Pre-Roll (1g) | $4,235,264 | 578,863 | $7.32 | 13% |

| #5Fire Styxx- Tigers Breath Infused Pre-Roll (1g) | $4,085,965 | 598,258 | $6.83 | 13% |

-

-

- Total Pre-ROll Sales $29,628,998

- Pre-Roll Units Sold 7,098,070

-

-

-

TOTAL PRODUCTS

(2024) 42 -

AVG ITEM PRICE

(2024) $4.17 -

AVG UNIT COST

(2024) $2.29 -

PROFIT

MARGIN 45% -

BRAND MARKET SHARE

(2024) 0.97%

-

About the Brand

Coming in at a very respectable No. 7 is Goodlyfe Farms, our first single-state pre-roll manufacturer on the list of top national brands. Based out of pre-roll loving Michigan, Goodlyfe sold about 7.1 million pre-rolls, pulling in $29.7 million in revenue. Like many other Michigan pre-roll producers, Goodlyfe Farms keeps its price point low, with an average item price of $4.17 and contributing to larger sales numbers, despite every pre-roll being infused with live resin or a THC distillate, depending on the pre-roll. While the company’s products only account for 1% of all pre-roll sales revenue, they reach a full 2% of all pre-roll products sold, good enough for fourth among all producers. They even rank above STIIIZY and Dogwalkers in units sold, which is remarkable for only being in a single state. Founded in 2021 by Adam Piot and partners, the outdoor operation has grown from 70 acres that first year to a 300-acre farm and also recently began operations in New York.

Products and Packaging

Goodlyfe offers both traditional, flower-only pre-rolls and infused pre-rolls in a wide variety of strain choices, all made with the company’s famous sun-grown cannabis. While they also sell flower and vape cartridges, pre-rolls make up the majority of their products. The products are packaged in plastic, pop-top pre-roll “doob tubes” with colorful, custom labels created by an in-house design team that was given free rein to create whatever they wanted for each product. It packs its pre-rolls into Raw cones, with that company’s logo prominently displayed, and closed with a Dutch crown-style top.

Marketing

Goodlyfe Farms marketing starts with the farm itself. Goodlyfe grows its cannabis on a 300-acre outdoor and greenhouse farm in southwestern Michigan and the company promotes its “sun-grown” cannabis as being a more sustainable cultivation method, as well as having an improved terpene profile. In fact, the company’s website touts that the majority of its strains test for terpenes at over 3% with top strains earning 6%. As noted, the company only sells infused pre-rolls and has used word-of-mouth and its value proposition of a high potency product at a fair price to grow into a pre-roll powerhouse.TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Unicorn Piss Infused Pre-Roll (1g) | $2,755,624 | 661,032 | $4.17 | 9% |

| #2Apple Fritter Infused Pre-Roll (1g) | $2,132,043 | 505,048 | $4.22 | 7% |

| #3Blue Raspberry Infused Pre-Roll (1g) | $1,975,277 | 460,929 | $4.29 | 7% |

| #4Blueberry Banana Pancakes Infused Pre-Roll (1g) | $1,775,863 | 434,795 | $4.08 | 6% |

| #524K Gold Punch Infused Pre-Roll (1g) | $1,767,164 | 411,564 | $4.29 | 6% |

-

-

- Total Pre-ROll Sales $29,346,197

- Pre-Roll Units Sold 12,340,472

-

-

-

TOTAL PRODUCTS

(2024) 228 -

AVG ITEM PRICE

(2024) $2.38 -

AVG UNIT COST

(2024) $1.21 -

PROFIT

MARGIN 49% -

BRAND MARKET SHARE

(2024) 0.96%

-

About the Brand

Once again demonstrating the power of the Michigan pre-roll market with a single-state entry on our charts is Dragonfly Cannabis with $29.4 million in revenue. Not only that, but Dragonfly is No. 1 in the country when it comes to units sold, selling a massive 12.3 million units in 2024. That’s very impressive and probably related to its average item price of $2.38, by far the lowest of the top 10 brands. The company keeps its price point low by growing its cannabis outdoors (and in greenhouses) at its farm in southwestern Michigan. And though Dragonfly is only available in the Wolverine State, it has plans to expand into New York as well.

Products and Packaging

Dragonfly sells both traditional and infused pre-rolls in black tubes with rounded bottoms like a test tube or vial. The tubes all feature a deep red label with the company’s dragonfly logo, usually fading at the bottom into a color associated with the strain, for an elegant, upscale look. The company’s infused pre-rolls are infused using a distillate, rosin and live rosin formulation and are packaged similarly. The pre-rolls themselves all feature the company’s logo custom printed on the filters.

Marketing

The company’s marketing focuses on its 150-acre outdoor farm and the price point that it allows. Located in southwestern Michigan, Dragonfly grows mostly outdoors, with some greenhouse canopy, using organic farming methods. Dragonfly also prides itself on giving back to its local community, including police and fire departments, the Lions Club, schools, a food pantry and LoNia’s World Center, a Michigan organization that connects veterans and adults with disabilities with resources like career-training and social events. Their socials take you inside their grow and production facilities, with shots of their greenhouses, fields, production machinery, and finished products.TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Citrus Sunrise Infused Pre-Roll (1.25g) | $1,492,430 | 344,091 | $4.34 | 5% |

| #2Wavy Watermelon Infused Pre-Roll (1.25g) | $1,446,445 | 334,961 | $4.32 | 5% |

| #3Just Peachy Infused Pre-Roll (1.25g) | $1,358,466 | 310,894 | $4.37 | 5% |

| #4Tropic Thunder Infused Pre-Roll (1.25g) | $1,341,174 | 308,329 | $4.35 | 5% |

