The Rise of 7/10 and Premium Cannabis

Posted by Custom Cones USA on Jul 10th 2024

Move over, 4/20 - there's a new date on the cannabis calendar that's sparking excitement among concentrate enthusiasts. While April 20th has long reigned as the ultimate celebration of all things cannabis, July 10th (7/10) has emerged as a day dedicated to the potent world of oils, waxes, and other concentrated forms of marijuana.

Despite being a relatively new holiday, 7/10 has taken the cannabis world by storm in recent years – helping to contribute to a major boost in sales in pre-roll categories like infused/connoisseur and concentrates.

Today, we’ll dive deep into the data to analyze 7/10 trends and its impact on the booming pre-roll market, as well as taking a larger look at how oils and concentrates have revolutionized the industry. Whether you’re a seasoned dab aficionado or a curious newcomer, join us we reveal the growing impact of 7/10 on the cannabis landscape.

All pre roll data was pulled from Headset.io, which is sourced from consumer transactions in 12 states: Arizona, California, Colorado, Illinois, Massachusetts, Maryland, Michigan, Missouri, Nevada, New York, Oregon, and Washington.

The Origins and Essence of 7/10

At its core, 7/10 is a clever play on words - or rather, numbers. When flipped upside down, 710 spells "OIL," making it the perfect numerical representation for cannabis concentrates. This connection sparked the idea of celebrating July 10th as a holiday dedicated to dabs, oils, and other high-potency cannabis extracts.

While the exact origins of 7/10 remain shrouded in a haze of mystery, the term began gaining traction in the early 2010s on social media. Regardless of its precise beginnings, 7/10 quickly caught fire within the cannabis community.

Much like its older sibling 4/20, this holiday sees cannabis enthusiasts gathering to enjoy their favorite concentrates. Many partake at precisely 7:10 AM or PM for an extra touch of thematic fun. Dispensaries and cannabis brands often run special promotions, while some cities host 7/10-themed events and competitions.

As concentrates continue to gain popularity, 7/10 is evolving from a niche observance to a mainstream cannabis holiday. It's a day that highlights the innovation and potency that define the concentrate market, offering both seasoned consumers and curious newcomers a chance to explore the cutting edge of cannabis consumption.

Concentrate Sales: A Steady Presence in the 7/10 Landscape

While 7/10 has become synonymous with concentrates, the sales data for July over the past four years tells a nuanced story. Rather than showing dramatic spikes, concentrate sales have maintained a consistent presence in the market, reflecting the steady integration of these products into consumers' regular routines.

In July 2020, concentrate sales reached an impressive $99,567,220, capturing 9% of the market share. Notably, this made July the second-highest sales month for concentrates that year, surpassed only by October. This strong performance hinted at the growing importance of 7/10 as a focal point for concentrate enthusiasts.

The following years saw fluctuations in sales figures, but concentrates held their ground:

- July 2021: Sales climbed to $126,562,825, maintaining an 8% market share

- July 2022: A slight dip to $119,763,372, still holding 8% of the market

- July 2023: Sales settled at $117,522,019, with a 6% market share

While the slight downward trend in market share might raise eyebrows, it's important to view these figures in context. The overall cannabis market has been expanding rapidly, with new product categories emerging and gaining traction. In this light, concentrates' ability to maintain substantial sales figures speaks to their enduring appeal.

Moreover, the consistent performance of concentrates during July, despite not showing dramatic 7/10-specific spikes, suggests that these products have transcended the realm of novelty or once-a-year indulgence. Instead, they've become a staple in many consumers' cannabis repertoires, enjoyed year-round rather than just on special occasions.

The evolution of concentrate sales reflects a maturing market where high-potency and specialized products are no longer niche offerings but essential components of the cannabis landscape. As we continue to track these trends, it will be fascinating to see how concentrate sales evolve in tandem with growing consumer education and the increasing prominence of events like 7/10.

The Surge of Connoisseur and Infused Pre-Rolls

As we delve into the sales data surrounding 7/10, a compelling narrative emerges: the connoisseur and infused pre-roll market is experiencing unprecedented growth, reshaping the cannabis landscape. This segment has not only expanded its footprint but has also demonstrated a remarkable ability to capture consumer interest and market share.

