Pre-Roll Growth In The Canadian Market

Posted by Custom Cones USA on Sep 17th 2023

Cannabis sales in Canada continue to increase, with pre-rolls leading the way and poised to eclipse flower as the country’s top product category, according to data from cannabis analytics firm Headset.

In 2022, total revenues for pre-roll products grew more than 54% to nearly CAD$1 billion. Every tracked province saw huge year-over-year increases in pre-roll sales, from 33% and 37% growth in Saskatchewan and Alberta, respectively, to nearly 54% growth in British Columbia and a whopping 69% increase in Ontario, the country’s most-populous province.

And according to the data, one of the major growth drivers is the increase of sales in the pre-roll market, and sales of infused pre-rolls specifically.

Pre-Roll Growth in the Canadian Market

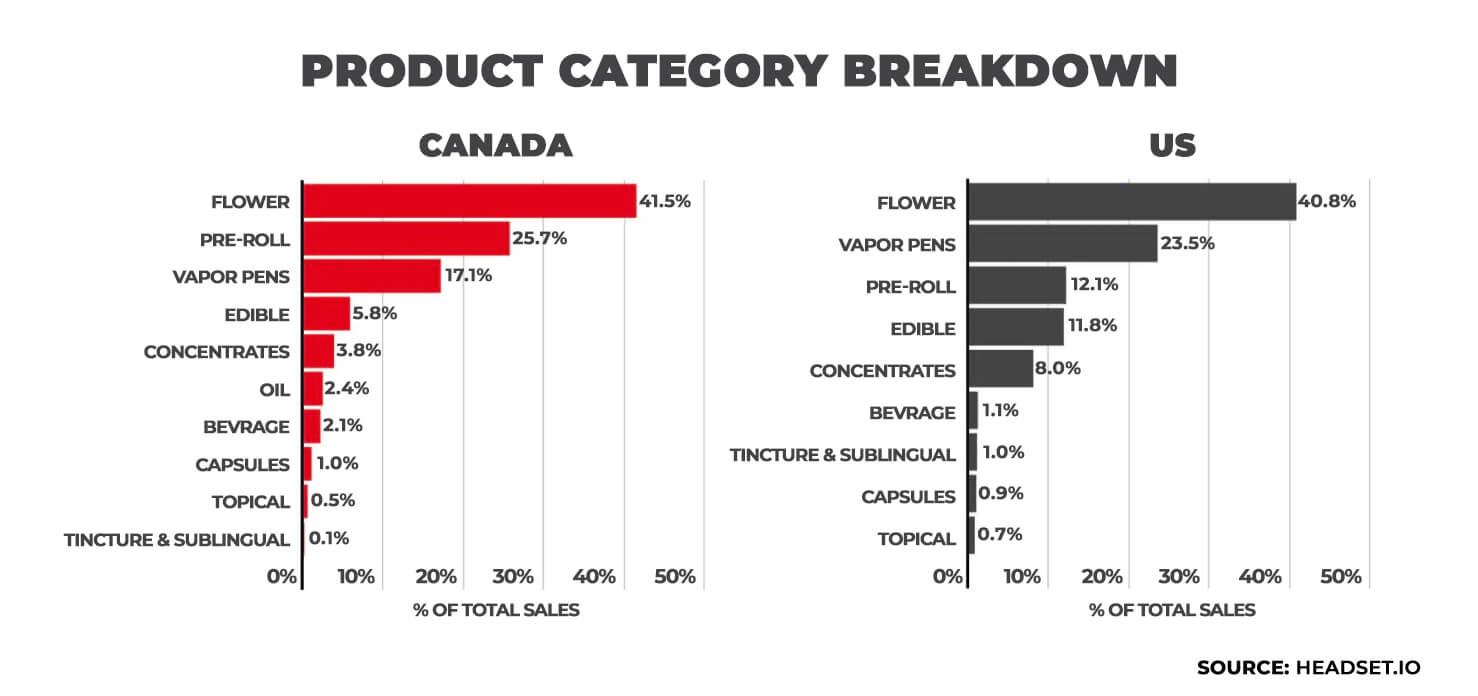

Pre-rolls are the fastest-growing product category in the entire cannabis industry, with revenues growing 12% year-over-year in the U.S. and 38% year-over-year in Canada from November 2021 to November 2022 alone. Additionally, while pre-rolls are the third-largest category in the U.S. with 12.1% total market share, they are the second-largest category in Canada with a 28.9% market share average over the first five months of 2023, a YoY growth of 23.5%.

In fact, the data shows pre-rolls may soon overtake flower as the No. 1 product category in Canada!

