Pre-Rolls Trends of 2024

Posted by Custom Cones USA on Jun 1st 2024

As we near the halfway point of 2024, pre-rolls remain the hottest products in the cannabis space, increasing its market share even through the first four months of the year. But some categories continue to do better than others.

We dove into the data from cannabis analytics firm Headset to take a deeper look at he pre-roll category and find out what’s helping push the market forward in 2024.

Topline

We looked at Headset data over the past two years to compare the category’s numbers from April 2024 (the last full month of data) to where it was in April 2022 and the most important takeaway is that the Pre-Roll category continues to grow.

In April 2022, the category accounted for 12.5% of the cannabis market with $167.6 million in sales. By April 2024, it had grown to a market share of 15.3% and $239.4 million in sales.

Over the same time period, the average price of a pre-roll product, equalized to a gram, fell from $9 to $6.65.

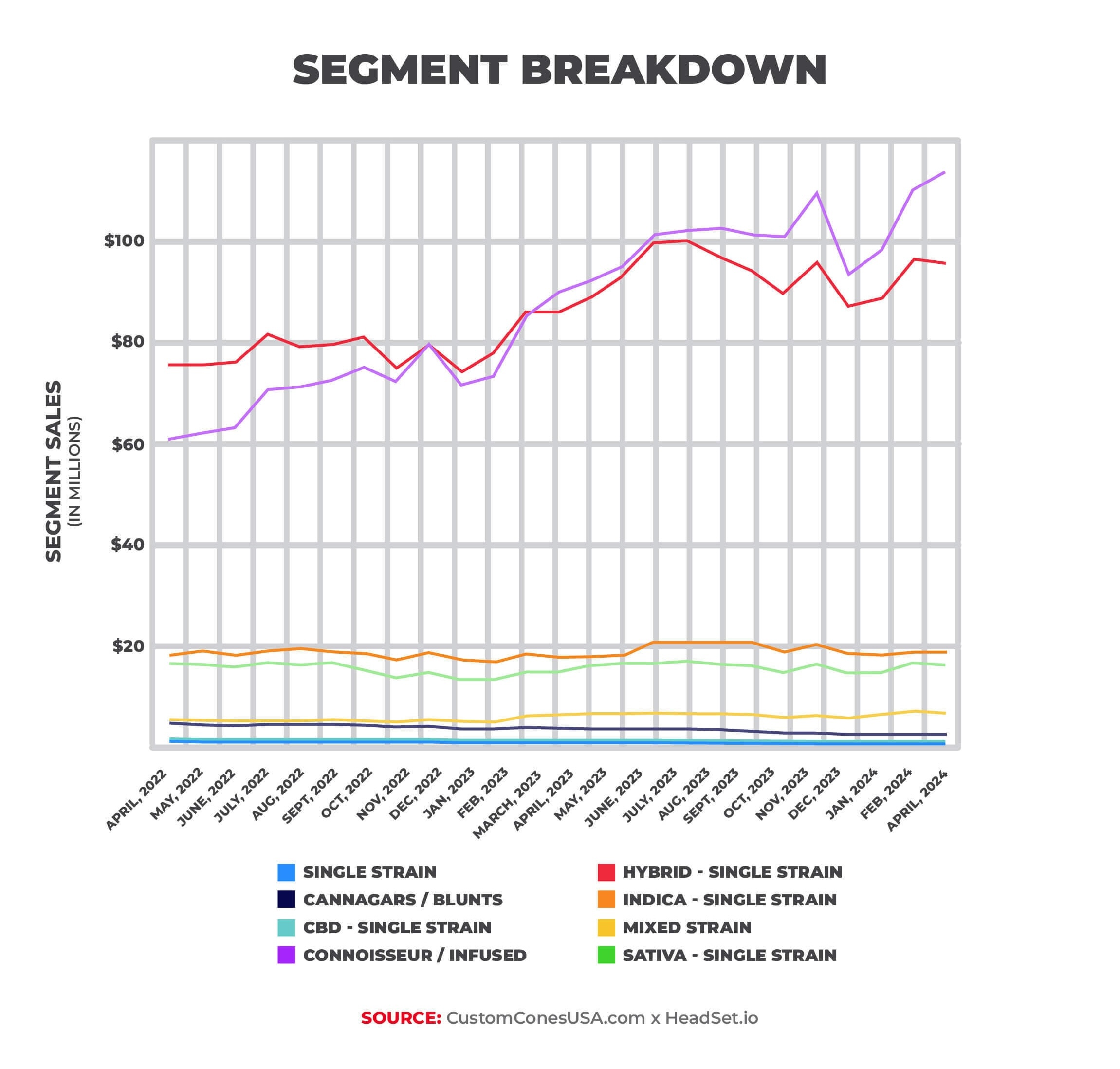

But what segments are driving the growth? Infused pre-rolls and hybrid-single strain pre-rolls show the most growth, with all other categories of pre-rolls remaining strong, but relatively flat in growth.

