Top Pre-Roll Brands of 2025 by State and Province

Posted by Custom Cones USA on Jul 5th 2025

Top Pre-Roll Brands of 2025 by State and Province

North America, the United States and Canada to be specific, is a massive $4.4+ billion dollar pre-roll market moving than 388 million units in 2024.

With pre-rolls controlling 15.6% of the U.S. total cannabis market and a whopping 32.8% in Canada, the category ranks 3rd and 2nd respectively among all cannabis products throughout the two countries.

In partnership with Seattle-based cannabis analytics firm Headset, whose data is sourced from actual consumer transactions across over 3,500 retailers in 12 U.S. state markets and 4 Canadian provinces, we identified North America's pre-roll titans, the leaders in total pre-roll sales last year.

So without further ado, we present to you the Top Pre-Roll Brands of 2025 by State and Province.

North America's Top Pre-Roll Earners

Alberta

-

- Total Pre-Roll Sales $36,920,033

- Pre-Roll Units Sold 1,249,686

-

-

TOTAL PRODUCTS

(2025)34 -

AVG ITEM PRICE

(2025)$29.58 -

AVG UNIT COST

(2025)$20.66 -

PROFIT

MARGIN30% -

BRAND MARKET SHARE

(2025)11.60%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Tiger Blood Distillate Infused Pre-Roll 3-Pack (1.5g) | $6,516,821 | 247,722 | $26.31 | 18% |

| #2Razzilicious Infused Pre-Roll 5-Pack (2.5g) | $3,835,735 | 102,582 | $37.39 | 10% |

| #35 Loco Distillate Infused Pre-Roll 5-Pack (2.5g) | $2,424,193 | 63,280 | $38.31 | 7% |

Arizona

-

- #1

-

Jeeter

-

- Total Pre-Roll Sales $44,998,297

- Pre-Roll Units Sold 1,696,630

-

-

TOTAL PRODUCTS

(2024) 316 -

AVG ITEM PRICE

(2024) $26.52 -

AVG UNIT COST

(2024) $17.95 -

PROFIT

MARGIN 32% -

BRAND MARKET SHARE

(2024) 22.70%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Baby Jeeter - Grandaddy Purple Quad Infused Pre-Roll 5-Pack (2.5g) | $1,174,419 | 37,873 | $31.01 | 3% |

| #2Baby Jeeter - Blueberry Kush Infused Pre-Roll 5-Pack (2.5g) | $1,097,133 | 33,762 | $32.50 | 2% |

| #3Baby Jeeter - Maui Wowie Quad Infused Pre-Roll 5-Pack (2.5g) | $1,061,778 | 32,298 | $32.87 | 2% |

British Columbia

-

- Total Pre-Roll Sales $35,160,551

- Pre-Roll Units Sold 1,400,067

-

-

TOTAL PRODUCTS

(2025)32 -

AVG ITEM PRICE

(2025)$25.11 -

AVG UNIT COST

(2025)$16.70 -

PROFIT

MARGIN34% -

BRAND MARKET SHARE

(2025)12.10%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Tiger Blood Distillate Infused Pre-Roll 3-Pack (1.5g) | $5,295,200 | 215,414 | $24.58 | 15% |

| #2Peach Ringz Kief Distillate Infused Pre-Roll 3-Pack (1.5g) | $3,621,145 | 147,355 | $24.57 | 10% |

| #3Tiger Blood Distillate Infused Pre-Roll (1g) | $2,903,012 | 170,940 | $16.98 | 8% |

California

-

- #1

-

Jeeter

-

- Total Pre-Roll Sales $98,965,289

- Pre-Roll Units Sold 4,111,059

-

-

TOTAL PRODUCTS

(2025) 494 -

AVG ITEM PRICE

(2025) $24.07 -

AVG UNIT COST

(2025) $13.58 -

PROFIT

MARGIN 44% -

BRAND MARKET SHARE

(2025) 13.90%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Baby Jeeter - Watermelon Zkittlez Diamond Infused Pre-Roll 5-Pack (2.5g) | $2,891,918 | 110,182 | $26.25 | 3% |

| #2Baby Jeeter - Bubba Gum Diamond Infused Pre-Roll 5-Pack (2.5g) | $2,842,309 | 107,595 | $26.42 | 3% |

| #3Baby Jeeter - Blueberry Kush Infused Pre-Roll 5-Pack (2.5g) | $2,807,270 | 105,795 | $26.53 | 3% |