| #5Sour Pebbles Infused Pre-Roll (1.25g) | $1,322,999 | 302,847 | $4.37 | 5% |

-

-

- Total Pre-ROll Sales $28,344,209

- Pre-Roll Units Sold 1,002,683

-

-

-

TOTAL PRODUCTS

(2024) 248 -

AVG ITEM PRICE

(2024) $28.27 -

AVG UNIT COST

(2024) $13.97 -

PROFIT

MARGIN 51% -

BRAND MARKET SHARE

(2024) 0.92%

-

About the Brand

Born at the dawn of legalization, “Nothing Smokes Like a Lowell”. With great respect for the cannabis plant, our planet, and the consumer, Lowell Herb Co., was established in 2017 in Southern California at the dawn of legalization and expanded into other markets in 2021 following legalization around the country. Their headquarters are now based out of the Hudson Valley Region of New York with operations spread across the country. Their flower is sourced from hundreds of growers, and they only accept product that meets rigorous standards. In order to add terpene diversity and flavor to their products, Lowell Herb blends their flower strains, making their relentlessly engineered pre-rolls smooth and easy to draw. Celebrity investors see the value that Lowell brings to the industry, with names like Sarah Silverman and Mark Ronson associated with the brand. Lowell can be considered trailblazers in the industry, opening the first cannabis café in the United States in West Hollywood. They also assert that many applicants in the U.S. are removed from consideration based on having cannabis convictions on their records, for this reason, Lowell began hiring pardoned non-violent marijuana-related offenders for specific roles in their company. As staunch advocates of abolishing cannabis prohibition at the federal level, Lowell Herb Co. believes that expanded legalization will lead to more individuals enjoying the world at large through the enhanced love, appreciation, focus and clarity a good pre-roll can bring.

Products and Packaging

Reflecting their respect for cannabis and the planet, Lowell uses sustainable packaging and practices to produce their premium, all-natural cannabis products. Their products range from flower to pre-rolls to vapes and concentrates, and all carry the same natural tones and branding whether in mylar pouches, cigarette boxes, tubes, magnetic boxes, or cardboard multi-packs. Their 0.35-gram Mini Pre-Rolled Cone 10-packs come in recyclable slide boxes with matches and a built-in striker on the box for maximum convenience, and their Mind Safari 10-pack is their number one seller. The natural brown tones of all their pre-rolls match the ethos of the brand, sustainability. The Lowell 35’s Slim Tall Smokes also contain 0.35-grams of flower but come in stylish cigarette tubes in a wide range of their signature, single-origin blends. The blends feature a curated ratio of unique strain and terpene profiles ready for any occasion. The 1-gram pre-roll in a clear doob tube keeps the legacy of the single pre-roll alive, and with over 130 total pre-rolls in total on dispensary shelves, the reputation of Lowell Herb Co. Is well deserved.

Marketing

With their artisan flower, sustainable packaging, and laidback vibe, Lowell presents as a leader in cultivation, quality and public perception. Tying their brand to the dawn of legalization through William “Bull” Lowell’s story who carried on with growing cannabis in the early 1900’s when regulation was passed to shut him down. But “Bull” Lowell ignored the pressure to quit and for that he was shut down and jailed. What better representation of a cannabis brand than someone who stands up to the powers that be in the face of adversity. It is safe to say that Lowell Herb Co. was and still is a pioneer in the cannabis industry and they show no signs of stopping coming in at number 9 on our list. Their social marketing is simple, put on display the signature aesthetics of the brand next to the trichome covered bud they curate that would make Bull Lowell proud.TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1The Happy - Hybrid Blend Pre-Roll 6-Pack (3.5g) | $2,466,749 | 63,982 | $38.55 | 9% |

| #2The Zen - Hybrid Blend Pre-Roll 6-Pack (3.5g) | $1,472,241 | 38,722 | $38.02 | 5% |

| #3The Creative - Sativa Blend Pre-Roll 6-Pack (3.5g) | $1,421,872 | 36,756 | $38.68 | 5% |

| #4The Social - Sativa Blend Pre-Roll 6-Pack (3.5g) | $1,308,781 | 35,450 | $36.92 | 5% |

| #535's - Mind Safari Pre-Roll 10-Pack (3.5g) | $1,276,779 | 64,976 | $19.65 | 5% |

-

- #10

-

Good Day Farm

-

-

- Total Pre-ROll Sales $25,879,167

- Pre-Roll Units Sold 1,330,823

-

-

-

TOTAL PRODUCTS

(2024) 525 -

AVG ITEM PRICE

(2024) $19.45 -

AVG UNIT COST

(2024) $10.51 -

PROFIT

MARGIN 46% -

BRAND MARKET SHARE

(2024) 0.84%

-

About the Brand

With more than $25.9 million in pre-roll sales in 2024 Missouri alone, Good Day Farm rounds out our Top 10 Pre-Roll Brands selling more than 1.3 million units. Founded as a medical cannabis provider – and still a major player across several Southern states that have medical-only markets including Mississippi, Arkansas and Louisiana – Good Day Farm moved into the recreational game in 2023, as Missouri’s adult-use market opened. Good Day Farm has established itself as the top pre-roll manufacturer in Missouri, dominating the Show Me State’s market, accounting for 16.5% of all pre-roll revenue and 12.3% of all unit sales in the state. The company had 525 total products available for sale in 2024 with an average item price of $19.45. It should be noted that Headset numbers for Good Day Farm only include Missouri, so it is likely that they would place even higher on this list if all the medical states were included.

Products and Packaging

Good Day Farm produces a variety of pre-roll products, as well as flower, vapes, concentrates and edibles. Its main line of pre-rolls is the Good Day J’s line, which pack premium flower into hemp paper cones and are available in various sizes up to and including full gram king size pre-rolls, packed in resealable mylar pouches, like cigarillos. The company’s Super J’s line features infused joints, rolled in kief. Those are packed in jars featuring colorful custom labels with the slogan “Fly Higher” printed in gold ink on glossy colored caps. There are also two lines of pre-rolled blunts, Good Day Blunts and Southern Sweets, both of which are hand-rolled and feature glass filter tips, both also packaged in cigarillo-style pouches.

