Did 4/20 Live Up to the Hype? Insights Into Pre-Roll Sales

Posted by Custom Cones USA on May 3rd 2024

In the world of pre-rolls, few dates are circled as bigger sales opportunities than 4/20. The cannabis holiday sparks a surge in consumer demand and purchases each year. And according to cannabis data firm Headset, this year was no exception.

Headset recently released a report analyzing receipts that accounted for $83.6 million in sales across the U.S. and Canada on that Saturday alone. The data shows that over 6 million cannabis products were sold on 4/20 in tracked areas this year.

While those numbers show strong 4/20 sales, total sales were slightly down compared to last year. And with such lofty expectations surrounding the holidays, the data indicates a mixed bag for the overall cannabis market.

But what about the pre-roll market? We took a closer look at Headset data to find out how pre-rolls fared on the holiday, as well as which markets overperformed and underperformed against expectations. So, let’s dive in to see if 4/20 pre-roll sales lived up to the hype.

Pre-Roll Sales Surged

While this year’s 4/20 sales failed to meet last year’s sales for the cannabis market, the data tells a different story for the pre-roll market.

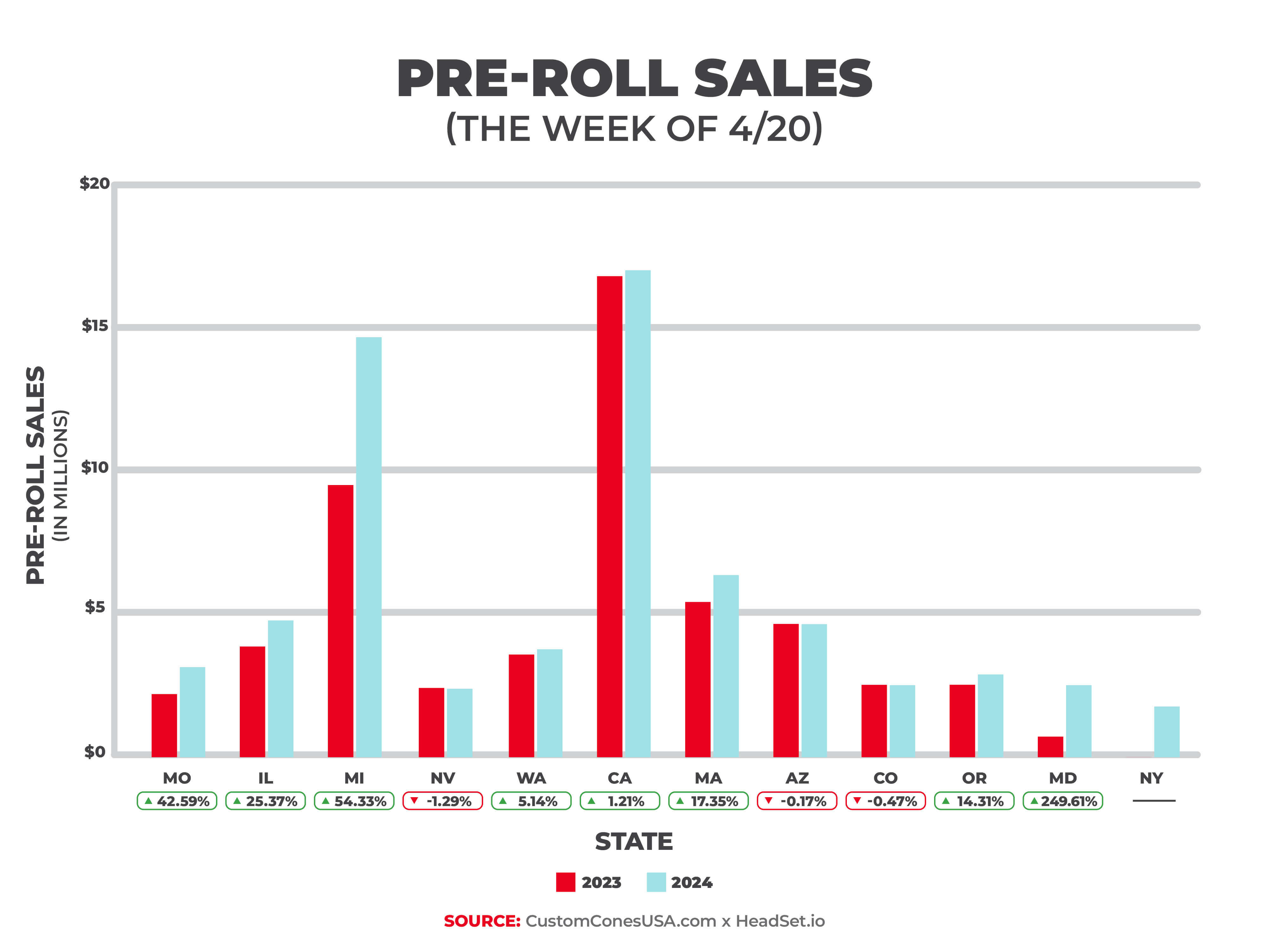

Headset data shows that this year’s pre-roll sales for the week of 4/20 exceeded last year’s sales by more than $11 million. Pre-roll sales for the week of 4/20 hit $63.9 million compared to $52.2 million last year. The week of 4/20 also had a mammoth 22% increase over the $52.4 million average the four weeks prior. The spike in sales shows that 4/20 was a clear winner for pre-rolls, underscoring how much of a sales catalyst 4/20 has become for cannabis brands and retailers.

Unit data tells a similar story – nearly 7 million pre-rolls were sold the week of 4/20, up a staggering 43% from the 4.9 million sold in 2023. The market demonstrated accelerating growth, aided by the introduction of emerging markets Maryland and New York and strong sales numbers in states like Michigan (more on that later).

