The Top 50 Canadian Pre-Roll Brands

Posted by Custom Cones USA on Sep 10th 2025

Researched, written and produced by Brian Beckley and James Valentine of Custom Cones USA

In 2024, pre-rolls in the Canadian market topped $1.27 billion in revenue, selling nearly 69 million units, with both numbers increasing despite falling revenues in other top categories, like flower and edibles. That was good enough for a 32.8% market share, second behind only flower.

It led us to predict that within the year, the humble pre-roll, which already moved more units than any other form, would also rise to the top of the revenue pack as the top-selling category across Canada.

And we were right. As of mid-2025, pre-rolls have overtaken flower as the top revenue category in the entire Canadian cannabis market. Inexpensive, potent, portable and fun ways to consume both by yourself and in a group, the pre-roll has become a palette for innovation.

Pre-Rolls Surpass Flower as Canada’s Top Cannabis Products

Through Sept. 9 of this year, pre-roll sales reached $982 million and a 34% market share, up $72 million (8%) over the previous year-to-date period and on pace to break last year's record. By comparison, flower recorded $909.4 million in sales and a 32% market share over the same period, down $23 million (-2.5%) from 2024.

And while pre-rolls grew 4.3% year-over-year, flower continued to lose market share, as it has since the legal market's inception, seeing marginal declines last year. Zoom out, and the trend is clear: pre-rolls have gained an average of 3.6% market share annually since legalization, while flower has lost 4.2% per year.

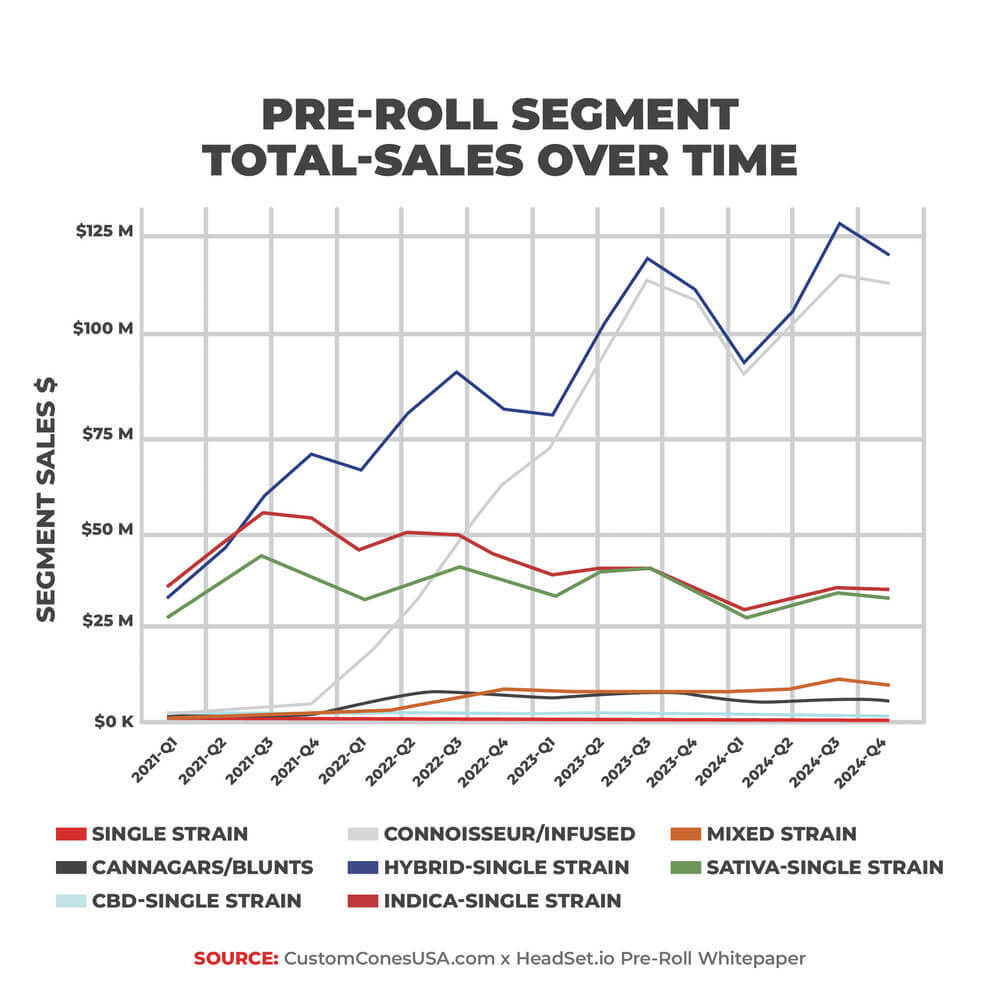

Infused pre-rolls also continue to drive growth within the broader category, recording $359 million and 36.5% of all total pre-roll sales, up $31 million (9.5%) from the previous year-to-date. And with YoY growth of 8.1%, it's no surprise that 40% of Canada's top-selling pre-roll products are infused.

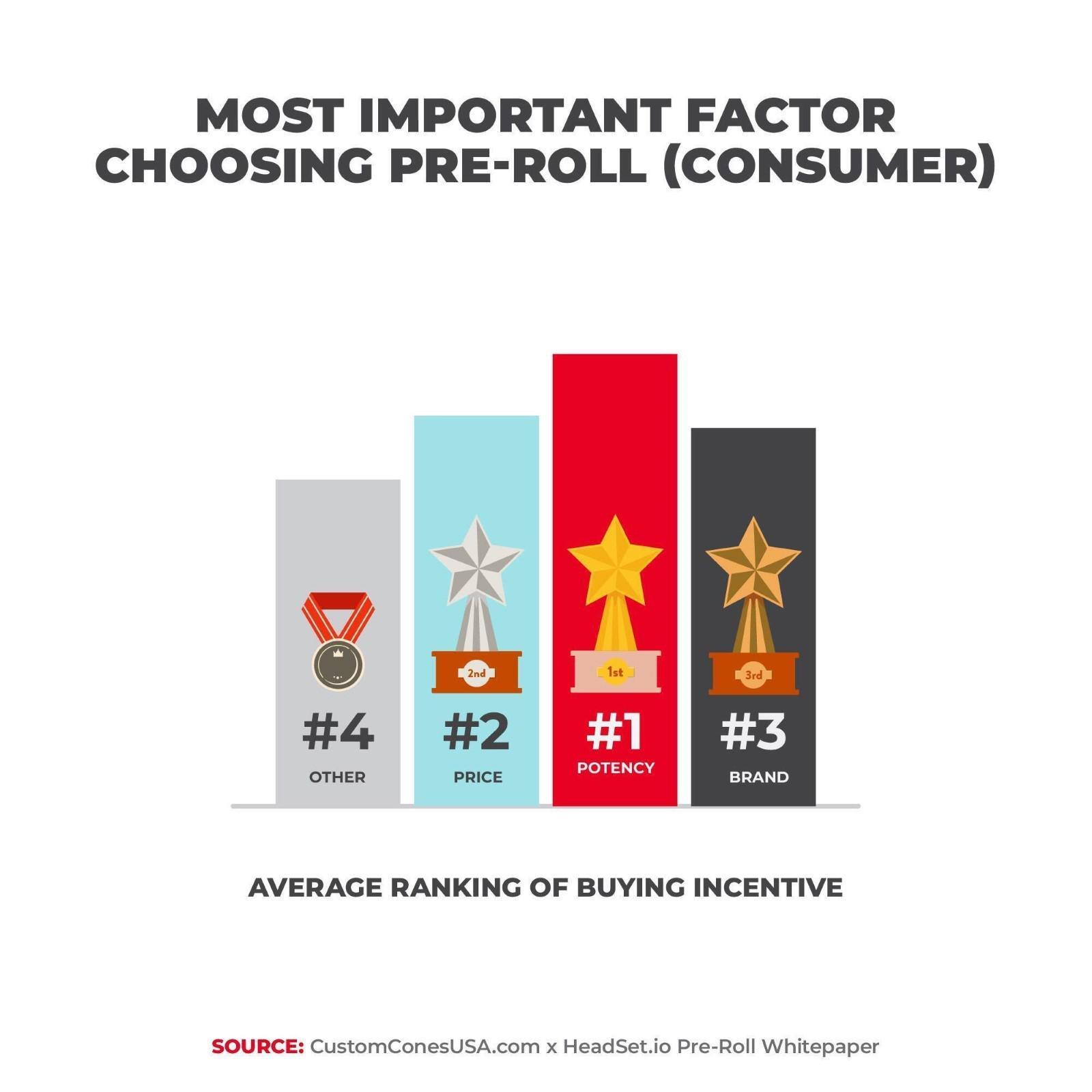

And with consumers consistently citing potency, price and brand as their top determining factors, the competition among pre-roll makers to capture this rising share of the marketplace is fierce. Well, from the second spot on down, anyway.