Marketing

Primarily a medical provider, Good Day Farms has a mission of helping people feel good and prides itself on its genetics as well as its cultivation methods to produce strains high in cannabinoids and terpenes. The company also teams up with a pair of charities as part of its “Doing Good” program. The company’s “Titty Sprinkles” (or “Pink Sprinkles” in less fun states) was developed by a breeder inspired to develop a strain that alleviated pain and stress for his mother, who was battling breast cancer. Proceeds from the strain’s sales go to Realm of Caring to fund breast cancer research. Good Day Farms also partners with the Last Prisoner Project, fighting for criminal justice reform, as well as working to release and rebuild the lives of cannabis offenders still in prison.TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Super J's - Grapefruit x Cookies Infused Pre-Roll 5-Pack (2.5g) | $554,207 | 15,716 | $35.26 | 2% |

| #2Super J's - Black Jack x Blueberry Infused Pre-Roll 5-Pack (2.5g) | $475,066 | 13,555 | $35.05 | 2% |

| #3Super J's - Grape x Gas Truffle Infused Pre-Roll (1g) | $441,654 | 31,600 | $13.98 | 2% |

| #4Super J's - Tropical x Watermelon Gushers Infused Pre-Roll (1g) | $428,655 | 29,944 | $14.32 | 2% |

| #5Super J's - Lemon x OG Kush Infused Pre-Roll 5-Pack (2.5g) | $412,485 | 11,504 | $35.86 | 2% |

-

- #11

-

Verano

-

-

- Total Pre-ROll Sales $23,931,106

- Pre-Roll Units Sold 1,244,717

-

-

-

TOTAL PRODUCTS

(2024) 562 -

AVG ITEM PRICE

(2024) $19.23 -

AVG UNIT COST

(2024) $12.12 -

PROFIT

MARGIN 37% -

BRAND MARKET SHARE

(2024) 0.78%

-

About the Brand

Illinois-based Verano comes in just outside the top 10, selling more than 1.2 million pre-roll units across three states for just under $24 million in revenue. Verano, the company, owns many brands and has operations across nearly a dozen states, but not every state carries the Verano brand, which had 562 pre-roll products available in 2024, many infused, leading to an average item price of $19.23. The numbers above only reflect sales in Illinois, Maryland and Ohio, states that provide data to Headset, so it is likely that Verano would place higher on this list if all states were accounted for.

Products and Packaging

Verano offers multiple pre-roll options, including its traditional 1-gram flower Stix, the infused 1.2-gram Dynamite Stix and the Swift Lifts multi-pack of five half-gram pre-rolls available in traditional and the “Iced” variety, infused with THCa. Each product has standard “Essence” and “Reserve” varieties available. Both the Stix and Dynamite Stix are packaged in stylishly minimalistic white pre-roll tubes with twist tops that feature the brand name printed vertically in black. The Swift Lifts, meanwhile, are packaged in a black slider tin with white lettering, and like the Stix, infused products have additional text in sky blue.

Marketing

In its marketing, the Verano brand emphasizes the products’ proprietary genetics grown at one of its 14 facilities and presents as a sophisticated choice. As a mostly medical supplier, Verano also emphasizes education, with a focus on “curiosity.” Cultivation of local, organic, exceptional bud is the company's ethos and their dedication to premium in-house grown flower that goes above and beyond quality standards takes center stage. Consumer messaging on the other hand focuses on rewriting the narrative, with their “we say yes” moniker rivaling the “just say no” campaign championed by Nancy Reagan. Their stance on cannabis decriminalization and democratization is loud and proud, promoting clemency to nonviolent offenders, partnering with The Weldon Project’s Misson Green, a leader in clemency, expungement, and pardons for persons currently or formerly incarcerated due to nonviolent cannabis-related crimes. An initial donation of $50,000 was gifted to The Weldon Project with an additional company match of up to $13,000 in customer and patient-generated donations at its nearly 100 dispensaries across 13 states on the first Friday of each month through the latter half of 2022. Annual Pride Partnerships with Center on Halsted, an organization offering programs and services for LGBTQ+ populations, further show Verano’s commitment to advancing, supporting, destigmatizing cannabis in America.TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Reserve Swift Lifts - Space Mints Pre-Roll 5-Pack (2.5g) | $1,077,624 | 38,786 | $27.78 | 5% |

| #2Reserve Swift Lifts - Gelato Pre-Roll 5-Pack (2.5g) | $966,229 | 35,683 | $27.08 | 4% |

| #3Reserve Swift Lifts - Strawberry Milkshake Pre-Roll 5-Pack (2.5g) | $672,510 | 24,047 | $27.97 | 3% |

| #4Reserve Swift Lifts - The Soap Pre-Roll 5-Pack (2.5g) | $546,054 | 21,058 | $25.93 | 2% |

| #5Reserve Swift Lifts - Cherry Malt Pre-Roll 5-Pack (2.5g) | $497,765 | 17,000 | $29.28 | 2% |

-

-

- Total Pre-ROll Sales $21,808,806

- Pre-Roll Units Sold 2,272,906

-

-

-

TOTAL PRODUCTS

(2024) 245 -

AVG ITEM PRICE

(2024) $9.60 -

AVG UNIT COST

(2024) $5.74 -

PROFIT

MARGIN 40% -

BRAND MARKET SHARE

(2024) 0.71%

-

About the Brand

Glorious Cannabis Co. is all about holding themselves to high standards when producing weed. Their production and extraction methods are all about being thorough and not rushing to produce the bud. The motto they live by is “we cut buds not corners” which speaks volumes to the consumer. They believe in transparency and purity, taking a stand against cannabis products that contain synthetic or converted oils in lieu of real, natural THC oils, supporting enhanced regulations to weed out these types of products. There are several brands they serve under like Crude Boys, Drip, and Choice Chews. In 2024 GC Co. had $21.8 million in sales, which came from 2.7 million units.

Products and Packaging

GC Co. has a wide selection of pre-roll options, ranging from double infusions to single infusions, to non-infused, and their very own ‘Strain Art Series’.

Firestyxx are their basic forms of pre-rolls, marketed as slow burning. These come in a standard black doob tube with a slightly similar sticker/wrapper for each strain.

Chulas Tarantulas are a part of their non-infused selection, although coated in kief. These are sold in single serve glass or plastic containers with a simple design including multiple shades of colors and the strain name at the bottom.

IceWater is their pre-roll selection with an infusion of bubble hash and diamond dust, sold in similar containers to the Chulas. however having a more elaborate design.

Strain Art Series is their 12ct selection of high-potency (35-50%) bubble hash infused pre-rolls with no added terpenes that come in similar packaging to that of Chulas, but with a highly developed image to reflect the strain name.

GC Co. also has their Crude Boys line of infused pre-rolls that includes types called Heater, Tarantula, and Black Widow. The 3 differences between them are potency, flavor, and the use of various cannabis products:

GC Co. has a wide selection of pre-roll options, ranging from double infusions to single infusions, to non-infused, and their very own ‘Strain Art Series’.

Firestyxx are their basic forms of pre-rolls, marketed as slow burning. These come in a standard black doob tube with a slightly similar sticker/wrapper for each strain.

