Maryland Pre-Roll Market Overview

Posted by Custom Cones USA on Jan 14th 2025

Though not yet one of the top-selling pre-roll states in the country, Maryland’s pre-roll market showed considerable growth throughout the past year and the sky appears to be the limit.

In its first full year of operation, Maryland pre-roll sales easily topped the $100 million mark showing tremendous potential for the category in the Old Line State.

But like all recreational markets, Maryland has its own unique quirks and trends, so let’s dive into the numbers, explore the top-selling items and brands, and take a look ahead to the upcoming year so you’re informed on everything you need to know to compete in Maryland’s exciting and expanding pre-roll marketplace.

Table of Contents- Maryland Pre-Rolls by the Numbers

- Maryland Pre-Roll Market Share

- Maryland Pre-Roll Price Trends

- Maryland Pre-Roll Segment Trends

- Top Maryland Pre-Roll Package Sizes

- Top Maryland Pre-Roll Brands

- New Pre Roll Products in Maryland

- Maryland Pre Roll Predictions

- Final Thoughts on the Maryland Pre Roll Market

Maryland Pre-Rolls by the Numbers

Last year was a major one for pre-rolls in Maryland, as 2024 marked the first full calendar year for the state’s recreational cannabis program. As such, it saw major increases in sales across the board, including pre-rolls.

In calendar year 2024, Marylanders bought 8.3 million pre-roll units for a total of $123.3 million dollars. That’s a massive jump from the $67.2 million in pre-roll revenue sold in 2023, though the state’s recreational market only opened in July 2023.

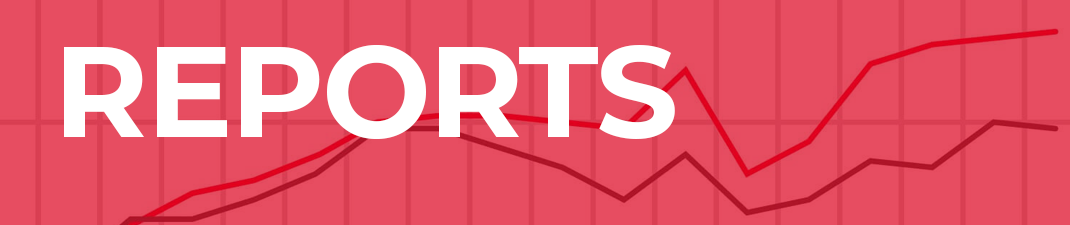

In terms of unit sales, pre-rolls accounted for nearly 22% of all units sold in Maryland in 2024, making it the second-highest selling category behind only flower. That equates to about 11% of all cannabis revenue in Maryland going to pre-rolls.