Year-Over-Year Growth: A Testament to Changing Preferences

The week of 7/10 has witnessed a staggering upward trajectory in the connoisseur and infused pre-roll segment over the past four years. From a modest $924,699 in sales and 22.8% market share for the week of 7/10/2020, the segment has skyrocketed to $3,577,110 and a commanding 48.1% market share by 7/10/2024. This meteoric rise represents more than just increased sales; it signifies a fundamental shift in consumer preferences towards premium, infused products.

Week of 7/10 Connoisseur & Infused Pre-Roll Sales & Market Share 2020-2024 (Source: Headset.io)

The market share more than doubled from 2020 to 2024. The data shows that connoisseur and infused pre-rolls are not just growing alongside the broader cannabis market but are actively capturing market share from other product categories. This trend indicates that consumers are increasingly seeking out more potent, flavorful, and experiential cannabis products.

Pricing Dynamics: Balancing Premium Appeal and Market Expansion

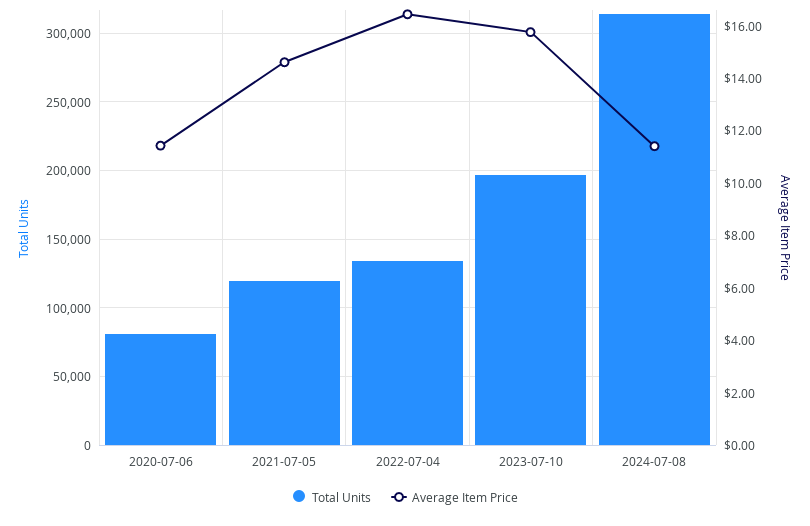

Week of 7/10 Connoisseur & Infused Pre-Roll Unit Sales & Price 2020-2024 (Source: Headset.io)

The pricing trends in the connoisseur and infused segment reveal a nuanced strategy by manufacturers. While the average item price (AIP) saw an initial increase from the week of 7/10/2020 to the week of 7/10/2022, peaking at $16.42, the AIP has since dipped down to levels below 2020. The AIP in 2024 was $11.40, a 31% decrease from the 2022 high. This drop, coupled with a significant jump in unit sales, suggests a strategic move by brands to find the sweet spot between premium positioning and mass-market appeal.

Week of 7/10 Connoisseur & Infused Pre-Roll Unit Sales & Price 2020-2024 (Source: Headset.io)