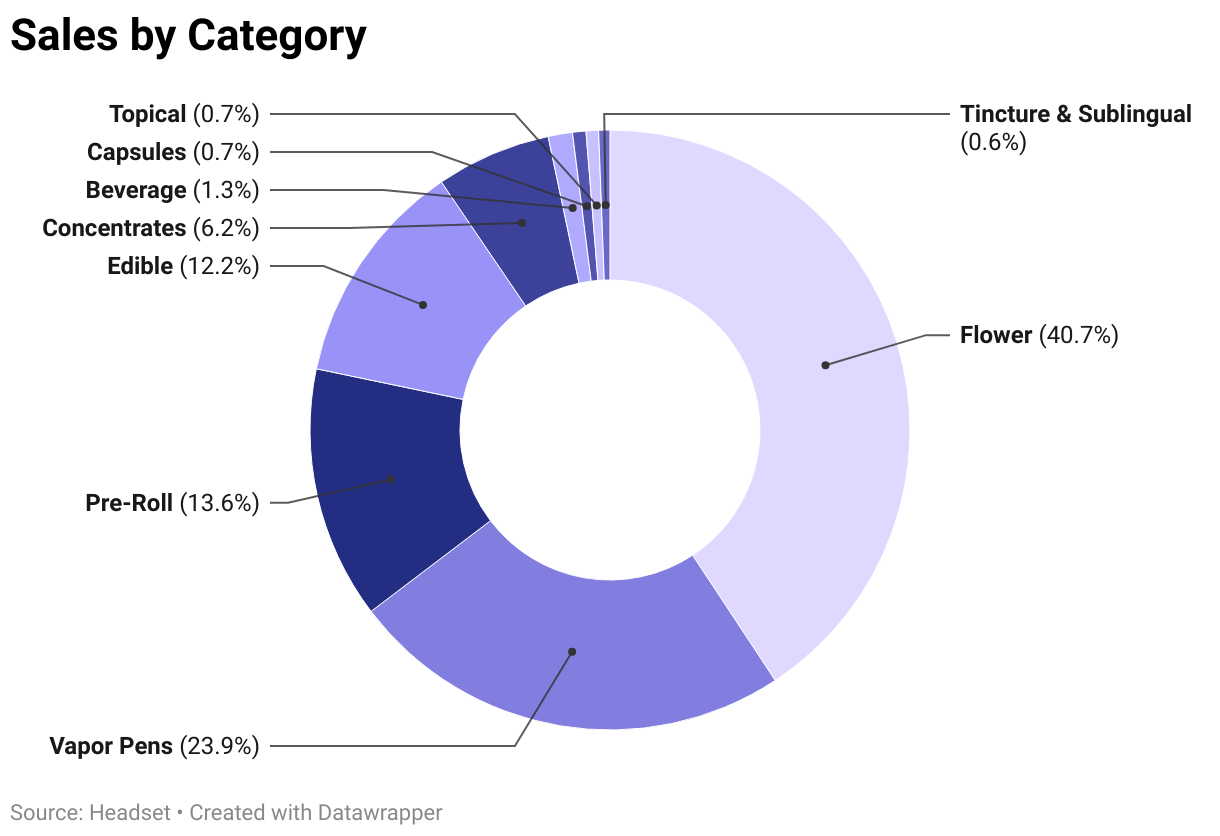

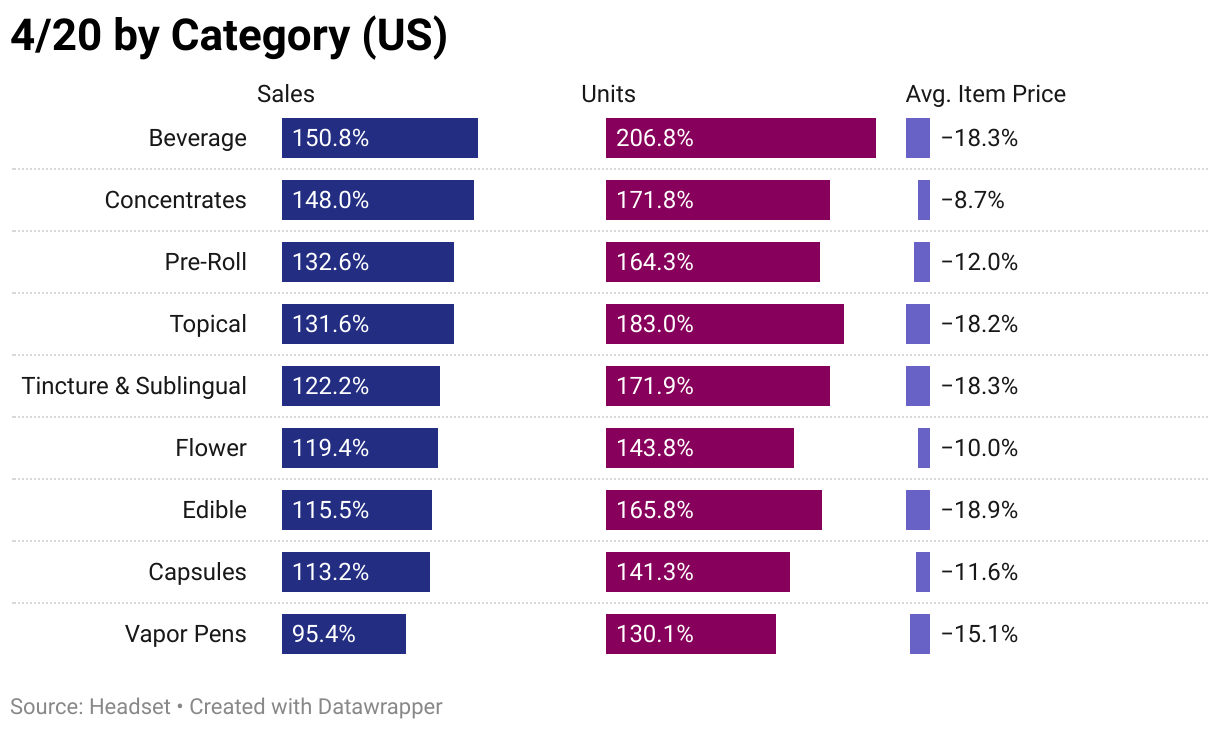

Headset’s report indicates that pre-rolls outperformed other categories. According to the report, pre-rolls were the third-highest selling category on 4/20 behind only flower and vapor pens. They were also the third best category by percentage increase, trailing only beverage and concentrates.

Moral of the story? Consumers showed up in full force to celebrate with pre-rolls this year.