Once an afterthought, the best-selling brands in Canada’s best-selling category understand that the pre-roll is no longer a throwaway, but a dynamic driver of sales in every category that consumers now expect to be high-quality, highly-potent and exciting.

Custom Cones USA is diving deep into the 2024 data from cannabis analytics firm Headset to explore how the top pre-roll manufacturers in Canada make sure their pre-rolls stand out and keep moving off the shelves, creating a blueprint for growth that keeps customers coming back to join the circle again and again

Methodology

In partnership with Seattle-based Headset, whose data is sourced from actual consumer transactions across over 3,500 retailers in 15 U.S. state markets and 4 Canadian provinces, Custom Cones USA has identified the Top 50 Pre-Roll Brands in the Canadian market using total pre-roll sales data to highlight the top-selling brands in the Canadian cannabis Pre-Roll segment

Headset data from the following 4 provinces was analyzed: Alberta, British Columbia, Ontario, and Saskatchewan.

Custom Cones USA created a 10-point Social Score, by calculating the percentile rank of each brand’s Instagram, LinkedIn, and website metrics to reduce the impact of outliers. These percentile-based values were then weighted by relevance to generate a balanced score that reflects how engaged and visible a brand is online.

Instagram contributes 40% to the overall score and is based on several factors: 35% of the score comes from the number of followers, 20% from the number of posts, 30% from the average number of likes calculated as an average of the 10 most recent posts, and 15% from the average number of comments, also calculated from the 10 most recent posts.

It should be noted, Instagram’s rules are especially tough on cannabis brands, getting shadow-banned or having their accounts deleted just for showing someone smoking or using words like "cannabis" in their captions. Some profiles may be down right now as Instagram’s moderation hits hard.

LinkedIn accounts for 25% of the overall score and is based on the number of followers.

Website metrics make up 35% of the total score, with 45% of that score coming from the domain rating and 55% from the amount of organic traffic.

Canada's Top Pre-Roll Brands of 2025

Canada's Top Pre-Roll Brands of 2025

-

-

- Total Pre-ROll Sales $147,462,740

- Pre-Roll Units Sold 5,657,184

-

-

-

TOTAL PRODUCTS

(2024) 133 -

AVG ITEM PRICE

(2024) $26.07 -

AVG UNIT COST

(2024) $18.03 -

PROFIT

MARGIN 31% -

BRAND MARKET SHARE

(2024) 10.95%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Tiger Blood Distillate Infused Pre-Roll 3-Pack (1.5g) | $25,886,553 | 1,079,912 | $23.97 | 18% |

| #2Peach Ringz Kief Distillate Infused Pre-Roll 3-Pack (1.5g) | $13,261,254 | 554,198 | $23.93 | 9% |

| #3Razzilicious Infused Pre-Roll 5-Pack (2.5g) | $10,883,439 | 316,016 | $34.44 | 7% |

| #45 Loco Distillate Infused Pre-Roll 5-Pack (2.5g) | $10,646,044 | 310,933 | $34.24 | 7% |

| #5Taster Kief Coated Distillate Infused Pre-Roll 3-Pack (1.5g) | $8,634,311 | 348,462 | $24.78 | 6% |

About the Brand

Originally known for their wide selection of vapes, General Admission has risen to the top of the Canadian pre-roll market on the strength of its flavored and infused pre-rolls. Founded in 2020 as an offshoot of the Decibel Cannabis Company and located in Calgary, Alberta, the company launched its pre-roll line in 2021 and quickly climbed the sales charts to the top. With a focus on infused products, General Admission has a higher-than-average price point, but that hasn’t stopped the product from flying off the shelves, moving an astounding 5,657,184 units for a total pre-roll revenue of nearly $147.5 million in 2024, far and away the highest total of any pre-roll maker in Canada, with four pre-roll products in the top 10, including No. 1.

Products and Packaging

General Admission uses premium flower infused with distillate and dusted with kief. They are known for bold, candy-like flavors and their bright, colorful packaging and names, such as “Grape Grenade,” “Razzilicious” and its top-selling “Tiger Blood” pre-rolls. The company sells single pre-rolls in plastic, screw-top tubes as well as multi-packs of 3 and 5. In fact, all 10 of the company’s top-selling products are multi-packs. General Admission also distinguishes its pre-rolls with customized filters that feature the company’s movie ticket logo.-

- #2

-

Shred

-

-

- Total Sales $58,526,286

- Units Sold 2,510,006

-

-

-

TOTAL PRODUCTS

(2025) 81 -

AVG ITEM PRICE

(2025) $23.32 -

AVG UNIT COST

(2025) $16.10 -

PROFIT

MARGIN 31% -

BRAND MARKET SHARE

(2025) 4.34%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Shred X - Gnarberry Heavies Infused Pre-Roll 3-Pack (1.5g) | $6,993,904 | 307,220 | $22.77 | 12% |

| #2Dartz - Gnarberry Pre-Roll 10-Pack (4g) | $6,530,255 | 316,931 | $20.60 | 11% |

| #3Shred X - Blueberry Blaster Heavies Infused Pre-Roll 3-Pack (1.5g) | $5,660,541 | 247,484 | $22.87 | 10% |

| #4Dartz - Tropic Thunder Pre-Roll 10-Pack (4g) | $4,929,765 | 239,826 | $20.56 | 8% |

| #5Shred X - Tropic Thunder Heavies Infused Pre-Roll 3-Pack (1.5g) | $4,661,423 | 203,817 | $22.87 | 8% |

About the Brand

Launched in 2020 from their HQ in Moncton, New Brunswick, Shred first rose to prominence with its line of blended pre-milled flower designed to emphasize bold flavors, like the “Flower Power” pack that highlights sweet floral notes or the “Gnarberry” that focuses on fruit and berry notes. Shred’s average pre-roll price point is higher than the national number, but that is due to the focus on infused products and multipacks, including jars of 14 pre-rolls, and did not stop Shred from moving more than 2.5 million pre-rolls across Canada in 2024, all housed in brightly colored packaging.

Products and Packaging

The company uses the same aromatic blends in their pre-rolls, as well as producing pre-rolls infused with terpenes, diamonds and distillate to enhance flavor and potency. More than half of Shred’s pre-roll sales are in the connoisseur/infused category. The company offers both pre-rolled cones and pre-rolled tubes. Shred's primary pre-roll product is its “Dartz” line of 0.4-gram pre-rolled tubes that feature colorful, custom filters that use colors to identify the strain. They are sold in packs of 10. Shred also sells standard pre-rolled cones as well as its diamond, terp and distillate infused pre-rolls under the “Heavies” name, available in packs of 3 in a plastic tube, 5 in a mylar bag and the “Jar of Joints” featuring 14 pre-rolls. The “Heavies” all have custom-branded filters featuring the company’s logo. They also sell single, 1-gram “Big A** Joints,” packaged in plastic tubes and featuring a matching custom paper filter tip.-

-

- Total Sales $49,818,258

- Units Sold 2,368,638

-

-

-

TOTAL PRODUCTS

(2024) 73 -

AVG ITEM PRICE

(2024) $21.03 -

AVG UNIT COST

(2024) $14.87 -

PROFIT

MARGIN 29% -

BRAND MARKET SHARE

(2024) 3.70%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Banana OG Pre-Roll 10-Pack (3.5g) | $10,752,824 | 518,770 | $20.73 | 22% |

| #2Wedding Pie Pre-Roll 10-Pack (3.5g) | $9,583,283 | 471,495 | $20.33 | 19% |

| #3Mandarin Cookies Pre-Roll 10-Pack (3.5g) | $7,378,142 | 357,768 | $20.62 | 15% |

| #4Apple Fritter Pre-Roll 10-Pack (3.5g) | $4,738,251 | 231,407 | $20.48 | 10% |

| #5Panda Puff Pre-Roll 10-Pack (3.5g) | $4,145,031 | 200,231 | $20.70 | 8% |

About the Brand

Toronto-based Back Forty Cannabis is one of Canada’s oldest cannabis brands and it has gained a reputation for accessibility and focusing on the basics. Founded in 2018, the name references the “back forty” acres of farmland usually left uncultivated but has come to represent a place of escape from daily life. The founders of Back Forty Cannabis sought to create a brand that embodied that sense of relaxation and convenience, launching first with vape carts before moving into the pre-roll category. The single strain hybrid pre-roll still accounts for a majority of Back Forty pre-roll sales, though the company’s focus on large multipacks drives up its average price point to $21.03, a few bucks above the national average.