Chulas Tarantulas are a part of their non-infused selection, although coated in kief. These are sold in single serve glass or plastic containers with a simple design including multiple shades of colors and the strain name at the bottom.

IceWater is their pre-roll selection with an infusion of bubble hash and diamond dust, sold in similar containers to the Chulas. however having a more elaborate design.

Strain Art Series is their 12ct selection of high-potency (35-50%) bubble hash infused pre-rolls with no added terpenes that come in similar packaging to that of Chulas, but with a highly developed image to reflect the strain name.

GC Co. also has their Crude Boys line of infused pre-rolls that includes types called Heater, Tarantula, and Black Widow. The 3 differences between them are potency, flavor, and the use of various cannabis products:

- - 1.2-gram CB Heater - Infused with THC diamonds

- - 1.2-gram CB Tarantula - Infused with THC diamonds + coated in kief

- - 1.3-gram CB Black Widow - Infused with THC diamonds & concentrate + coated in kief, taking 3rd place in the 2023 High Times Cannabis Cup

Marketing

Glorious Cannabis Co. target demographic is people who want quality weed with no harmful additives or synthetics. They make this clear in every post on social media and in every section of their website. Though the collaborations are slim to none, they just outright own several companies making it easier to target several audiences. It also doesn’t hurt that their Big Nasty Indica flower took first place at the 2025 Massachusetts High Times Cannabis Cup. Their journey to create the best cannabis experience stems from internal reflection and consumer feedback for how they could improve their popular lines of infused pre-rolls; the public requested higher potency and higher potency they now have. The visual presentation in their pre-roll marketing highlights the vast amount of concentrates that make up their infused lines, attracting the eyes of high-potency smokers everywhere they’re offered.TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Fire Styxx - Tigers Breath Infused Pre-Roll (1g) | $1,732,327 | 258,138 | $6.71 | 8% |

| #2Fire Styxx - Unicorn Tears THCA Infused Pre-Roll (1g) | $1,338,404 | 188,554 | $7.10 | 6% |

| #3Fire Styxx - Grape Escape Infused Pre-Roll (1g) | $1,257,043 | 189,996 | $6.62 | 6% |

| #4Fire Styxx - Razzberry Diesel THCA Infused Pre-Roll (1g) | $1,177,870 | 170,735 | $6.90 | 5% |

| #5Fire Styxx - Shipwrecked Infused Pre-Roll (1g) | $1,166,036 | 197,072 | $5.92 | 5% |

-

- #13

-

Pacific Stone

-

-

- Total Pre-ROll Sales $21,791,357

- Pre-Roll Units Sold 844,553

-

-

-

TOTAL PRODUCTS

(2024) 88 -

AVG ITEM PRICE

(2024) $25.80 -

AVG UNIT COST

(2024) $12.58 -

PROFIT

MARGIN 51% -

BRAND MARKET SHARE

(2024) 0.71%

-

About the Brand

Family owned and operated Pacific Stone is a California-based producer/processor founded in 2015 that uses single-source greenhouse-grown flower for all of its products, including its pre-rolls. Only available in California, Pacific Stone sold nearly 844,000 units in 2024 for a total of almost $21.8 million in revenue. The company sells only flower and pre-rolls, but offers a wide variety of pre-roll products, including pre-rolled blunts and infused pre-roll products. And though it has a seemingly high average price point of $25.80, the company has several multi-pack varieties on the market, driving up the average price.

Products and Packaging

Pacific Stone offers a wide variety of pre-roll products, including traditional flower, infused flower and blunt options. In traditional pre-rolls, the company has its 2K Pre-Roll Tubes, featuring a pair of 1 ¼ half-gram pre-rolls packed together in a black plastic pop-top doob tube emblazoned with a colorful custom label. The pre-rolls themselves are also custom printed with the company logo appearing on the filter. The company also sells a 7-gram pack of 14 half-gram pre-rolls in a black small flip-top box, packed with a “Terp Shield” packet to keep it fresh. Finally, Pacific Stone offers a “3Pk Variety Pack” that includes three 1-gram pre-rolls including one each of a sativa, indica and hybrid strain, all packed in a mylar pouch. The company also offers “Slims,” featuring 20 0.35-gram pre-rolled tubes packed in hemp paper cigarette-style tubes and packaged in black tin with a spring-loaded button. For its infused offerings, Pacific Stone sells THCa diamond-infused pre-rolls. Each pack comes with 7 half-gram pre-rolls packaged in one of the company’s flip-top boxes, but instead of the black label, they feature an eye-grabbing yellow sticker. Pacific Stone also enters the pre-rolled blunt market, packaging two 1.75-gram pre-rolled blunts wrapped in hemp with a glass filter tip to provide a premium experience. Pacific Stone also shakes things up with its Sugar Shake product, which, though not a pre-roll, is designed for joint rollers as it is a pouch of shake that is packed with rolling papers and crutches.

Marketing

Pacific Stone’s marketing focuses on the quality of its Dutch greenhouse-grown flower. The company touts its single-source strains, propagated from clones on the property and the sustainability of its greenhouse grows, as well as the wider terpene profile that natural sunlight provides, allowing it to keep its price down compared to indoor competitors. Pacific Stone is also family owned and operated, touting their bud as “California’s best-selling flower.”TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Blue Dream Pre-Roll 14-Pack (7g) | $4,060,432 | 119,875 | $33.87 | 19% |

| #2Wedding Cake Pre-Roll 14-Pack (7g) | $2,753,452 | 81,408 | $33.82 | 13% |

| #3805 Glue Pre-Roll 14-Pack (7g) | $2,336,752 | 71,273 | $32.79 | 11% |

| #4Cereal Milk Pre-Roll 14-Pack (7g) | $1,376,888 | 39,343 | $35.00 | 6% |

| #5Starberry Cough Pre-Roll 14-Pack (7g) | $1,335,541 | 38,815 | $34.41 | 6% |

-

- #14

-

Claybourne Co.

