Key Pre-Roll Findings: The New York OCM Market Report

Posted by Custom Cones USA on Jun 9th 2025

Though still in its early stages, the New York cannabis market projects to soon be one of the largest in the country, with pre-rolls once again helping push the market forward.

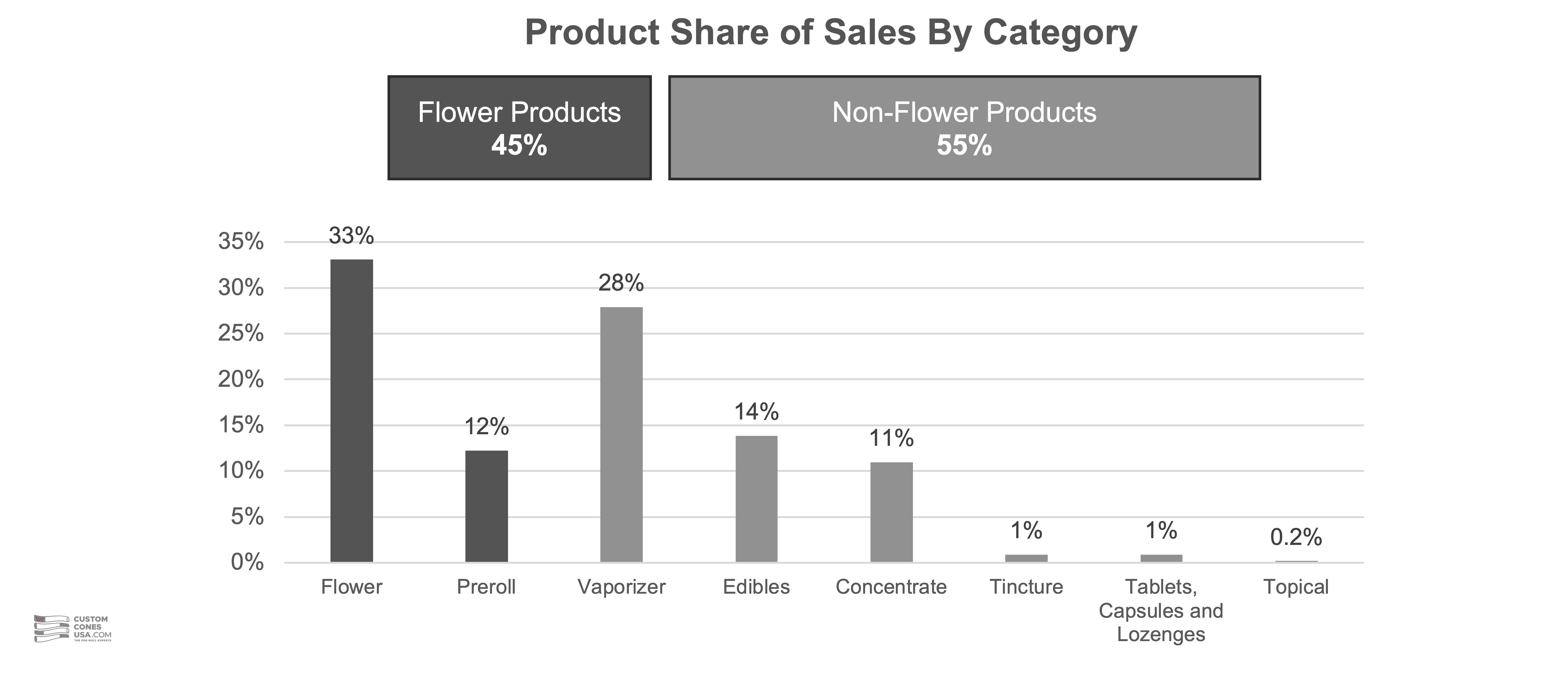

Accounting for 12% of revenue, pre-rolls are the fastest growing category in New York, according to a new report from the State of New York’s Office of Cannabis Managment, and once again are providing the innovation and options that customers have come to expect.

However, compared to other states, there is still plenty of room for New York’s pre-roll market to grow, and despite hundreds of different brands in the space, there is still opportunity for producers to rise above and dominate the space.

