Projecting Future Trends in Cannabis Pre-Rolls

Posted by Custom Cones USA on Jun 25th 2024

The pre roll segment has undoubtedly been one of the biggest success stories in the cannabis industry.

What was once a niche product has exploded into the third largest cannabis category, raking in over $1.3 billion in sales and capturing a 14.6% market share across tracked markets in just the last 12 months alone.

With 131.7 million pre roll units sold in that time, this convenient and ready-to-consume format has clearly struck a chord with cannabis consumers.

But the pre roll boom is just getting started. Analyzing recent growth trends and emerging market dynamics points to an even brighter blazing future for this red-hot category in the years ahead.

All pre roll data was pulled from Headset.io, which is sourced from consumer transactions in 12 states: Arizona, California, Colorado, Illinois, Massachusetts, Maryland, Michigan, Missouri, Nevada, New York, Oregon, and Washington.

The Pre Roll Market's Accelerating Ascent

While it’s no secret that the pre-roll market has experienced major growth, you may be surprised at just how meteoric its rise has been in the last few years.

Both sales revenue and market share percentages have charted an upward trajectory over the past half-decade across major markets.

Pre roll market share has increased every year since 2020, when it held just a 9.8% market share among tracked markets. That figure has steadily climbed ever since, reaching 13.8% in 2023. It now sits at a robust 14.9% year to date as of June 2024.

More staggering has been the sheer dollar sales growth. Total pre roll revenues soared from $469 million in 2019 all the way to $2.7 billion in 2023 – a nearly 6x increase in just a four-year period. Unit sales skyrocketed as well, from 56 million pre rolls in 2019 up to 247 million units in 2023.

As impressive as those numbers are, the category is still just hitting its stride. With cannabis continuing to gain legal and social acceptance, sales are projected to keep accelerating.

Projecting the trajectory forward, the pre-roll market could potentially exceed $5 billion in annual sales by 2030 based on a variety of factors that we’ll discuss later.

Connoisseur & Infused Pre Rolls Driving Premium Demand

Riding the wave of pre roll popularity has been the rapid growth of the "Connoisseur/Infused" pre roll subcategory. Representing pre-rolls infused with concentrated cannabis extracts or featuring ultra-premium flower, this upscale segment overtook traditional "Hybrid - Single Strain" pre rolls as the No. 1 seller in 2023 with a staggering $1.12 billion in sales.

The rise of connoisseur and infused pre rolls aligns with the overall premiumization trend in cannabis, as consumers gravitate toward specialized, elevated consumption experiences.

Pre rolled cones of all kinds lend themselves perfectly to experimentation with exotic flavor infusions, amplified potencies, and ultra-craft cannabis strains.

These enhanced pre rolls come at a premium price point though. The average price of a pre roll since 2019 sits at $5.40 in tracked markets, whereas infused pre rolls command nearly double the price at $10.46 per unit.

The "Connoisseur/Infused" pre-roll segment will continue pushing the boundaries of premiumization and command luxury pricing, although prices vary wildly from state to state.

California, for example, commands an average price of $19.20 for infused pre rolls compared to more value-focused markets like Michigan where an infused pre roll will only cost you an average of $10.23.

As innovation accelerates to bring us new infusion technologies, exotic strain crosses, and ultra-premium ingredients/formulations, brands will have more runway to elevate pricing for their most premium pre-roll offerings.

Since 2019, infused pre rolls have held an impressive 34.4% average market share of the pre roll category across tracked markets. Their share has been rapidly accelerating in recent years, hitting 41.5% in 2023 and an even higher 44% so far in 2024.

This trajectory suggests infused pre rolls will likely continue aggressively capturing additional market share from conventional pre roll segments in the years ahead.

By 2025, infused pre-rolls could represent 50% or more of total pre roll category sales as they continue rapidly outpacing conventional pre roll growth.

Looking further out, infused versions may even approach a 60-65% market share as they potentially become the dominant pre roll subcategory. This would make them the clear primary driver of overall pre roll pricing trends and the segment's revenue performance.

Infused Pre Roll Pricing Paradox

While the rise of infused and connoisseur pre rolls represents an exciting premiumization play, it also presents an interesting pricing paradox for the pre-roll category overall.

Despite this new wave of ultra-premium, higher-potency, and higher-priced infused offerings, average pre roll prices across all segments have remained relatively stable, and even dipped slightly in 2024 to $5.20 per unit compared to the peak of $6.06 in 2022.

Newly operational legal markets like Missouri and Maryland have ushered in an influx of value-priced pre roll offerings aimed at gaining share in these emerging customer bases.

More mature markets have also seen increased pricing competition as the pre-roll segment becomes more saturated. These dynamics create downward pricing pressure that value-focused brands are capitalizing on.

So while luxurious $10+ infused pre rolls are elevating the category's ceiling, emerging markets, competitive pressures, and a pursuit of balanced revenue optimization are keeping the overall pre roll category's average price point in check.