The above chart shows that sales of pre-rolls in Canada have grown more than 50% over the past 18 months, from a 20.7% market share in early 2022 to a 31.5% total market share in May 2023. You can also clearly see the consistent decline of flower sales, which used to make up over 45% of total sales but have declined steadily to just over 35% halfway through 2023. If these trends continue, pre-rolls will soon become the most popular product type in Canada.

Headset data also shows that in 2022, 27% of new products introduced into the Canadian market were pre-roll products, a 48.2% growth rate over 2021, second only to beverages. In total, 1,870 new pre-roll products were released into the Canadian market to keep up with the category’s growing popularity.

The lifespan of the average pre-roll product is only 7 months, however this is due to the fact that producers are constantly launching new strains or refreshing packaging to remain competitive in the marketplace. Consumers love variety and are constantly seeking new strains and formats to experiment with.

Pre-roll sales have steadily increased since the Canadian market opened, and the price of the average pre-roll has followed that trend. This is different from the U.S. market, where data shows that prices dropped as sales went up.

The biggest driver increasing average Canadian pre-roll prices is the sudden popularity of infused pre-rolls. Health Canada, the governmental organization that regulates the Canadian cannabis industry, is especially strict, as they are providing federal guidance. As a result, Health Canada did not allow the sale of infused pre-rolls until quite recently. Since infused pre-rolls incorporate cannabis concentrate, they are naturally more expensive. The explosion in popularity of infused pre-rolls, at a higher price point, is keeping the average price of a Canadian pre-roll relatively high, even as flower and concentrate prices fall.

The chart above tracks pre-roll sales and prices across Canada beginning in 2019 and shows that the infused, or connoisseur pre-roll segment (red) is a major driver of sales, growing from just 6.2% of total sales in January 2022 to an incredible 29.8 percent of total sales by February 2023, a growth rate of nearly 606%!

Total Market Sales

While the U.S. saw many of its established markets shrink in the last year, the Canadian provinces tracked by Headset continued to grow. It’s hard to compare the countries because Canada legalized cannabis nationally in 2018, and the U.S. has been slowly legalizing cannabis one state at a time since 2012. But at only 5 years old, the relative newness of Canada’s market could be a reason that sales have continued to grow, instead of facing the fluctuations found in U.S. markets.

It does bring up an important point though. There is a lot of opportunity in cannabis, but the overall sales will always be capped by demand. Growth will not be infinite; however, segment trends change all the time. Digging into the data can reveal how much people are spending on cannabis, how much of that money they are spending on specific products and when your business needs to move into a new direction or launch a new product.

Infused Pre-Roll Growth: The Reason Pre-Roll Prices are "Rising"

With an astonishing year-over-year growth of 1426% from 2021 to 2022, infused pre-rolls are by far the segment with the largest growth in the Canadian markets. This segment has grown so quickly that it has had a profound impact on the sales data. For example, as mentioned, Canada is unique in that the price of the average pre-roll rose as sales increased.

A quick glance at the average price graph above may make it seem as though that the price of every pre-roll was increasing; however, if you stop to think about it, that doesn’t make sense. Most mature markets produce an excess of cannabis and producer/processors lower prices to stay competitive, so an increase in pre-roll consumption wouldn’t necessarily create a situation where prices could rise.

What makes more sense is that the average price of pre-rolls is going up because consumers are choosing infused pre-rolls over regular pre-rolls. Also known as “connoisseur pre-rolls," infused pre-rolls combine concentrates with the ground flower. And because they require more processing than regular pre-rolls, they carry a higher price tag.

Though common in the States, infused pre-rolls are a relatively new product in Canada following a Health Canada rule clarification in late 2021. Since then, Canadian consumers have flocked to the products, with the segment growing from just under 3% of the market at CAD$12.7 million in 2021 to nearly 30% and CAD$47.9 million by mid-2023. That’s more growth than any other pre-roll category except single-strain hybrids.

However, according to the data Headset collected around price compression, pre-rolls are actually falling in price—infused pre-rolls included.

Price Compression & Pre-Rolls

As you can see in the graph below, price compression is having a huge impact on the cannabis markets. The U.S. and Canada have differences in which products are most affected by price compression, but the trend across the two industries is the same. However, pre-rolls show the least amount of price compression in both markets, and in Canada, pre-rolls are the only product segment to see an increase in equivalized price.

This is partially due to the fact that pre-rolls are a manufactured item and less of a pure commodity and therefore tend to be less price elastic. But as mentioned, this anomaly is more likely explained by the boom in infused pre-rolls. But the price compression data provides an extra layer of depth to the data as well. For example, it does not make sense that flower and concentrates are showing negative price compression and pre-rolls do not. Pre-rolls are made with flower and concentrate. So, unless the pre-roll-making process magically allows flower and concentrates to avoid price compression, the answer lies elsewhere.