The New York Cannabis Market Today

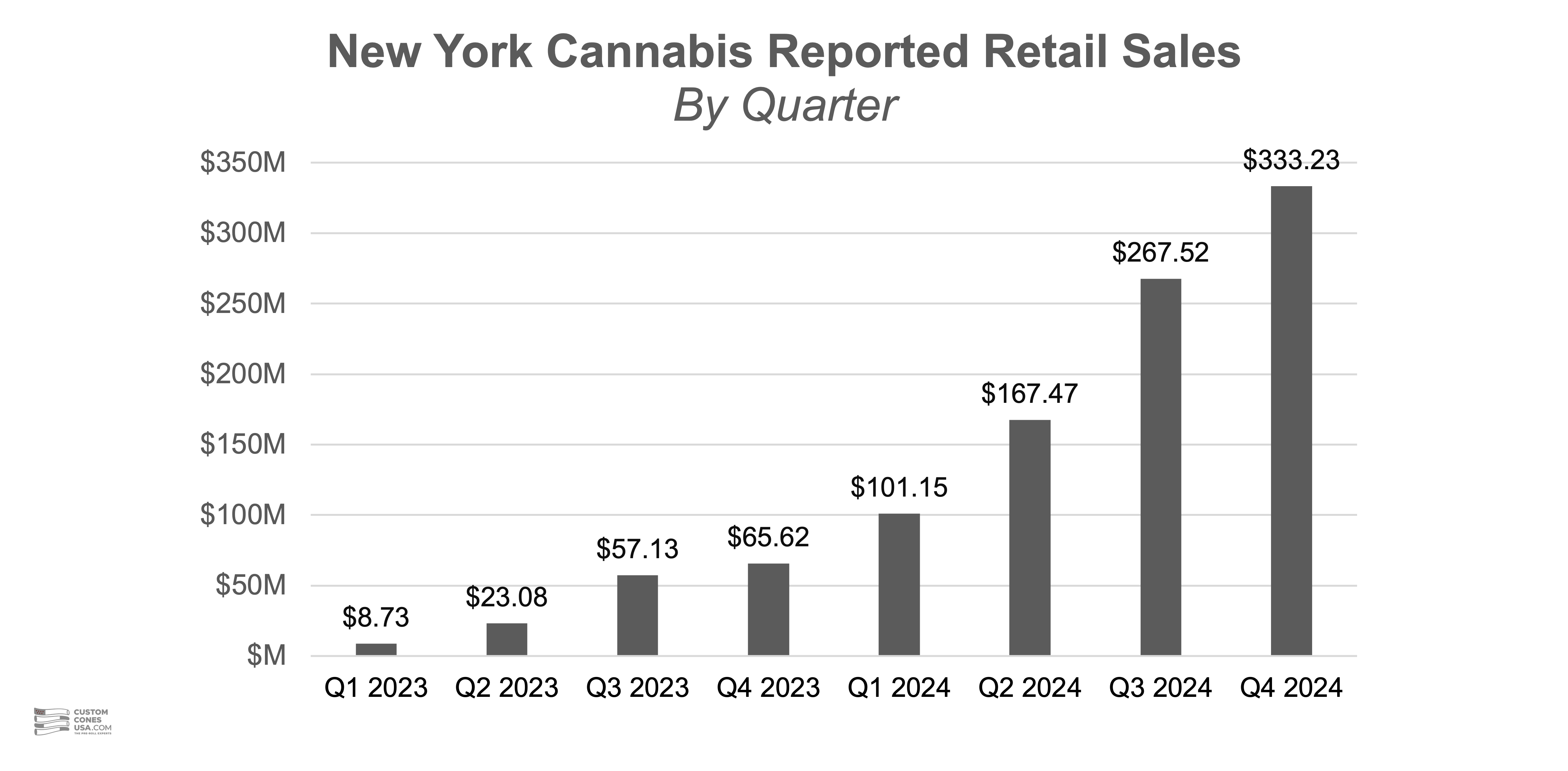

According to the New York OCM report, 2024 saw massive increases in cannabis sales each quarter, as more and more licensees opened cultivation operations and retail stores. The Empire State saw cannabis revenues grow from $101.15 million in the first quarter of 2024 to an incredible and record-shattering $333.23 million in Q4.

In total, New York cannabis revenues topped $869 million in 2024, according to the report.

And there is still room for growth as the market is still in the early stages, with dozens of licenses still waiting to go active. For example, according to the report, there were 260 dispensaries reporting sales to the state through 2024. By April 20, 2025, that number had grown to 363 with more set to be issued as the market matures.

