Michigan Pre-Roll Market Overview

Posted by Custom Cones USA on Jun 12th 2024

Put simply, there is no hotter pre-roll market in the country than Michigan.

While California and its massive populations still lead the country in total pre-roll dollar sales, consumers in the Great Lakes State buy nearly double the number of pre-roll products as their counterparts in Cali, taking advantage of low prices and an innovative marketplace.

It’s a major market that is slowly becoming the pre-roll capital of the industry and it still has room to grow. So let’s take a deep dive into what the numbers – and those on the ground – tell us about the Michigan pre-roll sector.

The Numbers

According to data provided by cannabis analytics company Headset, over the first five complete months of 2024, pre-rolls accounted for 18% of total cannabis sales and 35% of total units sold at Michigan dispensaries – or "provisioning centers" as they are known in the state.

The sector has accounted for more than $243 million dollars and nearly 38.7 million units sold through May of this year, putting it in a tie for second place in revenue (with vape products and behind flower) and first in unit sales.

A closer look at the year-over-year numbers shows even more impressive growth, with pre-roll sales in Michigan passing the $50 million per month in March 2024. This May, sales in the category rose to $52,676,830. That’s a 138% year-over-year increase from May 2023’s sales total of $38,157,792, which itself was an 87.6% year-over-year increase from May 2022.

In fact, every month this year has seen a huge year-over-year growth ranging from 138% in May to an astounding 156.4% in February.

Unit sales have seen massive growth as well. In May, more than 8.8 million pre-roll units were sold, nearly doubling May 2023’s total of 4.7 million units, which itself was more than double the May 2022 total of 2 million units.

The increase in sales may be in part to the drop in the average cost of a pre-roll in the state over the same time period, going from $9.96 in May 2022 to $8.12 in May 2023 and an industry low of $5.95 by May 2024.

The increase in sales may also be in part to producers and manufacturers in the state consistently releasing new pre-roll products, with 1,156 new pre-items introduced to the marketplace in the past 90 days alone.

