2025 State of the Canadian Pre-Roll Market Report

Posted by Custom Cones USA on Feb 18th 2025

Despite a drop in overall cannabis revenue in the Canadian market in 2024, Pre-Roll sales continued to grow, helping balance losses in other product categories, and are poised to become the top sales category in the country, eclipsing even Flower, with multi-packs driving growth.

The Canadian cannabis market appears to be entering full maturity, a shift from the growth market experienced in years prior. The nationwide recreational market has now been open for more than 6 years, and while changes in consumer preference in cannabis products may fluctuate within the market, demand for cannabis products may be reaching a point of saturation.

In this report, we take a look at the progression of the Pre-Roll market through 2024, their positioning among product categories available to consumers, Pre-Roll demand by market, segment, product, brand and package size, price and cost trends, and finally 2025 predictions for the Pre-Roll market and consumer.

All data pulled from Headset.io, curators of the largest point-of-sale dataset in cannabis, and all dollar figures are in Canadian Dollars.

Table of Contents

- The 2024 Canadian Cannabis Market

- Pre-Roll Growth in the Canadian Market

- Total Market Pre Roll Sales

- Pre-Roll Price Comparison

- Pre-Roll Product Packaging Size

- Brands Leading the Pre Roll Market

- Product Analysis of the Top Canadian Pre Roll Brands of 2024

- Pre-Roll Preference by Province

- A Look at the Pre Roll Consumer

- Final Thoughts and 2025 Predictions

The 2024 Canadian Cannabis Market

Overall, total cannabis revenue fell 3.27% in 2024 due to a staggering decline in Flower and Edible sales. However, Pre-Rolls continue to grow in sales and units, all but assuring their ascent to the top of the market in 2025 if these trends continue.

While Pre-Roll sales and units sold grew 1.24% and 1% respectively, Flower, the clear market leader in 2023, saw a 9.3% decline in sales and 2.2% fall in market share. The overall market saw a 0.5% drop in unit sales YoY over 2023.

In 2023, Flower led Pre-Roll market share by nearly 4%, in 2024 that lead was only 0.25%, equating to only $11.4 million in sales while in 2023 that number was nearly 14 times the amount; a 92% drop in sales dominance over Pre Rolls. In fact, for 6 months from May to October 2024, Pre-Rolls led Flower in market share, outselling Flower by $33 million during the warm months, peaking in July ’24 with a 3% lead in sales. This can be seen as a consumer preference in convenient, smoke-ready products during the summer months when people are on the go and outside more.

Alberta drove growth in the Pre Roll category with unit sales growing 5.6% and units sold growing 9.5% while small market Saskatchewan also grew 3.5% in sales, though units sold declined by 1%. British Columbia grew only 0.45% in revenue with a 0.53% drop in unit sales while Ontario, the largest Canadian market, saw minor declines in total Pre Roll sales (-0.65%) and larger declines in units sold (-1%) following substantial growth dating back to the opening of the national legal market.

Looking at all other categories, all provincial cannabis sales and nearly all units sold outside of Alberta were down YoY from 2023 to 2024, with a cumulative drop of 5.34% in sales and a 1.5% drop in units sold.

Non-pre roll sales in Alberta grew a modest 1.7% with strong rise in unit sales YoY of 7%. Large market British Columbia saw a 4.2% drop in sales while growing in unit sales by a marginal 0.08%. Ontario’s declines in sales and units sold for both pre-rolls and non-pre-rolls lead tracked provinces, with a decline in non-pre-roll sales at 8.75% equating to a loss of revenue of over $131 million. While a fraction the size of other markets, Saskatchewan too saw a drop in total sales at 2.6% and a 1% drop in unit sales.

The 1.24% growth of the Pre-Roll category in 2024 suggests a plateau in sales after an 11% jump in market share between mid-2022 and mid 2023, though evolving products on the market like infused pre roll multi-packs could continue the trend of modest growth in 2025. This is in stark contrast to trends in non-pre roll categories where sales from 2022 to 2023 grew 7.5% followed by a drop in sales to 2022 levels in 2022.

The data shows that Pre-Rolls, second in market share to Flower by just 0.27%, are the stable-category leaders within Canadian cannabis. Our trend analysis in September 2023 showed Pre Rolls growing in a pattern that could soon make them the top category in the Canadian market, and the trend stands with Flower’s 2024 market sales lead over Pre Rolls dropping from 5.7% to just 0.1%.