Infused

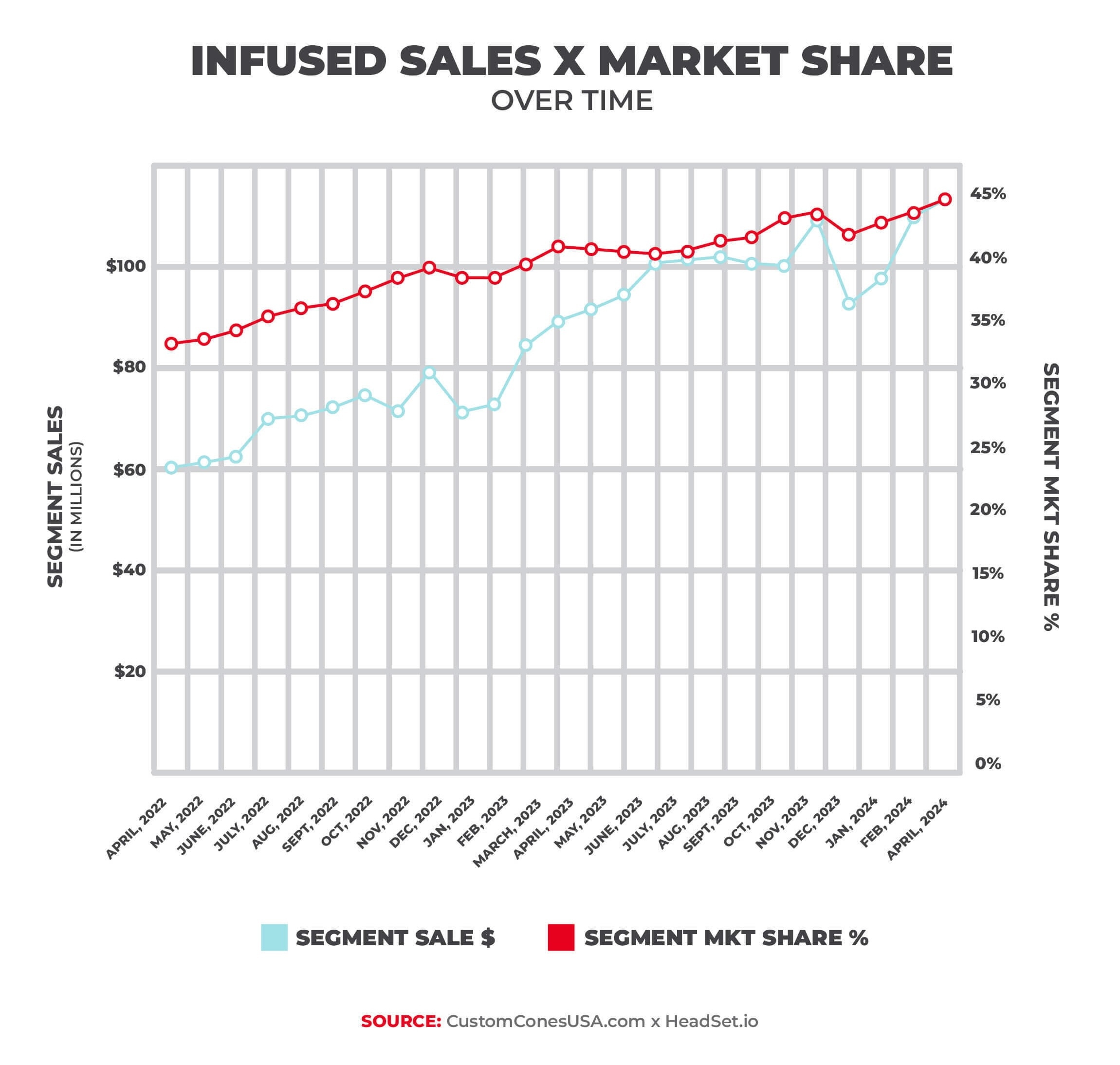

Within the pre-roll category, the hottest segment nationally continues to be the Infused/Connoisseur segment. Made by combining flower with a cannabis concentrate, infused pre-rolls have a higher potency, stronger flavors and an elevated price point. They are by far the top-selling pre-roll products available and continue to grow.