-

-

- Total Pre-ROll Sales $21,546,140

- Pre-Roll Units Sold 783,904

-

-

-

TOTAL PRODUCTS

(2024) 107 -

AVG ITEM PRICE

(2024) $27.49 -

AVG UNIT COST

(2024) $13.56 -

PROFIT

MARGIN 51% -

BRAND MARKET SHARE

(2024) 0.70%

-

About the Brand

“Frost Around and Find Out”, Claybourne Co. Is one of only 4 brands in our Top 15 Pre-Roll Companies operating out of a single state and also sells the least number of pre-rolls out of the top 15. Their ability to capture the 15th spot? The Infused Flyers line of pre-rolls, pre-rolled blunts, and pre-roll multi-packs carrying the second highest average item price among brands at $27.49. Since their inception in 2017, they have become the 3rd largest cannabis brand in California, the 5th largest pre-roll producer in the state, and one of the country's top pre-roll brands that grows top tier flower using proprietary techniques that maximize potential and maintain quality and consistency. Their meticulous cultivation yields a modest 107 products, compared to other top pre-roll brands, offering a wide range of premium flower and infused pre-rolls. As a premium brand representing the largest market in the country, Claybourne Co.’s high margins establish them as a top pre-roll brand in the country.

Products and Packaging

From its Ultra-Premium Gold Cut Fower to their recently launched Flyers Infused Blunts, only the highest quality indoor grown cannabis is used in Claybourne Co.’s product lines. Single 1.5-gram infused blunts rolled in an herbal wrap are the latest additions to the Infused Flyer line and come in a foil pouch in six strains. Its half-gram Frosted Flyers Pre-Rolls are coated with THCa Diamond Frost on the outside, enhanced with terpenes, contain Liquid Diamond infused full flower nugs, and are available in nine strains in 2-packs and 5-packs. The Diamond Infused Flyers available in the same multi-pack sizes as the Frosted Flyers are ultra potent and use premium indoor grown full flower and crushed THCa Diamonds to deliver maximum lift. Their pre-rolls come in clear, custom labeled tubes with 5-packs in jars and a matching box, sure to catch the eye of consumers on dispensary shelves. With the signature “Flyers” script donning the packaging of all it’s pre-rolled joints and blunts, this line offers consumers the opportunity to “Take Flight”.

Marketing

“Always on the Gas,” the Claybourne Crew, comprised of a range of folks from professional athletes to nine-to-fivers, never slow down and represent those dedicated to their craft who seek high-quality flower and infused pre-rolls. Rugged, cool and connoisseur, Claybourne Co. celebrates the dedication of hard workers and their passion for the High Life. In a licensing partnership with Canadian heavyweight Canopy Growth Corporation established at the end of 2024, five strains of Claybourne’s Frosted Flyers Infused pre-rolls have been released to the Canadian market. Beyond cannabis, they partner with Powerplant Motorcycles on an accessories line featuring the collection’s custom branding on rolling trays, piston shaped pokers, grinders and swag. Their own line of merch is branded with custom Claybourne designs that keep with their Always on the Gas message. The brand celebrates drive and commitment, using cars, motorcycles and athletics to represent the passion of their elite cultivation.TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Flyers - Blue Dream Frosted Liquid Diamond Infused Pre-Roll 5-Pack (2.5g) | $1,807,053 | 58,627 | $30.82 | 8% |

| #2Flyers - Pineapple Express Frosted Liquid Diamond Infused Pre-Roll 5-Pack (2.5g) | $1,648,297 | 52,698 | $31.28 | 8% |

| #3Flyers - Grape Gasolina Frosted Diamond Infused Pre-Roll 5-Pack (2.5g) | $1,561,740 | 51,117 | $30.55 | 7% |

| #4Flyers - Watermelon Zkittles Frosted Liquid Diamond Infused Pre-Roll 5-Pack (2.5g) | $1,384,187 | 45,505 | $30.42 | 6% |

| #5Flyers - Super Sour Apple Frosted Liquid Diamond Infused Pre-Roll 5-Pack (2.5g) | $1,088,800 | 34,881 | $31.21 | 5% |

-

- #15

-

Distro 10

-

-

- Total Pre-ROll Sales $21,351,767

- Pre-Roll Units Sold 4,694,570

-

-

-

TOTAL PRODUCTS

(2024) 167 -

AVG ITEM PRICE

(2024) $4.55 -

AVG UNIT COST

(2024) $2.70 -

PROFIT

MARGIN 41% -

BRAND MARKET SHARE

(2024) 0.70%

-

About the Brand

Michigan-based Distro 10 is a cannabis distribution center dedicated to taking “the sales portion of the cannabis industry off the hands of specialized growers.” However, its self-branded pre-rolls have gained a following of their own to rank on our list. With 167 different pre-roll products, Distro 10 generated just under $21.4 million in revenue in 2024, moving more than 5 million units. Like many manufacturers in pre-roll-happy Michigan, the company keeps its average item price low, at $4.55, which is more impressive given that the company’s top 12 pre-roll products are all infused.

Products and Packaging

Distro 10 is primarily known for its 1.2-gram infused pre-rolls, many of which are made with an injection process that places the concentrate into the center of the pre-roll. The company uses a custom pre-rolled cone that has its logo printed directly on the filter. Distro 10 uses black plastic pop top “doob tubes” to package its products, with custom labels for each strain. Its infused pre-rolls use a similar look, but with bolder font and the phrase “Injected Pre-Roll" featured very prominently on the side. The company also has multi-pack offerings of half-gram pre-rolls infused with bubble hash that it calls “icicles,” packaged in a glass jar with a large black cap.

Marketing

Like many producers in Michigan, Distro 10’s marketing focuses on the quality of its products and the high THC content of its infused pre-rolls at the price point being offered. The company has partnered in Michigan with stoner comedy legends Cheech & Chong to exclusively release the Cheech & Chong Cannabis Co.’s “botanical line.” Their unique positioning as a distributor sets them apart from others in the top 15, and their website content reflects just that, focusing on their sales and distribution business for specialized growers over their pre-roll line. But, with over 5 million pre-roll units sold last year, they seem to be doing just fine.TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Watermelon Gummy Bears Infused Pre-Roll (1.2g) | $3,300,509 | 719,986 | $4.58 | 16% |

| #2Lemon Meringue Pie Infused Pre-Roll (1.2g) | $2,980,552 | 650,538 | $4.58 | 14% |

| #3Blue Razzberry Infused Pre-Roll (1.2g) | $2,836,005 | 623,593 | $4.55 | 13% |

| #4Sour Green Apple Infused Pre-Roll (1.2g) | $2,696,680 | 586,306 | $4.60 | 13% |

| #5Grape Soda Infused Pre-Roll (1.2g) | $2,614,172 | 578,306 | $4.52 | 12% |

-

- #16

-

Ozone

-

-

- Total Pre-ROll Sales $20,847,735

- Pre-Roll Units Sold 1,702,271

-

-

-

TOTAL PRODUCTS

(2024) 163 -

AVG ITEM PRICE

(2024) $12.25 -

AVG UNIT COST

(2024) $7.60 -

PROFIT

MARGIN 38% -

BRAND MARKET SHARE

(2024) 0.68%

-

About the Brand

Ozone likes to describe themselves as “Your go-to go-to,” but what does it mean? To Ozone the saying means having the right cannabis for every event, moment, mood, or occasion, while being perfect for the everyday smoker. In 2024 Ozone had $21 million in sales, which came from 1.7 million units.