State Sales Standouts and Disappointments

Taking a closer look at the state level data illuminates which markets really capitalized on 4/20 and where there is room for improvement:

Michigan Reigns Supreme

If we had to declare a big winner for pre-roll sales this 4/20, it would be Michigan. The state experienced a 54% revenue increase year over year. Michigan’s unit sales also exploded, more than doubling last year’s sales at over 2.3 million pre-rolls sold. Michigan’s $14 million+ in pre-roll sales was second to only California at $16 million – despite having nearly 30 million fewer people, highlighting the rise of this pre-roll market.

The Southwest Slumps

Arizona, Colorado, and Nevada were the only three states to experience a decrease in year-to-year 4/20-week pre-roll sales. The total units sold in Arizona and Colorado did increase year over year, showing the impact of pricing discounts on sales revenue.

However, Nevada experienced both a decrease in revenue and in total units sold. Nevada's slight dip in pre-roll sales (-1.3%) was less disappointing when you consider the average item price for pre-rolls. Headset notes in their report that the Connoisseur/Infused segment jumped a full 10% in its share of sales, helping to an above average revenue boost for 4/20 cannabis sales in the state overall.

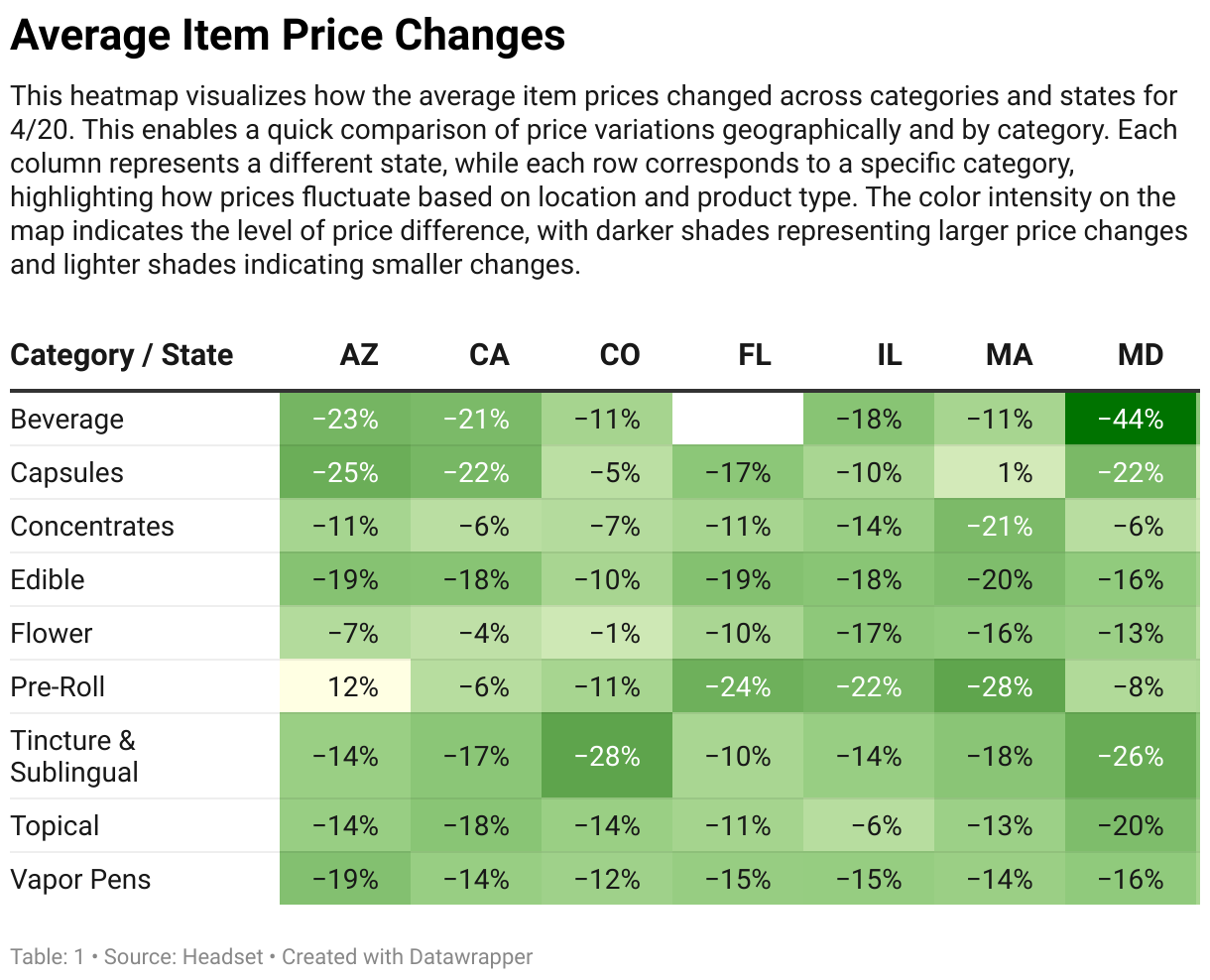

It’s worth noting that in Arizona, there was a 12% increase in the average pre-roll item price, which is in contrast with the price decreases seen in other categories and states for pre-rolls. This may be due to the higher cost of infused pre-rolls, which continue to drive sales.

New Markets Still Finding their Footing

As new cannabis markets mature, their pre-roll data is beginning to come into focus – showing both promising and disappointing results, depending on the market.

Maryland came out of the gates hot in their first fully legal holiday with a strong $2.4 million in pre-roll sales to go along with 172,000 units sold the week of 4/20. This is a 250% increase from the $692,000 in pre-roll sales last year when the state was still in the process of rolling out legalization.

On the other side, New York was dead last in total pre-roll sales as the Empire State still deals with a slow rollout of cannabis legalization. New Yorkers purchased only $1.7 million in pre-rolls, the lowest of any tracked state in Headset.

But cannabis businesses have reason for optimism on the East Coast. Massachusetts saw a 17.3% year-to-year increase for 4/20-week pre-roll sales, with $6.1 million in sales in 2024. This boost, coupled with Maryland’s strong holiday, shows the potential of the East Coast pre-roll market. Brands would be wise to study what promotional efforts, product lineups, and retailer activations worked in this blossoming market.

Varying Price Dynamics at Play