Products and Packaging

Back Forty’s signature pre-roll product is its line of Back Forty 40s, a machine-rolled straight tube pre-roll with a customized paper filter that is filled with 0.35 grams of flower and sold in re-sealable, recyclable packs of 10. Eight of Back Forty’s Top Ten Products are multipacks of 10 or more. They also sell their straight pre-rolls in smaller packs of three 0.75-gram pre-rolls, as well as in “Backpackers” packs of 10, packaged in a water-resistant, resealable tin. The company also has an infused line of pre-rolls called “Frosted Icicles,” pre-roll cones that are diamond-coated and distillate infused, available in both 0.5 and full-gram sizes-

- #4

-

Jeeter

-

-

- Total Sales $47,138,803

- Units Sold 1,413,043

-

-

-

TOTAL PRODUCTS

(2024) 16 -

AVG ITEM PRICE

(2024) $33.36 -

AVG UNIT COST

(2024) $23.66 -

PROFIT

MARGIN 29% -

BRAND MARKET SHARE

(2024) 3.50%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Baby Jeeter - Multi-Pack Infused Pre-Roll 5-Pack (2.5g) | $16,890,544 | 458,061 | $36.87 | 36% |

| #2Baby Jeeter - Bubba Gum Diamond Infused Pre-Roll 5-Pack (2.5g) | $9,228,250 | 263,042 | $35.08 | 20% |

| #3Baby Jeeter - Blue Zkittles Quad Infused Pre-Roll 5-Pack (2.5g) | $6,853,832 | 193,886 | $35.35 | 15% |

| #4Baby Jeeter - Strawberry Sour Diesel Liquid Diamond Infused Pre-Roll 5-Pack (2.5g) | $6,093,893 | 172,200 | $35.39 | 13% |

| #5Baby Jeeter - Mango Sherbs Infused Pre-Roll 3-Pack (1.5g) | $2,897,368 | 119,636 | $24.22 | 6% |

About the Brand

Launched into the Canadian market in March 2024 and despite only having a handful of products available, America’s top-selling pre-roll brand, Jeeter, rocketed to No. 4 on the Canadian charts. In Canada, Jeeter partnered with BZAM Ltd., a licensed Canadian producer headquartered in Ancaster, Ontario. BZAM is responsible for producing and distributing Jeeter-branded products under Canadian regulations. Jeeter products have the highest average price point in the top 50, a whopping $33.36, but that has not slowed the brand’s incredible hockey stick curve growth through its first year on the market. In fact, by mid-2025, the brand had already climbed another notch to third.

Products and Packaging

Jeeter’s Canadian success, like its American success, is fueled by its signature Baby Jeeter 0.5-gram infused pre-roll, available in multiple strains and infused with liquid diamonds and kief. It comes in 3- and 5-packs. All of the Baby Jeeter line uses bright custom filter tips that are color-coded for the strain and are packed in matching wide-mouth plastic twist top jars. The Baby Jeeter Multi-Pack Infused Pre-Roll 5-Pack includes five different strains, all with color-coded and labeled custom filter tips, and quickly rose to No. 2 on the Canadian charts, generating nearly $17 million in revenue, a full 1.3% of total pre-roll sales.-

- #5

-

Redecan

-

-

- Total Sales $46,286,484

- Units Sold 1,860,238

-

-

-

TOTAL PRODUCTS

(2024) 86 -

AVG ITEM PRICE

(2024) $24.88 -

AVG UNIT COST

(2024) $17.16 -

PROFIT

MARGIN 31% -

BRAND MARKET SHARE

(2024) 3.44%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Redees - Cold Creek Kush Pre-Roll 10-Pack (4g) | $10,944,150 | 508,628 | $21.52 | 24% |

| #2Redees- Hemp'd Animal Runtz Pre-Roll 10-Pack (4g) | $7,841,920 | 368,462 | $21.28 | 17% |

| #3Redees - Wappa Pre-Roll 10-Pack (4g) | $5,727,253 | 270,568 | $21.17 | 12% |

| #4Redees - Royal Collection Pre-Roll 70-Pack (28g) | $3,636,513 | 30,967 | $117.43 | 8% |

| #5Redees - Cold Creek Kush Pre-Roll 10-Pack (3.5g) | $3,194,633 | 146,765 | $21.77 | 7% |

About the Brand

Founded by an experienced agricultural family in the Niagara region of Ontario with a focus on greenhouse-grown cannabis and sustainable cultivation, Redecan has since been purchased by HEXO Corp. and subsequently by Tilray Brands. It is still headquartered in Fonthill, Ontario. The company focuses on traditional, non-infused pre-rolls, though it does have some infused offerings. However, because a large percentage of its sales come from large multipacks, its $24.88 average item price is above the national average.

Products and Packaging

Redecan’s signature product is the Redee, a slim, straight 0.4-gram pre-roll that comes in packs of 10 loaded into a cigarette-style box. They are available in a wide range of different strains and have a black filter that features the company’s green logo. They also sell a massive “king pack” of 70 Redees (packaged as seven packs of 10), including a “variety pack” of different strains. The company has also introduced the Redees Hemp’d line, featuring the same straight pre-roll tubes, but made with unbleached hemp paper and hemp tips. They also produce limited editions and variety packs of exclusive genetics or special formats, like the “holiday style” pre-rolls with custom red and green tips that look woven like a Christmas sweater or candy cane stripes.-

- #6

-

Good Supply

-

-

- Total Sales $43,471,759

- Units Sold 2,701,622

-

-

-

TOTAL PRODUCTS

(2024) 165 -

AVG ITEM PRICE

(2024) $16.09 -

AVG UNIT COST

(2024) $11.06 -

PROFIT

MARGIN 31% -

BRAND MARKET SHARE

(2024) 3.23%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Jean Guy Pre-Roll 14-Pack (7g) | $3,962,422 | 105,092 | $37.70 | 9% |

| #2Monsters - Monkey Walker Infused Pre-Roll (2.38g) | $3,681,026 | 118,117 | $31.16 | 8% |

| #3Jean Guy Pre-Roll 7-Pack (3.5g) | $3,644,482 | 165,428 | $22.03 | 8% |

| #4Jean Guy Pre-Roll (1g) | $3,229,261 | 418,658 | $7.71 | 7% |

| #5Monsters - Golden Guy Infused Pre-Roll (2.38g) | $1,879,740 | 60,633 | $31.00 | 4% |

About the Brand

Good Supply was originally launched by Aphria, which merged with Tilray in late 2020. It is headquartered in Leamington, Ontario. The company prides itself on “no frills, no gimmicks.” They are the first company on our list with a price point below the national average at $16.09, good enough to move more than 2.7 million pre-roll units. The company sells mostly non-infused, traditional pre-rolls but does have a line of infused products, including what it touts as “Canada’s Strongest Infused Pre-Rolls.” They are known for larger pack sizes, value pricing and recognizable, fun branding, with names like “Jean Guy,” Monkey Butter” and “Inzane in the Membrane.”