Colorado

-

- #1

-

Kaviar

-

- Total Pre-Roll Sales $7,778,330

- Pre-Roll Units Sold 405,391

-

-

TOTAL PRODUCTS

(2025)144 -

AVG ITEM PRICE

(2025)$19.19 -

AVG UNIT COST

(2025)$10.32 -

PROFIT

MARGIN46% -

BRAND MARKET SHARE

(2025)6.20%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Kaviar x Happy Eddie - Zen Wen Infused Pre-Roll (1.5g) | $2,205,480 | 115,944 | $19.02 | 29% |

| #2Indica Blend Infused Pre-Roll (1.5g) | $2,701,386 | 91,459 | $18.60 | 22% |

| #3Kaviar x Happy Eddie - The CEO Hybrid Infused Pre-Roll (1.5g) | $1,578,285 | 86,074 | $18.34 | 20% |

Illinois

-

- #1

-

Dogwalkers

-

- Total Pre-Roll Sales $40,981,472

- Pre-Roll Units Sold 1,600,546

-

-

TOTAL PRODUCTS

(2025)237 -

AVG ITEM PRICE

(2025)$25.60 -

AVG UNIT COST

(2025)$14.73 -

PROFIT

MARGIN43% -

BRAND MARKET SHARE

(2025)18.70%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Mini Dog - Animal Face Pre-Roll 5-Pack (1.75g) | $2,036,298 | 88,388 | $23.04 | 5% |

| #2Mini Dog - Head Cracker Pre-Roll 5-Pack (1.75g) | $1,460,882 | 57,667 | $25.33 | 4% |

| #3Mini Dog - Brownie Scout Pre-Roll 5-Pack (1.75g) | $1,112,820 | 49,137 | $22.65 | 3% |

Maryland

-

- #1

-

Dogwalkers

-

- Total Pre-Roll Sales $18,980,292

- Pre-Roll Units Sold 963,030

-

-

TOTAL PRODUCTS

(2025)152 -

AVG ITEM PRICE

(2025)$19.71 -

AVG UNIT COST

(2025)$12.09 -

PROFIT

MARGIN39% -

BRAND MARKET SHARE

(2025)15.50%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Mini Dog - Animal Face Pre-Roll 5-Pack (1.75g) | $2,466,340 | 101,319 | $24.34 | 12% |

| #2Mini Dog - Afternoon Delight #4 Pre-Roll 5-Pack (1.75g) | $2,299,077 | 94,007 | $24.46 | 12% |

| #3Mini Dog - Brownie Scout Pre-Roll 5-Pack (1.75g) | $1,526,249 | 62,420 | $24.45 | 8% |

Massachusetts

-

- #1

-

Happy Valley

-

- Total Pre-Roll Sales $20,540,750

- Pre-Roll Units Sold 2,033,393

-

-

TOTAL PRODUCTS

(2025)155 -

AVG ITEM PRICE

(2025)$10.08 -

AVG UNIT COST

(2025)$8.75 -

PROFIT

MARGIN11% -

BRAND MARKET SHARE

(2025)6.40%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Super Lemon Haze Pre-Roll (1g) | $909,126 | 88,003 | $10.33 | 12% |

| #2Super Lemon Haze Pre-Roll 7-Pack (3.5g) | $558,760 | 14,579 | $38.33 | 7% |

| #3Banana Jealousy Pre-Roll 7-Pack (3.5g) | $488,388 | 12,661 | $38.57 | 6% |

Build Your Pre-Roll Line with Custom Cones USA

Michigan

-

- #1

-

Jeeter

-

- Total Pre-Roll Sales $90,836,096

- Pre-Roll Units Sold 3,798,224

-

-

TOTAL PRODUCTS

(2025)431 -

AVG ITEM PRICE

(2025)$23.92 -

AVG UNIT COST

(2025)$18.67 -

PROFIT

MARGIN22.00% -

BRAND MARKET SHARE

(2025)15.20%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Baby Jeeter - Blueberry Kush Infused Pre-Roll 5-Pack (2.5g) | $2,569,988 | 88,028 | $29.20 | 3% |

| #2Baby Jeeter - Acapulco Gold Diamond Infused Pre-Roll 5-Pack (2.5g) | $2,423,044 | 82,060 | $29.53 | 3% |

| #3Baby Jeeter - Blue Zkittles Quad Infused Pre-Roll 5-Pack (2.5g) | $2,029,651 | 68,308 | $29.71 | 2% |

