Pre-Roll Trends of 2025

Posted by Custom Cones USA on Nov 20th 2025

In the world of cannabis sales, pre-rolls are not just another product to take up space on your shelves, they are key component to ensuring the success of your dispensary or retail shop.

That’s because pre-rolls are the fastest-growing category in the industry and a top driver of revenue. According to Headset data, more than 310.7 million pre-roll products were sold through the first 10 months of 2025, generating nearly $2.8 billion in revenue across the 13 different recreational markets tracked by the company.

That’s a 15.8% market share for the category, good enough for third behind flower and vapes. And in Canada, pre-rolls recently overtook flower as the top-selling category in the country.

Pre-rolls have gone from an afterthought to category leader, driven by broad consumer demand, innovation (infused, tips, multi-packs), ease-of-use, and a price point that allows customers to experiment.

All told, pre-rolls are popular, increase basket totals and help build repeat business making a wide range of pre-rolls an absolute must for successful retailers.

A Wide Range of Products

At its core, the pre-roll is simply a pre-made joint. It is a pre-rolled cone or tube, usually with a filter (or “crutch”) that has been filled with flower and packaged so it is ready to be lit and smoked. But dive a little deeper and the pre-roll category is one of the largest and most innovative sectors of the cannabis industry, with producers constantly finding new ways to use the pre-rolled canvas to attract customers.

In fact, due in part to its diversity, no category in the industry moves more units than pre-rolls. And while they are all essentially pre-rolled joints, it’s important for dispensary owners to understand the differences between each pre-roll segment and how it sells in order to create the right mix to keep sales flowing.

The wide variety of options in the pre-roll sector means shoppers buy them for a variety of reasons, from personal, everyday use, to party favors, special occasions and gifting. Which is why it is important for stores to carry a full range of products and price points, giving consumers the option of grabbing something simple and cheap, trying a new brand or strain or even checking out a premium option, like an infused pre-roll that combines flower and a concentrate.