The Details

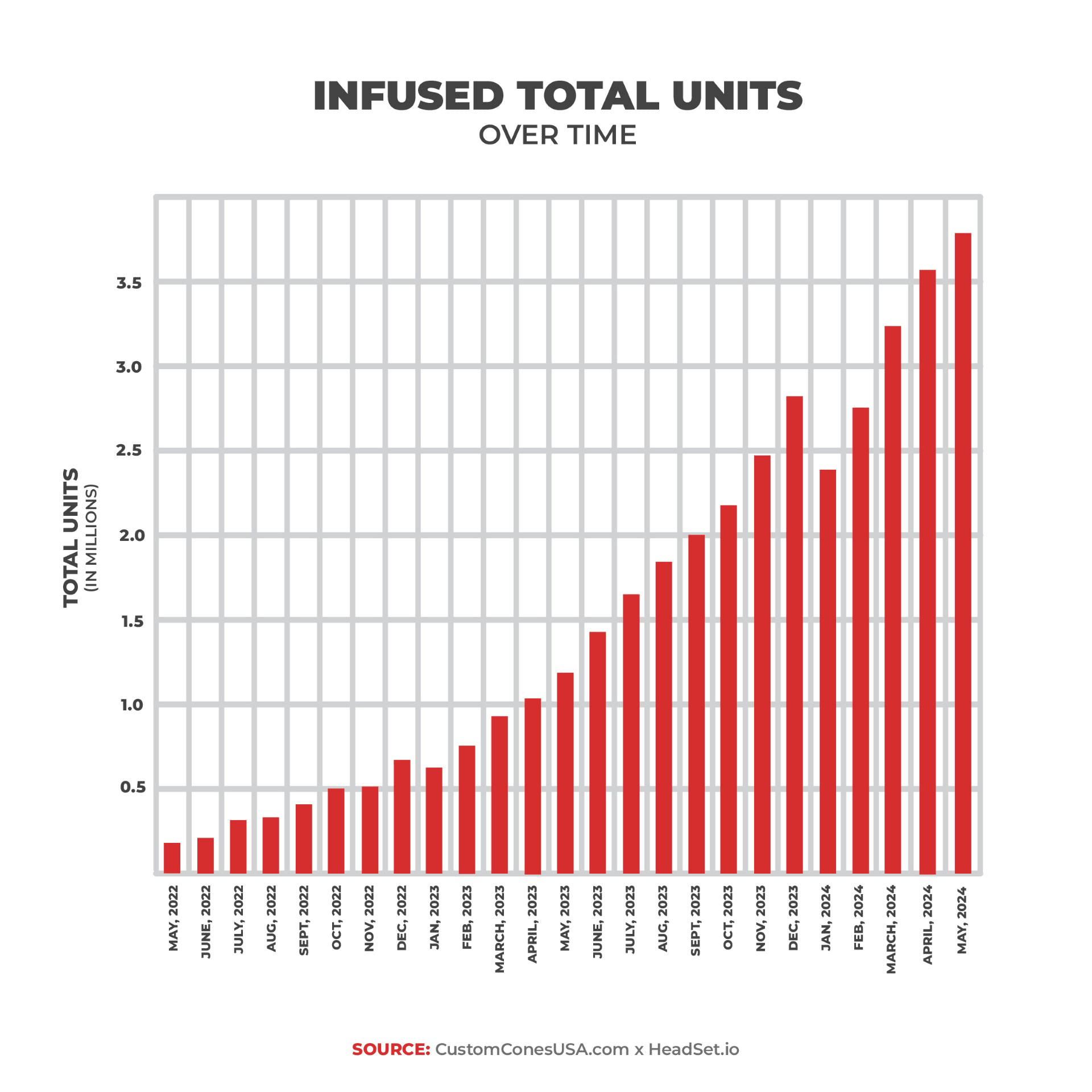

Like many states, the top category for pre-roll sales in Michigan is the “Infused/Connoisseur” category, featuring pre-rolls containing both flower and a concentrate. Nearly 3.8 million infused pre-roll products were sold in Michigan in May 2024, the highest ever in the state, giving the category a market share of 62% of pre-roll products sold.

The entire category has seen remarkable growth. Just under 1.2 million infused units were sold in May 2023 and only 186,539 were sold in May 2022, an increase of more than 1,728% over two years. During the same time frame, the cost of an average infused pre-roll has dropped from $15.31 to $6.83.

Single strain hybrid pre-rolls are the second most popular category among pre-roll buyers in Michigan, though where infused pre-rolls has seen constant growth, the "Hybrid - Single Strain" category has remained relatively consistent over time.

For example, in May 2024, nearly 3.9 million units were sold for a total sales revenue of about $15.5 million. In May 2023, about 2.6 million units were sold for a total revenue of just under $14.9 million. The category market share over the same time period, however, dropped from 38.9% last year to 29.3% in 2024, reflecting the growth of the infused category.

The Products and Brands

While the top pre-roll product sold in Michigan is a house brand single strain hybrid (meaning the brand produced by and for the dispensary), the next 19 top-selling products are all infused.

The top selling brand in the state, by far, is Jeeter, pulling in a total of more than $105 million over the past two years compared to $72.1 for the second-best-selling brand, Cali-Blaze. STIIZY comes in third. It should be noted though that the average price of a Jeeter pre-roll is more than $25, which drives up the overall total.

When looking at May 2024, the most recent full month of data, Jeeter and Cali-Blaze retain the two top spots at $7.6 million and $5.2 million in sales, respectively. However, for the month, the 4 top-selling pre-roll products in Michigan by revenue were all infused products produced by Simpler Daze.

Distro 10’s Watermelon Gummy Bears Infused Pre-Roll, with an average price of $497, moved the most units in May 2024: 118,436.

The View

All in all, it adds up to the hottest pre-roll market in the country. But that doesn’t mean it’s an easy one.

"Michigan is a challenging market," says Jacon Roland, Director of Marketing for Loud Labs, makers of the Doinks brand of infused pre-roll blunts available in Colorado, New Jersey and Michigan. "A lot of people look at the top line numbers and get very excited, but it is a very, very competitive market. There's a ton of operators, a ton of growers and a really strong legacy market still in play."

"There are big numbers to be had, but it is highly competitive," he says.

Roland believes the Michigan pre-roll market is so strong because consumers put convenience and a low price point first, unlike in his brand’s home state of Colorado, where customers are more drawn to high quality flower, something he attributes in part to the relative ages of the two markets, as well as the average income levels of both states.

"The Michigan consumer is very price driven," he says. "What's driving the whole pre roll market is it's just that they’re a cheap product you can grab and go and Michigan has just embraced that. It is one of the most price sensitive consumers I've seen across the entire industry."

Roland says he sees the next step in Michigan’s pre-roll evolution to be the inclusion of higher-quality flower in pre-roll products as producers perfect their cultivation techniques to help bring the prices of those products more in line with what Michigan consumers are looking for.

He also expects to see more innovation in the marketplace, with companies doing what they can to stand out, be it flavors, filter tips or methods of infusion like the "hash hole," among other things.

"That is the advantage of very competitive markets," he says, "it forces innovation."

What he doesn’t see is the pre-roll market cooling off at all in the Great Lakes State.

"I think the pre-roll is going to continue to do well," Roland says. "I think there's still a lot of innovation to come about in the pre roll space and I'm excited where it goes. It’s a really great proving ground because it's so competitive."

Final Thoughts

The growth in Michigan’s pre-roll market over the past years has been beyond impressive as the state has become the best market in the country for the category and shows no signs of slowing down.

But as the industry matures and shifts, customer interest often changes and shifting prices brought on by changes in the cannabis supply chain can lead to new innovations and producers need to keep on eye on the shifting trends in their state.

Contact the Pre-Roll experts today to see how to prepare your pre-roll line for the next step and how to ensure that your brand dominates this exciting and growing market.

Put simply, there is no hotter pre-roll market in the country than Michigan.