Missouri

-

- Total Pre-Roll Sales $25,357,072

- Pre-Roll Units Sold 1,295,114

-

-

TOTAL PRODUCTS

(2025)530 -

AVG ITEM PRICE

(2025)$19.58 -

AVG UNIT COST

(2025)$10.53 -

PROFIT

MARGIN46% -

BRAND MARKET SHARE

(2025)16.10%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Super J's - Grapefruit x Cookies Infused Pre-Roll 5-Pack (2.5g) | $547,114 | 15,512 | $35.27 | 2% |

| #2Super J's - Black Jack x Blueberry Infused Pre-Roll 5-Pack (2.5g) | $467,618 | 13,341 | $35.05 | 2% |

| #3Super J's - Grape x Gas Truffle Infused Pre-Roll (1g) | $444,641 | 31,802 | $13.98 | 2% |

Nevada

-

- #1

-

STIIIZY

-

- Total Pre-Roll Sales $13,820,756

- Pre-Roll Units Sold 711,278

-

-

TOTAL PRODUCTS

(2025)93 -

AVG ITEM PRICE

(2025)$19.43 -

AVG UNIT COST

(2025)$9.69 -

PROFIT

MARGIN50% -

BRAND MARKET SHARE

(2025)13.50%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #140's - Blue Dream Infused Pre-Roll 4-Pack (2g) | $1,026,800 | 35,989 | $28.53 | 7% |

| #240s- Strawberry Cough Infused Pre-Roll 4-Pack (2g) | $847,462 | 30,968 | $27.37 | 6% |

| #340's - Blue Burst Infused Pre-Roll 4-Pack (2g) | $767,103 | 27,439 | $27.96 | 6% |

New York

-

- #1

-

Ruby Farms

-

- Total Pre-Roll Sales $21,161,171

- Pre-Roll Units Sold 560,429

-

-

TOTAL PRODUCTS

(2025)49 -

AVG ITEM PRICE

(2025)$37.77 -

AVG UNIT COST

(2025)$18.80 -

PROFIT

MARGIN50% -

BRAND MARKET SHARE

(2025)12.10%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Doobies - White Widow Pre-Roll 7-Pack (3.5g) | $2,712,678 | 70,531 | $38.46 | 14% |

| #2Doobies - Granddaddy Purple Pre-Roll 7-Pack (3.5g) | $2,288,804 | 59,281 | $38.61 | 11% |

| #3Doobies - Black Cherry Gelato Pre-Roll 7-Pack (3.5g) | $1,807,028 | 47,231 | $38.26 | 9% |

Ontario

-

- Total Pre-Roll Sales $65,471,949

- Pre-Roll Units Sold 2,613,635

-

-

TOTAL PRODUCTS

(2025)38 -

AVG ITEM PRICE

(2025)$25.05 -

AVG UNIT COST

(2025)$17.60 -

PROFIT

MARGIN30% -

BRAND MARKET SHARE

(2025)10.40%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Tiger Blood Distillate Infused Pre-Roll 3-Pack (1.5g) | $12,295,576 | 542,380 | $22.67 | 19% |

| #2Peach Ringz Kief Distillate Infused Pre-Roll 3-Pack (1.5g) | $6,425,693 | 281,610 | $22.82 | 10% |

| #3Razzilicious Infused Pre-Roll 5-Pack (2.5g) | $5,273,784 | 160,773 | $32.80 | 8% |