Products and Packaging

Good Supply’s top seller is its “Jean Guy” traditional pre-rolled cones, with the 14-pack, 7-pack and 1-gram option all ranking in the company’s top 5 best sellers. Most of the company’s pre-rolls are offered in similar size options, with the 14-packs of half-gram pre-rolls being a very popular size. They also offer “Juiced Pre-Rolls” that are infused with terpenes and distillate to boost flavor and potency. They feature colorful designer filter tips. Recently, it also began selling “Monster” pre-rolls, featuring massive 2.38-gram joints that combine two strains, hash oil, a coating of extract and kief to provide a whooping 1,000mg of THC in a single pre-roll. They also sell “Mini Monsters” that keep the potency, but halve the size.-

- #7

-

Spinach

-

-

- Total Sales $39,878,310

- Units Sold 2,019,411

-

-

-

TOTAL PRODUCTS

(2024) 115 -

AVG ITEM PRICE

(2024) $19.75 -

AVG UNIT COST

(2024) $13.71 -

PROFIT

MARGIN 31% -

BRAND MARKET SHARE

(2024) 2.96%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Fully Charged - Pink Lemonade Infused Pre-Roll 5-Pack (2.5g) | $3,708,176 | 116,915 | $31.72 | 9% |

| #2Stix- GMO Cookies Pre-Roll 10-Pack (3.5g) | $3,073,837 | 144,313 | $21.30 | 8% |

| #3Fully Charged - Strawberry Slurricane Infused Pre-Roll 5-Pack (2.5g) | $2,410,777 | 75,517 | $31.92 | 6% |

| #4Fully Charged- Peach Punch Infused Pre-Roll 5-Pack (2.5g) | $2,253,260 | 70,530 | $31.95 | 6% |

| #5Green Monster Breath Pre-Roll 10-Pack (3.5g) | $2,091,831 | 93,865 | $22.29 | 5% |

About the Brand

Known for its diverse selection of potent pre-rolls, the Spinach brand is owned by Cronos and based in Toronto. Launched in 2018, Spinach emphasizes “farm-to-bowl freshness” and focuses on social interaction with a lighthearted, colorful identity. For example, the name “Spinach” was chosen the for the brand specifically to NOT appeal to kids. The majority of the company’s pre-roll revenue comes from infused products, accounting for about 58% of sales and seven of the top 10 Spinach products, leading to its reputation as an innovative pre-roll manufacturer.

Products and Packaging

Spinach packs its classic, non-infused pre-rolls with custom green filters that feature the brand’s logo, available in singles as well as “Buddy Packs” of three, five or 10. But Spinach also has multiple infused varieties. The “Spinach Feelz” pre-roll line infuses each pre-roll with additional cannabinoids to enhance the effects of the minor cannabinoids. For example, the “Deep Dreamz” pre-roll includes 40% THC and 5% CBN to create a mellower high aimed for helping sleep. Other pre-roll lines are infused with THCV, CBC and CBG, all designed to offer a wider high than just THC – also known as the Entourage Effect. Meanwhile the “Fully Charged” line are highly potent, infused pre-rolls using cold-filtered cannabis extract, liquid diamonds and a kief coating for maximum strength smoke. Some also contain additional cannabinoids to enhance certain feelings. They feature color-coded custom filters that highlight the “Fully Charged” logo.-

- #8

-

Weed Me

-

-

- Total Sales $34,078,612

- Units Sold 1,451,673

-

-

-

TOTAL PRODUCTS

(2024) 202 -

AVG ITEM PRICE

(2024) $23.48 -

AVG UNIT COST

(2024) $15.56 -

PROFIT

MARGIN 34% -

BRAND MARKET SHARE

(2024) 2.53%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Sativa 420 Pre-Roll 20-Pack (8g) | $5,875,188 | 132,709 | $44.27 | 17% |

| #2Indica 420 Pre-Roll 20-Pack (8g) | $4,813,165 | 111,207 | $43.28 | 14% |

| #3Sativa 20% Plus Pre-Roll 3-Pack (3g) | $2,080,846 | 105,663 | $19.69 | 6% |

| #4Indica 20% Plus Pre-Roll 3-Pack (3g) | $2,055,572 | 104,947 | $19.59 | 6% |

| #5Sativa 20% Plus Pre-Roll 10-Pack (3.5g) | $2,040,001 | 78,456 | $26.00 | 6% |

About the Brand

Weed Me specializes in strain-specific, high-THC pre-rolls, large multipacks and highly potent infused pre-rolls. They are headquartered in Concord, Ontario. The company prides itself on quality, value and sustainability, planting one tree for every ounce sold through One Tree Planted. They have also partnered with Second Harvest since 2022, providing 8,000 meals monthly to hungry Canadians. The vast majority of Weed Me pre-rolls sold are traditional, non-infused pre-rolls, which keeps costs lower. However, 24 of its 25 top-selling products are multi-packs, including several 10- and 20-packs, which drives the average price point to an above-average $23.48.

Products and Packaging

Weed Me’s classic pre-rolls are strain-specific are available in 1-gram singles sizes, as well as multi-packs of three 1-gram joints, ten 0.35-gram mini cones and the “Grind” line of twenty 0.4-gram cones. They are packed in natural brown paper cones with custom filters featuring the brand logo and packaged in relatively plain tubes or other small plastic containers. The “Max” line of infused pre-rolls use distillate and kief to boost potency and come in highly-stylized black tubes printed with bright images and fonts for a striking, contrasting look. Weed Me also sells an infused blunt, made with palm leaf wraps.-

-

- Total Sales $29,362,694

- Units Sold 1,681,838

-

-

-

TOTAL PRODUCTS

(2024) 122 -

AVG ITEM PRICE

(2024) $17.46 -

AVG UNIT COST

(2024) $12.01 -

PROFIT

MARGIN 31% -

BRAND MARKET SHARE

(2024) 2.18%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Pink Kush Pre-Roll 10-Pack (3g) | $10,267,480 | 512,906 | $20.02 | 35% |

| #2Blue Dream Pre-Roll 10-Pack (3g) | $4,444,149 | 214,759 | $20.69 | 15% |

| #3Pink Kush Pre-Roll 3-Pack (1.5g) | $2,970,763 | 226,093 | $13.14 | 10% |

| #4Kush God Pre-Roll 10-Pack (3g) | $1,967,462 | 98,813 | $19.91 | 7% |

| #5Berry Cream Puff Pre-Roll 10-Pack (3g) | $1,093,498 | 56,053 | $19.51 | 4% |

About the Brand

Pure Sunfarms is a British Columbia-based company that seeks to highlight the legacy of “BC Bud” and is renowned for its flower, grown in its 1.1-million-square-foot greenhouse, one of the largest cannabis greenhouses in Canada, located in Delta, British Columbia. Established in 2017 as a joint venture between Emerald Health Therapeutics and greenhouse produce company Village Farms International, Pure Sunfarms is a craft-focused cannabis company. The vast majority of its nearly 1.7 million pre-roll products sold are traditional pre-rolls, which keeps its price point below the national average. In fact, only about $314,000 of its $29.4 million in pre-roll revenue comes from infused products, less than it makes in CBD pre-rolls, even.

Products and Packaging

Pure Sunfarms pre-rolls are packed into slim, refined white cones with plain filter tips and sold as either single, full-gram joints packaged in plastic tubes, 3-packs of half-gram pre-rolls in wide mouth tubes or ten 0.35 mini “dogwalker” pre-rolls packed in gorgeous slider tins that have been custom-printed, depending on the strain. The company also offers what it calls “High Def” pre-rolls that are high in potency, but do not include a concentrate. Instead, the High Def pre-rolls use a sticky, high-quality, THC-rich flower that is loosely packed to help with air flow.-

- #10

-

Dab Bods

-

-

- Total Sales $29,048,064

- Units Sold 1,033,721

-

-

-

TOTAL PRODUCTS

(2024) 123 -

AVG ITEM PRICE

(2024) $28.10 -

AVG UNIT COST

(2024) $19.38 -

PROFIT

MARGIN 31% -

BRAND MARKET SHARE

(2024) 2.16%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #160s - Motor Breath Double Infused Pre-Roll 3-Pack (1.5g) | $3,763,766 | 106,615 | $35.30 | 13% |

| #260s- Blue Lobster Double Infused Pre-Roll 3-Pack (1.5g) | $2,829,082 | 278,902 | $35.86 | 10% |

| #3Grape Ape Resin Infused Pre-Roll 3-Pack (1.5g) | $2,002,234 | 56,832 | $35.23 | 7% |

| #460s - Hawaiian Plushers Double Infused Pre-Roll 3-Pack (1.5g) | $1,693,227 | 47,988 | $35.28 | 6% |

| #5Blueberry Resin Infused Pre-Roll 3-Pack (1.5g) | $1,646,495 | 46,562 | $35.36 | 6% |

About the Brand

The cleverly named Dab Bods brand is owned by Stigma Grow, an Alberta-based subsidiary of CanadaBis Capital, launched in 2016. Located in Red Deer, the company operates a 66,000-square-foot facility dedicated to cultivation and extraction. It is known for infused pre-rolls with exceptionally high potency rates. Dab Bods pre-rolls are mostly infused, with $24.2 million of its $29 million in revenue coming from sales of infused joints. The company also focuses on multipacks, which leads to a price point of $28.10, nearly $10 above average, but still low enough to move more than 1 million units.