When fully operational, New York projects to be among the top markets in the country, potentially even No. 1, thanks to its massive population, reputation as a tourist destination and because it will draw from nearby states that do not have adult use programs, like Pennsylvania, with which it shares a nearly 226-mile border.

The New York Pre-Roll Market

Diving deeper into both the report and point-of-sales data collected and analyzed by Headset.io shows the pre-roll market to be an integral and growing part of the larger New York cannabis market.

It is important to note here that while Headset data was used in crafting the report, not all of the numbers pulled from the company’s database match with those found in the OCM report, though they are similar.

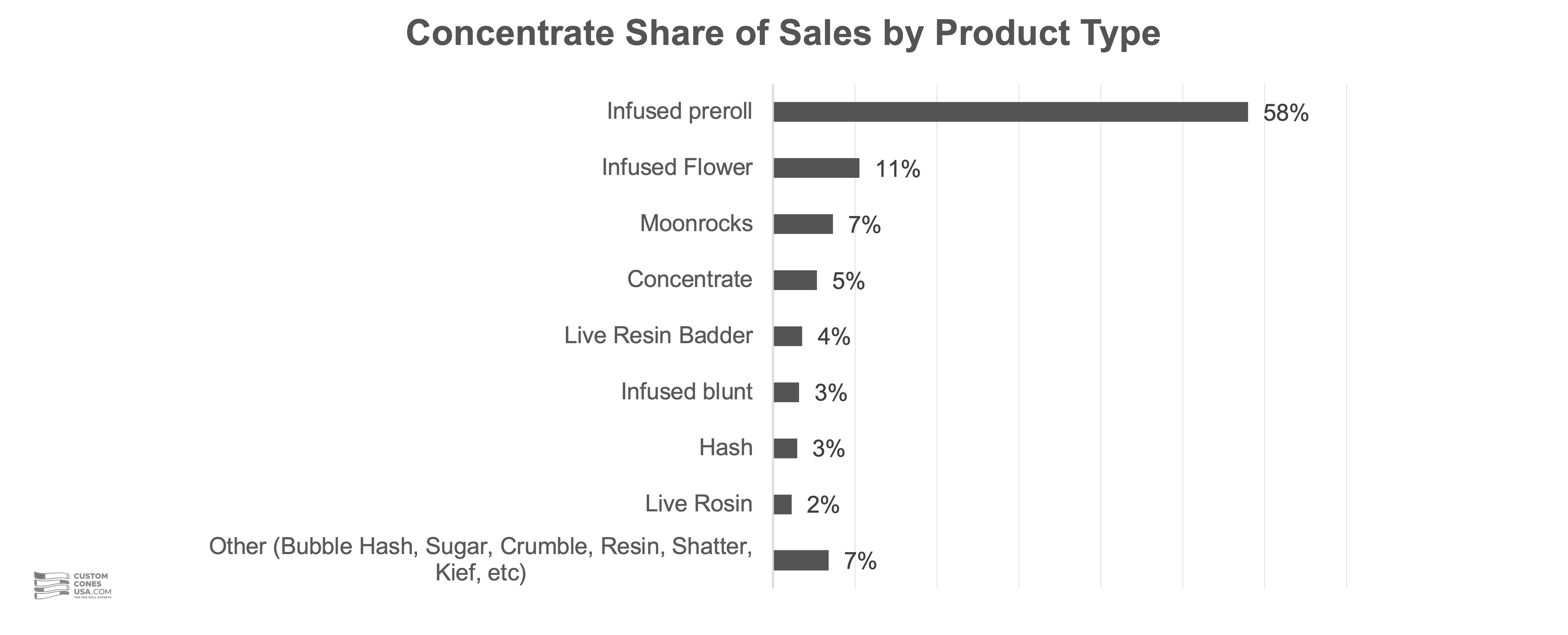

For example, according to the OCM report, pre-rolls account for 12% of all cannabis sales in New York State in 2024. However, that number does not appear to include infused pre-rolls, which combine flower with a concentrate for increased potency, flavor and, notably, price point. Infused pre-rolls are the top-selling segment of the pre-roll category. The OCM, however, places these top-selling items in the “concentrates” category, where they account for a full 58% of concentrate sales.