Oregon

-

- Total Pre-Roll Sales $9,479,111

- Pre-Roll Units Sold 625,112

-

-

TOTAL PRODUCTS

(2025)634 -

AVG ITEM PRICE

(2025)$15.16 -

AVG UNIT COST

(2025)$8.19 -

PROFIT

MARGIN46% -

BRAND MARKET SHARE

(2025)7.00%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Sweets- Guava Gorilla Moonrock Infused Blunt (2g) | $222,597 | 14,597 | $15.25 | 2% |

| #2Sweets - Mango Dream Moonrock Infused Blunt (2g) | $163,412 | 11,396 | $14.34 | 2% |

| #3Sweets- Watermelon Cough Moonrock Infused Blunt (2g) | $158,907 | 10,308 | $15.42 | 2% |

Saskatchewan

-

- Total Pre-Roll Sales $3,263,391

- Pre-Roll Units Sold 132,678

-

-

TOTAL PRODUCTS

(2025)29 -

AVG ITEM PRICE

(2025)$24.60 -

AVG UNIT COST

(2025)$16.42 -

PROFIT

MARGIN33% -

BRAND MARKET SHARE

(2025)6.60%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1Tiger Blood Distillate Infused Pre-Roll 3-Pack (1.5g) | $672,651 | 26,506 | $25.38 | 21% |

| #2Peach Ringz Kief Distillate Infused Pre-Roll 3-Pack (1.5g) | $434,516 | 17,321 | $25.09 | 13% |

| #35 Loco Distillate Infused Pre-Roll 5-Pack (2.5g) | $280,245 | 8,264 | $33.91 | 9% |

Washington

-

- #1

-

Phat Panda

-

- Total Pre-Roll Sales $17,355,221

- Pre-Roll Units Sold 4,590,144

-

-

TOTAL PRODUCTS

(2025)935 -

AVG ITEM PRICE

(2025)$3.78 -

AVG UNIT COST

(2025)$1.97 -

PROFIT

MARGIN48% -

BRAND MARKET SHARE

(2025)8.40%

-

TOP-SELLING PRODUCTS |

TOTAL SALES (2024) |

TOTAL UNITS SOLD (2024) |

AVG ITEM PRICE (2024) |

% OF BRAND SALES |

|---|---|---|---|---|

| #1OG Chem Pre-Roll (1g) | $1,094,699 | 368,800 | $2.97 | 6% |

| #2Bangers - Golden Pineapple Pre-Roll 2-Pack (1g) | $863,683 | 279,155 | $3.09 | 5% |

| #3Platinum Line - Trophy Wife Pre-Roll 28-Pack (28g) | $390,952 | 100,815 | $3.88 | 2% |

The Booming Pre-Roll Market

Whether you're looking to enter the pre-roll market or an established cannabis brand ready to scale your operations and pre-roll offerings, understanding the production pipeline from whole-flower buds to packaged final products is paramount for maximizing sales revenue. The pre-roll industry has evolved from simple hand-rolled joints or hand-packed cones to sophisticated, automated pre-roll production operations that lean heavily on accuracy, consistency, and quality at every step of the process.

Introducing Pre-Rolls to Your Product Line

For emerging cannabis brands, pre-rolls represent an ideal entry point into the market, as well as an opportunity for cultivators to expand their product lines as they:- Require a lower initial investment compared to concentrates or edibles

- Offer higher margins than raw flower products

- Have emerged as the fastest-growing product category in cannabis with an impressive 12% year-over-year growth, now controlling a record 15.4% market share with monthly sales exceeding $257 million, solidifying their position as the third largest product category in the U.S. market.

Understanding Cannabis Consumers

Consumer research from a survey of 900 pre-roll consumers reveals compelling opportunities for incorporating pre-rolls across all demographics, with 82% of cannabis smokers purchasing pre-rolls and 94.2% preferring joints as their consumption method, the market potential is massive.

- Millennials lead purchases at 44.6%,

- followed by Gen X (24.3%),

- Gen Z (18.5%),

- and Boomers (12.5%).