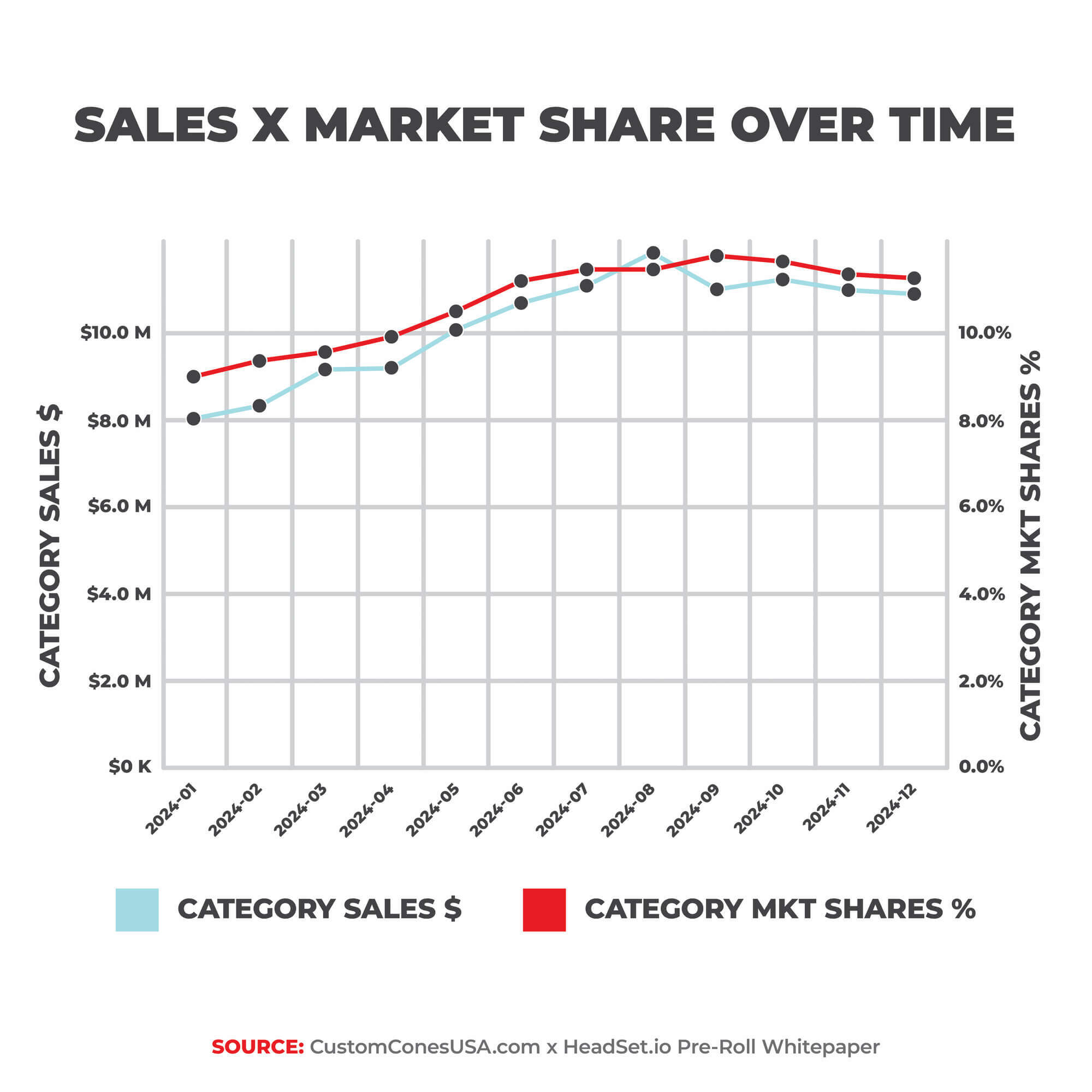

Maryland pre-roll sales hit an all-time high in August of 2024, selling more than 779,600 units for a total revenue of $11.9 million. In December 2024, Maryland retailers sold 733,373 pre-roll units, up from 529,860 units in January and a 27% year-over-year increase from December 2023, showing a steady growth trajectory and increasing consumer interest in the pre-roll category.

Maryland Pre-Roll Market Share

It’s no surprise that Maryland residents, like those in every state with a legal market, have gravitated to pre-rolls as a convenient and easy way to not only consume their favorite strains of cannabis, but as a relatively inexpensive way to try new strains and products.