Cannabis Category Total Sales and Units Sold Year-Over-Year

Pre-Rolls are far and away the leaders in unit sales, moving 68.7 million units in 2024, accounting for 39% of total units sold, followed by Edibles at a 21% share, Flower at 16.3% and Vape Pens at 12.5%. Both total units sold and sales revenue grew more than 1% for Pre-Rolls, and while seemingly marginal, this accounted for an additional $15 million in sales and 600,000 units moved.

Only Edibles and Vape Pens saw larger unit sales increases in 2024 over the previous year with impressive growth of 6.8% for Edibles and 6% for Vape Pens. While Edibles had the highest jump in units sold YoY, Edibles revenue was down a staggering 12.4% on the year, in sharp contrast to the steady 1% growth in both units sold and revenue within the Pre-Roll category and a 6% increase in Vape Pen sales with revenues increasing 3.3%.

Interestingly enough, while Capsule unit sales were down 5.1%, revenue was up 9.6%, indicating that consumers are buying fewer products but at a higher price point.

Pre-Roll Growth in the Canadian Market

Pre-Rolls strongly hold the top spot in unit sales and are on the cusp of overtaking Flower as the highest-earning revenue category in the Canadian cannabis. However, seasonality appears to affect Pre Roll sales as the average category market share in the warmer months, April - September, was 34% while the colder months of October - March averaged 31.7% market share. We see a historical trend here as well with 2023 showing warmer months at 32.5% and colder months at 30.6%.

The recreational cannabis market opened in 2018 with nationwide legalization enacted by the passage of the Cannabis Act. Through the first 5 years, Pre Rolls were the fastest-growing product category in Canadian cannabis, with sales figures growing 38% YoY from 2022 to 2023. Year 6, however, appears to show the market reaching maturity with sales beginning to plateau, growing only 1.24%. For context, approximately

For example, the American Pre Roll market saw revenues increase nearly 12% between June 2023 and June 2024, which can be explained by new legal markets opening over time. Since all provinces and territories were allowed to begin selling recreational cannabis on October 17th, 2018, it appears that we are seeing a plateau effect due to maturity and saturation in markets over this time with the hyper growth period coming to an end in 2024.

However, even as the overall Canadian market begins to level out, the Pre-Roll category continues to show growth, and we expect it to overtake Flower as the top-performing category in the near future.

Based on the continued growth in total sales and units sold since last our last report in mid-2022, Pre-Roll sales should surpass Flower in 2025. While Pre-Roll sales continue to show growth, Flower sales saw a drop from 45% of total sales in the Canadian cannabis market in early 2022 to 35% by mid-2023, and new data shows the trend continued into 2024 with an additional 14.2% drop in unit sales and 9.3% drop in total sales.

Flower appears to have hit market maturity in 2023 with a slight rise in sales over 2022 followed by a $170 million decline in sales in 2024.