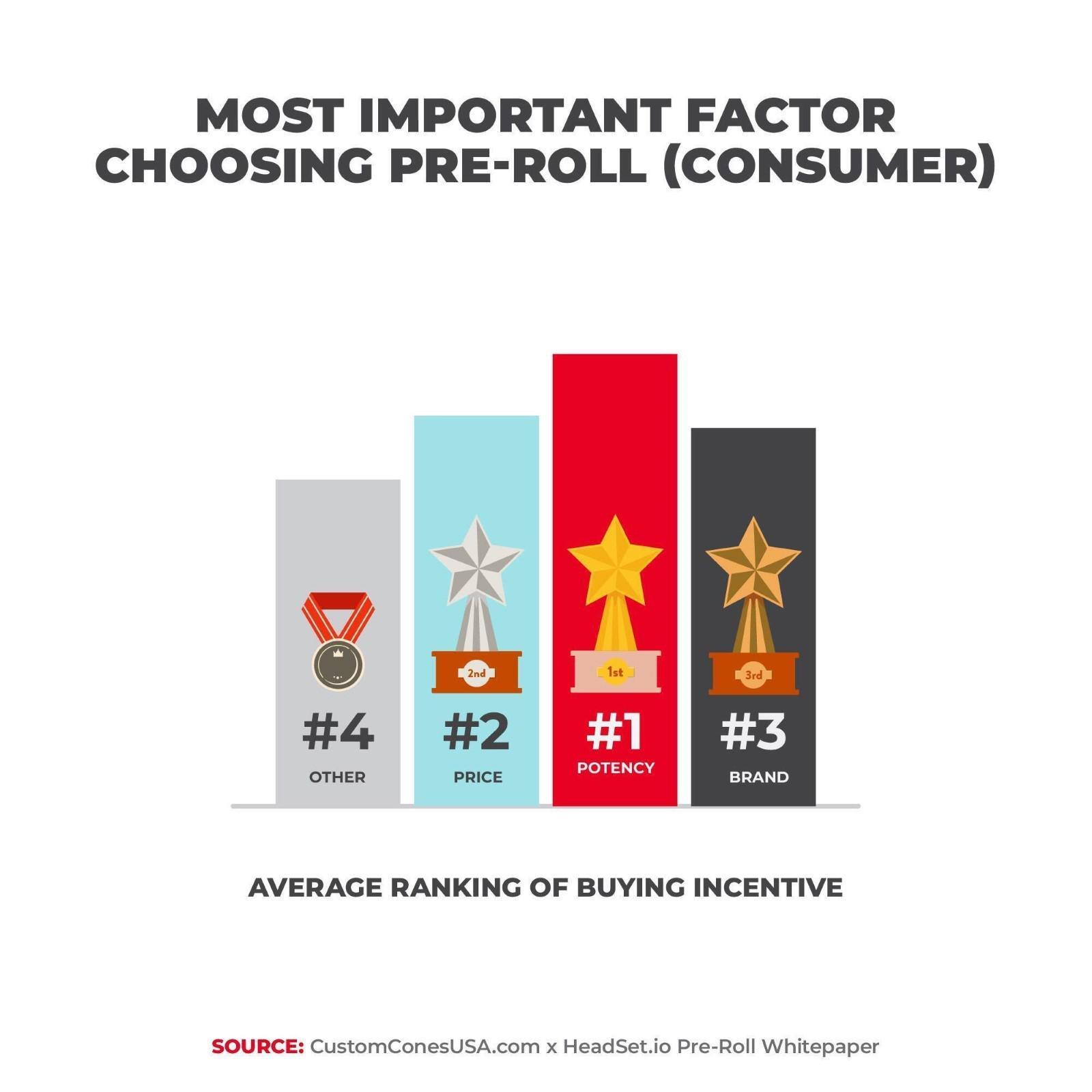

When consumers think of pre-rolls, convenience ranks as their top consideration (45% of respondents), while potency drives purchase decisions (70% rank it first) followed by price point.