Products and Packaging

Dab Bods focuses on infusing its pre-rolls with concentrates, including resin, shatter and terpenes. The brand’s resin-infused pre-rolls are packed in short, tube-like RAW cones, while the “Dartz” line uses straight tube, cigarette-style pre-rolls with custom-printed filters. The company also offers a line of “triple-infused,” diamond-dusted “50’s” pre-rolls, all with potencies above 50%, also packed into RAW cones. But Dab Bods goes even further with its flagship “60’s” line of diamond- and resin-infused pre-rolls that promise potencies over 60%. Most are packed into wide mouth multi-pack tubes, which account for 28 of the company’s top 30 best sellers.-

- #11

-

MTL Cannabis

-

-

- Total Sales $25,851,370

- Units Sold 1,263,801

-

-

-

TOTAL PRODUCTS

(2024) 35 -

AVG ITEM PRICE

(2024) $20.46 -

AVG UNIT COST

(2024) $13.83 -

PROFIT

MARGIN 32% -

BRAND MARKET SHARE

(2024) 1.92%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Wes' Coast Kush Pre-Roll 3-Pack (1.5g) | $5,127,344 | 294,762 | $17.39 | 20% |

| #2Wes' Coast Kush Pre-Roll 7-Pack (3.5g) | $4,351,041 | 134,057 | $32.46 | 17% |

| #3Strawberry N' Mintz Pre-Roll 3-Pack (1.5g) | $4,122,869 | 236,564 | $17.43 | 16% |

| #4Sage N' Sour Pre-Roll 3-Pack (1.5g) | $3,440,258 | 196,436 | $17.51 | 13% |

| #5Jungl' Cake Pre-Roll 3-Pack (1.5g) | $3,255,895 | 188,140 | $17.31 | 13% |

About the Brand

MTL Cannabis was founded in 2018 by two brothers as a craft-focused, “flower-first” cannabis company, headquartered in Montreal, Quebec with a 57,000-square-foot hydroponic grow operation in Pointe-Claire. It focuses on high-terpene, high-cannabinoid products and touts both its premium genetics and its rigorous quality control systems. Though it has an infused line, the company’s pre-roll offerings are overwhelmingly traditional, single-strain pre-rolls that are consistently high in THC and often described as flavorful. However, because it sells mostly multi-packs, it carries a higher-than-average price point of $20.46.

Products and Packaging

MTL Cannabis’s pre-rolls are mostly an extension of its flower line and are designed to highlight the company’s premium genetics, hydroponic grow system and cold cure method. The pre-rolls are mostly no-frills, packed into half-gram cones with plain white filter tips and packaged in simple, plastic tubes. MTL Cannabis also sells some straight-tube pre-rolls, also with mostly plain filters. The company carries 1-gram pre-rolled blunts, though they are not a large portion of its business.-

- #12

-

Color Cannabis

-

-

- Total Sales $24,203,763

- Units Sold 1,325,044

-

-

-

TOTAL PRODUCTS

(2024) 68 -

AVG ITEM PRICE

(2024) $18.27 -

AVG UNIT COST

(2024) $11.98 -

PROFIT

MARGIN 34% -

BRAND MARKET SHARE

(2024) 1.80%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Mango Haze Pre-Roll 10-Pack (3.5g) | $4,331,199 | 194,265 | $22.30 | 18% |

| #2Space Cake Pre-Roll 10-Pack (3.5g) | $3,532,358 | 164,695 | $21.45 | 15% |

| #3Ghost Train Haze Pre-Roll 10-Pack (3.5g) | $3,503,716 | 160,401 | $21.84 | 14% |

| #4Pedro's Sweet Sativa Pre Roll 10-Pack (3.5g) | $2,432,916 | 110,481 | $22.02 | 10% |

| #5Blueberry Seagal Pre-Roll 10-Pack (3.5g) | $1,694,777 | 80,618 | $21.02 | 7% |

About the Brand

Founded as part of WeedMD, now known as Entourage Health Corp., Color Cannabis was launched in 2019 with a mission of producing high-quality but affordable flower. The brand is headquartered in Strathroy, Ontario, where it operates a large greenhouse, with a dedicated processing site in Aylmer. The vast majority of the company’s pre-roll offerings are single strain, non-infused, keeping its average price point at $18.27, just below the national average.

Products and Packaging

Color Cannabis pre-rolls are mostly packed in refined white paper cones and packaged in multi-packs. The company sells half-gram pre-roll 2-packs, 3-packs and 24-packs. It also sells 0.35-gram mini “dogwalker” pre-rolls in packs of two and 10. The company has a handful of infused pre-roll products, though it was not a major part of its pre-roll line in 2024. And while it mostly uses plain, white filters, some of the products also feature a custom-printed filter that features the company logo.-

- #13

-

Carmel

-

-

- Total Sales $23,733,552

- Units Sold 923,100

-

-

-

TOTAL PRODUCTS

(2024) 69 -

AVG ITEM PRICE

(2024) $25.71 -

AVG UNIT COST

(2024) $17.60 -

PROFIT

MARGIN 32% -

BRAND MARKET SHARE

(2024) 1.76%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Animal Face Pre-Roll 3-Pack (1.5g) | $10,331,299 | 455,339 | $22.69 | 44% |

| #2Animal Face Pre-Roll 12-Pack (6g) | $4,367,927 | 76,201 | $57.32 | 18% |

| #3Variety Pack Infused Pre-Roll 3-Pack (1.5g) | $1,421,787 | 54,890 | $25.90 | 6% |

| #4Flamingo Pre-Roll 3-Pack (1.5g) | $894,935 | 43,654 | $20.50 | 4% |

| #5Slurty3 Pre-Roll 3-Pack (1.5g) | $835,350 | 40,511 | $20.62 | 4% |

About the Brand

Located in Oro-Medonte, Ontario, Carmel is a small-batch craft cultivator known for rare genetics, a commitment to pheno-hunting and handcrafted, boutique-style limited releases. Though the company officially launched in 2019, it traces its roots to Canada’s “gray market” as the team includes legacy growers and pheno-hunters. Carmel uses old-school techniques to greenhouse-grow, hang-dry and hand-trim its exclusive genetics and is best known for its “Animal Face” strain, the 3-pack of which ranks no. 9 in pre-roll product sales.

Products and Packaging

Carmel’s pre-rolls are mostly of the traditional, non-infused variety. The company uses slim, natural brown cones with custom-printed filter tips that feature the brand logo. It sells mostly half-gram pre-rolls packaged in mostly 3- and 12-packs. There are also 6-packs that include two different strains in pre-roll form. Carmel does have a handful of 1-gram infused pre-rolls as well, packed into short, mostly straight cones with a ceramic filter tip and a custom-printed “Carmel” cigar band. The company also has a line of 1-gram pre-rolled blunt and infused blunt offerings, packed in hemp wrap with a ceramic filter tip and a custom cigar band.-

-

- Total Sales $23,058,817

- Units Sold 2,007,516

-

-

-

TOTAL PRODUCTS

(2024) 54 -

AVG ITEM PRICE

(2024) $11.49 -

AVG UNIT COST

(2024) $7.84 -

PROFIT

MARGIN 32% -

BRAND MARKET SHARE

(2024) 1.71%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Sunny Daze Pre-Roll 2-Pack (2g) | $6,578,417 | 637,003 | $10.33 | 29% |

| #2Night Rider Pre-Roll 2-Pack (2g) | $4,827,283 | 473,724 | $10.19 | 21% |

| #3Sunny Daze Pre-Roll 4-Pack (4g) | $1,459,430 | 78,288 | $18.64 | 6% |

| #4Sunny Daze Pre-Roll 10-Pack (3.5g) | $1,429,563 | 65,738 | $21.75 | 6% |

| #5Night Rider Pre-Roll 4-Pack (4g) | $1,127,426 | 60,536 | $18.62 | 5% |

About the Brand

Toronto-based Fuego Cannabis is an in-house brand of Ayurcann Holdings Corp, which operates a 13,585-square-foot facility in Pickering, Ontario. The brand positions itself as a high-potency value brand. Fuego has by far the lowest average price point in the top 15 at $11.49, which is why despite selling more pre-roll units (2 million) than seven of the brands ahead of it, its revenue is only $23 million, landing Fuego in 14th place on the list.

