Arizona Pre-Roll Market Overview

Posted by Custom Cones USA on Aug 1st 2024

In a state where the sun blazes year-round, the cannabis industry is matching the heat with scorching growth in the pre-roll market. Arizona has seen an explosion in pre-roll sales, surpassing $200 million in the last 12 months.

Since recreational use became legal in 2021, the Grand Canyon State has become a pivotal player in the cannabis industry, showcasing remarkable growth and expansion even amid broader market downturns.

Let’s explore the factors driving Arizona's pre-roll market growth, the emerging trends, and what this means for the future of cannabis in the state.

*All pre roll data was pulled from Headset.io, which is sourced from consumer transactions in 13 states: Arizona, California, Colorado, Florida, Illinois, Massachusetts, Maryland, Michigan, Missouri, Nevada, New York, Oregon, and Washington.

Table of Contents

Arizona's Meteoric Rise in the Pre-Roll Market

When diving into the data on Arizona’s pre-roll market, one thing is clear: business is booming. The maturation of the legal cannabis market and rising consumer demand has resulted in a perfect storm that is catapulting Arizona’s pre-roll market to unforeseen levels.

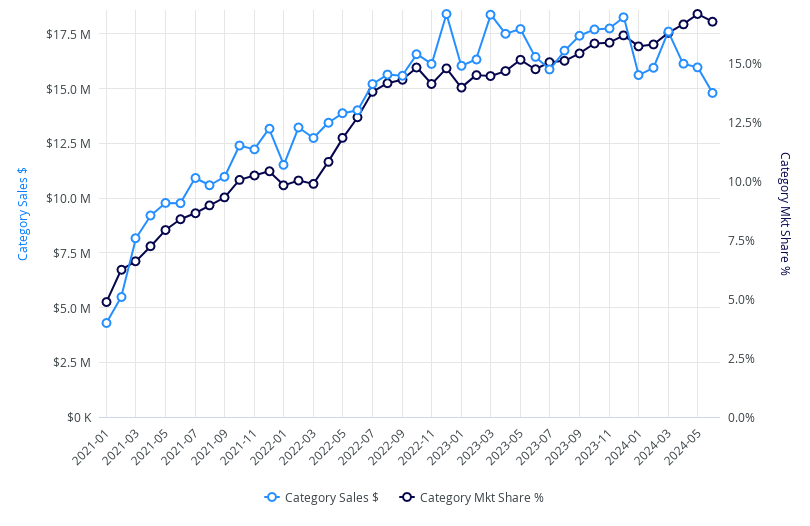

Arizona experienced more than $200 million in pre-roll sales from July 2023 to June 2024, ranking fifth among 13 tracked U.S. markets. Since the recreational cannabis market went live in January 2021, monthly pre-roll sales in Arizona have increased from $4.3 million per month to $15.1 million per month in June 2024.

While monthly pre-roll sales peaked at $18.4 million in December 2022, pre-roll sales have been remarkably consistent – reaching at least $15.8 million per month in 2023 and 2024.

Arizona’s thriving pre-roll market is part of an overall steady cannabis industry in the Grand Canyon State. Arizona cannabis sales have reached at least $87 million per month since legal cannabis sales began in January 2021.

As is the case in many other states, pre-rolls are the third biggest category behind flower and vapor penspre-rolls are the third biggest category behind flower and vapor pens – as they’re a convenient and popular add-on for consumers purchasing other cannabis products.

Market Share Expansion

There’s no denying the robust demand and acceptance of pre-rolls among Arizona consumers.

Since Arizona entered the legal cannabis market, more than 49.3 million pre-roll units have been sold, accounting for 24% of all cannabis products sold in the state through June 2024.

Additionally, the market share of pre-rolls in Arizona has seen a steady increase, rising from 4.9% in January 2021 to 16.7% in June 2024.

Pre-roll market share has been rising even faster in the past year. In June 2023, pre-rolls held a 14.7% market share and have steadily increased to an average of 16.4% for the first six months of 2024. This growth is indicative of the shifting consumer preferences towards pre-rolls, driven by their convenience and evolving product offerings.

*Arizona Pre-Roll Sales & Market Share 2021-2024 (source: Headset.io)

Rise of Infused Pre-Rolls

One of the most striking trends in Arizona's pre-roll market is the dominance of infused pre-rolls.

The 'Connoisseur/Infused' segment overtook the 'Hybrid - Single Strain' category in June 2022 and has maintained its lead ever since.