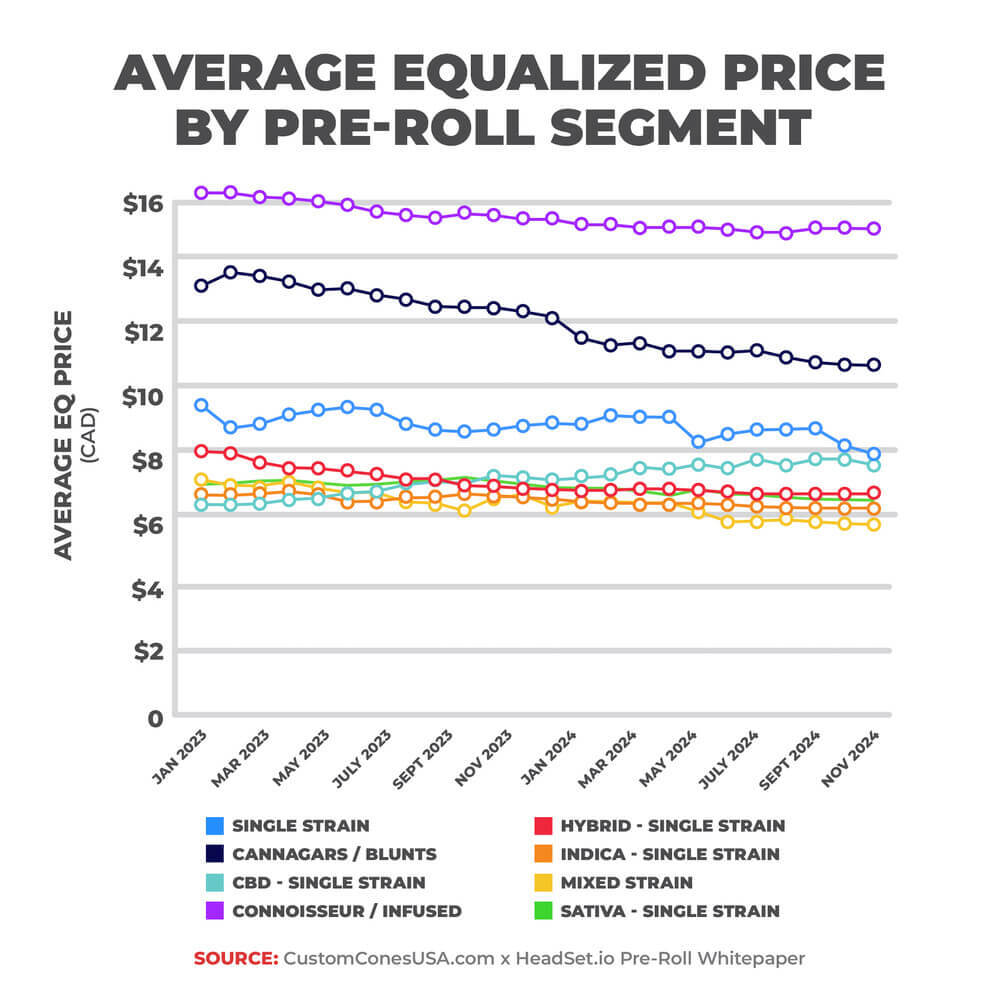

Turning to Pre-Rolls, in 2023 and 2024, the average equalized price, or the price per gram, reversed the prior year’s trends of rising price. Prices increased steadily in 2022, with the average equalized pre-roll price opening at $8.24 in January and rising to $9.17 by the end of the year, an 11.3% increase. The average price for Pre Roll products rose in 2023 with the equalized price of a pre roll in 2022 costing $8.63 and $8.94 in 2023. In 2024, we attributed this rise in price to the increased popularity of the infused pre-roll, which has a higher price point due to the addition of a concentrate to the flower.

According to the data, the price of pre rolls began to plateau in the first half of 2023, ranging from $9 to around $9.10 with an average price of $9.06. This trend turned around mid-May when prices began a steady decline that continued through 2024, with an average pre-roll price of $8.48, a 5% YoY drop from the average price of $8.94 in 2023, lowest average price since the start of Q2 2022.