According to the April 2024 Headset data, infused pre-rolls accounted for 46.3% of sales in the pre-roll market during the month, up from 34.9% in April 2022. Additionally, this April saw total infused pre-roll sales of 8.47 million units for a sales total of $110.6 million, up from 3.51 million units and $58.5 million in April 2022.

Over the same time period, the average price of infused pre-rolls has dropped more than $3, from $16.67 in April 2022 to $13.09 this year, reflective of a maturing market where producers have surplus flower to turn to concentrates and surplus concentrates to use to make infused pre-rolls.

Infused pre-roll sales are up 40.4% year-over-year from 2023, with unit sales up 47.1% over the same time frame. Additionally, 9 of the top 10 pre-roll products across all markets are infused or connoisseur products, with only “house brand – single strain hybrid” (a 1-gram pre-roll made of the dispensary’s own flower) breaking up the monopoly on sales.

Hybrid - Single Strain

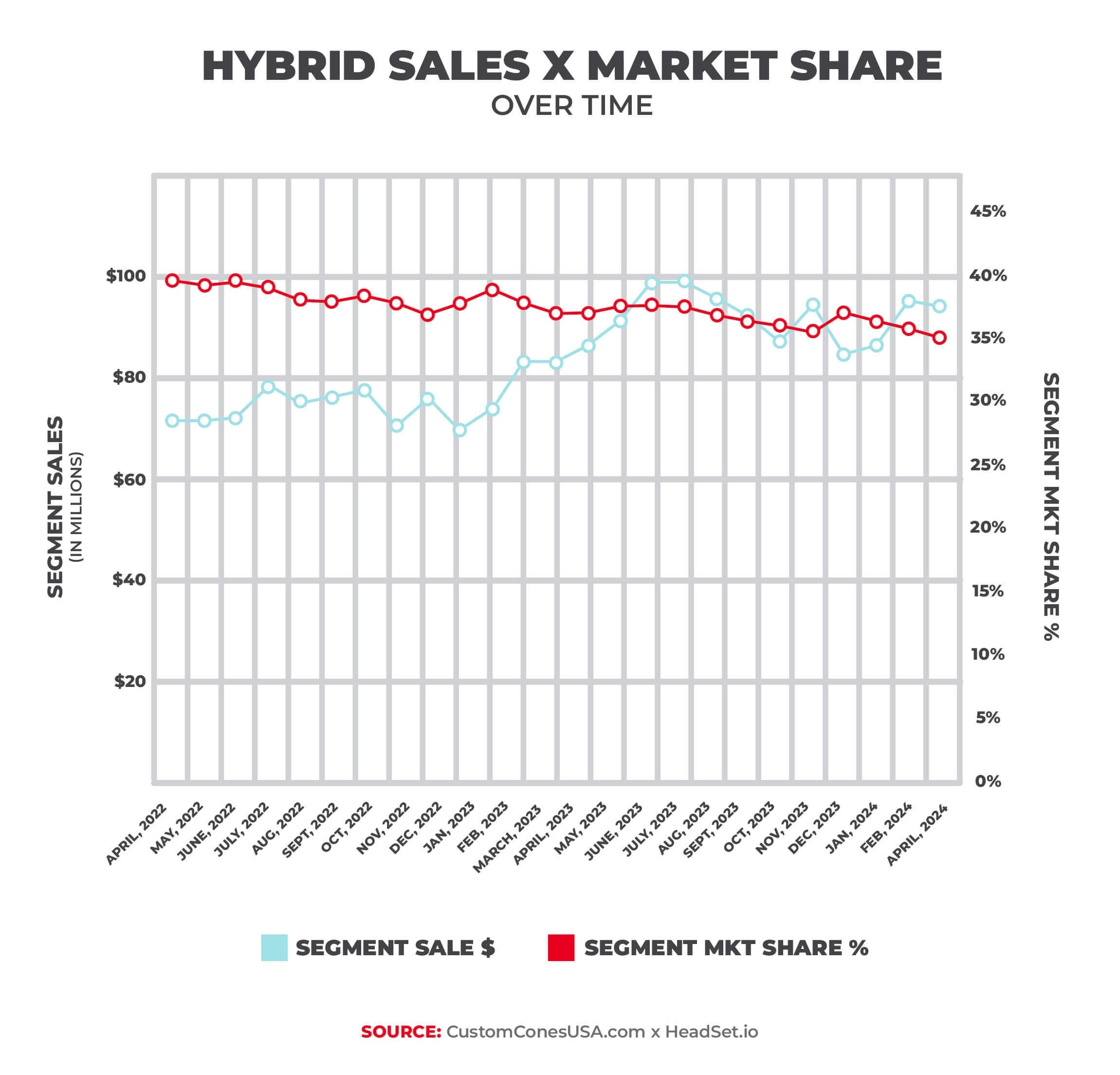

Along with infused pre-rolls, the other category driving national sales is the “Hybrid - Single Strain” pre-roll, though its market share has slipped a little over the past two years as infused pre-rolls have grown.