A realistic projection could see overall pre-roll prices stabilizing in the next few years at around $5.00 to $5.50 per unit as markets mature and higher-priced luxury options increase their market share.

Brands will continue balancing premium and value tiers, but the premiumization afforded by infused pre rolls will gradually elevate total category pricing in a sustainable manner aligned with market dynamics.

Legalization's Expansive Growth Catalyst

Continuing cannabis legalization at the state level across the U.S. remains the overriding catalyst projected to propel the pre roll category to even greater heights over the next decade. More legal markets mean more consumer access and higher overall sales.

Several states are emerging as fresh sources of pre-roll market growth.

New YorkNew York, which legalized in 2021, is poised for an explosion in pre roll sales from its underwhelming $20 million market in 2023. As of June 13, pre roll sales in New York are at $35.3 million for the year.

Despite the slow rollout of cannabis in the Empire State, with a population of 20 million, New York’s pre roll market could reach $100-$150 million or more annually over the next few years as more licensed businesses enter the market.

DelawareFor Delaware, its tiny population of just over 1 million residents presents a more limited initial pre roll opportunity compared to larger new markets.

If Delaware's market trajectory roughly mirrors the initial years of a similarly population-dense East Coast state like Maryland (population 6.2 million), we could conservatively estimate first-year pre-roll sales of $3-$5 million in Delaware. This accounts for Delaware having just one-sixth of Maryland's population base.

However, Delaware's geographic positioning could allow it to capture some cross-state tourism traffic from the major East Coast population centers like Philadelphia, which has yet to legalize recreational cannabis. This could potentially inflate initial demand and push first-year pre roll sales toward the $5-$8 million range.

MinnesotaMinnesota, with a population of 5.7 million (comparable to Colorado), may see pre roll revenues start around $30-$40 million in year one based on Colorado's trajectory. Within a couple years, Minnesota's pre roll market could then expand to over $100 million as consumer demand builds, mirroring Colorado's current $121 million market.

HawaiiAs for Hawaii, its recent approval to allow medical pre rolls presents an initially niche opportunity. With a small medical cannabis patient base of only 34,000 as of 2022, Hawaii's first year of pre roll sales may be fairly limited compared to adult-use markets.

However, it establishes an important regulatory foothold that could foster future growth if Hawaii opts to allow adult-use sales down the road, given its total population of 1.4 million and strong tourist market.

OhioOhio is a key state to watch as recreational cannabis sales are expected to begin soon. Although there is no set kickoff date, experts predict dispensary doors to open as soon as this month.

As the seventh-largest state in the U.S. with a population of nearly 12 million, the emergence of Ohio as a cannabis market could play a pivotal role in the growth of the pre-roll category.

We can draw parallels with Illinois, which has a similar population size of 12.5 million, to look at the potential growth of the Ohio market. Illinois pre roll sales have grown from $129.8 million in 2021 to $191.9 million in 2023.

Given these figures, Ohio's pre roll market holds significant potential. If Ohio follows a similar trajectory, it could see sales surpassing $150 million in the next few years.

FloridaWhile voters will weigh in on cannabis legalization in states such as Nebraska and South Dakota later this year, all eyes will be on Florida come November.

As the third largest state in the U.S., Florida has the biggest potential for a pre roll windfall when cannabis legalization goes up for a vote on election day. Despite political opposition and a required supermajority of 60% of voters to pass, recent polling shows this ballot initiative has strong support among Floridian voters.

If it passes, Florida's 22.6 million population suggests a legal pre-roll market worth $100-120 million in year one, potentially growing to rival California's $750 million pre roll market down the road.