In the end, the price increase is an example of just how steep the growth rate is for infused pre-rolls. The demand for stronger pre-rolls and the declining market prices for both flower and concentrates—combined with advances in pre-roll making machinery—makes now the perfect time to launch infused pre-roll products.

Multi-Packs

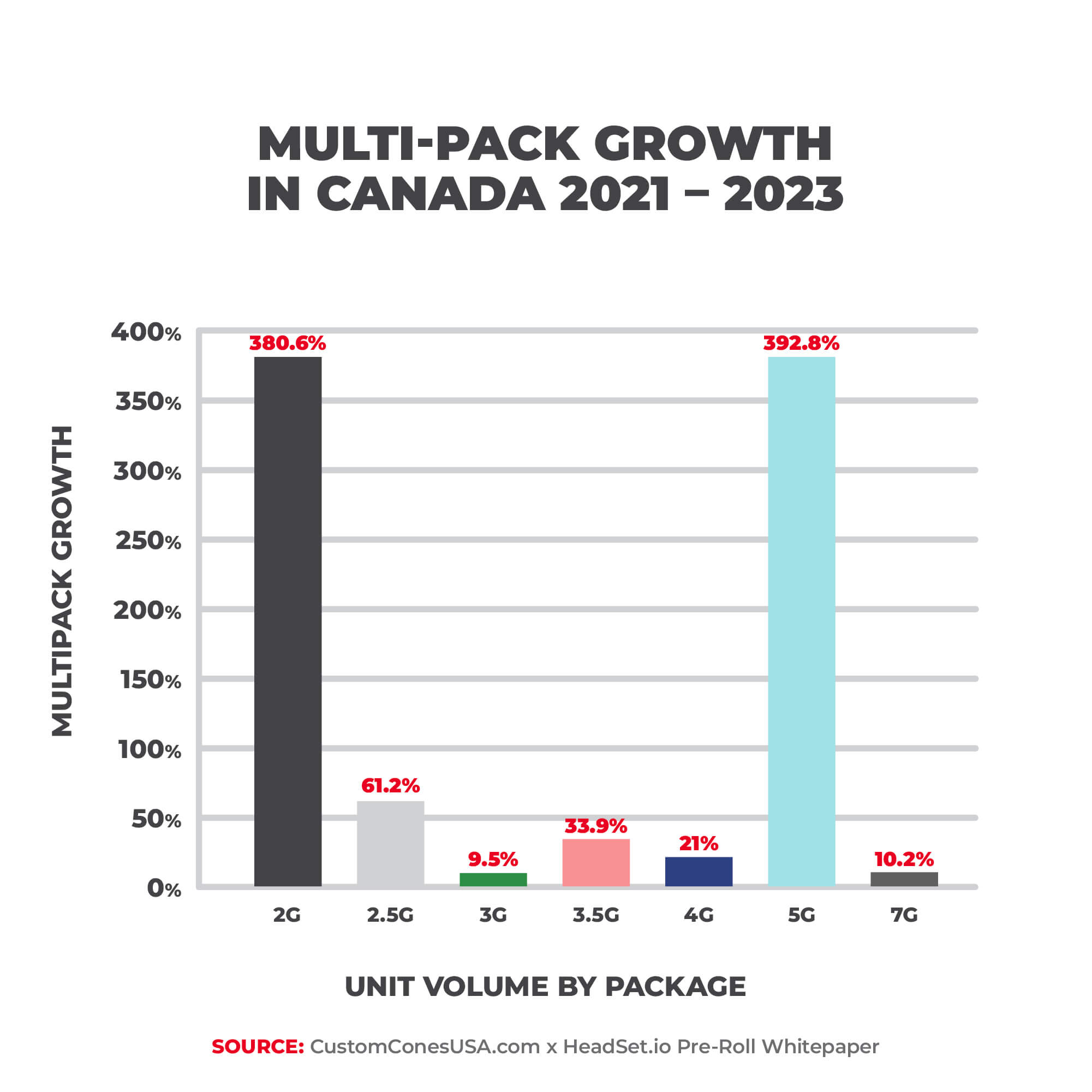

With pre-rolls being so popular with consumers, it makes sense that multi-packs would see growth as well, and this has created even greater savings for producers and consumers alike. It takes less time to package and label a pre-roll multi-pack than it does to do it individually. There is also typically less packaging used in a multi-pack versus individual packaging options. This cut in labor and material costs helps producers keep their margins healthy and their prices low for customers.