Infused pre-rolls, made by combining the flower with a cannabis concentrate, are known for their enhanced potency and flavor profiles and have captured the market's attention, contributing significantly to the overall sales. The data supports this, showing that in Arizona, infused pre-roll sales grew from just $490,000 in January 2021 to a staggering $9 million in June 2024.

The increasing sophistication of consumers has led to a demand for more potent and diverse products. Infused pre-rolls offer a richer and more intense experience that establishes infused pre-rolls as a premium product, driving consumer interest and sales.

*Arizona Pre-Roll Segment Sales 2021-2024 (source: Headset.io)

Price Trends

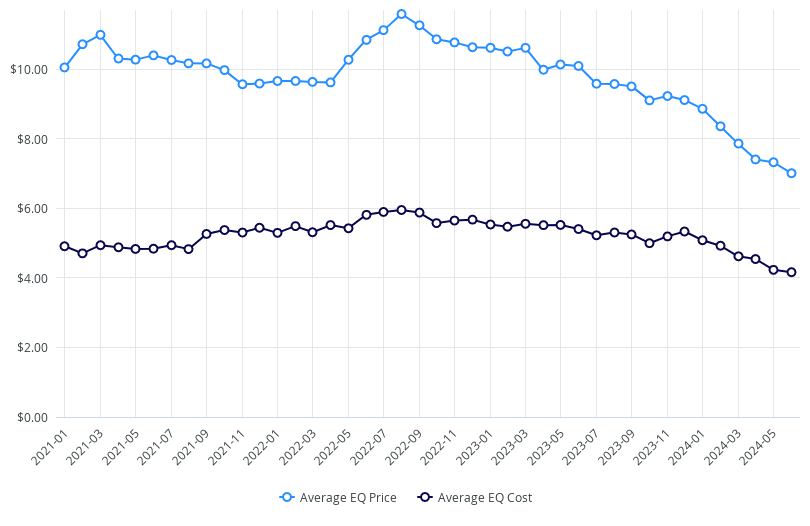

Despite the rising sales revenue, the average equivalent (EQ) price and cost of pre-rolls in Arizona have seen a downward trend.

The average pre-roll price dropped from $10.62 in January 2023 to $7.01 in June 2024. Similarly, the average cost of a pre-roll decreased from $5.54 to $4.17 in the same period.

This decline can be attributed to several factors, including increased competition, economies of scale as the market matures, and the introduction of more cost-effective production techniques.

This is not surprising, however, when you consider that pre-rolls experience a predictable cycle that sees their price decrease in mature markets as supply catches up to demandprice decrease in mature markets as supply catches up to demand. In fact, established markets like Colorado and Washington have some of the lowest pre-roll prices in the U.S.

But don’t fret for cannabis businesses in Arizona. The rising number of pre-roll units being sold has helped to offset the pre-roll price dip and help businesses be as profitable as ever.

*Arizona Average Pre-Roll Price & Cost 2021-2024 (source: Headset.io)

Top Selling Unit Sizes

One of the biggest pre-roll trends in recent years has been the rise of the multi-pack in markets across the U.S., and Arizona is no exception.

While 1-gram pre-rolls are still the highest selling pre-roll product in Arizona, multi-packs are catching up fast. In 2023, 1-gram pre-rolls accounted for 39% of total sales (although 63.9% of total units). In second place was 2.5-gram multi-pack pre-rolls, which accounted for 31.1% of total sales and 11.4% of total units.

| Rank | Normalized Primary Trait | % of Total Sales | % of Total Units |

|---|---|---|---|

| 1 | 1g | 39.0% | 63.9% |

| 2 | 2.5g | 31.1% | 11.4% |

| 3 | 2g | 6.4% | 2.9% |

| 4 | 3.5g | 5.0% | 2.6% |

| 5 | 3g | 4.9% | 2.2% |

| 6 | Other | 4.0% | 4.1% |

| 7 | 0.7g | 3.2% | 7.3% |

| 8 | 1.5g | 2.6% | 1.5% |

| 9 | 1.3g | 1.7% | 1.0% |

| 10 | 0.5g | 0.8% | 1.7% |

| 11 | 1.2g | 0.4% | 0.4% |

| 12 | 5g | 0.3% | 0.1% |

| 13 | 0.8g | 0.2% | 0.5% |

| 14 | 2.4g | 0.1% | 0.1% |

| 15 | 7g | 0.1% | 0.0% |

| 16 | 1.75g | 0.1% | 0.0% |

| 17 | 0.75g | 0.1% | 0.0% |

| 18 | 4g | 0.0% | 0.0% |

| 100.0% | 100.0% |

The popularity of the 1-gram pre-rolls can be attributed to their affordability and ease of use. They offer a single, pre-measured dose at a good price point that is perfect for individual use, making them an ideal choice for both new and experienced users.