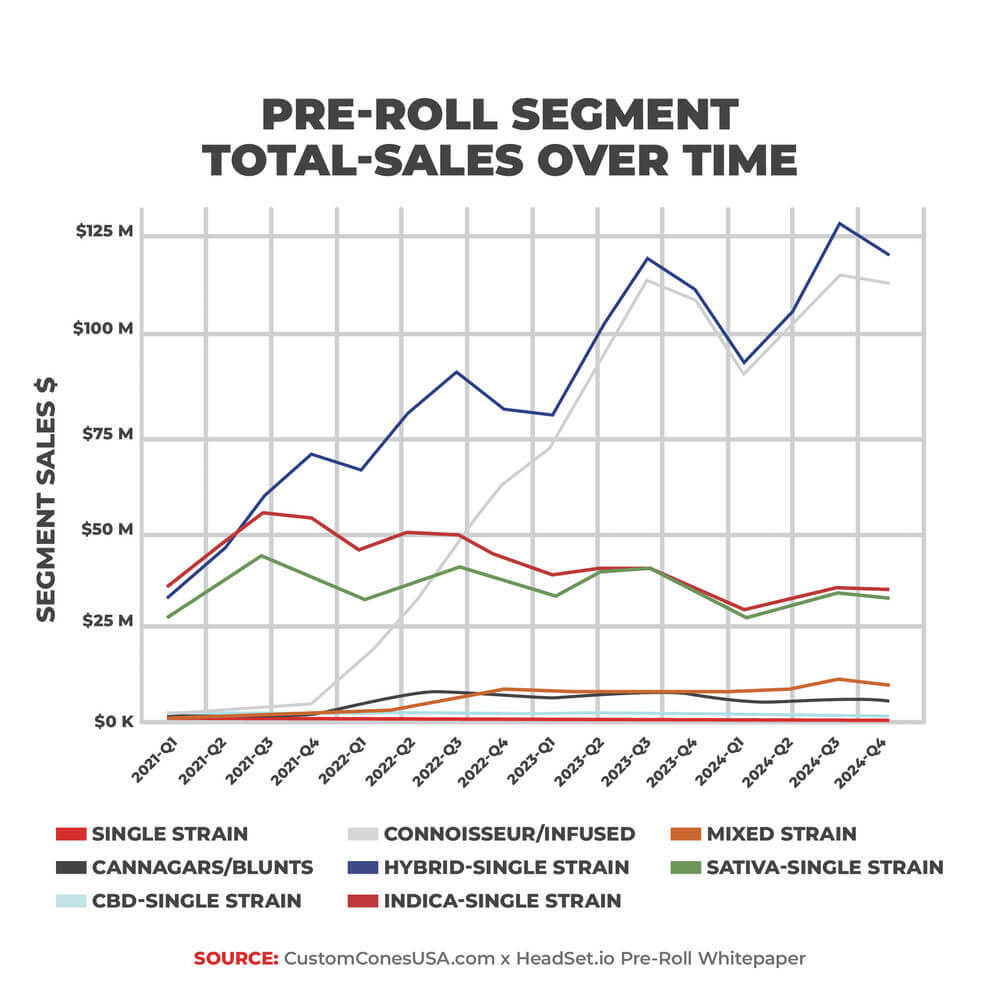

Growth in the Pre Roll market in 2024 was led by the Hybrid - Single Strain segment with sales increasing 8.3%, totaling more than $37 million. Infused/Connoisseur products also grew 6.5%, more than $27 million. Mixed Strain products saw the highest YoY jump in sales at 19%, but with a smaller market share that equates to an additional 6.3% in sales or $6.3 million.

Growth among the Infused/Connoisseur segment can be explained by Health Canada’s passing of Cannabis 2.0 regulations amending the Cannabis Act to allow sales of infused products. Health Canada is the governmental organization that regulates the Canadian cannabis industry. The regulations were passed in October 2019, but there was a two year delay before infused products hit dispensary shelves, during which time the agency clarified rules allowing their production. The addition of cannabis concentrates is an allure for consumers, as the primary factor when choosing a Pre Roll product is potency, followed closely by cost. According to feedback from producers and manufacturers, strain and brand loyalty follow potency and cost as the top drivers of consumer preference for pre-rolls.

Net sales losses among segments in decline totaled $55.6 million but was buoyed by growing segments that increased sales by $71.12 million, a $15.5 million net gain in total sales on the year. The following table shows how each segment changed YoY. The shift in preference is clear, with consumers tending towards Infused and Hybrid - Single Strain pre-rolls, as well as Mixed Strain pre-rolls at a smaller scale. The remaining product segments within the Pre Roll category all saw double-digit drops in sales YoY ranging from 14.4% all the way up to 23.3%.

Pre-Roll Segment Total Sales Year-Over-Year

Additionally, Headset data also shows that in the latter half of 2024, 444 Pre Roll products were released into the market, accounting for 40.4% of 1,100 new products, more than any other category. Flower comes in a close second with 425 new products (38.6%) followed by Vape Pens at 141 (12.8%). Concentrates, Edibles and Beverages followed with a combined 84 new products (7.7%) while the remaining categories, Capsules, Oils, Tinctures and Topicals saw only 6 products launched (1.8%).

Total Market Pre Roll Sales

All tracked provinces saw growth in the Pre Roll category from 2019 through 2023, but 2024 saw this trend slow for the two largest markets tracked by Headset, Ontario and British Columbia. While smaller markets like Alberta, up 5.6% YoY, and Saskatchewan, up 3.5%, saw solid gains in pre-roll sales, British Columbia saw only a 0.45% growth in pre roll sales YoY while Ontario saw a 0.65% drop in 2024.

This is a major trend change from the past 5 years, when YoY pre-roll revenue grew 350% from 2019 to 2020, nearly 100% from ’20 to ’21, 55% in ’22, 40% in 2023, before dropping to 1.2% in 2024. Early growth makes sense with the market opening in 2018, but overall sales will always be capped by demand, which for Ontario and British Columbia may be nearing. Growth cannot be infinite, but the changing landscape of consumer preferences among cannabis products will surely influence producer strategy as consumers turn to the ease and convenience of high-quality pre-roll products.

Hybrid - Single Strain and Infused/Connoisseur pre rolls have been on a similar growth trajectory since 2023 following considerable gains in the years prior. As mentioned, the Infused/Connoisseur segment only entered the market prior to the start of 2022 after the 2019 passage of regulations legalizing the sale of extracts, edibles and topicals, with infused pre-rolls falling into the Extracts category. While sales growth for these two segments were both under 9% in 2024, the growth rate has slowed from the previous year, when the Infused segment grew 157% and the Hyrbid – Single Strain grew 31%.