Headset, on the other hand, considers infused pre-rolls as part of the pre-roll category. According to its numbers, pre-rolls accounted for 19% of all cannabis sales in 2024. We believe this discrepancy shows the impact of the infused/connoisseur segment, which according to Headset generated $65 million in revenue last year.

According to Headset’s numbers, pre-rolls account for 18% of revenue, third behind flower and vape pens, and 30% of unit sales, where it is the top category.

New York Pre-Roll Packaging Trends

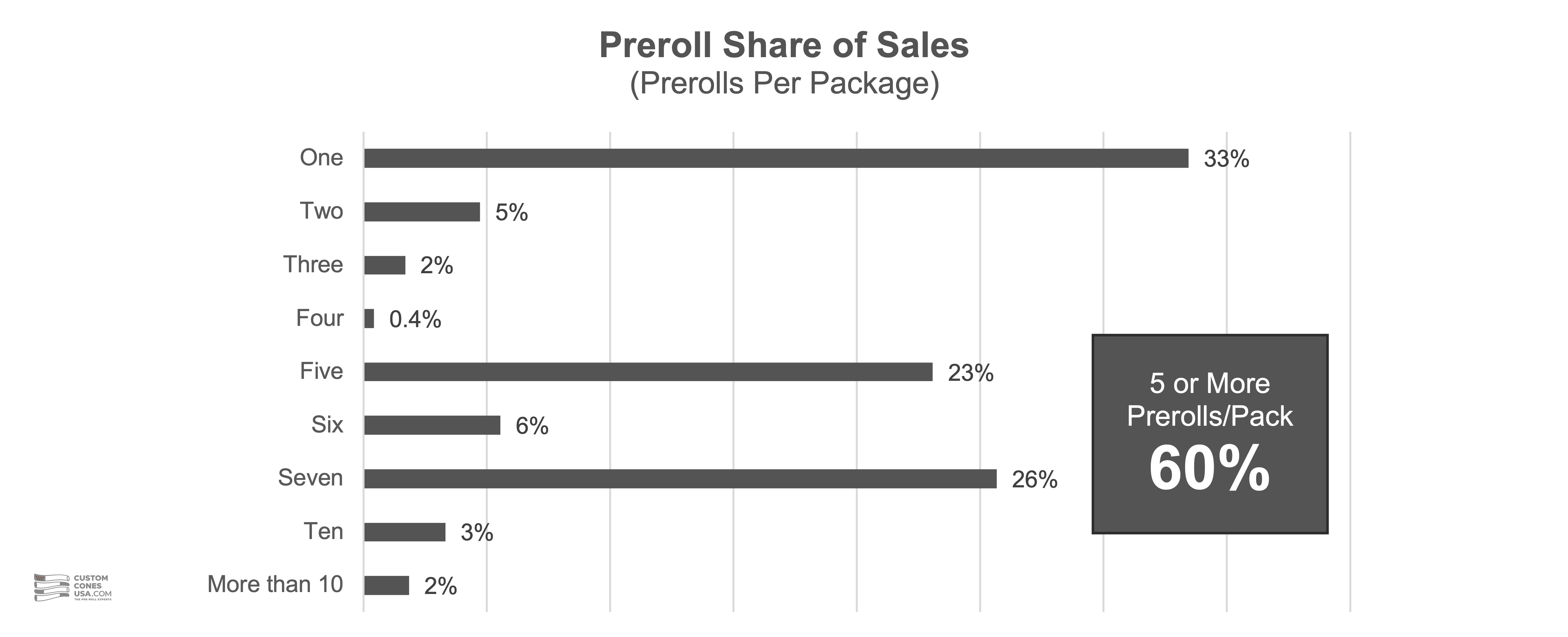

Single pre-roll packages account for 33% of all sales in New York, according to the OCM, with 80% of those single-packs containing a full gram of flower. The report also notes that half-gram pre-rolls make up 15% of single-pack sales.

But that means that 67% of all pre-roll packages sold in the Empire State are multi-packs. In fact, according to the OCM, packs of 5 or more pre-rolls make up a full 60% of pre-roll sales.