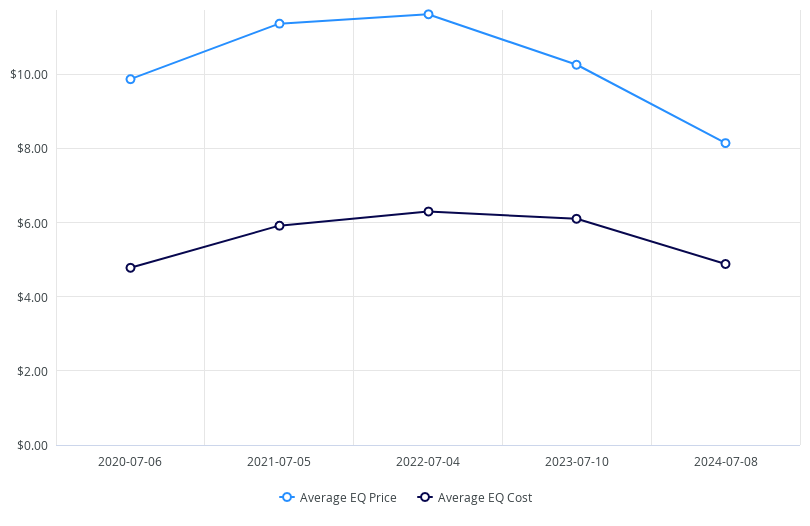

Further insights can be gleaned from the average equivalent (EQ) price and cost data for all pre-rolls.The EQ cost has dropped $1.42 since 2022 highs, a 22.5% decrease in cost per infused pre-roll in that time. So while prices are dropping, declining production costs and an increase in sales volume show that 7/10 profitability for cannabis businesses remains robust.

The drop in both average item cost and average item price showcases the maturing nature of the connoisseur and infused pre-roll market. It suggests improvements in production efficiency and economies of scale, allowing manufacturers to offer competitive pricing without sacrificing quality.

Brand Dominance and Product Preferences

When looking at the top-performing connoisseur and infused products from the weeks of 7/10 2020-2024, one thing is clear – consumers love Jeeter. Jeeter's dominance, securing 19 of the top 25 spots, is a testament to the brand's ability to resonate with consumers in this specialized market. However, the presence of brands like Kaviar and STIIIZY in the top 25 rankings indicates that there's room for multiple players to succeed in this growing segment.

Product format preferences are equally telling. The overwhelming popularity of 5-pack (2.5g) products, accounting for 22 of the top 25 items, suggests that consumers in the connoisseur and infused pre-roll market value both quantity and quality. This preference for multi-packs could be driven by factors such as perceived value, convenience, or the social nature of cannabis consumption.

While 5-packs dominate, the presence of single packs in various sizes among the top products indicates a diverse market with room for different product formats. This variety allows brands to cater to different consumer needs, from the casual user to the dedicated enthusiast.