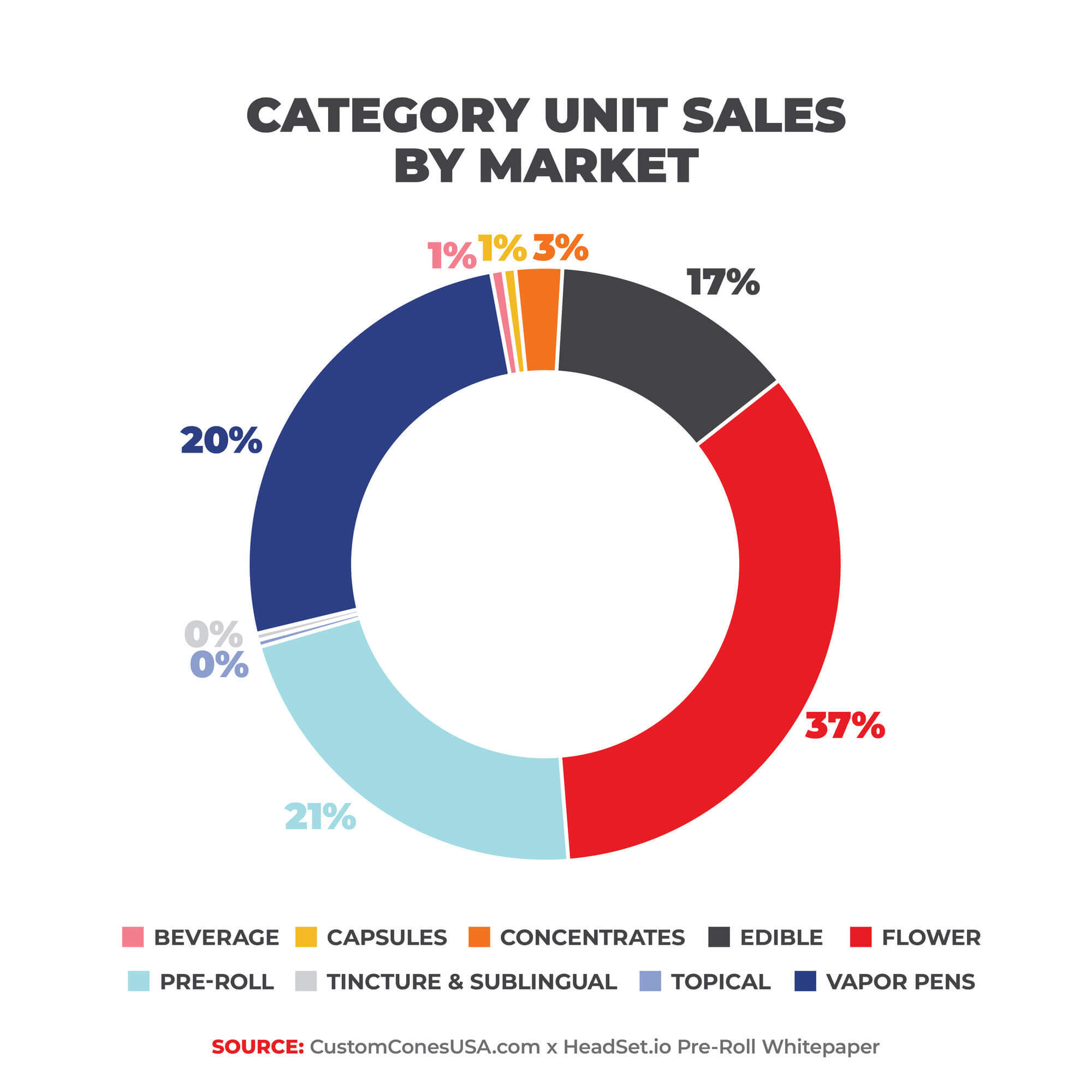

Throughout 2024, pre-rolls averaged a 10.8% market share in Maryland, ranking behind flower, vape pens and edibles. However, the market share for pre-rolls showed growth throughout the year.

In January, for example, pre-rolls had a market share of 9.1%. By December, that had risen to 11.3% with a peak market share of 11.9% in September. Looking year-over-year at December’s numbers shows an 18.6% growth in pre-roll market share from the same month in 2023.

Maryland Pre-Roll Price Trends

As Maryland’s recreational market grows and more flower becomes available, the cost of pre-rolls have dropped pretty steadily, though in 2024 the average item price danced around the $15 mark for most of the year. In January, the average pre-roll item cost $15.30. By December that had declined to $14.53, with a July peak of $15.33 and a November low of $14.37.

That’s down from a peak of $17.80 in August 2023, one month after the recreational market opened.