Infused Pre-Rolls

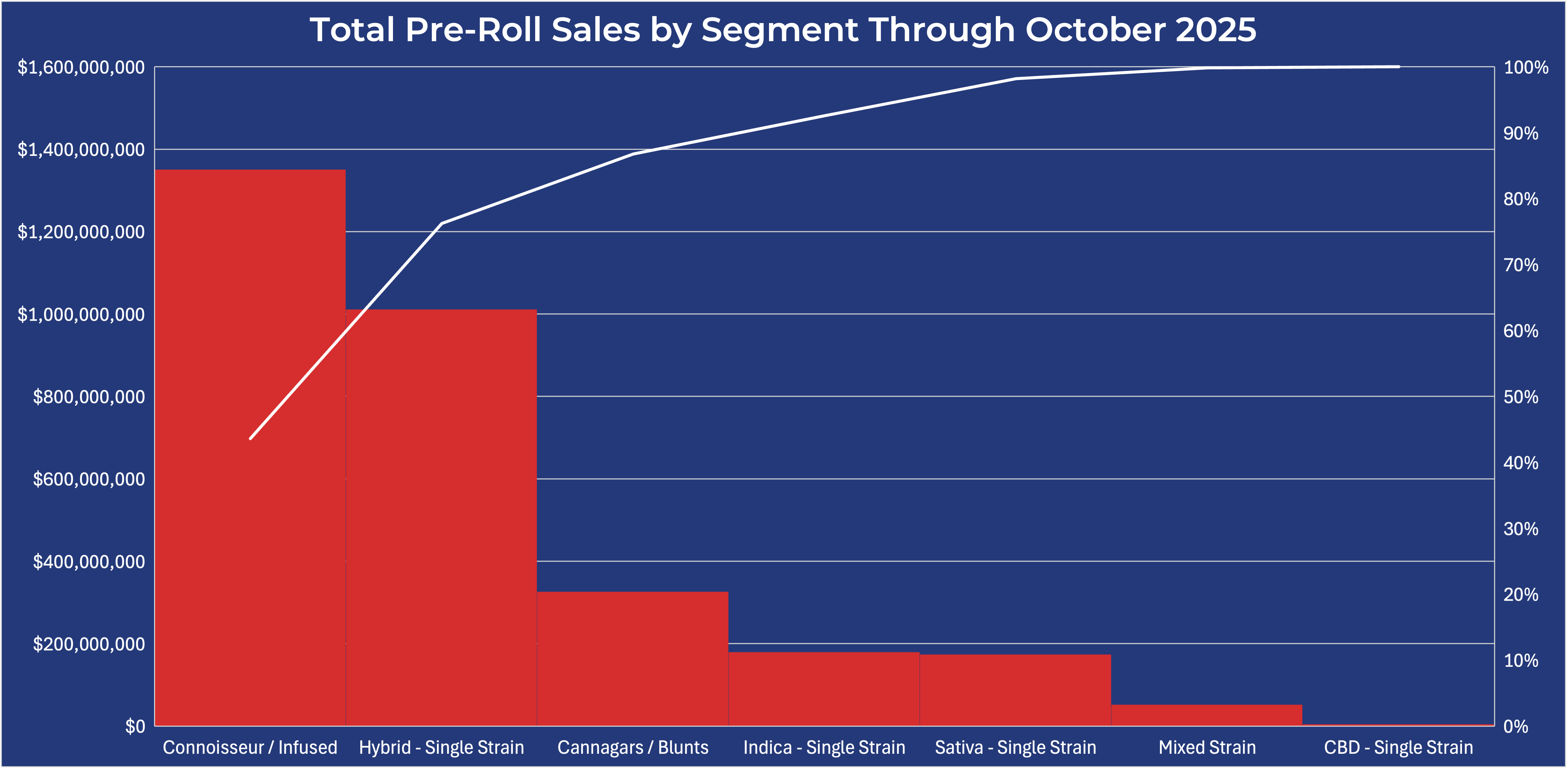

The top segment of the pre-roll category is the connoisseur/infused segment. These are pre-rolls that have a concentrate of some sort added to the flower and/or the pre-roll itself.

The blending of flower with a concentrate not only boosts the potency and flavor profile of the pre-roll – and customers consistently rank potency as the top thing they look for when making a purchase – they also drive up the price point, generating additional revenue for the store and the producer.

Infused pre-rolls account for more than $1.1 billion (with a B) of all pre-roll sales revenue so far in 2025, a full 48.5%. And that’s up 14% year-over-year. They also make up 38% of the units sold, up 28% year-over-year. So it goes without saying that if you do not have a wide selection of infused pre-rolls at your shop, you are leaving money on the table.

Single Strain Hybrid Pre-Rolls

While infused pre-rolls generate the most revenue – due in part to their higher price point – the segment that moves the most units is the Single Strain – Hybrid pre-roll. This segment has generated about $987.4 million in revenue, or about 36.3%.

But when we look at units sold, the single strain hybrid leads all others at 46% of all pre-roll sales, or nearly 142.8. million units. That’s up 14% year-over-year. So again, make sure your shelves contain multiple Single Strain – Hybrid options as they are the pre-roll product people reach for the most.

Single Strain Indica and Sativa Pre-Rolls

After the hybrids, the numbers drop off considerably, though both the Single Strain Indica and Single Strain Sativa segments still generated $179.1 million and $160.5 million, respectively. While only a nominal growth for the indica pre-rolls, sativa pre-roll revenue is up 8.6% year-over-year.

Switching to units sold, the indica pre-rolls have sold about 26 million units, up 11.3% year-over-year, while just over 18.8 million sativa pre-rolls have been sold, an 8.7% increase year-over-year.

So while the hybrids move more units, both single strain indica and sativa pre-rolls account for about 6% of the category’s sales, so keeping them in the mix is an important step toward dispensary success.

Mixed Strain and CBD Pre-Rolls

Mixed Strain pre-rolls, on the other hand, took a major hit this year with revenues falling 15.9% so far this year to $51.9 million. The drop in units sold is smaller, but the segment still lost 6.3% this year, moving only 4.2 million units.