On the other hand, multi-packs provide value for money and convenience, especially for social settings or for users who prefer to buy in bulk. Notably, the top 25 selling products by sales revenue for 2023 and the first six months of 2024 were all 2.5-gram multi-pack pre-rolls.

The dominance of infused pre-rolls and multi-packs is further highlighted by the top-selling products in Arizona.

Top Selling Pre-Roll Products in Arizona

- STIIIZY 40's - Strawberry Cough Infused Pre-Roll 5-Pack (2.5g)

- Jeeter Baby Jeeter - Blueberry Kush Infused Pre-Roll 5-Pack (2.5g)

- Jeeter Baby Jeeter - Maui Wowie Infused Pre-Roll 5-Pack (2.5g)

- STIIIZY 40's - Blue Dream Infused Pre-Roll 5-Pack (2.5g)

- Jeeter Baby Jeeter - Watermelon Zkittlez Diamond Infused Pre-Roll 5-Pack (2.5g)

Leading Brands in Arizona's Pre-Roll Market

Several brands have established a strong foothold in Arizona's pre-roll market. The top brands, such as Jeeter and STIIIZY, dominate the market with significant sales figures and a wide range of product offerings. Here are the top 10 brands by sales for 2023 and the first six months of 2024:

- Jeeter - $86,393,746

- House Brand (Dispensary-owned) - $30,771,404

- STIIIZY - $27,075,794

- Tumble - $9,115,451

- Leafers - $7,604,647

- Dutchie - $7,406,202

- Mohave Cannabis Co. - $7,389,348

- 22Red - $7,030,569

- The Pharm - $6,166,780

- DTF - Downtown Flower - $5,959,224

Jeeter has become synonymous with high-quality, potent pre-rolls that offer a premium experience. STIIIZY, on the other hand, is known for its sleek branding and diverse product range, catering to a wide array of consumer preferences.

House Brand, which ranks second in sales, encompasses companies that grow and sell their cannabis products in their own dispensaries. The sheer sales numbers show the profitability of these vertically integrated businesses.

The success of these brands highlights the importance of product quality and branding in capturing market share in a competitive landscape.

What are the Cannabis Laws in Arizona?

If you're looking to capitalize on the growth of the cannabis and pre-roll markets in Arizona, you’ll need to be prepared. Knowing the laws and standards before opening a business in the Grand Canyon State is a must.How to Get a Cannabis Business License in Arizona

For one, businesses must obtain a license. Medical dispensaries require a nonprofit medical marijuana dispensary registration certificate from the Arizona Department of Health Services (ADHS). For recreational sales, dispensaries need a marijuana establishment license.

In Arizona, the only license for cultivating marijuana is the marijuana establishment license, which requires ownership of a dispensary. Essentially, Arizona only offers dispensary licenses for marijuana facilities, but these licenses include options for cultivation through supplementary applications.

Applicants for any cannabis license must be 21+ and comply with state regulations, including detailed operational information and a non-refundable application fee.

Arizona Cannabis Packaging Requirements

Products must meet strict labeling and packaging standards to avoid appeal to children and prevent imitation of food brands.

Cannabis products must be in child-resistant, opaque packaging that is not misleading or appealing to children. Compliant containers or additional opaque packaging at the point of sale are required.

Arizona Pre-Rolls Stay Hot

Arizona's pre-roll market is blazing a trail in the cannabis industry, showcasing remarkable growth and resilience. With increasing market share, dominance of infused pre-rolls, and competitive pricing, Arizona is set to remain a key player in the pre-roll segment.

As consumer preferences evolve and the market matures, we expect continued innovation and expansion in this vibrant sector. For businesses and consumers alike, Arizona's pre-roll market offers a dynamic and promising landscape, brimming with opportunities and potential.

In a state where the sun blazes year-round, the cannabis industry is matching the heat with scorching growth in the pre-roll market. Arizona has seen an explosion in pre-roll sales, surpassing $200 million in the last 12 months.