The consistent growth in sales for infused pre rolls, and at a higher price point due to the added concentrate, is keeping the average price of a Canadian pre-roll relatively high, even as Flower and Concentrate prices continue to fall.

Mixed Strain pre-rolls hold less than 10% of the sales of both Infused and Hybrid - Single Strain, but saw substantial growth in their own right with 46% YoY sales growth ($10.3 million) YoY in 2023, and 19% ($6.2 million) in 2024. Single Strain -Indica and -Sativa pre rolls saw a combined loss of $46.8 million YoY in 2024.

These are trends we will continue to watch in 2025.

Pre-Roll Price Comparison

The average item price for the Pre Roll category of the Canadian cannabis market is $18.43. Alberta is the only province that directly reflects this price with their $18.41 average item price. British Columbia was the only province with average item prices exceeding the national mean, with an average item price of $19.31. Ontario, the largest provincial market, sells pre-rolls at an average price of $18.12, below the national average while the average pre roll price in Saskatchewan sits at $17.30, a full 6.5% under the national average.

Prices for pre rolls in Canada differ drastically from the U.S. with the average pre roll item price in the U.S. costing about half ($9.26) that of a Canadian pre roll product. The reason appears to be a Canadian consumer preference for multi-packs, which carry a higher price point.

Of the top 50 products sold in the Canadian Pre Roll market, 96% were multi-packs. Only two individual pre-rolls landed in the top 50 (37th and 41st), while the multi-pack versions of these products topped the list. Feedback from Canadian producers is clear, the majority of pre-roll brands invest in multi-packs to meet market demand.

While we would expect per item prices to drop as the market matures, this is not the case for most Pre-Roll segments. In fact, the average pre roll item price in 2024 was $0.41 higher than in 2023, again likely due to the rise of infused products.

Pre-Roll Segment Average Unit Price Year-Over-Year

Looking again at the top 50 products sold in the past year, nearly half were infused multi-packs with average equalized prices between $13.54 and $18.24, averaging $14.58. The average EQ price for the remaining non-infused multi-packs in the top 50 is drastically cheaper.

The average equalized price for the remaining Sativa-, Indica- and Hybrid- Single Strain products sit at $6.67, ranging primarily between $3.79 and $9.38. With that said, it makes sense that producers would lean into the trend of consumers preferring infused pre-rolls as the price point is substantially higher than that of non-infused pre rolls and segment sales continue to grow, offering producers a potential higher profit margin.

Retailer margins on pre roll products across segments was very similar in 2024, ranging from 31% to 32%, with profits ranging from $3.50 for Single Strain pre rolls to $8.55 for Mixed Strain and $7.19 for Infused. So while the margins on pre-rolls are similar, profits on individual units in the Mixed Strain and Infused/Connoisseur segments are substantially higher, and with these segments being the top movers by far, producers are smart to focus on these products for the financial upside they provide per unit sale.

Single Strain products saw retailer margin growth of 29%, followed by Mixed Strain products growing 15%. The 15% figure though is much more impactful due to the market share of the Pre-Roll category held by these two product segments. Single Strain sales we’re under $2 million in 2024 while Mixed Strain sales were nearly $40 million.

Of the 4 largest segments, only Infused/Connoisseur products saw a growth in retailer profit margins YoY in ’24 at a modest 3%, while Single Strain THC products (Sativa, Indica and Hybrid) all saw average drops in margins of about 2.5%.

Pre-Roll Product Packaging Size

Canada’s pre-roll consumers prefer multi-packs.

Multi-packs garnered 85% of the Canadian Pre-Roll market share while single 1-gram pre-rolls account for the majority of non-multi-pack sales (75%) with a pre-roll market share of 11%. As noted, 48 of the 50 best-selling products were multi-packs. This is in stark contrast to the American pre-roll market where multi-packs make up only 50% of the market.

These trends were similar in 2023 with multi-packs cornering 83% of Canadian segment sales.

Single, 1-gram pre-rolls accounted for 79% of non-multi-pack sales in 2024, or 13.1% of overall Pre-Roll sales.

The 1.5-gram multi-pack is the most popular package size in Canada by many metrics including sales (27.4%), units sold (25.1%), the number of brands selling this size multi-pack (347), and by the number of individual 1.5-gram multi-pack products available (1,477).