Single Strain CBD pre-rolls make up the smallest part of the pre-roll category – to be expected when looking exclusively at recreational markets - this year accounting for just 0.16% of the revenue total, or about $4.6 million, moving just 450,000 units (0.1%), though that is a 14.4% increase over 2024.

While both of these segments are small, they have a dedicated customer base, particularly the CBD segment, and both should still be kept as part of pre-roll sales, though it’s important to note that they do move in much smaller quantities, so be sure to watch your POS data so as not to over-order from your suppliers.

Pre-Rolled Blunts

The final pre-rolled category is the Cannagar and Blunt segment and I saved this for last because the numbers here simply do not tell the whole story. According to Headset’s numbers, pre-rolled blunts only account for 0.47% of pre-roll revenue and 0.3% of units sold.

That doesn’t seem like a lot. But according to surveys, the blunt is still the third-favorite way for people to consumer cannabis. When we looked deeper into the data, we found that Headset puts infused blunts in its Connoisseur/Infused segment, boosting that segment at the expense of blunts.

So while the segment only seemed to generate $13 million in revenue, a data pull of the Top 200 Products that feature the word “blunt” in their name pulled in $67,047,817 in totals sales on 3,494,703 units sold.

The total on just those 200 products would place blunts ahead of Mixed Strain pre-rolls, though, again, it’s hard to get a clear read on the segment. However, we see a tremendous opportunity here as pre-rolled blunts remain a popular form for smokers and the segment appears poised for a massive breakout. We absolutely recommend keeping in stock a selection of pre-rolled blunts, particularly infused pre-rolled blunts.

Pre-Roll Package Sizes

One more note for dispensary owners: When it comes to pre-rolls, shoppers love multi-packs, particularly multi-packs of half-gram, or 84mm pre-rolls.

The top-selling package size, by far, is 1-gram, moving nearly 210 million units for a total of $1.15 billion. While the data does not break it down into a single full-gram pre-roll vs 2 half-grams, the vast majority of the top-selling products are multi-packs of half-gram pre-rolls.

With this in mind, it’s important to keep in stock an array of sizes and packaging options, including single-gram pre-rolls, half-gram multipacks and the increasingly popular multi-packs of 70mm, 0.3-gram “dogwalker” size pre-rolls.

Multi-packs also tend to carry higher margins.

Shoppers looking to try something new will gravitate toward smaller sizes that offer opportunities to branch out, while returning customers lean toward picking up larger quantities of their favorites to cut down on trips to the store.

Filter Tips Matter

Beyond the strains and size options, it’s important to maintain a selection of pre-rolls with premium filter tips, such as wood, glass and ceramic. These products have been proving increasingly popular to consumers, elevating the humble pre-rolled joint into a more premium experience by cooling the smoke and stopping particles and resin better than their traditional paper counterparts.

Selling Pre-Rolls

There are a few basic tips when it comes to merchandizing your pre-roll supplies. The first is to keep them near the register as they make a great upsell and attachment item to any basket. Make sure your price points are well labeled so customers can quickly make decisions, but keep them visible for impulse buys, like candy bars and soda at grocery stores.

We also recommend training budtenders on the differences between the segments and product offerings of various vendors so they can quickly make a recommendation to shoppers based on what they are buying.

And finally, always track the data from your POS software to make sure your sales mix is the right one.

Final Thoughts on Pre-Roll Sales

As the fastest-growing category in the industry, pre-rolls have evolved into an important part of any retail strategy; they’re convenient, priced to move, and are a prime testing ground for new formats and brands.

A thoughtful, tiered pre-roll assortment balanced across singles, multi-packs, infused/premium options, and a value line can help dispensaries raise revenues, increase basket size and build loyalty. Back those assortment decisions with your POS data and market analytics, and you’ll convert category momentum into dependable retail growth.

With more than 310.7 million pre-rolls sold in the first 10 months of 2025 generating nearly $2.8B, we highlight major pre-roll trends for 2025.