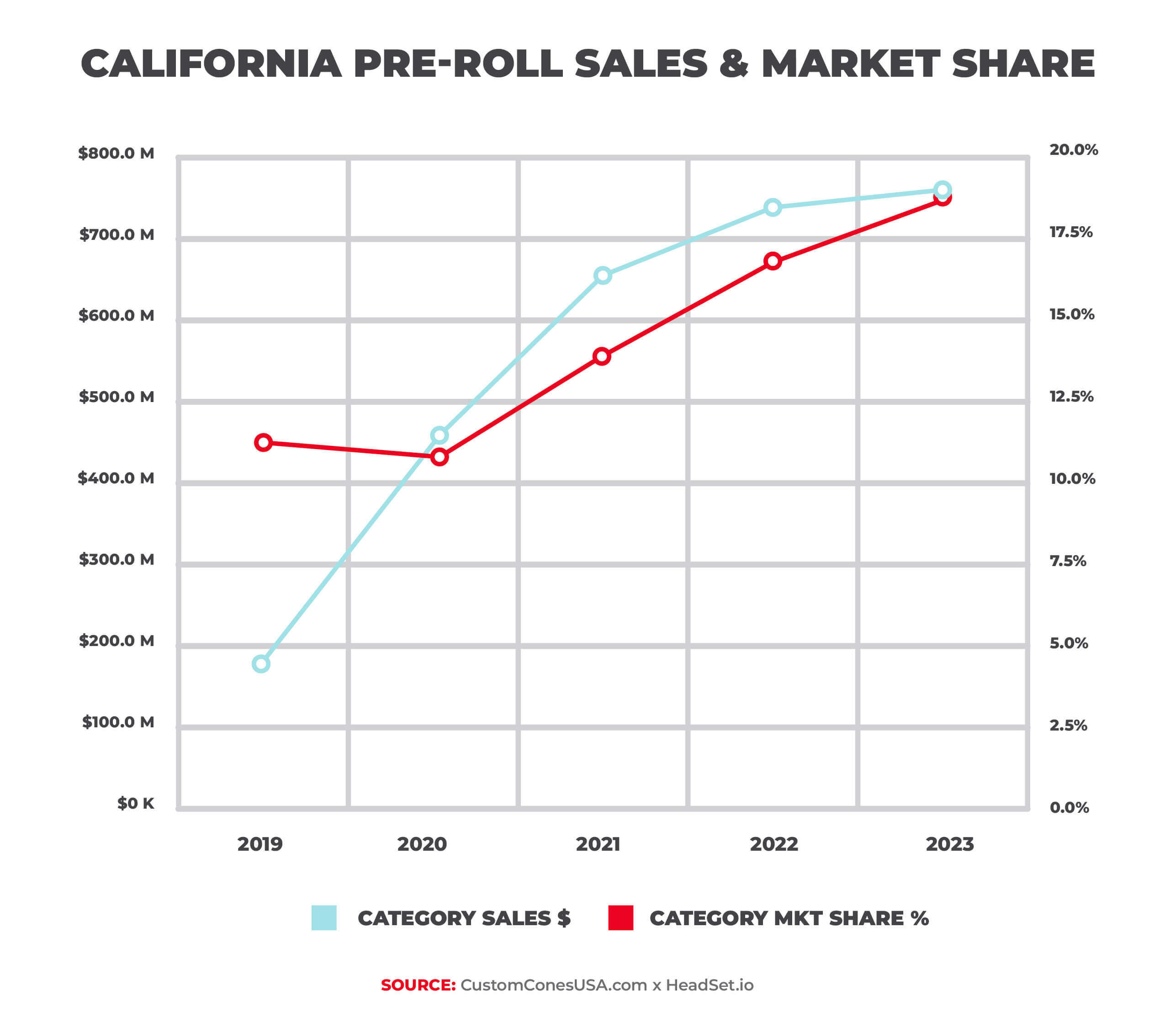

Here is a graph showing California’s stratospheric growth in the pre-roll market:

While we don’t quite expect Florida to become the new gold standard for pre-roll markets, even conservative estimates would put the sunshine state in the $400-$500 million annual range as a pre roll market once it matures.

Pre Roll Market Projections

So where does the pre roll market go from here?

Looking at all these factors, let's forecast what the state of the pre-roll industry will look like in the future.

2025 Outlook:- Market Growth: We expect the pre roll market to continue its upward trajectory, potentially reaching a 17-18% market share by 2025. This would translate to approximately $4 billion in sales.

- Infused Pre Rolls: The demand for infused pre rolls will likely grow, maintaining their premium price point. As consumer preferences evolve, we might see even more innovative products entering the market.

- Legalization Impact: New markets such as Ohio, Florida, and others could significantly boost pre roll sales. Florida, with its large population, could become one of the top markets, potentially rivaling California's sales figures.

- Market Maturation: By 2030, the pre-roll market could stabilize at around 20% of the total cannabis market, with annual sales potentially exceeding $5 billion.

- Product Diversification: The variety and quality of pre rolls, especially infused ones, will likely expand. As technology and production methods improve, we can expect more sophisticated and potent products.

- Widespread Legalization: With more states likely to legalize cannabis by 2030, the market will see a broader customer base. States like South Dakota and Nebraska, once legalized, could add significant sales volume.

The Unstoppable Ascent of Pre Rolls: Cannabis' Crown Jewel Category

The future is blazing bright for pre rolls as this consumer-friendly, tectonically shifting category rides a tidal wave of growth in the decade ahead. Cannabis brands and retailers need to be ready to capitalize on this red-hot segment's upward trajectory.

As much as savvy brands have propelled pre rolls' ascent, regulatory reforms and policy momentum have provided the real rocket fuel. The past five years have seen pre roll sales blossom in new adult-use markets like Illinois, Arizona, and New York as legacy medical states like Florida, Ohio, and Minnesota also embraced the category. Legalization's snowballing progress powers pre rolls' perpetual expansion into fertile new territories hungry for turnkey cannabis experiences.

Whether the frictionless experience for new consumers, the premiumization play for seasoned connoisseurs, or the unbridled innovation canvas for brands, the pre roll appears poised to reign as cannabis' crown jewel format for the foreseeable future.

The pre roll segment has undoubtedly been one of the biggest success stories in the cannabis industry.What was once a niche product has exploded into the third largest cannabis category, raking in over $1.3 billion in sales and capturing a 14.6% market share across tracked markets in just the last 12 months alone.