Products and Packaging

Ozone offers non-infused pre-rolls in a single 1-gram pack, 1-gram 2-packs, 1.5-gram 3-packs, and a 2.5-gram 5-pack in select strains. The non-infused pre-rolls are sold in a white doob tube with a wrapper containing their logo and either indica, sativa, or hybrid for singles and in a sleek 2-tone box for 2-packs. A grey flip-top box with orange and light grey text at the bottom for 3- and 5-packs, as well as a metallic slide box for 5-packs. For their infused pre-rolls, they only offer a 1-gram 2-pack and a 2.5-gram 5-pack which come in a blue mylar bag labeled Ozone Reserve.

Marketing

They really drive the point home on a few brand messages, “The smoke you smoke when you want a great smoke,” and, “Your go-to go-to.” Touted as the perfect everyday smoke for every occasion, every mood, and every moment, whatever you’re into, Ozone has exactly what you need, when you need it.-

- #17

-

Kingpen

-

-

- Total Pre-ROll Sales $20,810,764

- Pre-Roll Units Sold 946,144

-

-

-

TOTAL PRODUCTS

(2024) 287 -

AVG ITEM PRICE

(2024) $22.00 -

AVG UNIT COST

(2024) $11.51 -

PROFIT

MARGIN 48% -

BRAND MARKET SHARE

(2024) 0.68%

-

About the Brand

Kingpen is primarily a vape brand, promoting that they can even ship overseas. They don't go all out to promote how or where they get their flower to make their products, but they are active on social media, presenting their brand and products in a hip way. And with nearly 950,000 pre-roll units sold and sales just shy of $21 million, Kingpen and its playing card branding are leading the way in more than just vape pens.

Products and Packaging

Kingpen offers infused and non-infused pre-rolls on top of their vast line of vape pens and cartridges. Their infused pre-rolls contain 1.3-grams of whole nug flower, made with their own cannabis oil infusion and rolled in kief. Sold in single black doob tubes with their standard red, black, white, or green wrapper featuring their large and recognizable logo, a stoned king’s head and face at the top followed by Kingroll, the name of their pre-roll line. Their 4 packs come in a red or black box that looks like a deck of cards, with each pre-roll weighing around 0.75 grams. They have another pre-roll product line, Royale, which resemble their infused pre-rolls, but instead of cannabis oil, they use live resin for the infusion and the larger 6-packs are packaged in a gold variation of their card-box design.

Marketing

Kingpen is all about the vibes of playing cards, with branding, design and packaging that makes it feel like you’re being dealt a hand of poker. And while their marketing and web presence is modest, one thing they do tout with pride are their vape carts, which have been voted best in the world and have secured 12 High Times Cannabis Cup wins.-

- #18

-

Simply Herb

-

-

- Total Pre-ROll Sales $20,438,908

- Pre-Roll Units Sold 2,983,776

-

-

-

TOTAL PRODUCTS

(2024) 205 -

AVG ITEM PRICE

(2024) $6.85 -

AVG UNIT COST

(2024) $4.48 -

PROFIT

MARGIN 35% -

BRAND MARKET SHARE

(2024) 0.67%

-

About the Brand

Simply Herb, as the name suggests, is all about simplicity, with the goal of making weed easy to understand for the consumer. They are dedicated to making their shoppers feel at home with their products by featuring informative labels and even offering a pre-ground version of their flower to make joints that much easier to roll when they’re feeling adventurous. In 2024 Simply Herb sold 2.9 million pre-roll units with total sales nearing $20.5 million.

Products and Packaging

With single 1-gram pre-rolls, 0.5-gram 3-packs, and 0.35-gram 10-packs, Simply Herb offers a variety of sizes to fit any occasion. Sticking to simplicity, their packaging is easily recognizable, featuring a standard green doob tube with their name running down the length of the tube in white lettering.

Marketing

Simply Herb is a brand under MSO Ascend Wellness Holdings (AWH), a publicly traded company. Simply Herb was created as a value-focused brand by simply being simple, straying away from luxury packaging and celebrity collaborations, and instead, simply providing consumers with affordable cannabis products. And get this, they have a recipe on their linktr.ee for a delicious infused nacho cheese dip, bon appétit.-

- #19

-

Find.

-

-

- Total Pre-ROll Sales $20,165,790

- Pre-Roll Units Sold 2,110,172

-

-

-

TOTAL PRODUCTS

(2024) 599 -

AVG ITEM PRICE

(2024) $9.56 -

AVG UNIT COST

(2024) $4.23 -

PROFIT

MARGIN 56% -

BRAND MARKET SHARE

(2024) 0.66%

-

About the Brand

Find. is a minimalist brand with simple designs and colors on their products, sticking out in the industry by striving to make the best cannabis possible, and it has worked quite well for them. Selling pre-rolls in 8 different states, Find. amassed sales of over $20 million, moving over 2.1 million units.

Products and Packaging

Consumers can pick up either single 1-gram pre-rolls or go all out and snag a 10-gram 10-pack. Single pre-rolls are sold in black doob tubes with blue wrappers reading “Find. Pre-Roll" down the length of the tube and “Share your find.” along the circumference at the bottom. A 10-pack is sold in a red rectangular flip-top box reading, “Find. Everyday Cannabis Flower. Pre-Rolls," on the front, making it easily identifiable to customers.