Digging in further, the average equalized price per gram of a pre-roll product for consumers dropped throughout the year from a January high of $12.07 to a December low of $11.26, a drop of about 7%. But that still marked a profitable product, as the average cost for retailers per gram only declined from $6.48 in January to $6.32 in December.

Maryland Pre-Roll Segment Trends

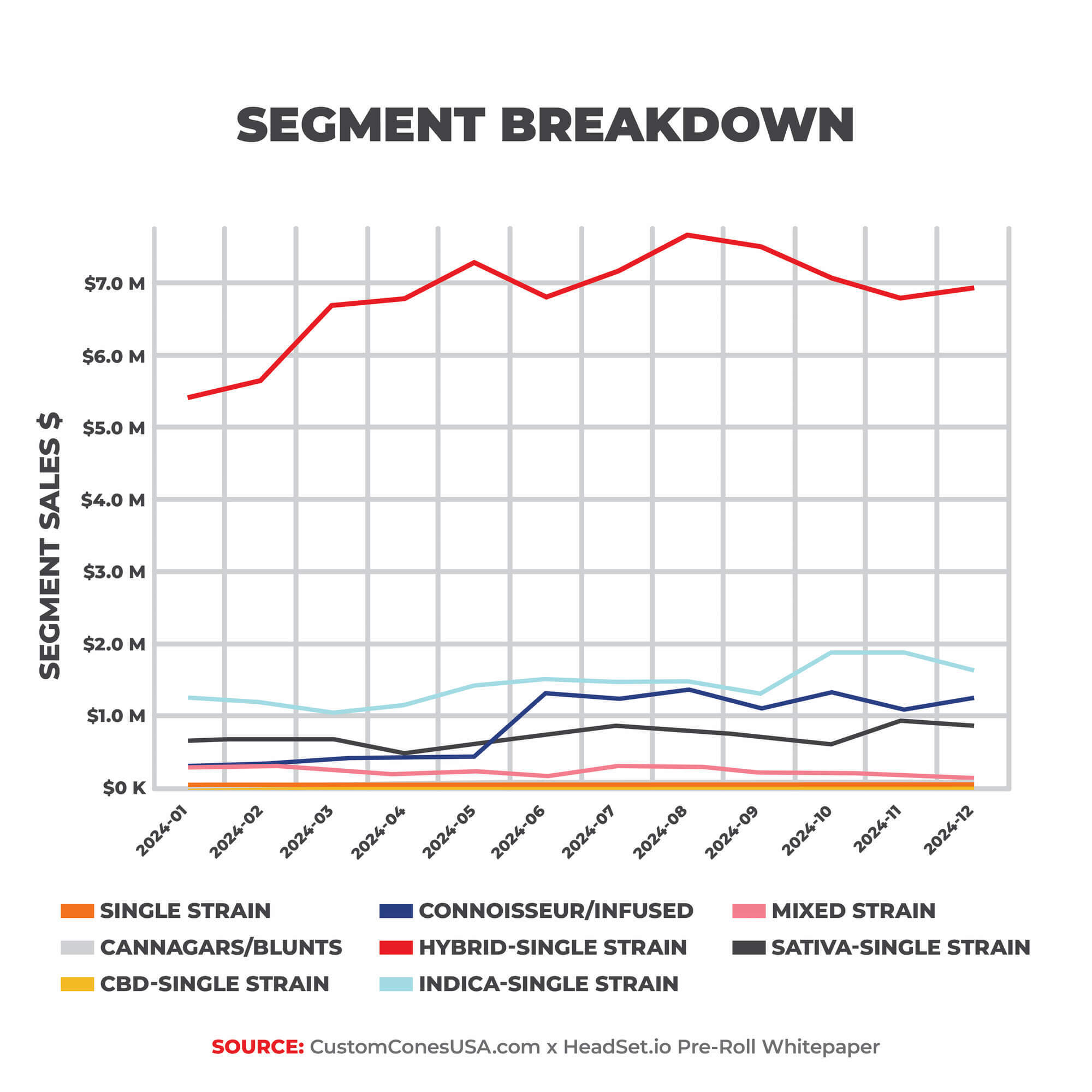

While the Connoisseur/Infused segment – combining flower with a cannabis concentrate – was the top pre-roll segment in the country in 2024, that was not the case in the Old Line State.