In 2023, there were a total of 3,548 pre-roll products on the market throughout the year, in 2024, that number grew to 4,640. 1,092 additional products were cycled through the Pre-Roll market in 2024, a 31% increase YoY, and of these products, 804 of these were multi-packs, which increased their product offerings by 30% on the year, with single pre-roll products adding 306 new items for a 30% increase YoY.

Certain multi-pack pack sizes lost a substantial share of the Pre-Roll market YoY, with popular 1.5- and 3.5-gram multi-packs losing 8.6% of total sales.1.5-gram multi-packs saw a 7.1% drop in market share while 3.5-gram packs lost 2.3%, and single 1-gram pre-rolls also saw a reduction in market share with a 2.7% drop.

The 2- and 2.5-gram size multi-packs acquired the lion's share of this shift in consumer preference away from 3.5- and 1.5-gram multi-packs, both growing an average of 3.3% YoY. In fact, 4 product segments featuring the 2- or 2.5-gram multi-pack acquired the majority of market share from the 3.5- and 1.5-gram packs:

- 2-gram Hybrid - Single Strain products grew 3.7% in market share

- 2.5-gram Infused/Connoisseur products grew 3.7%

- 2-gram Sativa - Single Strain products grew 1.7%

- 2-gram Indica - Single Strain products grew 1.4%

Producers seem to be leaning into this trend as there was an 84.4% growth in 2- and 2.5-gram products on the market, up 282 from the previous year’s 334. Average Item prices for multi-packs also went down across the board, except the 2.5-gram pack, which saw a $1.62 increase in price, due in part to a large influx of 2.5-gram products in the infused pre-rolls, which carry a higher price tag.

Of the 27 new products in the top 50 products of 2024 by total sales, 55.5% (15) of those were infused 2- or 2.5-gram multi-pack products. The average equalized cost for these products also rose substantially, indicating that higher priced infused pre-roll products are entering the 2- and 2.5-gram multi-pack market. Additionally, 2-gram multi-packs moved an additional 105% units YoY while 2.5-gram packs grew in unit sales by 190%. In total, 2- and 2.5-gram packs sold an additional 7.82 million units in 2024 while the most popular multi-packs, 1.5- and 3.5-grams, saw a 5.1 million unit drop in sales.

Brands Leading the Pre Roll Market

General Admission retained their hold as the standalone leader in the Canadian Pre-Roll market in 2024 as they did in 2023, 250% ahead of the No. 2 brand Shred in total sales, 225% in units sold, and 250% in market share

Redecan remains in the top 5 selling brands of 2024, though holding that spot by less than $3 million. The number nine 2023 pre-roll brand Shred gained 2% market share and an 85% increase in sales to claim the No. 2 brand position in the nation. Black Forty Cannabis rose 2 positions to No. 3 with a 16% rise in sales and 0.3% growth in market share, while 2022 sales leader Redecan trailed the No. 4 brand and recent Canadian market entrant Jeeter by only a few hundred thousand dollars to remain in the top 5 brands by market share for the 5th consecutive year, though far from the sales leaders they were from 2020 through 2022 where they led sales by 40% in ’22 and over 100% in ’21 and ’20.

The following table looks at 2024 growth brands in the Canadian Pre-Roll market, and while not in the ranks of the top 10, these brands have found strong positioning in the market to continue their growth.

Top Pre-Roll Growth Brands Outside of the Top 10 by Total Sales Growth

| MTL Cannabis | $24.5 M | ||

| Fuego Cannabis Canada | $21.6 M | ||

| PIFF | $17.5 M | ||

| Space Race Cannabis | $12.8 M | ||

| Original Fraser Valley Weed Co. | $11.1 M | ||

| Thumbs Up Brand | $11.0 M | ||

| SUPER TOAST | $10.9 M | ||

| Tasty’s Canada | $10.5 M | ||

| Pistol and Paris | $10.0 M | ||

| Sheeesh! | $7.7 M |

General Admissions’ hold on the Pre Roll market in 2023 and 2024 is dominant, and while Shred and Black Forty also saw strong growth, Redecan saw loses over this timespan but remained a top 5 Canadian pre-roll brand. American Pre-Roll sales leader Jeeter, with less than a full year of sales logged, ranked No. 4 ahead of past Pre Roll leader Redecan with 450,000 less unit sold.

Product Analysis of the Top Canadian Pre Roll Brands of 2024

Half of the top 50 products of 2023 were also represented in 2024, with 7 of the top 10 pre rolls maintaining their position among the top 10 selling pre-rolls in the country. Tiger Blood Distillate Infused Pre Roll 3-Packs retained the top position in 2024, with nearly $25 million in sales, 2% of total the entire Pre Roll market. Peach Ringz Kief Distillate Infused 3-Pack in maintained the No. 3 position, with $12.7 million in sales totaling 1.3% of Pre-Roll market share. New product to the market, the Baby-Jeeter Infused 5-Pack, took the No. 2 position in sales with 1.3% market share.