Marketing

This company uses eye-catching tones of blue, yellow, green, and red on their packaging, making their pre-rolls recognizable from a distance on dispensary shelves. They tailor to the everyday person who just wants the bud, no confusion.-

- #20

-

Ruby Farms

-

-

- Total Pre-ROll Sales $19,787,515

- Pre-Roll Units Sold 524,283

-

-

-

TOTAL PRODUCTS

(2024) 50 -

AVG ITEM PRICE

(2024) $37.74 -

AVG UNIT COST

(2024) $18.80 -

PROFIT

MARGIN 50% -

BRAND MARKET SHARE

(2024) 0.65%

-

About the Brand

Ruby Farms is all about sustainability and one of the top manufacturers of all-natural cannabis in the industry. They are loyal to the soil, living off the land while using everything that's natural before employing alternative methods in their process. Ruby Farms has a simple yet elegant logo that has the company's name in a nice cursive red font, though sometimes the lettering is in gold. By staying loyal to the land, Ruby Farms generated $19.9 million in total pre-roll sales stemming from 528,000 pre-roll units sold.

Products and Packaging

Ruby Farms offers 3 different-size pre-roll packs for a total of 1-gram, 3.5-gram and just around 5-gram. They offer a 0.5-gram 2 pack which comes in a slightly antique-looking amber vial with a cork top. Both of their 7 packs on the other hand are packaged in a metal tin that contains information about the company and how their cannabis is grown in Hudson Valley, as well as the strain name. The other half of the tin houses the 7 either 0.5- or 0.7-gram pre-rolls with multiple cutout images imprinted on the back in black and white. Each pre-roll has a mint green filter with ‘Ruby Farms’ printed in black. Ruby Farms offers 3 different sizes of pre-roll packs totaling 1-gram, 3.5-gram and around 5-grams. The 0.5-gram 2-pack has an antique looking amber vial with a cork top. Both of their 7-packs on the other hand are packaged in metal tins that contain information about the company, how their cannabis is grown in Hudson Valley, as well as the strain name. The other half of the tin houses 7 pre-rolls at either 0.5- or 0.7-grams with multiple cutout images imprinted on the back in black and white. Each pre-roll has a mint green filter with ‘Ruby Farms’ printed in black.

Marketing

Ruby Farms represents themselves more as a blue-collar farm than a multi-million-dollar company, appealing to consumers in subtle ways like using glass vials to set the one-of-a-kind aesthetic of their brand. Most of their products include a label that resembles a feed grain tag printed in a natural pen-stroke font, making the product feel home-grown and natural.-

- #21

-

Pure Beauty

-

-

- Total Pre-ROll Sales $19,177,647

- Pre-Roll Units Sold 530,196

-

-

-

TOTAL PRODUCTS

(2024) 75 -

AVG ITEM PRICE

(2024) $36.17 -

AVG UNIT COST

(2024) $18.18 -

PROFIT

MARGIN 50% -

BRAND MARKET SHARE

(2024) 0.63%

-

About the Brand

Pure Beauty surely is a one-of-a-kind cannabis operation based out of Los Angeles, California which they use to their advantage. The climate they operate in offers many advantages to cultivation including bug and insect populations naturally keep their plants healthy and happy. They also limit themselves to 150-250 gallons of water per plant as that's all that one plant needs to yield flower, lowering Pure Beauty's toll on California's water supply. Pure Beauty is all about educating consumers on where their weed is from and how it's grown. They've climbed their way up the ladder to become the seventh largest pre-roll distributor in the state by promoting their passion for cannabis and their products, sharing testing data on their products while also testing their cones frequently.

Products and Packaging

Pure Beauty offers quite a large selection of pre-rolls and infused pre-rolls to choose from, with 5 (1.75-grams) and 10 (3.5 grams) count packs of mini pre-rolls, 2-gram 5 packs of infused mini pre-rolls, 1.5-gram gram 3-packs, and even cannabis filled cigarettes featuring 5 cannabis cigarettes holding a full eighth of flower. Their mini pre-rolls come in simple flip-top boxes with their respective colors identifying the strain. The 3-packs come in a tall pull pack in the same color coordination, with their logo centered on the box in either white or black lettering, with the mini packs mirroring the packaging. Their hybrid flower cigarette line comes color coordinated in tall flip-top boxes, all-white cigarette tubes with their signature eyes logo on the filter paper, similar to the filter designs on their pre-roll filter tips.

Marketing

Pure Beauty’s offers testing results for their product lines that also include terpene concentrations. They collaborate with local artists to create apparel, custom designed boxes and art, with all of their boxes and bags made from a plant starch blend they have been developing for over a year and a half. Their socials have a cool, simple, consistent theme, like their products, and it is clearly a hit.-

- #22

-

Happy Valley

-

-

- Total Pre-ROll Sales $18,709,963

- Pre-Roll Units Sold 1,823,026

-

-

-

TOTAL PRODUCTS

(2024) 149 -

AVG ITEM PRICE

(2024) $10.26 -

AVG UNIT COST

(2024) $8.75 -

PROFIT

MARGIN 15% -

BRAND MARKET SHARE

(2024) 0.61%

-

About the Brand

Happy Valley is one of those operations that just loves to give back, engage and help out the community aa across Massachusetts. Whether it be teaching people how to grow normal produce for themselves, trying to help decriminalize the substance on a federal level, or supporting veterans causes, Happy Valley gives back. Their logo, a fancy old fashioned key, could be symbolic of how cannabis a key part of growing a community. While building this strong footprint in the community, Happy Valley garnered nearly $18 million in sales from 1.8 million pre-roll units sold.