New York Pre-Roll Pricing

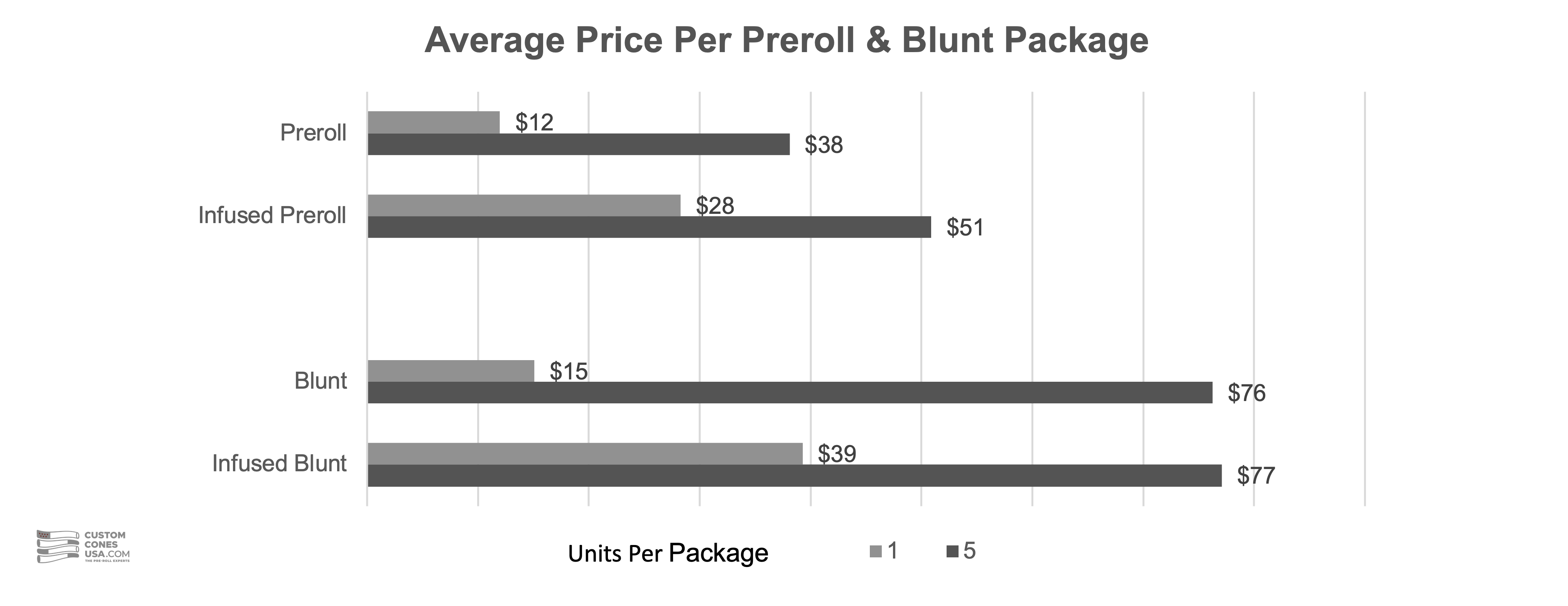

According to the OCM report, the average price for a single pre-roll in New York in 2024 was over $12. For blunts, the average price per package was higher, at over $18.

The average price for a pre-roll 5-pack is around $38 while a 5-pack of pre-rolled blunts go for an average of $76.

Compared to other categories in the report, pre-rolls are an attractive and inexpensive option as an eighth of flower (3.5 grams) averages $42 per package while edibles and concentrates average $25 and $38 per package, respectively.

However, again, those average price numbers do not appear to include infused pre-roll products which, according to the OCM, average $28 for an infused pre-roll and $39 for an infused blunt. A 5-pack of infused pre-rolls will run $51 on average while a 5-pack of infused blunts goes for an average of $77.