The Tigers Blood 3-Pack outsold the Peach Rings by nearly 100% and the No. 2 product, a 5 pack of Baby Jeeter joints, by 56%.

Positions 4 and 6 also went to new products, the 0.5-Gram 20-Pack of Big Red Pre-Rolls and the Razzilicious Infused Pre Roll-5 pack. 6 top selling products in 2024 weren’t on the market in 2023, and for pre-roll products that did rank in 2023, the majority lost positioning in favor of new items. The number 1 seller in 2023 and 2024, the Tiger Blood Infused 3-Pack, remains the leader of the Pre Roll category, accounting for 2% of Canadian pre-roll sales.

The profile of the top 50 products sold annually has shifted over the last three years, and for those innovating their product lines to meet changes in consumer demand, growth is possible. Indica - Single Strain and Cannagar/Blunts products lost nearly half their positioning in the top 50 products list, with those losses moving primarily to Infused pre-rolls, which grew by 192% for a massive top product gain of $132 million.

Hybrid - Single Strain products also saw average YoY growth of 17% from 2022 through 2024.

While Hybrid - Single Strain products were the only segment in the top 50 products to grow their presence YoY in 2024, Infused products sit comfortably atop the list in sales, up $67.5 million on Hybrid pre rolls. And while $95 million in sales were added to the top 50 products list in 2023, that trend reversed in 2024 with $50 million flowing back to products outside of the top 50, a sign of growing competition.

If the trend in growth continues from last year, an investment in Infused and Hybrid - Single Strain products will meet the demands of consumers better than Single Strain -Indica or -Sativa products.

Feedback from cannabis producers revealed that those who invest in Infused product lines either commit heavily, carrying more than 75% infused pre-roll products, or marginally, carrying less than 15% infused products, with internal infusion being the primary method of infusion. The scale of production greatly influences the method of combining concentrates and flower for infused products, with scaled operations leaning on specialized machinery in production while smaller operations use less automated processes like food mixers or manually by hand.

Looking at the top 50 products of 2024, 23 were Infused, an increase of 5 from 2023. Another 17 were Hybrids, up 2 from last year. Indica remains stable at 5 products, while Sativa products lost half of their presence in the top 50, falling to just 5 products.

Those who adapted their product offerings to market demand saw a rise in sales, while those innovating their product lines less saw newcomers establish themselves as the new market leaders in Pre-Rolls. For example, Redecan, once the long-time sales leader in Canadian pre-rolls, did not have one infused product in the top 50 through 2024, nor did Weed Me, resulting in both losing position to brands offering more popular products.

In 2023, General Admission exploded to the top of the most popular products list with 5 in the top 10 and 3 in the top 5. Of those products, all were infused and 4 were multi-packs, with the single pack version of the No. 3 product sitting 4 spots behind as the 7th most popular pre roll product in the country by sales revenue.

Out of the products General Admission had in the top 10 by market share in 2023, the total gain in sales was a staggering $97 million, their investment in bringing high quality infused multi-pack pre rolls with an average top 10 product price of $25 secured their reign in the market.

In 2024, General Admission’s top 10 Canadian pre-roll products dropped in sales by nearly $40 million, while their products in the top 50 dropped by a total of $50 million, a 29% drop.

Shred was far and away the top product growth leader on the year, increasing top 50 products sales by $23 million, a 475% increase YoY. The majority of brands saw double digit loses, while 8 brands with top products in 2023 lost their presence in the ranking completely. Looking at total sales in 2024, brands represented in the top 50 products in 2023 lost $132 million in top product sales in 2024.

No. 2 Shred and No.3 Back Forty saw growth in 2023 through Hybrid - Single Strain multi-packs sales. Back Forty continued their growth in 2024 through Hybrid sales, while Shred increased revenue though their Infused products.

And finally, Jeeter, with less than one full year on the market, ranked fourth in pre-roll sales with 4 Mini Baby Jeter 0.5-Gram Infused Pre Roll 5-Packs on the top 50 products list. Jeeter had the No. 2 selling pre roll product in the country, $9 million dollars behind General Assembly’s wildly successful Tiger Blood Distillate Infused Pre-Roll 3 Pack containing 0.5-gram pre rolls.