Instead, the top-selling segment in Maryland by far is the Hybrid - Single Strain, which saw sales rise from $5.5 million in January to $6.8 million in December, with a peak of $7.8 million in August. No other segment topped $1.9 million in sales in any month (Indica – Single Strain; November).

The Infused segment, which dominated in national sales charts, did see tremendous growth in Maryland through the year, pulling in only $323,000 in January but growing to $1.2 million in December (with an August peak of just under $1.4 million). That’s a 272% growth for the segment in 2024.

The Sativa – Single Strain and Mixed Strain segments ranked fourth and fifth, respectively.

Top Maryland Pre-Roll Package Sizes

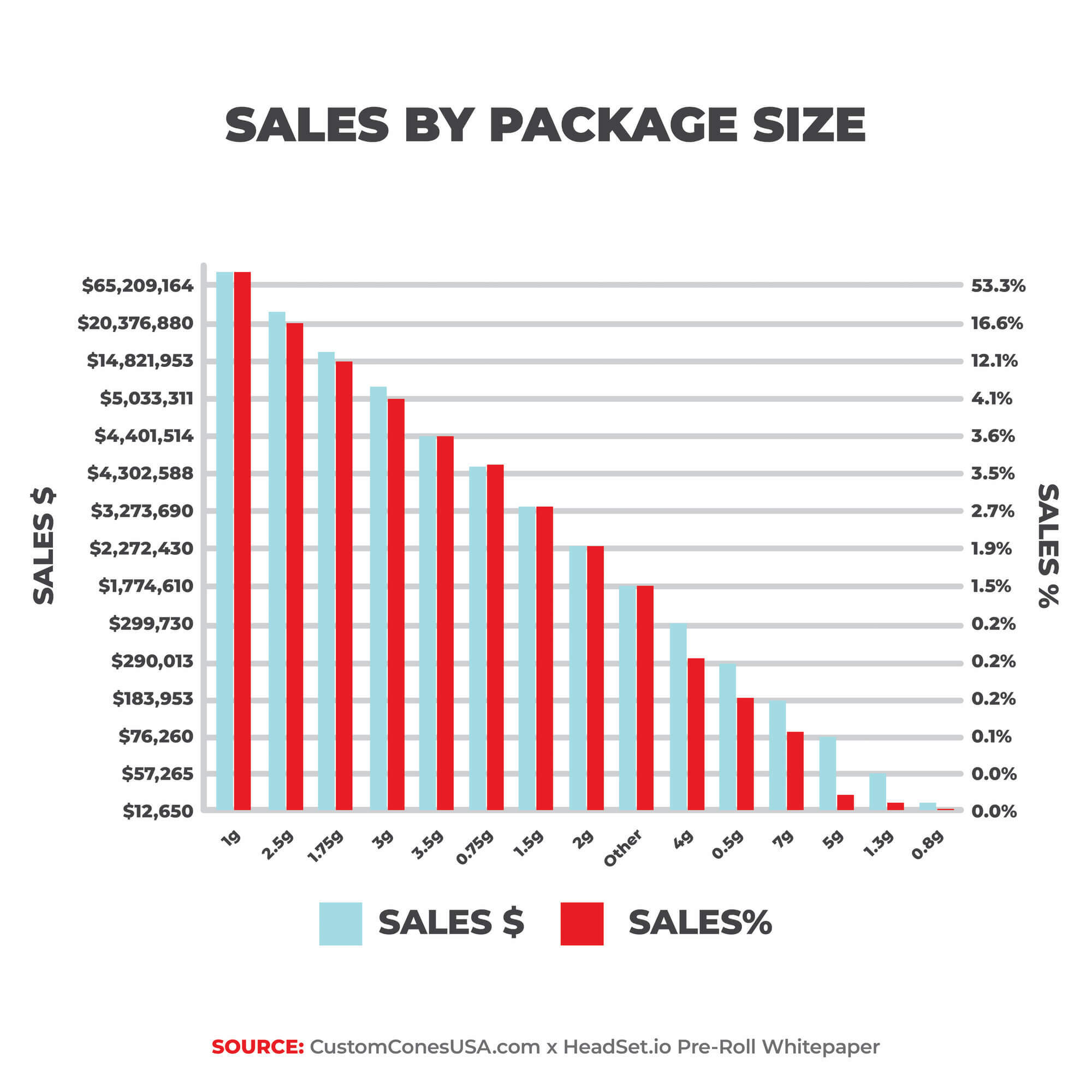

The 1-gram package size was by far the most popular size for pre-rolls in Maryland, selling nearly 6 million units for a total of about $65.7 million, or about 53% of all pre-roll revenue and 71.9% of total units sold. It has an average price point of $11.02.

The popularity of 1-gram pre-rolls can be attributed to their affordability and ease of use. They offer a single, pre-measured dose at a good price point that is perfect for individual or on-the go use, making them an ideal choice for both new and experienced users.

However, the multi-pack continues to be popular with 2.5-gram packs coming in second at 16% of sales and 8.2% of units, followed by 1.75-gram packs (12.2% of sales; 7.8% of units). The 3-gram pack and 3.5-gram pack round out the top 5.

It is also worth noting that not all 1-gram packages are single pre-rolls, as the top selling pre-roll product in Maryland is a 1-gram pack featuring two pre-rolls.

The Top 10 Pre-Roll Products by Revenue in Maryland in 2024

- SunMed – Snoop Dogg OG Pre-Roll 2-pack (1g)

- Dogwalkers – Mini Dog – Animal face Pre-Roll 5-Pack (1.75g)