New York Pre-Roll Brands

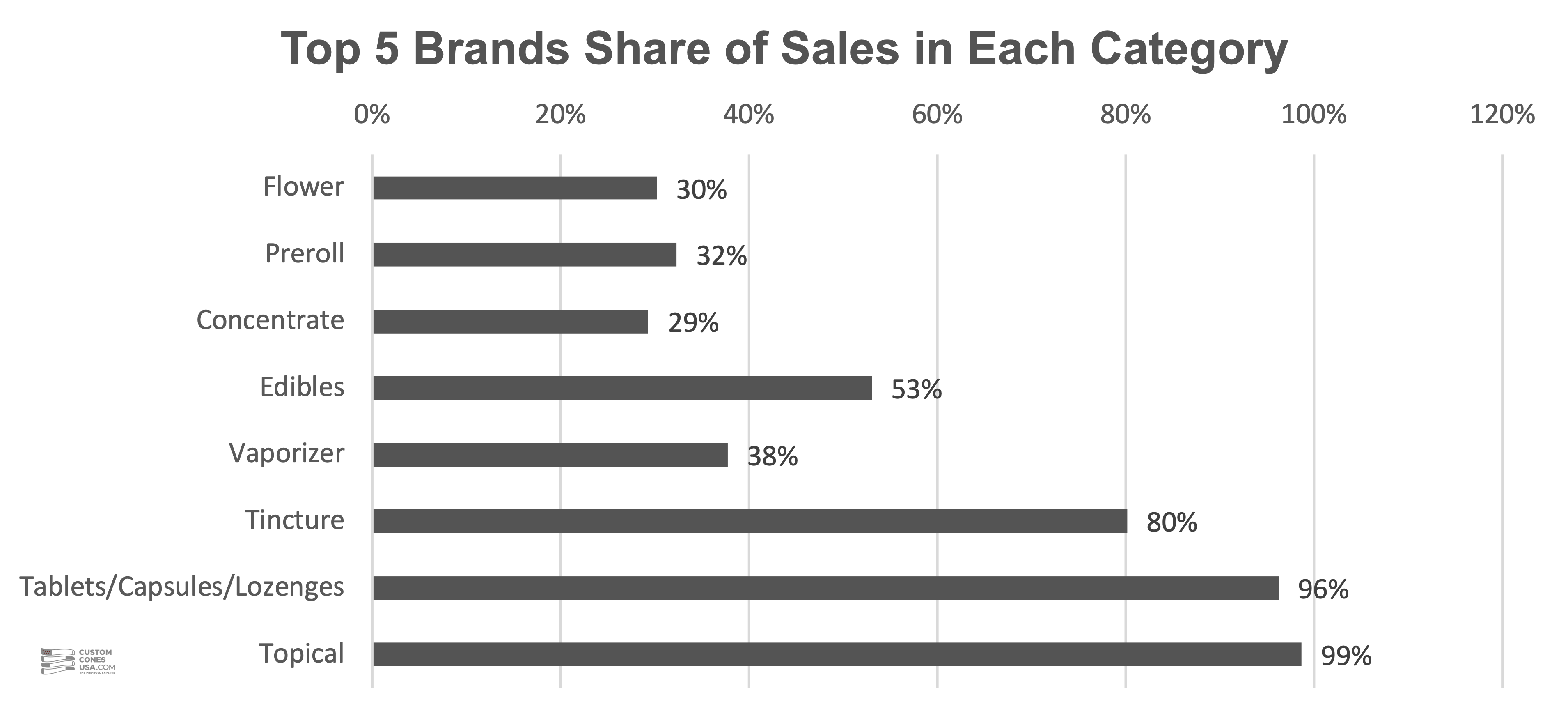

According to the OCM, there are 226 unique brands in the pre-roll category. It is the most competitive sector, behind flower. The Top 5 pre-roll brands account for 32% of total sales, though the report does not name those brands.

However, according to Headset, the top pre-roll brands in New York State are:

Additionally, 8 of the top 10 pre-roll products are made by Ruby Farms.

Final Thoughts on New York Pre-Rolls

As the New York market continues to grow, we expect pre-rolls to continue to be a major driving force behind sales, as it has in other markets as they mature.

Often, pre-rolls lag in quality when markets open, but as cultivators have more and better flower to use in pre-rolls – and as concentrates become more readily available for infused pre-rolls – market share for pre-rolls tends to increase.

Additionally, we expect infused pre-rolls, with their high potency and price point, to continue to grow in popularity among both consumers and producers. And while, according to Headset, they are a close second in NY among pre-roll segments in 2024 (behind Hybrid – Single Strain), they had taken over the top spot in the fourth quarter and we expect them to continue to increase in sales, taking the top spot in 2025.

With additional licenses coming online, we also expect the average price to continue to drop, making pre-rolls even more attractive to consumers looking to try new strains or simply wanting an easy, ready-to-go product.

New York projects to be among the most important markets in the country and producers would be wise to create high-quality pre-roll lines to meet what will surely be rising demand in the future.