Multi-packs are perfect for consumers that enjoy a specific strain or those that like to mix it up with a variety pack. With pre-roll quality constantly improving and the latest in pre-roll-making machinery allowing producers to make them quickly and easily, it really is a situation that benefits both manufacturers and consumers.

The clear favorites for consumers have been multi-packs that include 2 or 5 grams of cannabis—each having seen an almost 400% growth in the past two years. The great thing about 2-gram packs is that they are typically two full-gram pre-rolls that fit in a single tube, cutting down production costs. With the "doob tube" becoming a standard packaging option for individual pre-rolls, it makes sense that they would become even more popular once producers started putting two pre-rolls in them.

There is an important contextual note. The global Covid-19 pandemic certainly affected the past 5 years of cannabis sales. It is clear from the data that cannabis sales increased during the pandemic. But while sales have fallen slightly since the world has returned to normal, they still remain above pre-pandemic levels, though the future remains uncertain.

It makes sense that pre-roll multi-packs would also grow in sales during this time. Buying one or two pre-rolls at a time meant that regular consumers would have to return to shops several times a week or month to restock; however, by purchasing packs of pre-rolls, consumers could limit the number of visits to retailers. In other words, the pandemic seems to have created new buying habits that helped normalize the purchase of multi packs, a trend we expect to continue moving forward.

Top Pre-Rolls in Canada by Province

A deeper look at Province-specific data, particularly best-sellers, shows that consumers are, in fact, buying more infused and/or multi-pack products, helping keep revenues in the pre-roll category high.

By late summer 2023, two of the top five best-selling pre-roll products in Ontario were infused, multi-pack products, both from the General Admission brand and commanding a price point between two and three times higher than non-infused pre-rolls. Leading the pack in Ontario pre-roll sales during the summer months was the Tiger Blood Distillate Infused Pre-Roll 3-Pack (1.5g) at an average price of more than CAD$23, followed by the Sunny Daze Pre-Roll 2-Pack (2g) from Fuego at just under CAD$10, the Grower’s Choice Indica Pre-Roll (1g) at CAD$6 from Good Supply, the Taster Kief Coated Distillate Infused Pre-Roll 3-Pack (1.5g) from General Admission at more than CAD$24 and the Jean Guy Pre-Roll (1g) from Good Supply at less than CAD$9.

In Alberta, the top 5 best-selling pre-roll items were all multi-packs, with General Admission again taking 2 of the top 5 spots with infused pre-roll products, including the Tiger Blood Distillate Pre-Roll 3-Pack (1.5g) once again taking the top sales position, this time for more than CAD$26. The Redees – Cold Creek Kush Pre-Roll 10-Pack (4g) from Redecan, selling on average at just under CAD$20 come in second followed by the Sativa Pre-Roll 2-Pack (2g) from Hiway at around CAD$9.50. General Admission’s Peach Ringz Kief Distillate Infused Pre-Roll 3-Pack (1.5g) comes in fourth, selling at an average of more than $26 with Hiway’s Indica Pre-Roll 2-Pack (2g) rounding at the top 5 at an average price of more than CAD$9.

In Saskatchewan, the top 5 best-selling pre-roll items were also all multi-packs, and though the Tiger Blood Distillate Infused Pre-Roll 3-pack (1.5g) drops to fifth, it still has the highest average price point on the list at more than CAD$22. Topping the Saskatchewan best-sellers is Daily Special’s Indica Js Pre-roll 7-pack (2.1g) at an average price of just more than CAD$4, followed by the 950 Series – Kalifornia Pre-Roll 10-Pack (3.5 g) from Kolab at CAD$14, Daily Special’s Evergreen Kush Pre-Roll 7-Pack (3.5 g) at just under CAD$12 and the Pals- Fruit Salad Pre-Roll 10-Pack (4g) from Palmetto with an average price of just over CAD$20.

In British Columbia, the Tiger Blood Distillate Infused Pre-Roll (1g) from General Admission retains the top spot with an average price of more than CAD$17, followed by the Ghost Train Haze Pre-Roll 10-Pack (3.5 g) from Color Cannabis at more than CAD$20, the Jack Haze Pre-Roll 2-Pack (1g) from 7 Acres at about CAD$10, Color Cannabis’s Space Cake Pre-Roll 10-Pack (3.5g) at an average of about CAD$20 and the Sativa Pre-Roll (1g) from Twd. at just over CAD$7.

Wallet Share

Part of the strength of the pre-roll segment is its cross-generational appeal.

This graph from our June 2023 white paper shows that each generation has preferences when it comes to cannabis consumption. But it’s interesting to note that pre-rolls are the most stable segment of the bunch. Even as flower sales decline within younger generations, pre-rolls stay firm.