Connoisseur and Infused Pre-Rolls: A New Market Leader

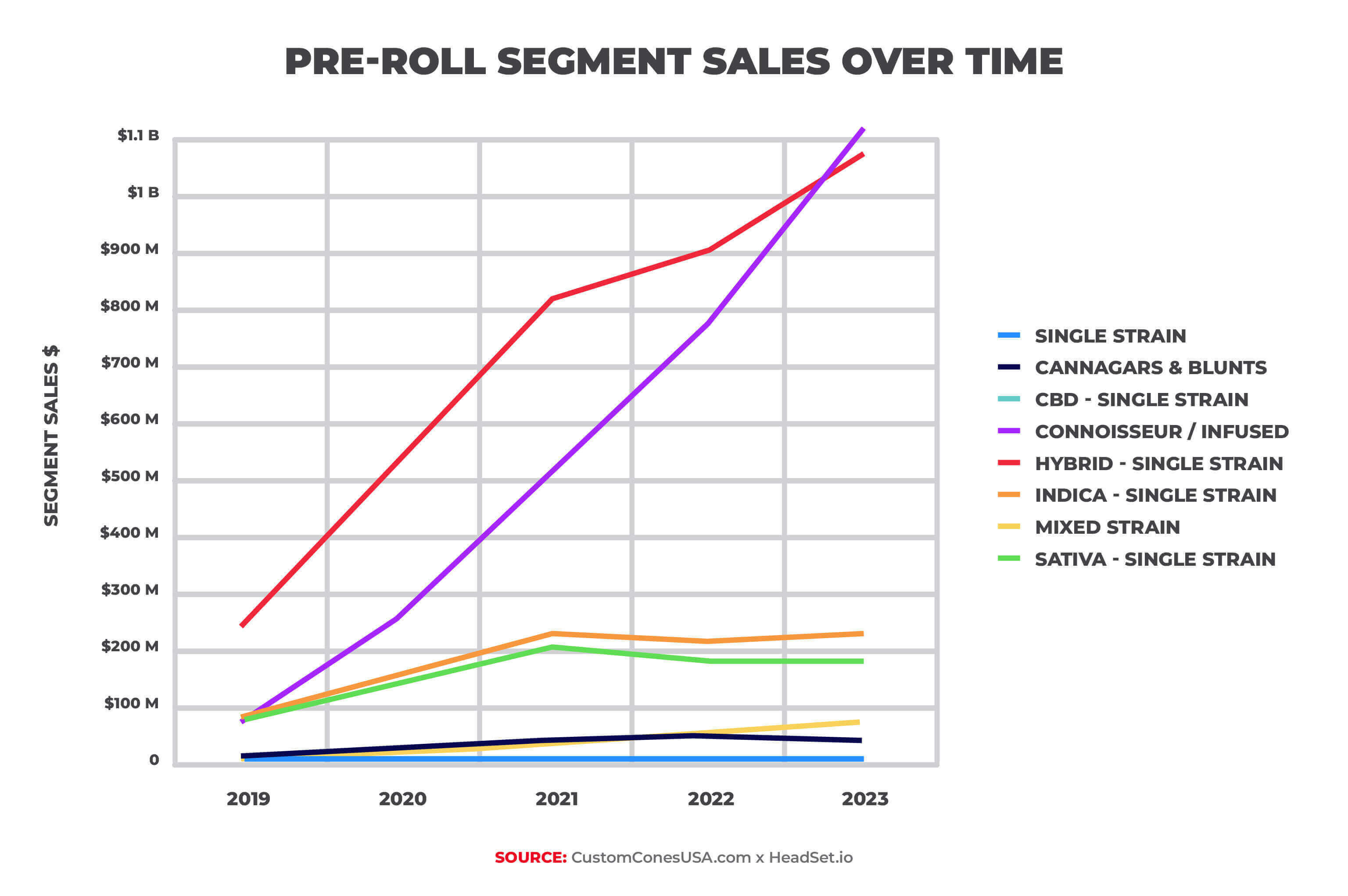

The substantial growth in connoisseur and infused product sales during the 7/10 holiday aligns with the category's explosive expansion in recent years.

In 2023, the connoisseur and infused pre-roll subcategory achieved a remarkable milestone, surpassing traditional "Hybrid - Single Strain" pre-rolls to become the top-selling segment with an impressive $1.12 billion in sales. This ascent is a testament to the growing consumer appetite for specialized, elevated cannabis experiences.

Pre-Roll Segment Sales 2019-2023 (Source: Headset.io)

These premium pre-rolls, infused with concentrated cannabis extracts or featuring ultra-premium flower, perfectly align with the broader trend of premiumization in the cannabis industry. They offer consumers the opportunity to explore exotic flavor profiles, experience amplified potency, and indulge in ultra-craft cannabis strains, all conveniently packaged in a pre-rolled format.

Market Share and Future Projections

The growth trajectory of infused pre-rolls is nothing short of impressive. Since 2019, they've maintained a robust 34.4% average market share across tracked markets. This share has been accelerating rapidly, reaching 41.5% in 2023 and an even more impressive 44% in early 2024.

If this trend continues, we could see infused pre-rolls capturing 50% or more of total pre-roll category sales by 2025. Looking further ahead, there's potential for this subcategory to dominate the pre-roll market with a 60-65% share, fundamentally altering the landscape of pre-roll pricing and revenue performance.

Looking Ahead: Innovation and Growth

As we look beyond the 7/10 celebrations, the infused and concentrate pre-roll segment shows no signs of slowing down. This holiday's success highlights the potential for continued innovation in infusion technologies, exotic strain development, and ultra-premium ingredient formulations, likely driving further growth and price elevation in this category.

For brands and retailers, the 7/10 holiday's popularity presents both opportunities and challenges. While there's clear demand for premium, infused products during this concentrate-focused celebration, success in this space will require a delicate balance of quality, innovation, and value. As the market matures, we can expect to see even more sophisticated offerings that push the boundaries of what's possible in the pre-roll format, potentially elevating future 7/10 product lineups.

The rise of infused and concentrate products, particularly in the pre-roll category, is more than just a passing trend or annual holiday phenomenon. It represents a fundamental shift in consumer preferences towards more potent, flavorful, and experiential cannabis products.

Move over, 4/20 - there's a new date on the cannabis calendar that's sparking excitement among concentrate enthusiasts. While April 20th has long reigned as the ultimate celebration of all things cannabis, July 10th (7/10) has emerged as a day dedicated to the potent world of oils, waxes, and other concentrated forms of marijuana.