In April 2024, the “Hybrid – Single Strain” category accounted for 37.8% of the category’s sales, down slightly from 41.6% in April 2022. However, despite losing a few points of market share, the category grew considerably in raw numbers, with total unit sales jumping from 6.78 million units in April 2022 to 11.88 million units in the same month this year.

Additionally, total sales revenue in the category jumped from $69.7 million to $90.66 million over the same time frame, even as the average price dropped from $10.29 to $7.63. And, as noted, house brand single-strain hybrids like those offered at Likewise Cannabis in Oklahoma remain the top selling pre-roll product in the country.

Multi-Packs

The rise of multi-packs is another pre-roll trend we’ve been following for a few years now and like infused pre-rolls, it shows no signs of slowing.

While Headset does not track “multi-packs” as a specific category of pre-roll data, it does track package size, as well as the top selling products. While single-gram packages are still the top-selling size (by far), multi-pack sales continue to grow.

Aside from the house brand (hybrid, single strain) products that lead all sales, the next nine products in the top 10 are all 5-packs of half-gram pre-rolls (total weight 2.5 grams). In total, 60% of sales come from the 1g and 2.5g package size categories.

Additionally, products 11-20 on the sales charts are also multi-packs, with the majority being 5-packs and the remainder being 10-packs of mini Dogwalker cones, with a total weight of 3.5 grams.

State Market Outliers

While the numbers above reflect national trends, the cannabis industry, of course, is in actuality a collection of multiple state markets, each with its own unique regulations, sales cycle and top products, resulting in a few distinct notes within individual states.

For example, a handful of states tracked by Headset show the top two categories flipping, with the Hybrid - Single Strain segment ahead of the Infused/Connoisseur segment, or only recently changing.

For example, in Nevada, while infused pre-rolls are currently the top segment, it did not overtake single strain hybrids in sales until January of this year.

In other, younger markets, such as Illinois, Massachusetts, Missouri and Maryland, the single strain hybrid pre-roll remains the top segment, though in each of those states, sales of infused pre-rolls are catching up as the market matures and the cost of infused pre-rolls continue to drop as concentrate supply increases.

In Missouri, where the recreational market opened in February 2023, single strain hybrids constitute nearly 55% of all sales in April 2024, but the infused segment has grown from 3.1% of market share (about 8,000 units sold for a total of about $221,000) at opening to 27.7% in April (183,000 units totaling $3.5 million).

In Illinois, infused pre-rolls have grown from 11.7% of sales ($1.7 million) in April 2022 to 33.3% of sales ($6 million) in April 2024. Massachusetts, meanwhile, while still dominated by the single strain hybrid, has seen infused products grow their market share from 11.7% to 33.3% in the past two years.

Maryland, which only opened its recreational market in January 2023, is the exception that proves the rule, with infused pre-rolls coming in fourth among pre-roll products in the state behind single strain hybrid, single strain indica and single strain sativa products. In fact, the market share for infused products has actually dropped in Maryland, going from 17.8% at opening to just 4.9% in April 2024 after reaching a peak of 20.8% in May 2023.

Meanwhile, among mature markets, Oregon and Colorado remain outliers with single strain hybrids continuing to outsell infused products, though in both cases, the market share of infused products continues to grow, particularly in Oregon where the infused market share jumped from 16.4% in April 2022 to 24% this year.

Final Thoughts

As the cannabis market continues to grow, it is important for producers to understand the latest trends in the marketplace to ensure they are offering the products that consumers want to purchase.

Nationally, infused pre-rolls continue to lead the way for the entire category, with consumers gravitating toward the higher potency and increased flavor the products deliver. Customers are also continuing to flock to multi-pack products, preferring 5-packs of half-gram pre-rolls, particularly of infused products.

However, because each state is its own unique market, the top-selling pre-roll product in some states – particularly new markets where the supply of concentrates is lower – continues to be the 1g single strain hybrid, a standard that all pre-roll brands should be sure to carry, though infused products continue to grow their market share.

Manufacturers would be wise to jump on the infused trend now, particularly in young markets, to establish their brand ahead of the coming surge in infused sales.

Pre-rolls remain the hottest products in the cannabis space, increasing its market share even through the first four months of the year. But some categories continue to do better than others.