- Dogwalkers – Mini Dog – Afternoon Delight #4 Pre-Roll 5-pack (1.75g)

- Dogwalkers – Mini Dog – Brownie Scout Pre-Roll 5-Pack (1.75g)

- Dogwalkers – Big Dog – Afternoon Delight #4 Pre-Roll (0.75g)

- Dogwalkers – Big Dog – Animal Face Pre-Roll (0.75g)

- Curio Wellness – Alien OG Pre-Roll 2-Pack (1g)

- Dogwalkers – Mini Dog – White Durban Pre-Roll 5-Pack 1.75g)

- Kaviar – Kavier x Happy Eddie – Zen Wen Infused Pre-Roll (1.5g)

- Kavier – Indica Infused Pre-Roll (1.5g)

Top Maryland Pre-Roll Brands

As noted by the top 10 products above, one brand reigned over the Maryland pre-roll market in 2024. The Dogwalkers brand towered over its competitors, accounting for 15.6% of all pre-roll sales and raking in $19.3 million in 2024. SunMed finished second at $13 million with 10.6% of sales.And unlike in most states, House Brand pre-rolls released by retailers under their own name – fell all the way to no. 10.

The Top 10 Pre-Roll Brands in Maryland by Revenue

- Dogwalkers

- SunMed

- Verano

- District Cannabis

- Curio Wellness

- Fade Co.

- Grassroots

- Grow West Cannabis Company

- Happy J’s

- House Brands

New Pre-Roll Products in Maryland

One of the ways to show growth and strength in any pre-roll market is by checking the number of new products released in the category, and Maryland manufacturers are consistently releasing hundreds of new pre-roll SKUs.

In the 90 days prior to our data pull on January 8, 2025, pre-roll producers released 183 new pre-roll products into the marketplace with an average new item price of $13.70. Looking back 180 days, that number jumps to 376 new products at an average price point of $16.63.

Of the products released in the past 180 days, the vast majority - 317 - were 1-gram products, followed by 2.5-gram packs (77) and 3.5-gram packs (58).