So while Infused joints lead the market in revenue, Hybrid - Single Strains are still the most popular non-infused pre roll among Canadian consumers.

Pre-Roll Preference by Province

Provincial preference of pre-roll products and brands vary, though they hold more similarities than differences. Every top 5 product in each province was a multi-2pack, and the majority of those products were Infused or Hybrid products.

Alberta and British Columbia are near identical with Infused/Connoisseur pre rolls leading sales and Hybrid - Single Strain in second, though only by about 10%. The preference between Indica and Sativa are flipped in each province, with Alberta preferring Indica versus BC’s Sativa preference, but these differences are marginal at about $1 million difference in sales.

The largest market, Ontario, aligned with the smallest market Saskatchewan, preferring Hybrid - Single Strain products over Infused/Connoisseur while aligning with the national trend in exact order, with Indica leading Sativa - Single Strain for the No. 3 position, Mixed Strain at No. 5, Cannagars/Blunts at 6%, and small segments CBD - Single Strain and Single Strain at 7% and 8% respectively. Infused/Connoisseur pre-rolls in Alberta held an 8% sales lead over Hybrids while British Columbia‘s Infused/Connoisseur market held an 11% lead. In Ontario, Hybrids hold a 27.6% sales lead over Infused/Connoisseur products while that number triples in Saskatchewan at 62%, showing a strong investment in Hybrid and Infused pre-roll products in Canada is a must.

General Admission reigns supreme in all tracked markets with more than double the sales of the next competitor in the three largest tracked markets. There is only one case where a province shares a brand in positions 2 and 3 in sales revenue (Back Forty in Ontario and Saskatchewan). British Columbia has Shred followed by Weed Me, Ontario has Jeeter followed by Back Forty, Alberta has Redecan followed by Spinach, and Saskatchewan with Back Forty followed by Encore. In the smallest tracked markets Saskatchewan, General Admission leads Back Forty in sales by 61%.

Below we can see a breakdown of segment preference by province, followed by the top brands and products.

A Look at the Pre Roll Consumer

Males purchase more cannabis than females, making up nearly 2/3 of the consumer market, but that gap varies by generation. The youngest generations having a higher percentage of male consumers with that gap shrinking from Gen Z through Baby Boomers.

Younger consumers are also the largest consumers, with Millennials owning 45% of the market, Gen Z at 28%, Gen X at 19% and Baby Boomers at 8%. Gen Z, the youngest market, accounts for 10% more customers than they do sales, spending less at dispensaries compared to Millennials and Gen Z who both spend an average of 5% more than the market share they control. Baby Boomers were the most in line, with 8% of customers in the market and 8.3% of total sales.

The breakdown of category spend is nearly identical between women and men, with females consuming more Hybrids and fewer Infused/Connoisseur pre-rolls by an average of 2.5%. Overall, the product preference trend among generations is consistent, with Hybrid - Single Strain leading the market by an average of 8%. Whether male or female, younger in life or more experienced, Hybrids and Infused/Connoisseur products dominate the market garnering around 75% of total sales in both generational and gender demographics.

Final Thoughts and 2025 Predictions

The Canadian cannabis market is transitioning from a rapid expansion to stabilizing maturity, with revenue dropping for the first time in the national legal market’s history and unit sales dropping 0.5% as well.

Pre Rolls led the Canadian cannabis market for 6 consecutive months and end the year only 0.25% behind Flower as the dominant category in the market with an $11 million gap in sales. But Pre-Rolls cut the market-share lead of Flower by 92% in 2024, so our 2023 prediction has been supported by the data as well as the 6 month lead in sales during the warmer months of 2024.

With the race tight for the top category in Canadian cannabis, we predict that with the market maturing yet still seeing growth in the pre-roll category, the near closure in total sales between the once dominant Flower product whose loss of market share continues to decline, as well as strong growth in Hybrid - Single Strain and further growth in the high-priced Connoisseur/Infused segments, pre-rolls are almost certain to control market share in 2025 for the first full year since national legalization in 2018.

Further supporting our prediction is the incredible rise in multi-packs which dominate the Pre-Roll market and carry a much higher price tag than their single pack counterparts.

With higher priced pre-roll packs nearly sweeping the top 50 products in 2024, and infused multi-packs at nearly 50% of the list, the continued increase in unit sales and revenue for pre rolls all but assures a new market leader through 2025.

Despite a drop in overall cannabis revenue in the Canadian market in 2024, Pre-Roll sales continued to grow, helping balance losses in other product categories, and are poised to become the top sales category in the country, eclipsing even Flower, with multi-packs driving growth.