Products and Packaging

Happy Valley offers infused and non-infused pre-roll products. Their infused pre-rolls called Moon Rockets are made from their signature flower, bubble hash, and kief. They are sold in a glass tube with a silicon top for single pre-rolls, and in a white, red, and black boxes that say ‘Moon Rocket’. Their non-infused pre-rolls are sold in 1-gram singles, 7-pack tins or variety 5-packs in both 2.5- or 5-gram sizes, included in each tin are matches and a striking surface. while The tins have a white top with their logo and the pre-roll info displayed, and a red bottom which says “pre-rolls” and “matches inside”

Marketing

Happy Valley offers a reward program for its customers where 1 point is earned for each $1 spent, which can be redeemed for various discounts. They are extremely philanthropic, with over 17 organizations they have supported, most being local. They offer great discounts, especially for first time customers, and they’ve collaborated with ETHOS Genetics to revolutionize genetic breeding in the industry; Baller’s Game is a cross between Melon Baller and Ends Game.-

- #23

-

Phat Panda

-

-

- Total Pre-ROll Sales $18,059,088

- Pre-Roll Units Sold 4,660,392

-

-

-

TOTAL PRODUCTS

(2024) 961 -

AVG ITEM PRICE

(2024) $3.88 -

AVG UNIT COST

(2024) $2.00 -

PROFIT

MARGIN 48% -

BRAND MARKET SHARE

(2024) 0.59%

-

About the Brand

Phat Panda has been in the cannabis game since 2014 and have been pioneers in the industry ever since, scaling 7x from 50 employees to 350. They’ve collaborated and partnered with some awesome brands in the industry including Dabstract and Hot Sugar! and are they are the top selling pre-roll brand in Washington by far, outselling the #2 brand by nearly double. Phat Panda made north of $18 million in sales last year from 4.7 million pre-roll units sold.

Products and Packaging

Calling Phat Panda’s pre-roll line extensive would be an undersell, it is massive, featuring tons of infused and all flower joints in a range of packaging, sizes and quantities. Their single pre-rolls and “Firecracker” infused joints come in a standard white doob tube with an appropriate strain sticker near the top while their 3-packs come in a flat tin. They also sell a glass jar of 28-gram joints to stock consumers with dozens upon dozens of strains to choose from.

Marketing

Phat panda has partnerships with Phat and Sticky, Pax, Dabstract, and GG Strains as well as their own apparel line and proprietary systems platforms called the Panda Portal to streamline their business operations. They have a large Instagram presence where they tout the quality and beauty every chance they get as they should, their buds are breathtaking.-

- #24

-

Sluggers Hit

-

-

- Total Pre-ROll Sales $16,644,109

- Pre-Roll Units Sold 640,088

-

-

-

TOTAL PRODUCTS

(2024) 155 -

AVG ITEM PRICE

(2024) $26.00 -

AVG UNIT COST

(2024) $13.72 -

PROFIT

MARGIN 47% -

BRAND MARKET SHARE

(2024) 0.54%

-

About the Brand

Sluggers, based in the heart of California, is all about making the highest quality weed while enriching your cannabis experience. Sluggers is a single source provider so you don't have to worry about who or what else your cannabis came in contact with, with state of the art facilities and extraction processes. Sluggers has countless collabs with several big brand companies which has helped make them what they are today. Sluggers has stapled themselves to the industry by making just over $16 million by selling 648 thousand units of product, While only selling 648,000 pre-roll units in 2024, they took in over $16.5 million from sales and find themselves in the num. 24 slot on our list of the top pre-roll brands in the country.

Products and Packaging

Sluggers only offers infused pre-rolls, but don’t worry, they do not disappoint. They carry 0.7- and 1.5-gram individual pre-rolls, 3.5-gram 5-packs, as well as 2-gram fatty blunts. The 0.7-gram singles come in white doob tube with their beautiful, specially designed wrapper that is just a bit shorter than your average tube, while the 1.5-gram singles come in a sealed glass container with a similar wrapper and a glass filter tip. The 2-gram blunt comes in a specially designed bag, also with a glass tip. The 3.5-gram 5-pack comes in a child-resistant tin that contains a ‘trading card’ of the strain with stats and information as well as unique characters pertaining to each strain. The blunts come in 100% tobacco-free hemp wraps and contain top-quality flower, rosin, and diamonds, while the pre-rolls feature solventless hash, liquid diamonds, and are rolled in kief, with a special slugger filter to top things off.

Marketing

Originally, Sluggers grew their brand through word of mouth but have since employed modern channels like Instagram and YouTube which they actively post on. They have a rewards program where you earn 10 points for every $1 you spend which can be used for discounts on orders ranging from $5 off all the way to $100. Their blog is highly informative, covering both topics of cannabis as well as deeper dives into their product, and they attend industry events and have pop-ups of their own. There Instagram is colorful and full of folks enjoying their pre-rolls, clearly, the vibe is right with Sluggers.-

- #25

-

(the) Essence

-

-

- Total Pre-ROll Sales $15,876,399

- Pre-Roll Units Sold 1,159,253

-

-

-

TOTAL PRODUCTS

(2024) 452 -

AVG ITEM PRICE

(2024) $13.70 -

AVG UNIT COST

(2024) $8.45 -

PROFIT

MARGIN 38% -

BRAND MARKET SHARE

(2024) 0.52%

-

About the Brand

Operated under Verano Holdings Corp., (the) Essence is no small operation considering that they operate in 14 different states with 14 different grow facilities and over 160 different strains of cannabis they grow. Verano is based on the lakeside of Chicago, helping their local community where they can. Verano supports several parts of their community from LGBTQ+ to supporting women in the field. (the) Essence has a unique logo that contains an hourglass and the sand within is the “brand's essence.” Last year (the) Essence made nearly $16 million in total pre-roll sales from 1.2 million units sold.

Products and Packaging

(the) Essence has a classic single 1-gram ‘j’s’ and 2.5-gram 5-packs of ‘j’s’. The 1-gram singles come in an all-white glass container with a screw-off top and their custom “(the) Essence” logo wrapped around, with Sativa, Indica, or Hybrid written above. Their 2.5-gram 5-packs come similarly designed in a small, all-white slider tin featuring their logo and strain ID.

Marketing

The artist series is a collaboration between (the) Essence and artists nationwide, creating artistic designs, illustrations, and imagery of different strains. Together they create unique packaging with original imagery that better captures the essence of the strain. Their online presence is cool and sleek, focusing on lifestyle imagery to present and represent their products and brand.-

- #26

-

High Supply

-

-

- Total Pre-ROll Sales $15,745,785

- Pre-Roll Units Sold 1,169,809

-

-

-

TOTAL PRODUCTS

(2024) 287 -

AVG ITEM PRICE

(2024) $13.46 -

AVG UNIT COST

(2024) $7.61 -

PROFIT

MARGIN 43% -

BRAND MARKET SHARE

(2024) 0.51%

-

About the Brand

High Supply has a knack for providing the customer who knows exactly what they do and don't want with just what they are looking for. High Supply is a straight-to-the-point brand who doesn't focus on making a quick buck, attracting their customers with high-quality cannabis over flashy packaging.

Products and Packaging