Products and Packaging

Feugo’s top pre-roll sellers are 1-gram versions of its Sunny Daze and Night Rider strains. It sells 2- and 4-packs of full gram pre-rolled cones, packed in natural brown paper with plain filters and packaged in colorful tubes, as well as in multipacks of 10 and 20 mini 0.35-gram pre-rolls. It also offers a wide selection of high potency infused products that use distillates to pump up the THC percentages, as well as the flavor by use of terpenes.-

- #15

-

BoxHot

-

-

- Total Sales $20,485,080

- Units Sold 918,676

-

-

-

TOTAL PRODUCTS

(2024) 96 -

AVG ITEM PRICE

(2024) $22.30 -

AVG UNIT COST

(2024) $15.09 -

PROFIT

MARGIN 32% -

BRAND MARKET SHARE

(2024) 1.52%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Fatties - Exotic Trifecta of Smoking Power Distillate Infused Blunt 3-Pack (3g) | $6,768,011 | 172,089 | $39.33 | 33% |

| #2Fatties - Cherry Kush Infused Blunt (1g) | $2,054,050 | 133,059 | $15.44 | 10% |

| #3Fatties - Peach OG Infused Blunt (1g) | $2,008,558 | 131,046 | $15.33 | 10% |

| #4Dusties -Retro Bubba Fruit Kief Infused Pre Roll 3-Pack (1.5g) | $1,343,602 | 57,838 | $23.23 | 7% |

| #5Fatties - CBN Couch Lock Kush Infused Blunt (1g) | $795,948 | 51,633 | $15.42 | 4% |

About the Brand

BoxHot is an Ontario-based cannabis brand created by Motif Labs, which specializes in cannabinoid and terpene extraction, so it’s no surprise that most of its offerings are infused. In late 2024, Motif was acquired by Organigram Holdings. The company produces high-potency pre-rolls using the distillate and terpenes that have made their vape carts among the best-selling in Canada.

Products and Packaging

Unlike any other manufacturer on the list, BoxHot’s top product line is actually infused pre-rolled blunts. They are packed into chamomile wraps and infused with distillate and botanical terpenes and finished with a colorful, custom-printed cigar band that features the company logo. They boast bold, fruity flavors and have colorful packaging and names like “Guava Stardog,” “Alien OG” and “Tropicanna Banana.” In fact, four of BoxHot’s top 5 best-sellers are infused blunts. The company uses fun names for their products like “Fatties” for its larger pre-rolls, “Stubbies” for smaller ones, “Dusties” for its distillate-infused pre-rolls that have been coated in kief and “Torpedos” for more traditional pre-rolls. There is also a 1.2-gram “Dusties XL” line and a 3-gram “Mega Fatties” pre-rolled blunt line. All have colorful, custom-printed filter tips or cigar bands that vary based on the strain.-

- #16

-

Station House

-

- Total Revenue $19,784,561

- Units Sold 2,489,025

-

-

TOTAL PRODUCTS

(2025) 94 -

AVG ITEM PRICE

(2025) $7.95 -

AVG UNIT COST

(2025) $5.29 -

PROFIT

MARGIN 34% -

BRAND MARKET SHARE

(2025) 1.47%

-

-

- #17

-

PIFF

-

- Total Revenue $18,336,401

- Units Sold 1,801,220

-

-

TOTAL PRODUCTS

(2025) 9 -

AVG ITEM PRICE

(2025) $10.18 -

AVG UNIT COST

(2025) $6.71 -

PROFIT

MARGIN 34% -

BRAND MARKET SHARE

(2025) 1.36%

-

-

- #18

-

Tweed

-

- Total Revenue $14,257,278

- Units Sold 611,053

-

-

TOTAL PRODUCTS

(2025) 45 -

AVG ITEM PRICE

(2025) $23.33 -

AVG UNIT COST

(2025) $16.11 -

PROFIT

MARGIN 31% -

BRAND MARKET SHARE

(2025) 1.06%

-

-

- Total Revenue $13,274,226

- Units Sold 1,289,469

-

-

TOTAL PRODUCTS

(2025) 42 -

AVG ITEM PRICE

(2025) $10.29 -

AVG UNIT COST

(2025) $7.14 -

PROFIT

MARGIN 31% -

BRAND MARKET SHARE

(2025) 0.99%

-

-

- #20

-

Simply Bare

-

- Total Revenue $12,685,320

- Units Sold 674,715

-

-

TOTAL PRODUCTS

(2025) 91 -

AVG ITEM PRICE

(2025) $18.80 -

AVG UNIT COST

(2025) $12.58 -

PROFIT

MARGIN 33% -

BRAND MARKET SHARE

(2025) 0.94%

-

-

- #21

-

Tribal

-

- Total Revenue $12,619,118

- Units Sold 488,845

-

-

TOTAL PRODUCTS

(2025) 41 -

AVG ITEM PRICE

(2025) $25.81 -

AVG UNIT COST

(2025) $17.31 -

PROFIT

MARGIN 33% -

BRAND MARKET SHARE

(2025) 0.94%

-

-

- #22

-

Versus

-

- Total Revenue $12,552,901

- Units Sold 480,144

-

-

TOTAL PRODUCTS

(2025) 71 -

AVG ITEM PRICE

(2025) $26.14 -

AVG UNIT COST

(2025) $17.68 -

PROFIT

MARGIN 32% -

BRAND MARKET SHARE

(2025) 0.93%

-

-

- Total Revenue $11,939,626

- Units Sold 1,284,926

-

-

TOTAL PRODUCTS

(2025) 23 -

AVG ITEM PRICE

(2025) $9.29 -

AVG UNIT COST

(2025) $6.22 -

PROFIT

MARGIN 33% -

BRAND MARKET SHARE

(2025) 0.89%

-

-

- #24

-

1Spliff

-

- Total Revenue $11,886,249

- Units Sold 537,304

-

-

TOTAL PRODUCTS

(2025) 37 -

AVG ITEM PRICE

(2025) $22.12 -

AVG UNIT COST

(2025) $15.39 -

PROFIT

MARGIN 30% -

BRAND MARKET SHARE

(2025) 0.88%

-

-

- #25

-

1964 Supply Co

-

- Total Revenue $11,856,146

- Units Sold 691,586

-

-

TOTAL PRODUCTS

(2025) 81 -

AVG ITEM PRICE

(2025) $17.14 -

AVG UNIT COST

(2025) $11.36 -

PROFIT

MARGIN 34% -

BRAND MARKET SHARE

(2025) 0.88%

-

-

- Total Revenue $11,633,303

- Units Sold 308,519

-

-

TOTAL PRODUCTS

(2025) 8 -

AVG ITEM PRICE

(2025) $37.71 -

AVG UNIT COST

(2025) $27.14 -

PROFIT

MARGIN 28% -

BRAND MARKET SHARE

(2025) 0.86%

-

-

- #27

-

Thumbs Up Brand

-

- Total Revenue $11,433,487

- Units Sold 1,166,084

-

-

TOTAL PRODUCTS

(2025) 37 -

AVG ITEM PRICE

(2025) $9.81 -

AVG UNIT COST

(2025) $6.68 -

PROFIT

MARGIN 32% -

BRAND MARKET SHARE

(2025) 0.85%

-

-

- #28

-

Tasty's (CAN)