Maryland Pre-Roll Predictions

So what does the future of Maryland pre-rolls look like?

With only 18 months of recreational sales on the books, it is difficult to make specific predictions for the next year or so. However, given both national trends and patterns we’ve seen in other emerging markets, we can confidently say we expect pre-rolls to continue to grow in revenues, unit sales and market share in Maryland.

For example, after establishing a baseline of right around $25 million in sales for the final two quarters of 2023 and the first quarter of 2024, the second quarter of 2024 saw a 17.6% increase in revenues to nearly $30 million. In Q3, it grew another 13.1% to $33.9 million before seeming to plateau around the $33 million mark for Q4.

It is not unusual for sales to plateau in new markets before beginning to grow again, and we expect to see the same in Maryland, particularly as new producers come on line and growers begin to reach their maximum output potential, making more and better flower available for use in pre-rolls.

More than 61% of consumers list the joint as their favorite consumption method, and pre rolls are already one of the top add-ons at dispensaries. As pre-roll prices drop and the quality increases, we expect more and more consumers will add pre-rolls to their baskets as a convenient way to try new things.

For example, Missouri, a state with a similar population, saw pre-roll growth plateau in the third and fourth quarters following the opening of their recreational market before beginning to climb again as new and higher-quality pre-roll products began hitting the market.

We expect a similar trend in Maryland.

Digging deeper, we also expect the Connoisseur/Infused segment to see a steeper growth curve in the next year-plus. As noted, the segment grew 252% in 2024, and while that level of growth may not be sustainable, the sales trajectory of infused pre-rolls will continue upward.

In 2023, Infused pre-rolls surpassed the Hybrid - Single Strain segment to become the no. 1 pre-roll segment in the country by revenue. Though this has not happened yet in the Old Line State, we are already seeing price drops in the segment consistent with a maturing market that has additional concentrates on hand to use in pre-rolls.

According to our consumer survey, potency is still the no. 1 thing consumers look for in a pre-roll, followed by price. Because of that, as the price for higher-potency infused pre-rolls drops, we should see considerable growth in the segment, with Infused pre-rolls eventually becoming the top-selling pre-roll segment in Maryland.

Final Thoughts on the Maryland Pre-Roll Market

Still in its infancy, the Maryland pre-roll market is nowhere near maturity and will only continue to grow. We expect to see increases in revenue, unit sales and market share as pre-roll quality improves and prices continues to drop, much as they have in other markets.

And because Maryland shares a border with Pennsylvania, a medical-only state, we expect to see additional growth as more residents from the Keystone State make the trip across the Mason-Dixon Line to check out Maryland’s recreational offerings, increasing revenue totals even further.

We also expect the Infused segment to continue its rise, eventually claiming the top revenue spot as consumers gravitate to the higher potency infused pre-rolls provide, as well as the higher price point that comes with the addition of a concentrate.

But competing – and standing out – in a new market like Maryland means not only producing top-quality cannabis, but top-quality pre-roll products as well. Contact the Pre-Roll Experts today to find out how Custom Cones USA can help set up your business for success, including top pre-roll machines like our made-for-cannabis industrial grinders, cone-filling machines, customizable packaging that will make your brand stand out. And of course, the highest quality pre-rolled cones available, always tested to the highest standards in the industry for microbials, pesticides and heavy metals to ensure that your pre-rolls are as clean as the flower you put in them.

Brian Beckley spent 20 years as an award-winning newspaper journalist and editor, covering cities on both coasts before becoming Managing Editor of Marijuana Venture magazine, where he covered all aspects of the cannabis industry for five years. In his role with the magazine, he spoke at numerous cannabis conferences and hosted several media panels. Brian joined Custom Cones USA as lead copywriter in 2023.

Though not yet one of the top-selling pre-roll states in the country, Maryland’s pre-roll market showed considerable growth throughout the past year and the sky appears to be the limit.