Scaling Your Operations

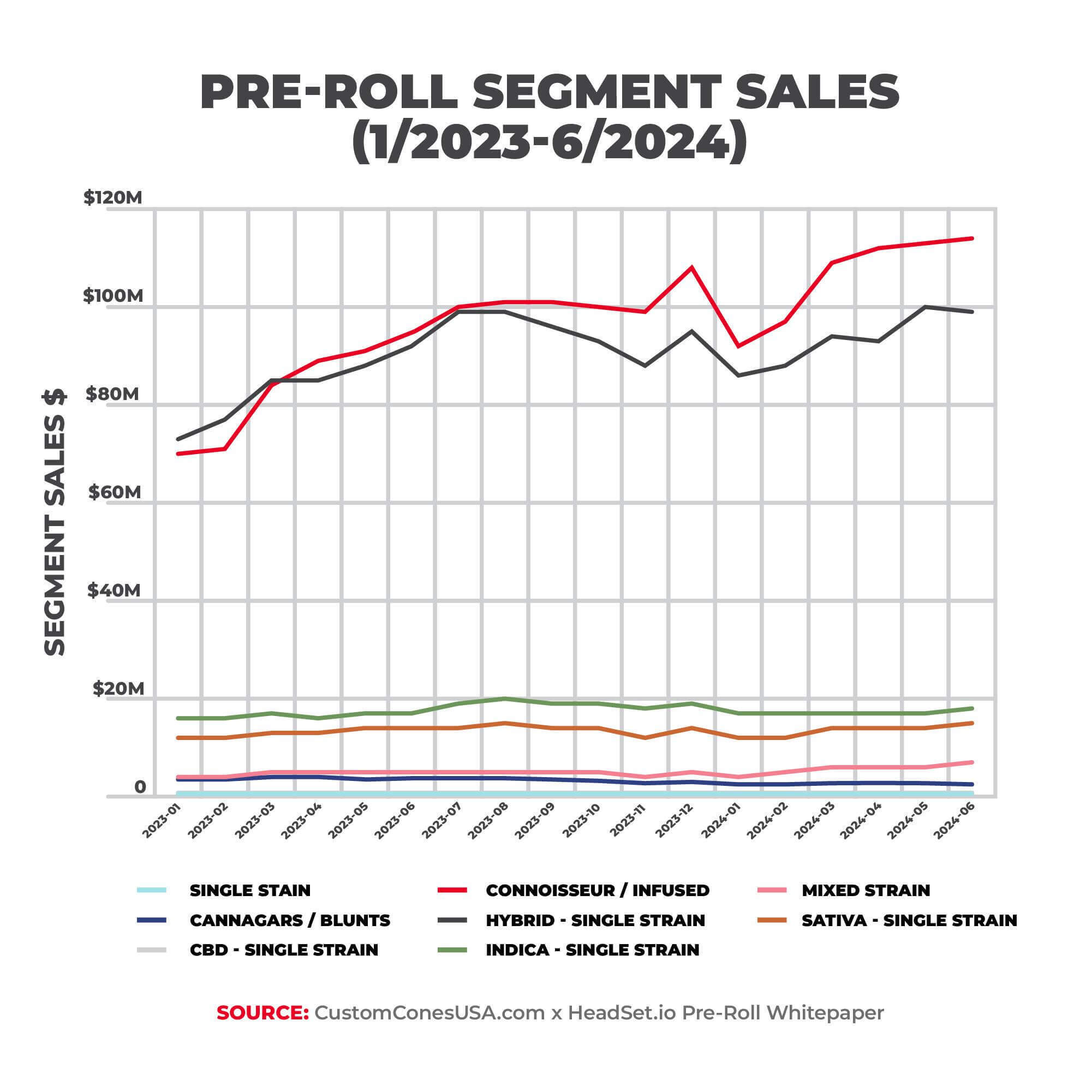

As demand and competition rise, successful brands quickly realize that hand-rolling and packing aren’t sustainable, this is where strategic investment in automated pre-roll machinery becomes critical. Smart operators also recognize the premium opportunity of infused pre-rolls, which have become the dominant segment within the pre-roll category, accounting for 44.4% of the market, commanding average prices of $10.25 compared to the overall category average of $6.50. Multi-packs now represent 49.6% of all pre-roll sales, with the 2.5-gram 5-pack variation leading at 16.2% of total sales.