-

- Total Revenue $11,277,283

- Units Sold 417,541

-

-

TOTAL PRODUCTS

(2025) 23 -

AVG ITEM PRICE

(2025) $27.01 -

AVG UNIT COST

(2025) $18.96 -

PROFIT

MARGIN 30% -

BRAND MARKET SHARE

(2025) 0.84%

-

-

- #29

-

SUPER TOAST

-

- Total Revenue $11,215,771

- Units Sold 797,872

-

-

TOTAL PRODUCTS

(2025) 19 -

AVG ITEM PRICE

(2025) $14.06 -

AVG UNIT COST

(2025) $9.59 -

PROFIT

MARGIN 32% -

BRAND MARKET SHARE

(2025) 0.83%

-

-

- #30

-

Common Ground

-

- Total Revenue $10,976,266

- Units Sold 636,241

-

-

TOTAL PRODUCTS

(2025) 60 -

AVG ITEM PRICE

(2025) $17.25 -

AVG UNIT COST

(2025) $11.50 -

PROFIT

MARGIN 33% -

BRAND MARKET SHARE

(2025) 0.81%

-

-

- Total Revenue $10,544,933

- Units Sold 391,930

-

-

TOTAL PRODUCTS

(2025) 39 -

AVG ITEM PRICE

(2025) $26.91 -

AVG UNIT COST

(2025) $18.16 -

PROFIT

MARGIN 33% -

BRAND MARKET SHARE

(2025) 0.78%

-

-

- #32

-

Pistol and Paris

-

- Total Revenue $10,412,525

- Units Sold 621,276

-

-

TOTAL PRODUCTS

(2025) 69 -

AVG ITEM PRICE

(2025) $16.76 -

AVG UNIT COST

(2025) $11.04 -

PROFIT

MARGIN 34% -

BRAND MARKET SHARE

(2025) 0.77%

-

-

- Total Revenue $11,939,626

- Units Sold 1,284,926

-

-

TOTAL PRODUCTS

(2025) 23 -

AVG ITEM PRICE

(2025) $9.29 -

AVG UNIT COST

(2025) $6.22 -

PROFIT

MARGIN 33% -

BRAND MARKET SHARE

(2025) 0.89%

-

-

- #34

-

OHJA

-

- Total Revenue $9,941,491

- Units Sold 538,803

-

-

TOTAL PRODUCTS

(2025) 36 -

AVG ITEM PRICE

(2025) $18.45 -

AVG UNIT COST

(2025) $12.53 -

PROFIT

MARGIN 32% -

BRAND MARKET SHARE

(2025) 0.74%

-

-

- #35

-

Rizzlers

-

- Total Revenue $9,724,435

- Units Sold 695,054

-

-

TOTAL PRODUCTS

(2025) 32 -

AVG ITEM PRICE

(2025) $13.99 -

AVG UNIT COST

(2025) $9.50 -

PROFIT

MARGIN 32% -

BRAND MARKET SHARE

(2025) 0.72%

-

-

- #36

-

Bold

-

- Total Revenue $9,255,341

- Units Sold 482,121

-

-

TOTAL PRODUCTS

(2025) 60 -

AVG ITEM PRICE

(2025) $19.20 -

AVG UNIT COST

(2025) $12.74 -

PROFIT

MARGIN 34% -

BRAND MARKET SHARE

(2025) 0.69%

-

-

- #37

-

Stunnerz

-

- Total Revenue $8,300,109

- Units Sold 661,425

-

-

TOTAL PRODUCTS

(2025) 17 -

AVG ITEM PRICE

(2025) $12.55 -

AVG UNIT COST

(2025) $19.13 -

PROFIT

MARGIN 27% -

BRAND MARKET SHARE

(2025) 0.62%

-

-

- #38

-

Hiway

-

- Total Revenue $8,159,672

- Units Sold 783,306

-

-

TOTAL PRODUCTS

(2025) 15 -

AVG ITEM PRICE

(2025) $10.42 -

AVG UNIT COST

(2025) $7.19 -

PROFIT

MARGIN 31% -

BRAND MARKET SHARE

(2025) 0.61%

-

-

- #39

-

Sheeesh!

-

- Total Revenue $8,132,843

- Units Sold 393,351

-

-

TOTAL PRODUCTS

(2025) 38 -

AVG ITEM PRICE

(2025) $20.68 -

AVG UNIT COST

(2025) $14.41 -

PROFIT

MARGIN 30% -

BRAND MARKET SHARE

(2025) 0.60%

-

-

- #40

-

Double J's

-

- Total Revenue $7,876,551

- Units Sold 660,343

-

-

TOTAL PRODUCTS

(2025) 4 -

AVG ITEM PRICE

(2025) $11.93 -

AVG UNIT COST

(2025) $8.05 -

PROFIT

MARGIN 32% -

BRAND MARKET SHARE

(2025) 0.58%

-

-

- #41

-

FIGR

-

- Total Revenue $7,769,636

- Units Sold 372,194

-

-

TOTAL PRODUCTS

(2025) 60 -

AVG ITEM PRICE

(2025) $20.88 -

AVG UNIT COST

(2025) $14.42 -

PROFIT

MARGIN 31% -

BRAND MARKET SHARE

(2025) 0.58%

-

-

- #42

-

The Loud Plug

-

- Total Revenue $7,405,538

- Units Sold 364,700

-

-

TOTAL PRODUCTS

(2025) 63 -

AVG ITEM PRICE

(2025) $20.31 -

AVG UNIT COST

(2025) $14.06 -

PROFIT

MARGIN 31% -

BRAND MARKET SHARE

(2025) 0.55%

-

-

- #43

-

DEBUNK

-

- Total Revenue $7,399,506

- Units Sold 287,516

-

-

TOTAL PRODUCTS

(2025) 20 -

AVG ITEM PRICE

(2025) $25.74 -

AVG UNIT COST

(2025) $17.82 -

PROFIT

MARGIN 31% -

BRAND MARKET SHARE

(2025) 0.55%

-

-

- #44

-

Divvy

-

- Total Revenue $7,304,905

- Units Sold 323,370

-

-

TOTAL PRODUCTS

(2025) 52 -

AVG ITEM PRICE

(2025) $22.59 -

AVG UNIT COST

(2025) $15.95 -

PROFIT

MARGIN 29% -

BRAND MARKET SHARE

(2025) 0.54%

-

-

- #45

-

Sticky Greens

-

- Total Revenue $6,741,718

- Units Sold 288,023

-

-

TOTAL PRODUCTS

(2025) 48 -

AVG ITEM PRICE

(2025) $23.41 -

AVG UNIT COST

(2025) $16.34 -

PROFIT

MARGIN 30% -

BRAND MARKET SHARE

(2025) 0.50%

-

-

- #46

-

BC Doobies

-

- Total Revenue $6,679,782

- Units Sold 278,851

-

-

TOTAL PRODUCTS

(2025) 37 -

AVG ITEM PRICE

(2025) $23.95 -

AVG UNIT COST

(2025) $15.89 -

PROFIT

MARGIN 34% -

BRAND MARKET SHARE

(2025) 0.50%

-

-

- #47

-

Buddy Blooms

-

- Total Revenue $6,648,509

- Units Sold 618,724

-

-

TOTAL PRODUCTS

(2025) 20 -

AVG ITEM PRICE

(2025) $10.75 -

AVG UNIT COST

(2025) $7.09 -

PROFIT

MARGIN 34% -

BRAND MARKET SHARE

(2025) 0.49%

-

-

- #48

-

Broken Coast

-

- Total Revenue $6,539,280

- Units Sold 446,922

-

-

TOTAL PRODUCTS

(2025) 62 -

AVG ITEM PRICE

(2025) $14.63 -

AVG UNIT COST

(2025) $10.19 -

PROFIT

MARGIN 30% -

BRAND MARKET SHARE

(2025) 0.49%

-

-

- #49

-

El Blunto

-

- Total Revenue $6,237,367

- Units Sold 203,528

-

-

TOTAL PRODUCTS

(2025) 35 -

AVG ITEM PRICE

(2025) $30.65 -

AVG UNIT COST

(2025) $21.06 -

PROFIT

MARGIN 31% -

BRAND MARKET SHARE

(2025) 0.46%

-

-

- #50

-

Soar

-

- Total Revenue $6,042,407

- Units Sold 447,586

-

-

TOTAL PRODUCTS

(2025) 30 -

AVG ITEM PRICE

(2025) $13.50 -

AVG UNIT COST

(2025) $9.21 -

PROFIT

MARGIN 32% -

BRAND MARKET SHARE

(2025) 0.45%

-

The Booming Pre-Roll Market

Whether you're looking to enter the pre-roll market or an established cannabis brand ready to scale your operations and pre-roll offerings, understanding the production pipeline from whole-flower buds to packaged final products is paramount for maximizing sales revenue. The pre-roll industry has evolved from simple hand-rolled joints or hand-packed cones to sophisticated, automated pre-roll production operations that lean heavily on accuracy, consistency, and quality at every step of the process.