This is another reason why pre-rolls are a part of any successful producer's business plan. It is a product that not only has universal appeal across the generations, but is easy to produce and requires very little startup money, space and machinery to do it. Even if you don’t produce flower, it makes sense to explore pre-roll production. All it takes to enter the category is sourcing flower at the quality/price you want (avoiding the risks associated with cultivating) and getting a few pre-roll making machines.

As mentioned, the Ontario market is the largest and fastest-growing of Canada’s provinces. With revenues reaching CAD$440 million in 2022, Ontario accounts for almost half of all sales in Canada. And within Ontario, the wallet share of pre-rolls grew within every generational group through 2021, with Gen X and Millennials seeing the largest growth, at around 45% each.

Within the fastest-growing group of consumers in the industry, Gen Z (which in Canada is a larger cohort than the U.S. due to a lower age restriction), pre-roll sales increased with both male and female consumers. The wallet share of pre-rolls among female buyers grew more than 4% to 20.4% in 2021. For males, the increase was even larger, growing from 14.6% of wallet share to 19.7%.

Closing Thoughts

After taking a closer look at the data, it is clear that Canada is not only seeing incredible growth in the pre-roll market, but they are setting the pace for infused pre-roll growth for the entire industry. While every market is unique, and an argument could be made that infused pre-rolls reflect a unique preference in the Canadian market, our previous white paper shows infused pre-roll sales are up in every market.

For better or worse, consumers often evaluate cannabis products based on THC percentage. A product with more THC is often viewed more favorably by shoppers than a product with less. Even though THC percentage has nothing to do with the quality of the product, this has been a consistent buying trend in the cannabis community and it’s not going to change overnight.

But with advances in pre-roll-making machinery and prices for flower and oil dropping, manufacturers can now produce infused pre-rolls for not much more than regular pre-rolls. And when given the chance, more people are choosing to go with the infused option, driving higher sales in the category and higher revenues for producers and retailers.

PROVINCE TOP 5 LISTS:

| SASKATCHEWAN: | Company | Price |

|---|---|---|

1. Indica Js Pre-Roll 7-Pack (2.1g) |

Daily Special |

$4.22 |

2. 950 Series - Kalifornia Pre-Roll 10-Pack (3.5g) |

Kolab |

$14.00 |

3. Evergreen Kush Pre-Roll 7-Pack (3.5g) |

Daily Special |

$11.98 |

4. Pals - Fruit Salad Pre-Roll 10-Pack (4g) |

Palmetto |

$20.01 |

5. Tiger Blood Distillate Infused Pre-Roll 3-Pack (1.5g) |

General Admission |

$22.56 |

| BRITISH COLUMBIA: | Company | Price |

|---|---|---|

1. Tiger Blood Distillate Infused Pre-Roll (1g) |

General Admission |

$17.23 |

2. Ghost Train Haze Pre-Roll 10-Pack (3.5g) |

Color Cannabis |

$20.48 |

3. Jack Haze Pre-Roll 2-Pack (1g) |

7 Acres |

$10.03 |

4. Space Cake Pre-Roll 10-Pack (3.5g) |

Color Cannabis |

$20.83 |

5. Sativa Pre-Roll (1g) |

Twd. |

$7.30 |

| ALBERTA: | Company | Price |

|---|---|---|

1. Tiger Blood Distillate Infused Pre-Roll 3-Pack (1.5g) |

General Admission |

$26.62 |

2. Redees - Cold Creek Kush Pre-Roll 10-Pack (4g) |

Redecan |

$19.98 |

3. Sativa Pre-Roll 2-Pack (2g) |

Hiway |

$9.47 |

4. Peach Ringz Kief Distillate Infused Pre-Roll 3-Pack (1.5g) |

General Admission |

$26.45 |

5. Indica Pre-Roll 2-Pack (2g) |

Hiway |

$9.44 |

| ONTARIO: | Company | Price |

|---|---|---|

1. Tiger Blood Distillate Infused Pre-Roll 3-Pack (1.5g) |

General Admission |

$23.29 |

2. Sunny Daze Pre-Roll 2-Pack (2g) |

Fuego |

$9.87 |

3. Grower's Choice Indica Pre-Roll (1g) |

Good Supply |

$6.00 |

4. Taster Kief Coated Distillate Infused Pre-Roll 3-Pack (1.5g) |

General Admission |

$24.31 |

5. Jean Guy Pre-Roll (1g) |

Good Supply |

$8.53 |

Cannabis sales in Canada continue to increase, with revenues in 2022 growing more than 54% to nearly CAD$1 billion.