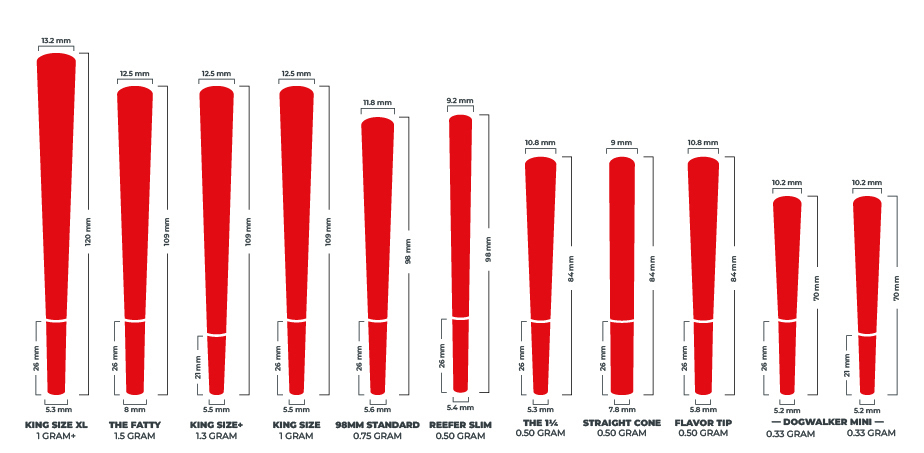

Size selection drives consumer preference, with full-gram pre-rolls dominating at 57% of consumer purchases. Successful scaling requires strategic machine selection, with tabletop units like the King Kone and Fill N' Fold ideal for emerging brands, with the progression to full-scale automated systems for pre-roll production exceeding 50,000 completed pre-rolls monthly.

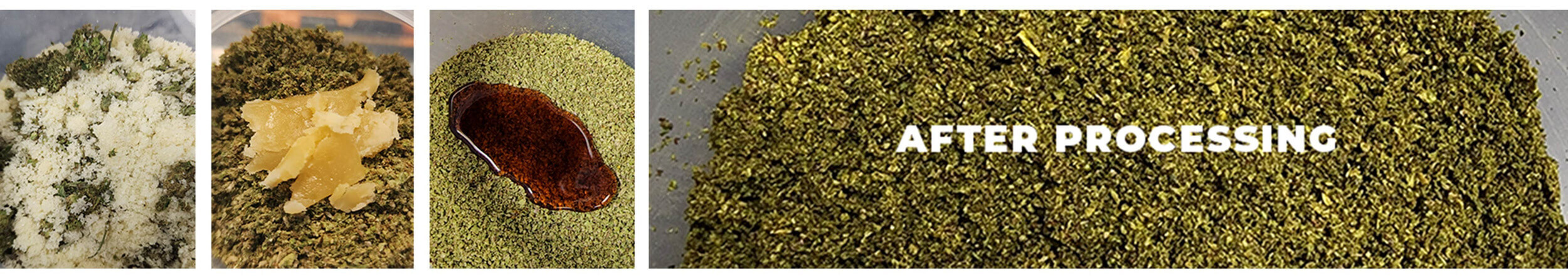

It All Starts with Grinding and Sifting

Quality pre-rolls start with consistent particle size, and the science proves why sifting is a non-negotiable when it comes to maximizing outputs. Industrial grinders with low RPM and high torque preserve terpenes while creating uniform material and remove stems and oversized particles that tear papers or create uneven burns. In a survey of over 300 companies representing every corner of the pre-roll industry, only 59% of pre-roll businesses sift their flower, though an additional 17.2% plan to implement sifting, representing a significant opportunity for competitive advantage.

Smart grinder selection scales with volume, like the industrial grinders for mid-volume operations and high-capacity systems processing hundreds of pounds per hour for large-scale producers. Modern filling machines require precise specifications, making proper grinding and sifting essential for preventing equipment jams and ensuring consistent weights.

We conducted an experiment to compare pre-roll output from sifted and non-sifted flower. Using sifted ground flower versus un-sifted flower in a run of 169 pre-rolls resulted in 27 more pre-rolls ready to package, along with 65% lower weight variance, 488% fewer holes, and 194% better packs. When you’re thinking about scaling up, the value of a sifter speaks for itself.

Automation Using Pre-Roll Filling Machines

The engine behind any serious pre-roll operation is cone and tube filling machinery. From tabletop units handling hundreds of pre-rolls per hour to fully automated systems processing thousands, the right equipment scales with your organization’s goals. With 39.2% of businesses using automated pre-roll machines and another 17.6% planning to implement them, automation is becoming the industry standard for serious producers.

Modern machines accommodate the complete spectrum of pre-roll construction, from standard cones and tubes to hemp wrap blunts and premium filter options. The most frustrating production bottleneck remains closing pre-rolls by twisting and folding (cited by 24.4% of businesses), followed by filling (22%), packaging (20.3%), grinding (12.2%), sifting (11.4%), and weighing (8.1%), challenges that proper equipment directly addresses.