While overall pre-roll dollar sales climbed dramatically, buyers benefited from more attractive pricing. During 4/20 week, the average pre-roll price fell to $11.63, 5.5% lower than the previous month’s average pre-roll price of $12.31. However, that price did represent a 3.4% increase from the $11.59 average for 4/20 week last year.

The week to week drop in price indicates that brands offered more promotions, discounts, and deals to maximize sales during the holiday. With heightened demand, brands seized the opportunity to sacrifice a bit of per-unit revenue in exchange for driving larger order volumes and sales.

From the pre-roll category perspective, we can observe that the average item price drop for pre-rolls varies significantly across states. For the week of 4/20, Oregon and Washington were among the states that saw average item prices rise year-over-year as customer demand allowed brands to command higher per-unit revenues and infused products drove up the average.

According to Headset’s report, Florida retailers discounted their pre-rolls the most on the day of 4/20 (a 24% drop in average item price). Despite the huge discounts, this didn’t hurt total revenue– Florida experienced a 185% increase in overall cannabis sales on 4/20. This comes at a time when Florida’s murky cannabis laws are still very much in flux, highlighting the state’s potential with a vote on full legalization set for this November.

Major markets like Michigan, Massachusetts, California, Colorado, and Missouri saw average 4/20-week pre-roll prices decrease compared to 2023. Notably, Massachusetts experienced the biggest drop in item price for the week of 4/20, going from $10.56 per item last year to $7.88 per item this year (a 25% discount on the average item price). This could signify stronger price competition and a rising importance of promotions to capture share of wallet.

The Future of the 4/20 Pre-Roll Sales

This year’s 4/20 provided further evidence of the immense sales potential the cannabis holiday unlocks, particularly for pre-roll products. With overall pre-roll sales up over 22% year-over-year, the day continues delivering on its heightened revenue expectations.

Looking ahead, the pre-roll category appears well-positioned to continue capitalizing on the 4/20 sales holiday. The pre-roll market's strong 2024 holiday performance suggests the segment is now a core cannabis product driving customer demand around major events like 4/20.

As more states like New York and Maryland fully roll out legal cannabis programs, consumer awareness and appetite for pre-rolls should only grow.

In the world of pre-rolls, few dates are circled as bigger sales opportunities than 4/20. The cannabis holiday sparks a surge in consumer demand and purchases each year. And according to cannabis data firm Headset, this year was no exception.