Introducing Pre-Rolls to Your Product Line

For emerging cannabis brands, pre-rolls represent an ideal entry point into the market, as well as an opportunity for cultivators to expand their product lines as they:

- Require a lower initial investment compared to concentrates or edibles

- Offer higher margins than raw flower products

- Have emerged as the top selling product category in Cannabis, outpacing 2024 leader, flower, by 4.2% through mid-2025. Now controlling a record 33.6% market share with monthly sales exceeding $122 million, solidifying their position as the top earner in the Canadian cannabis market.

Understanding Cannabis Consumers

Consumer research from a survey of 900 North American pre-roll consumers reveals compelling opportunities for incorporating pre-rolls across all demographics, with 82% of cannabis smokers purchasing pre-rolls and 94.2% preferring joints as their consumption method, the market potential is massive.

- Millennials lead purchases at 44.6%,

- followed by Gen X (24.3%),

- Gen Z (18.5%),

- and Boomers (12.5%).

When consumers think of pre-rolls, convenience ranks as their top consideration (45% of respondents), while potency drives purchase decisions (70% rank it first) followed by price point.

Scaling Your Operations

As demand and competition rise, successful brands quickly realize that hand-rolling and packing aren’t sustainable, this is where strategic investment in automated pre-roll machinery becomes critical. Smart operators also recognize the premium opportunity of infused pre-rolls, which have become the dominant segment within the pre-roll category, accounting for 36.4% of the market, commanding average prices of $25.16 compared to the overall category average of $18.20. Multi-packs now represent a staggering 85% of all pre-roll sales, with the 1.5-gram 3-pack variation leading at 27.4% of total sales.

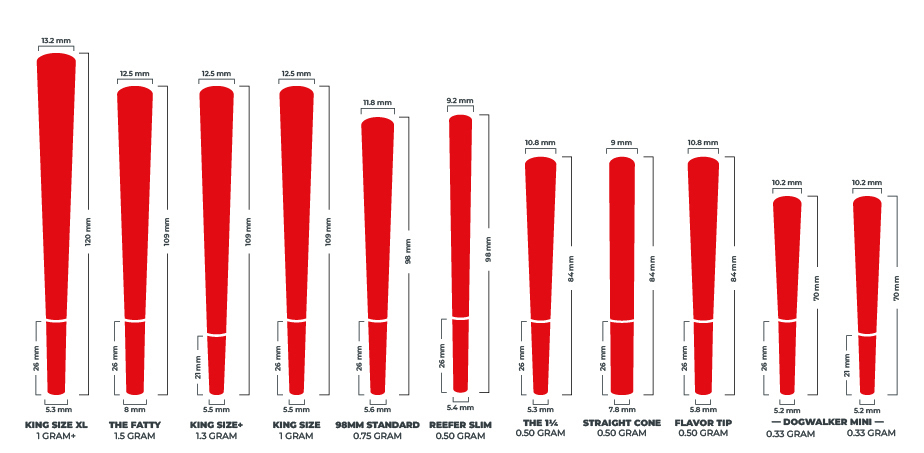

Successful scaling requires strategic machine selection, with tabletop units like the King Kone and Fill N' Fold ideal for emerging brands, with the progression to full-scale automated systems for pre-roll production exceeding 50,000 completed pre-rolls monthly.

It All Starts with Grinding and Sifting

Quality pre-rolls start with consistent particle size, and the science proves why sifting is a non-negotiable when it comes to maximizing outputs. Industrial grinders with low RPM and high torque preserve terpenes while creating uniform material and remove stems and oversized particles that tear papers or create uneven burns. In a survey of over 300 companies representing every corner of the pre-roll industry, only 59% of pre-roll businesses sift their flower, though an additional 17.2% plan to implement sifting, representing a significant opportunity for competitive advantage.

Smart grinder selection scales with volume, like the industrial grinders for mid-volume operations and high-capacity systems processing hundreds of pounds per hour for large-scale producers. Modern filling machines require precise specifications, making proper grinding and sifting essential for preventing equipment jams and ensuring consistent weights.

We conducted an experiment to compare pre-roll output from sifted and non-sifted flower. Using sifted ground flower versus un-sifted flower in a run of 169 pre-rolls resulted in 27 more pre-rolls ready to package, along with 65% lower weight variance, 488% fewer holes, and 194% better packs. When you’re thinking about scaling up, the value of a sifter speaks for itself.

Automation Using Pre-Roll Filling Machines

The engine behind any serious pre-roll operation is cone and tube filling machinery. From tabletop units handling hundreds of pre-rolls per hour to fully automated systems processing thousands, the right equipment scales with your organization’s goals. With 39.2% of businesses using automated pre-roll machines and another 17.6% planning to implement them, automation is becoming the industry standard for serious producers.

Modern machines accommodate the complete spectrum of pre-roll construction, from standard cones and tubes to hemp wrap blunts and premium filter options. The most frustrating production bottleneck remains closing pre-rolls by twisting and folding (cited by 24.4% of businesses), followed by filling (22%), packaging (20.3%), grinding (12.2%), sifting (11.4%), and weighing (8.1%), challenges that proper equipment directly addresses.

Incorporating Infused Pre-Rolls to Meet Consumer Demand

The fastest-growing segment in cannabis, Infused pre-rolls, now account for over $358 million in sales, representing 36.4% of all pre-roll revenue. Consumer adoption is astounding, with 70% of pre-roll smokers purchasing infused products, with kief leading concentrate preferences at 78.3%, followed by live resin (77.3%) and rosin (58.8%). Over 53.3% of pre-roll brands currently produce infused products, with 43.4% planning to incorporate them into their product lines.

Internal infusion delivers a superior smoking experience by incorporating concentrates whole or by mixing concentrates directly with flower. The most popular method of infusion involves painting with oil and rolling in kief externally, used by 90% of infused producers, while 45% mix flower and oil directly and 35% use the popular “hash hole” style infused pre-rolls.

Flower infusion equipment handles any concentrate that can be liquefied including distillate, live resin, rosin, shatter, hash and more. However, 60% of businesses still infuse by hand, leaving significant room for efficiency improvements through automation. Automated infusion technology transforms time-intensive manual processes into scalable production, essential for capturing the premium pricing that infused products command.

The Final Touch: Professional, Customizable Packaging

A brand's packaging communicates quality and ethos while also complying with state regulations and requirements. Pop-top tubes dominate the market, used by the majority of producers, while multi-pack formats continue their rapid growth. Consumer data shows 43% buy both single-use and multi-pack pre-rolls, with 31.1% preferring multi-packs over singles (25.9%).

Premium positioning requires attention to details, from child-resistant and custom-branded options to specialized blunt packaging that maintains product integrity. Filter selection enhances a brand identity and the overall smoking experience with consumer research revealing a strong adoption of premium filter tips

- 59% of smokers have purchased pre-rolls with premium filter tips

- Glass-tipped pre-rolls lead consumer preference at 79.7%

- 47.6% are willing to pay up to $2 more for the premium filter experience

- 21.4% purchase premium filter tip pre-rolls weekly

Paper type matters greatly to consumers as well, 55.5% rate it as "very important," with organic hemp paper leading at a 72.5%, followed by refined white (69.4%), hemp wraps (64.2%) and natural brown (61.6%).

Your Beginning-to-End Pre-Roll Production Partner

At Custom Cones USA, we've guided thousands of brands through every stage of their pre-roll journeys. Our team of Pre-Roll Experts understand that success is about more than individual machinery, it's about creating integrated systems and processes that grow with your business. From industrial grinders to automated pre-roll filling machines, to customized pre-roll materials and branding, we provide the equipment, expertise, and ongoing support that turn concepts into reality.

Ready to capitalize on the fastest-growing cannabis segment? Contact the Pre-Roll Experts today and discover why industry leading brands trust Custom Cones USA for their most critical pre-roll production needs.

About Our Contributors

Brian Beckley spent 20 years as an award-winning newspaper journalist and editor, covering cities on both coasts before becoming Managing Editor of Marijuana Venture magazine, where he covered all aspects of the cannabis industry for five years. In his role with the magazine, he spoke at numerous cannabis conferences and hosted several media panels. Brian joined Custom Cones USA and DaySavers as lead copywriter in 2023.

James Valentine is a 17-year cannabis consumer who has spent 9 years in digital leadership managing marketing, content and communications. James joined Custom Cones USA and DaySavers in 2024 and manages content marketing and communications.

As of mid-2025, pre-rolls have overtaken flower as the top revenue category in the entire Canadian cannabis market.