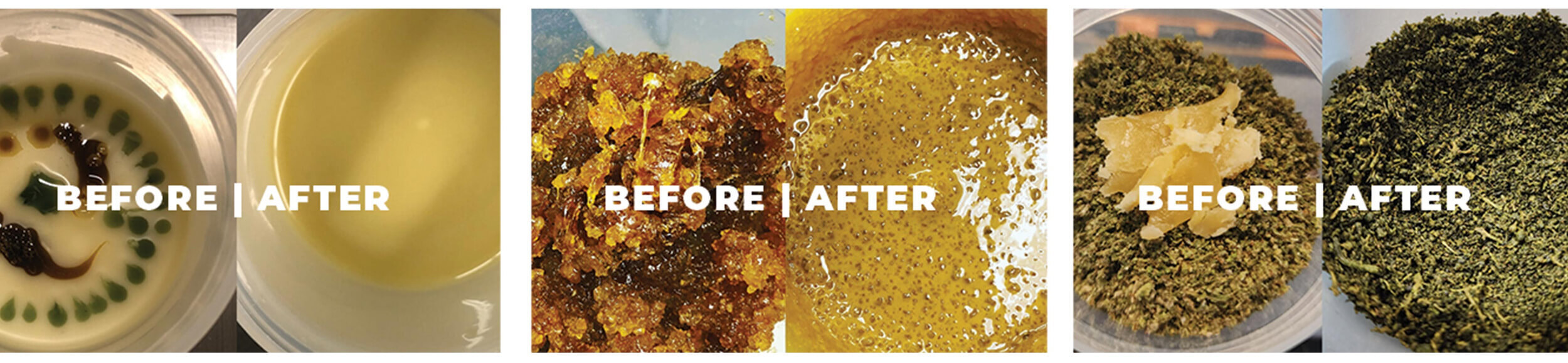

Incorporating Infused Pre-Rolls to Meet Consumer Demand

The fastest-growing segment in cannabis, Infused pre-rolls, now account for over $1.75 billion in sales, representing 44.4% of all pre-roll revenue. Consumer adoption is astounding, with 70% of pre-roll smokers purchasing infused products, with kief leading concentrate preferences at 78.3%, followed by live resin (77.3%) and rosin (58.8%). Over 53.3% of pre-roll brands currently produce infused products, with 43.4% planning to incorporate them into their product lines.

Internal infusion delivers a superior smoking experience by incorporating concentrates whole or by mixing concentrates directly with flower. The most popular method of infusion involves painting with oil and rolling in kief externally, used by 90% of infused producers, while 45% mix flower and oil directly and 35% use the popular “hash hole” style infused pre-rolls.

Flower infusion equipment handles any concentrate that can be liquefied including distillate, live resin, rosin, shatter, hash and more. However, 60% of businesses still infuse by hand, leaving significant room for efficiency improvements through automation. Automated infusion technology transforms time-intensive manual processes into scalable production, essential for capturing the premium pricing that infused products command.

The Final Touch: Professional, Customizable Packaging

A brand's packaging communicates quality and ethos while also complying with state regulations and requirements. Pop-top tubes dominate the market, used by the majority of producers, while multi-pack formats continue their rapid growth. Consumer data shows 43% buy both single-use and multi-pack pre-rolls, with 31.1% preferring multi-packs over singles (25.9%).

Premium positioning requires attention to details, from child-resistant and custom-branded options to specialized blunt packaging that maintains product integrity. Filter selection enhances a brand identity and the overall smoking experience with consumer research revealing a strong adoption of premium filter tips

- 59% of smokers have purchased pre-rolls with premium filter tips

- Glass-tipped pre-rolls lead consumer preference at 79.7%

- 47.6% are willing to pay up to $2 more for the premium filter experience

- 21.4% purchase premium filter tip pre-rolls weekly

Paper type matters greatly to consumers as well, 55.5% rate it as "very important," with organic hemp paper leading at a 72.5%, followed by refined white (69.4%), hemp wraps (64.2%) and natural brown (61.6%).

We've identified North American pre-roll titans, the state and province leaders in total pre-roll sales last year.